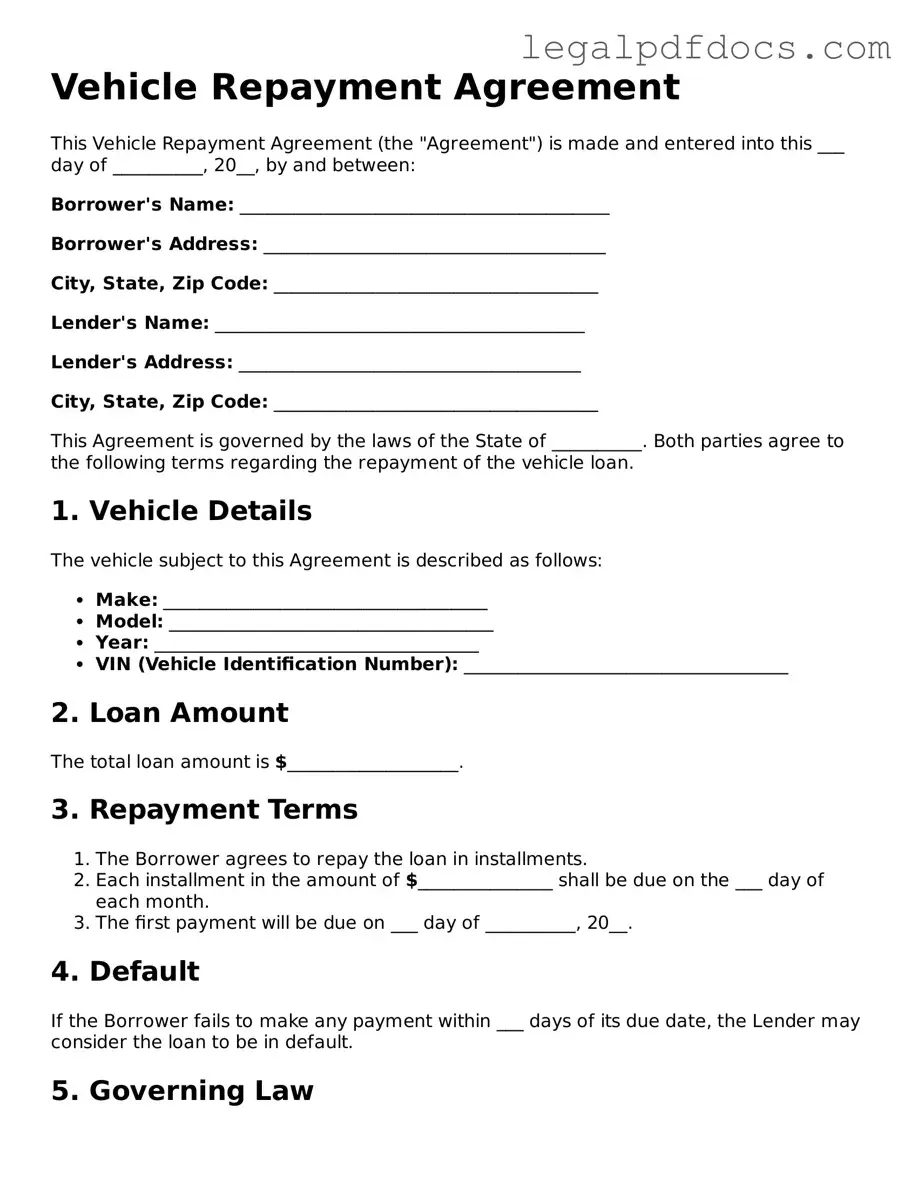

Vehicle Repayment Agreement Template

When individuals find themselves in a situation where they need to finance a vehicle, a Vehicle Repayment Agreement form becomes an essential tool in formalizing the terms of repayment. This document outlines the responsibilities of both the borrower and the lender, ensuring that both parties have a clear understanding of the payment schedule, interest rates, and any potential fees associated with the loan. It also includes important details such as the vehicle's identification, the total amount financed, and the consequences of defaulting on payments. By providing a structured approach to repayment, this form helps to protect the interests of both parties involved, fostering a sense of accountability and transparency. Additionally, it may include provisions for early repayment, allowing borrowers the flexibility to pay off their loans sooner without incurring penalties. Understanding the nuances of this agreement can significantly ease the financial burden of vehicle ownership, making it a vital component for anyone entering into a vehicle financing arrangement.

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some key points to consider:

- Do: Read the entire form carefully before starting.

- Do: Use clear and legible handwriting or type the information.

- Do: Double-check all numbers and amounts for accuracy.

- Do: Provide all required information as requested.

- Don't: Leave any sections blank unless specified.

- Don't: Use white-out or erasers on the form.

- Don't: Sign the form until all information is complete.

- Don't: Ignore instructions or guidelines provided with the form.

Following these steps will help ensure that your Vehicle Repayment Agreement form is completed correctly and efficiently.

How to Use Vehicle Repayment Agreement

Completing the Vehicle Repayment Agreement form is a crucial step in ensuring that both parties understand the terms of the repayment. This process will help clarify expectations and responsibilities. Follow the steps outlined below to fill out the form accurately.

- Begin by entering your full name in the designated field.

- Provide your current address, including street, city, state, and zip code.

- Next, fill in your phone number and email address for contact purposes.

- Identify the vehicle involved by entering its make, model, year, and Vehicle Identification Number (VIN).

- Clearly state the total amount owed on the vehicle.

- Indicate the repayment terms, including the payment amount and frequency (e.g., weekly, bi-weekly, monthly).

- Include the start date for the repayment schedule.

- Both parties should sign and date the form to validate the agreement.

After completing these steps, ensure that both parties retain a copy of the signed agreement for their records. This will provide clarity and serve as a reference throughout the repayment period.

More Forms:

Nurse Letter of Recommendation - The applicant is committed to promoting health equity and addressing disparities.

Is Certificate of Live Birth the Same as Birth Certificate - It also records the type of birth, such as single or multiple births.

Simple Promissory Note Template - A Promissory Note is a practical solution to document informal loans.

Documents used along the form

When dealing with a Vehicle Repayment Agreement, several additional forms and documents may be necessary to ensure a smooth transaction and legal compliance. Each of these documents serves a specific purpose and contributes to the overall clarity and security of the agreement.

- Bill of Sale: This document serves as proof of the sale of the vehicle. It includes details such as the purchase price, vehicle identification number (VIN), and the names of both the buyer and seller.

- Title Transfer Document: Required for transferring ownership, this document must be completed and submitted to the Department of Motor Vehicles (DMV) to officially change the vehicle's title from the seller to the buyer.

- Loan Agreement: If financing is involved, a loan agreement outlines the terms of the loan, including the interest rate, repayment schedule, and any collateral involved.

- Credit Application: This form is often required by lenders to assess the borrower's creditworthiness. It includes personal and financial information necessary for evaluating the loan request.

- Proof of Insurance: Before finalizing the vehicle purchase, buyers must provide proof of insurance. This document verifies that the vehicle is insured as per state requirements.

- Vehicle Inspection Report: This report details the condition of the vehicle at the time of sale. It can help prevent disputes regarding the vehicle's state post-purchase.

- Payment Receipt: After any payment is made, a receipt should be issued. This document serves as evidence of the transaction and can be important for record-keeping.

- Affidavit of Ownership: In cases where the title is lost or missing, this sworn statement can help establish ownership and facilitate the transfer process.

Having these documents prepared and organized can significantly ease the process of completing a Vehicle Repayment Agreement. Each plays a vital role in ensuring that all parties understand their rights and responsibilities, ultimately leading to a successful transaction.

Misconceptions

Understanding the Vehicle Repayment Agreement form is crucial for anyone involved in a vehicle financing situation. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

-

The form is only for those who have defaulted on payments.

This is not true. The Vehicle Repayment Agreement form can be used by anyone seeking to restructure their payment plan, regardless of their current payment status.

-

Filling out the form guarantees approval.

Submitting the form does not automatically ensure that the repayment plan will be accepted. Lenders will review the application based on their criteria and policies.

-

All lenders use the same Vehicle Repayment Agreement form.

Each lender may have their own version of the form with different requirements. It is essential to use the specific form provided by your lender.

-

The form is a legally binding contract immediately upon submission.

While the form initiates a request for a new repayment plan, it does not become legally binding until both parties sign the agreement.

-

You can change the terms of the agreement after it is signed.

Once the agreement is signed, any changes typically require a new negotiation and possibly a new form. It is important to fully understand the terms before signing.

Being aware of these misconceptions can help you navigate the vehicle repayment process more effectively. Always consult with your lender if you have questions about the form or its implications.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form is used to outline the terms under which a borrower agrees to repay a loan for a vehicle. |

| Parties Involved | The agreement typically involves a borrower (the individual purchasing the vehicle) and a lender (the financial institution or dealership). |

| Governing Laws | In many states, this agreement is governed by state-specific lending laws, including the Uniform Commercial Code (UCC). |

| Loan Details | The form includes critical information such as the loan amount, interest rate, and repayment schedule. |

| Default Terms | It outlines what constitutes a default, such as missed payments, and the consequences that may follow. |

| Signatures Required | Both parties must sign the agreement to make it legally binding, indicating their acceptance of the terms. |

| State Variations | Different states may have specific requirements for the form, including additional disclosures or terms. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties. |

| Record Keeping | It is essential for both parties to keep a copy of the signed agreement for their records. |

Key takeaways

When filling out and using the Vehicle Repayment Agreement form, keep these key points in mind:

- Accurate Information: Ensure all personal and vehicle details are correct. Mistakes can lead to misunderstandings.

- Clear Terms: Review the repayment terms carefully. Know the payment amounts, due dates, and any penalties for late payments.

- Signatures Required: Both parties must sign the agreement. Without signatures, the document lacks legal validity.

- Keep Copies: Retain a copy of the signed agreement for your records. This can help resolve any disputes that may arise.