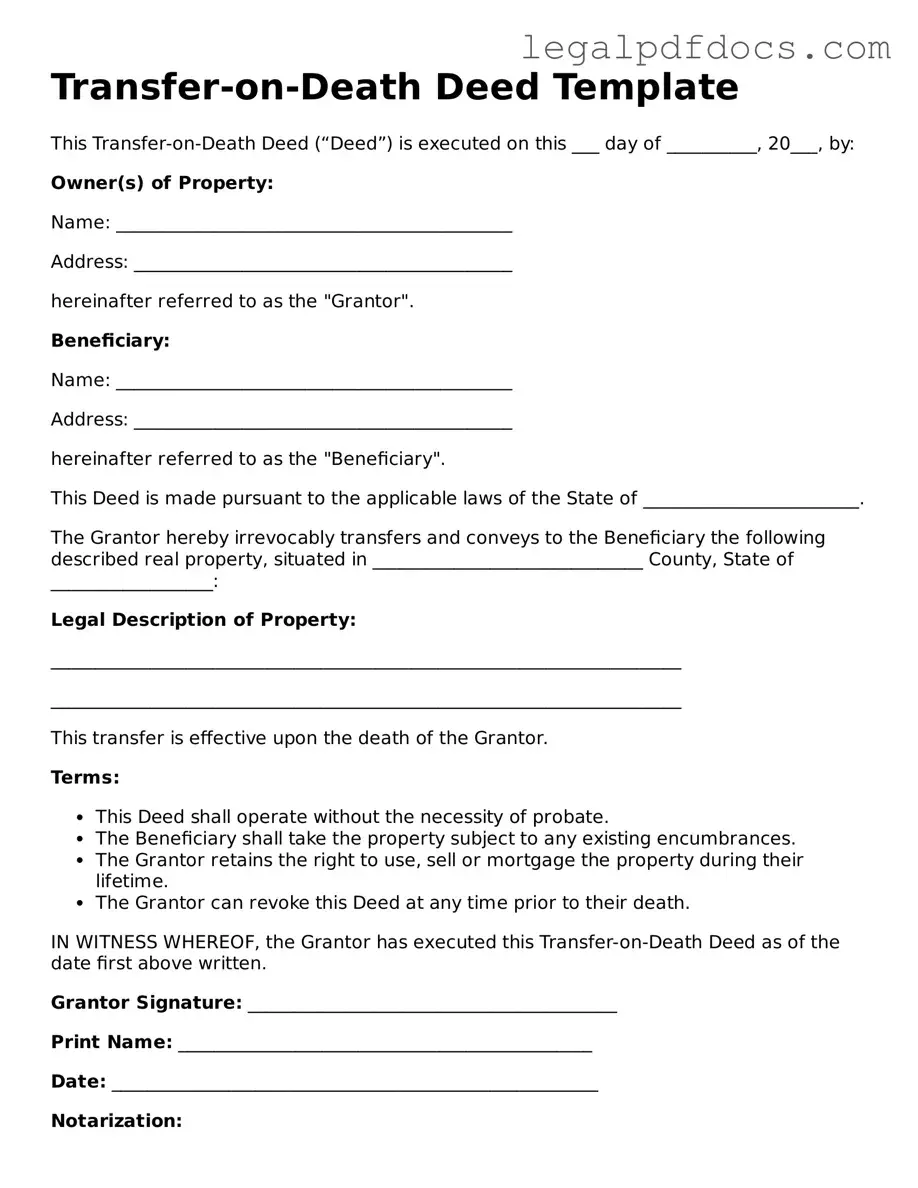

Transfer-on-Death Deed Template

The Transfer-on-Death Deed (TODD) is a powerful estate planning tool that allows property owners to designate beneficiaries who will automatically receive their property upon their death, bypassing the often lengthy and costly probate process. This deed is particularly appealing because it enables individuals to retain full control over their property during their lifetime, while providing a clear pathway for the transfer of ownership after they pass away. With a TODD, the property owner can specify one or more beneficiaries, and they can also change or revoke the deed at any time before their death. This flexibility makes it an attractive option for many people looking to simplify the transfer of their assets. Additionally, the TODD can help avoid disputes among heirs, as it clearly outlines the intended recipients. Understanding the nuances of this form can empower individuals to make informed decisions about their estate planning needs.

Dos and Don'ts

When filling out the Transfer-on-Death Deed form, it's essential to approach the task with care. Below is a list of things you should and shouldn't do to ensure a smooth process.

- Do: Clearly identify the property you are transferring. Include the full legal description to avoid any confusion.

- Do: Provide accurate information about the beneficiaries. Make sure their names and contact details are correct.

- Do: Sign the form in the presence of a notary public. This step is crucial for the deed to be valid.

- Do: Keep a copy of the completed form for your records. This will help you track the deed in the future.

- Don't: Leave any sections of the form blank. Incomplete forms can lead to delays or rejection.

- Don't: Use unclear language or abbreviations. Be precise and straightforward in your descriptions.

- Don't: Forget to check state-specific requirements. Different states may have unique rules regarding Transfer-on-Death Deeds.

- Don't: Rush through the process. Take your time to review all information before submission.

How to Use Transfer-on-Death Deed

Filling out a Transfer-on-Death Deed form is a straightforward process, but it requires careful attention to detail. Once completed, the form will need to be filed with the appropriate local authority to ensure it is legally recognized.

- Obtain the form: Download the Transfer-on-Death Deed form from your state’s official website or visit your local courthouse to obtain a physical copy.

- Provide your information: Fill in your full name and address as the grantor. Ensure that all information is accurate and current.

- Identify the beneficiary: Clearly state the name and address of the person or people you wish to designate as the beneficiary.

- Describe the property: Provide a detailed description of the property being transferred. This includes the address and any relevant legal description.

- Sign the form: As the grantor, you must sign the form in the presence of a notary public. This step is crucial for the document’s validity.

- Notarization: Have the notary public sign and seal the form, confirming that you have signed it in their presence.

- File the form: Submit the completed and notarized form to the appropriate local government office, such as the county recorder or registrar of deeds.

- Keep a copy: Retain a copy of the filed deed for your records. This will be important for your beneficiary in the future.

Check out Popular Types of Transfer-on-Death Deed Templates

California Corrective Deed - This form assists in creating a clear chain of title for the property.

What Is a Gift Deed in Real Estate - A Gift Deed transfers ownership of property without payment.

How to File a Quitclaim Deed in California - This deed does not involve any assessment of the property’s value.

Documents used along the form

A Transfer-on-Death Deed (TOD Deed) is a useful estate planning tool that allows individuals to transfer property directly to a beneficiary upon their death, avoiding the probate process. However, several other forms and documents often accompany this deed to ensure a smooth transition of property and to clarify the intentions of the property owner. Below is a list of some key documents that may be used in conjunction with a Transfer-on-Death Deed.

- This document outlines how a person's assets should be distributed upon their death. It can include specific bequests and appoint an executor to manage the estate.

- A trust that allows individuals to place their assets into a trust during their lifetime, providing management and distribution instructions that can help avoid probate.

- These forms specify who will receive certain assets, such as life insurance policies or retirement accounts, upon the owner’s death.

- A legal document that grants someone the authority to make financial or medical decisions on behalf of another person, particularly if they become incapacitated.

- These documents prove ownership of the property and may need to be updated or referenced when executing a Transfer-on-Death Deed.

- A sworn statement that establishes the heirs of a deceased person, often used in situations where no formal will exists.

- A document that may be filed with local authorities to formally notify them of a person’s passing, which can be important for public records.

- This document is used to transfer property from an estate to the beneficiaries after the probate process is complete.

- These documents are essential for reporting any taxes owed on the estate and ensuring compliance with tax laws.

Each of these documents plays a vital role in estate planning and property transfer. By understanding their functions, individuals can create a comprehensive plan that reflects their wishes and protects their loved ones. Proper documentation helps avoid potential disputes and ensures a smoother transition of assets after death.

Misconceptions

Understanding the Transfer-on-Death Deed (TODD) can help you make informed decisions about estate planning. However, several misconceptions can lead to confusion. Here are five common misconceptions:

- It is a will. Many people think a Transfer-on-Death Deed functions like a traditional will. In reality, it is a separate legal document that transfers property directly to a beneficiary upon the owner's death, bypassing probate.

- It can only be used for real estate. Some believe that the TODD applies only to real estate. While it primarily deals with real property, certain states allow for other types of assets to be transferred in a similar manner.

- It is irrevocable. Another common misconception is that once a TODD is executed, it cannot be changed. In fact, the owner can revoke or amend the deed at any time before their death.

- Beneficiaries must pay taxes immediately. There is a belief that beneficiaries will face immediate tax liabilities upon the transfer of property. Generally, taxes are assessed based on the property's value at the time of the owner's death, not at the moment of transfer.

- It eliminates all estate taxes. Some people think that using a TODD means there will be no estate taxes owed. However, the property value still counts toward the total estate, and taxes may still apply based on the overall estate value.

Clearing up these misconceptions can help you better navigate the complexities of estate planning. Consider seeking professional advice to ensure your wishes are accurately documented and understood.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | A Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive the property upon the owner's death, avoiding probate. |

| State-Specific Laws | Each state has its own laws governing Transfer-on-Death Deeds. For example, in California, it is governed by California Probate Code Section 5600. |

| Revocability | The deed can be revoked or changed at any time before the owner's death, allowing for flexibility in estate planning. |

| Recording Requirement | To be effective, the Transfer-on-Death Deed must be recorded with the county recorder's office where the property is located before the owner's death. |

Key takeaways

When considering the Transfer-on-Death Deed form, it is essential to understand its implications and requirements. Here are some key takeaways to keep in mind:

- Clear Identification: Ensure that the property is clearly identified in the deed. This includes the address and legal description, which helps avoid confusion later.

- Beneficiary Designation: You must designate a beneficiary. This person will receive the property upon your death, so choose someone you trust.

- Execution Requirements: The deed must be signed and notarized to be valid. Follow your state’s specific requirements to ensure it is legally binding.

- Revocation Possibility: You can revoke the deed at any time before your death. Keep this in mind if your circumstances change.

Understanding these points can help ensure that your wishes are honored and that the process goes smoothly for your loved ones.