Official Transfer-on-Death Deed Form for Texas

In Texas, planning for the future often includes ensuring that your property is passed on to your loved ones in a seamless manner. The Transfer-on-Death Deed (TODD) is a vital tool that allows property owners to transfer real estate to designated beneficiaries upon their death, bypassing the lengthy and often costly probate process. This straightforward form offers a way to retain control of your property during your lifetime while providing a clear path for its transfer after you are gone. Importantly, the TODD can be revoked or modified at any time, giving property owners flexibility as their circumstances change. Understanding how to properly execute this deed, including the necessary requirements for its validity, is crucial for anyone considering this option. This article will delve into the key features of the Transfer-on-Death Deed form, its benefits, and the steps involved in ensuring that your property is transferred according to your wishes, all while minimizing potential disputes among heirs.

Dos and Don'ts

When filling out the Texas Transfer-on-Death Deed form, it’s crucial to follow specific guidelines to ensure accuracy and legality. Here are seven essential do's and don'ts:

- Do ensure that you have the correct property description. Accurate details prevent future disputes.

- Do include the full names of all beneficiaries. This clarity helps in the transfer process.

- Do sign the deed in front of a notary public. This step is necessary for the deed to be valid.

- Do file the deed with the county clerk's office. This ensures that the deed is officially recorded.

- Don’t leave any sections blank. Incomplete forms can lead to rejection or complications.

- Don’t forget to check for any local requirements. Some counties may have additional rules.

- Don’t assume that verbal agreements will suffice. Written documentation is essential for legal validity.

Taking these steps seriously will help ensure that the transfer process goes smoothly and that your intentions are honored. Act promptly to avoid any potential issues.

How to Use Texas Transfer-on-Death Deed

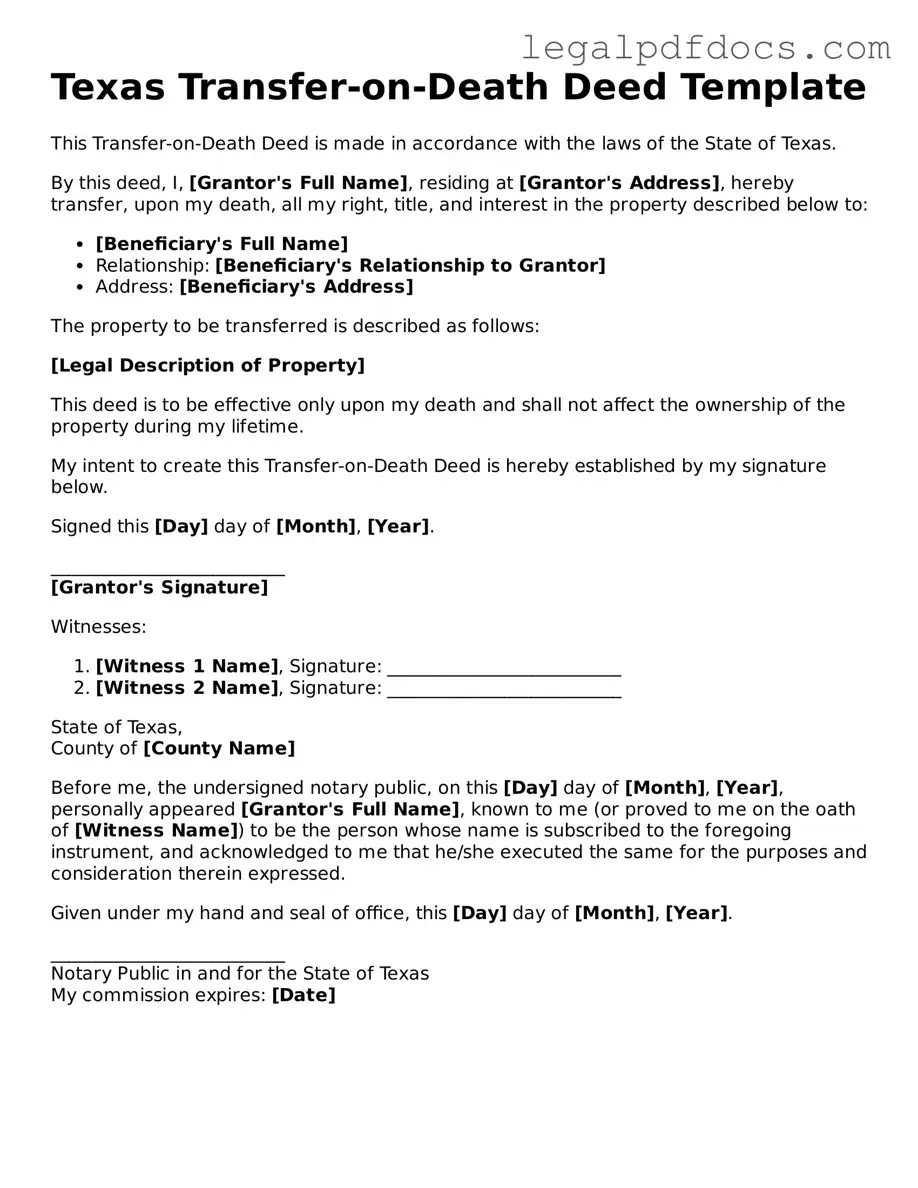

Filling out the Texas Transfer-on-Death Deed form is a straightforward process that allows property owners to designate beneficiaries for their property. Once completed, this form must be filed with the county clerk's office where the property is located. Below are the steps to successfully fill out the form.

- Begin by downloading the Texas Transfer-on-Death Deed form from a reliable source or obtain a physical copy from your local county clerk's office.

- At the top of the form, enter the name of the property owner(s). Ensure that the names match the names on the property title.

- Next, provide the legal description of the property. This can typically be found on the property deed or tax records. Be precise to avoid any confusion.

- In the designated section, list the name(s) of the beneficiary or beneficiaries. If there are multiple beneficiaries, indicate how the property should be divided among them.

- Include the address of each beneficiary. This helps ensure that they can be easily identified and contacted in the future.

- Sign the form in the presence of a notary public. This step is crucial, as the notarization verifies your identity and the authenticity of your signature.

- After notarization, make copies of the completed deed for your records and for the beneficiaries.

- Finally, file the original deed with the county clerk's office in the county where the property is located. There may be a filing fee, so check with the clerk’s office for details.

Find Popular Transfer-on-Death Deed Forms for US States

Kansas Transfer on Death Form - This deed does not alter how property taxes or maintenance responsibilities are handled during the owner’s lifetime.

How to File a Beneficiary Deed in Arizona - Some states require witnesses or notarization for the deed to be valid.

Documents used along the form

The Texas Transfer-on-Death Deed is a useful tool for estate planning, allowing property owners to transfer their property to beneficiaries without going through probate. Along with this deed, several other documents are commonly used to ensure a smooth transfer of property and to clarify the intentions of the property owner. Here are four important forms and documents that often accompany the Transfer-on-Death Deed.

- Will: A will outlines how a person's assets, including property, should be distributed after their death. It can specify beneficiaries and provide instructions for handling any debts or taxes.

- Affidavit of Heirship: This document helps establish the heirs of a deceased person. It is often used when there is no will, providing a legal declaration of who inherits the property.

- Property Deed: The property deed serves as the legal document that proves ownership of the property. It is essential to have the current deed on file to reference when transferring ownership.

- Beneficiary Designation Forms: These forms allow individuals to designate beneficiaries for certain assets, such as bank accounts or life insurance policies, ensuring that these assets pass directly to the chosen individuals outside of probate.

Using these documents alongside the Texas Transfer-on-Death Deed can help clarify the property owner's wishes and streamline the transfer process. Proper planning and documentation are key to ensuring that the property is passed on smoothly to the intended beneficiaries.

Misconceptions

The Texas Transfer-on-Death Deed (TODD) is a useful tool for estate planning, but several misconceptions surround its use. Understanding these misconceptions can help individuals make informed decisions about their property and estate. Here are four common misunderstandings:

- The Transfer-on-Death Deed avoids probate entirely. While a TODD allows property to pass directly to beneficiaries upon the owner's death, it does not completely eliminate probate. Other assets may still require probate, and if the property has debts or liens, those issues will need to be addressed.

- The deed must be recorded immediately. Many people think that a TODD must be recorded right after it is signed. However, it can be recorded at any time before the property owner's death. This flexibility allows for adjustments or changes to be made before the final recording.

- A Transfer-on-Death Deed is the same as a will. Some believe that a TODD serves the same purpose as a will. While both documents deal with the distribution of property after death, a TODD specifically transfers real estate directly to a named beneficiary, bypassing the probate process for that property. A will, on the other hand, covers a broader range of assets and requires probate.

- You cannot change or revoke a TODD once it is created. This is a common myth. In fact, a TODD can be revoked or modified at any time before the property owner's death. This allows individuals to adjust their estate plans as circumstances change, such as marriage, divorce, or the birth of children.

By dispelling these misconceptions, individuals can better navigate the complexities of estate planning and make choices that align with their goals and needs.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows a property owner to designate a beneficiary who will receive the property upon the owner's death, without going through probate. |

| Governing Law | The Transfer-on-Death Deed in Texas is governed by Chapter 114 of the Texas Estates Code. |

| Eligibility | Any individual who owns real property in Texas can execute a Transfer-on-Death Deed. |

| Revocation | The deed can be revoked at any time before the owner's death by executing a new deed or a formal revocation document. |

| Beneficiary Designation | Multiple beneficiaries can be named, and they can inherit the property in specified shares. |

| Recording Requirement | To be effective, the Transfer-on-Death Deed must be recorded in the county where the property is located before the owner's death. |

| Effect on Creditors | The property transferred via this deed may still be subject to claims from creditors of the deceased owner. |

| Tax Implications | There are no immediate tax implications upon executing the deed; however, the beneficiary may face tax responsibilities upon the owner's death. |

Key takeaways

When considering a Transfer-on-Death Deed (TODD) in Texas, it is essential to understand the implications and requirements involved. Here are ten key takeaways to guide you through the process:

- Purpose of the TODD: This deed allows you to transfer real estate to a beneficiary upon your death without going through probate.

- Eligibility: Only individuals can create a TODD; entities like corporations or partnerships are not eligible.

- Property Types: The TODD can be used for various types of real estate, including residential and commercial properties.

- Filling Out the Form: Ensure all required information is accurately filled out, including property description and beneficiary details.

- Beneficiary Designation: You can name one or multiple beneficiaries. If multiple, clarify how the property will be divided.

- Revocation: You can revoke the TODD at any time before your death by filing a new deed or a revocation document.

- Recording the Deed: To be effective, the TODD must be recorded with the county clerk in the county where the property is located.

- No Immediate Transfer: The property does not transfer to the beneficiary until the owner passes away.

- Tax Implications: Consult a tax professional to understand potential tax consequences for your beneficiaries.

- Legal Assistance: While you can fill out the form on your own, seeking legal guidance can ensure that everything is done correctly.

Understanding these key points can help you navigate the process of creating and utilizing a Transfer-on-Death Deed in Texas, ensuring your wishes are honored and your loved ones are taken care of.