Official Tractor Bill of Sale Form for Texas

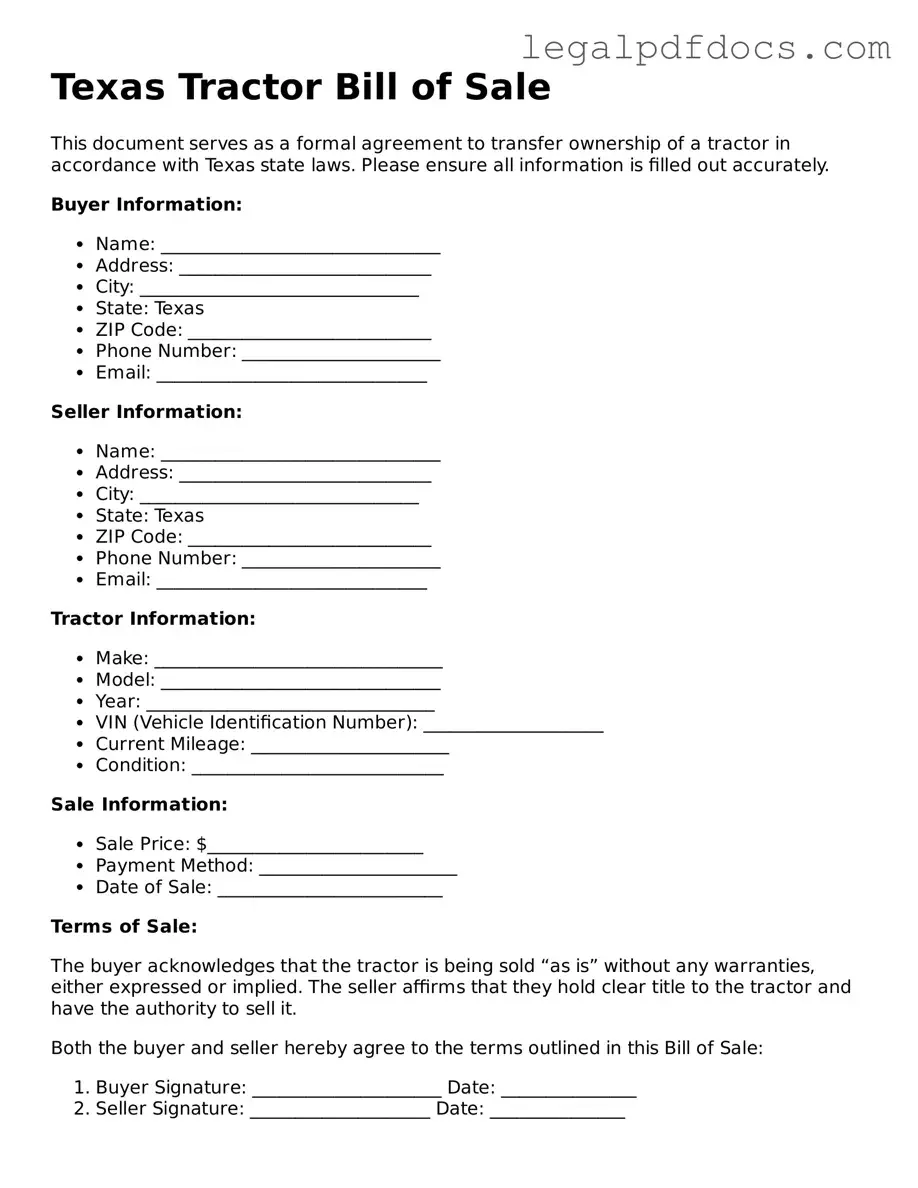

When it comes to buying or selling a tractor in Texas, having the right documentation is essential for a smooth transaction. The Texas Tractor Bill of Sale form serves as a crucial tool in this process, ensuring that both parties are protected and that the sale is legally recognized. This form typically includes important details such as the names and addresses of the buyer and seller, a description of the tractor being sold, including its make, model, and Vehicle Identification Number (VIN), and the sale price. Additionally, the form may outline any warranties or guarantees associated with the tractor, as well as the date of the transaction. By providing a clear record of the sale, this document helps to prevent disputes and offers peace of mind for both the buyer and seller. Understanding the components and significance of the Texas Tractor Bill of Sale form can greatly enhance the experience of purchasing or selling agricultural equipment in the Lone Star State.

Dos and Don'ts

When filling out the Texas Tractor Bill of Sale form, it's important to follow specific guidelines to ensure the process goes smoothly. Here are ten things to keep in mind:

- Do: Provide accurate information about the tractor, including make, model, and year.

- Do: Include the Vehicle Identification Number (VIN) to uniquely identify the tractor.

- Do: Clearly state the sale price to avoid any future disputes.

- Do: Sign and date the form to validate the transaction.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any sections blank; incomplete forms can cause issues later.

- Don't: Use vague descriptions; be specific about the tractor's condition.

- Don't: Forget to include the buyer's information; this is crucial for ownership transfer.

- Don't: Alter any information after signing; this can invalidate the document.

- Don't: Ignore local regulations; ensure compliance with Texas laws regarding sales.

By following these guidelines, you can help ensure a smooth transaction when selling or buying a tractor in Texas.

How to Use Texas Tractor Bill of Sale

Once you have your Texas Tractor Bill of Sale form ready, it's time to fill it out accurately. This document will serve as proof of the transaction between the buyer and seller. Follow these steps to ensure all necessary information is correctly provided.

- Identify the Seller: Write the full name and address of the seller. This should include the street address, city, state, and ZIP code.

- Identify the Buyer: Enter the full name and address of the buyer, including street address, city, state, and ZIP code.

- Describe the Tractor: Provide detailed information about the tractor being sold. Include the make, model, year, and Vehicle Identification Number (VIN) if applicable.

- Indicate the Sale Price: Clearly state the sale price of the tractor. This should be the amount agreed upon by both parties.

- Include the Date of Sale: Write the date when the transaction takes place. Make sure this is accurate to avoid any future disputes.

- Signatures: Both the seller and buyer must sign and date the form. This indicates that both parties agree to the terms of the sale.

After completing the form, keep a copy for your records. This document can be essential for future reference, especially when registering the tractor or if any issues arise later on.

Find Popular Tractor Bill of Sale Forms for US States

Can You Hand Write a Bill of Sale - Will clarify the responsibilities of the seller regarding the condition of the tractor.

Farm Tractor Bill of Sale - The form might include not just the sale amount but also payment terms if financing is involved.

Tractor Bill of Sale Form - Legal requirements for a bill of sale may vary by state, so it is important to be aware of local regulations.

Documents used along the form

When purchasing or selling a tractor in Texas, several documents often accompany the Tractor Bill of Sale. These documents help ensure a smooth transaction and provide necessary information for both parties. Here’s a list of commonly used forms and documents:

- Title Certificate: This document proves ownership of the tractor. It must be transferred to the new owner during the sale.

- Application for Texas Title: If the tractor is not currently titled in Texas, this form is needed to apply for a new title.

- Vehicle Identification Number (VIN) Verification: This form confirms the VIN of the tractor, which is crucial for registration and insurance purposes.

- Odometer Disclosure Statement: Required for vehicles less than ten years old, this statement verifies the mileage on the tractor at the time of sale.

- Sales Tax Form: This form documents the sales tax collected during the transaction, which is necessary for the buyer's registration.

- Affidavit of Heirship: If the tractor is inherited, this document establishes the rightful ownership of the tractor by the heir.

- Power of Attorney: If someone is handling the sale on behalf of the owner, this document grants them the authority to act in the owner's stead.

- Insurance Policy: Proof of insurance may be required before the tractor can be registered or used on public roads.

- Inspection Report: Some buyers may request a report confirming the tractor's condition and compliance with safety standards.

- Bill of Sale for Equipment: If the sale includes attachments or additional equipment, a separate bill of sale may be needed for those items.

Having these documents ready can simplify the buying or selling process. Each form plays a vital role in ensuring legal compliance and protecting the interests of both parties involved in the transaction.

Misconceptions

Understanding the Texas Tractor Bill of Sale form is essential for anyone involved in the buying or selling of tractors in the state. However, several misconceptions often arise. Below is a list that clarifies these misunderstandings.

- The form is only necessary for new tractors. Many believe that a bill of sale is only required for new tractors. In reality, it is important for both new and used tractors to provide proof of ownership.

- All sales require notarization. Some think that every bill of sale must be notarized to be valid. While notarization can add an extra layer of security, it is not a legal requirement for the bill of sale in Texas.

- The form must be filed with the state. There is a misconception that the bill of sale needs to be submitted to a state agency. This is incorrect; the bill of sale is a private document between the buyer and seller.

- A bill of sale guarantees a clear title. Buyers often assume that having a bill of sale ensures they receive a clear title. However, it is crucial to verify the title separately to avoid potential issues.

- Only licensed dealers can provide a bill of sale. Some individuals think that only licensed dealers can issue a bill of sale. In fact, any private seller can create and provide a bill of sale for a tractor.

- The form must be completed in person. Many believe that the bill of sale must be signed in person. While it is recommended, electronic signatures can also be valid if both parties agree.

- There is a specific format required for the bill of sale. Some think there is a mandated format for the bill of sale. While certain information is necessary, the format can vary as long as all essential details are included.

- The bill of sale is only for the buyer's protection. A common misconception is that the bill of sale solely protects the buyer. In fact, it also serves to protect the seller by documenting the transaction.

- It is unnecessary if the tractor is registered. Some individuals believe that if a tractor is registered, a bill of sale is not needed. This is false; a bill of sale is still important for establishing ownership.

- The bill of sale is not legally binding. Many people think that a bill of sale holds no legal weight. In truth, it is a legally binding document that can be enforced in a court of law.

By addressing these misconceptions, individuals can better navigate the process of buying or selling a tractor in Texas, ensuring that they understand the importance of the bill of sale in the transaction.

PDF Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Texas Tractor Bill of Sale form is used to document the sale of a tractor in Texas. |

| Governing Law | This form is governed by Texas state law, specifically under the Texas Business and Commerce Code. |

| Parties Involved | The form requires information from both the seller and the buyer, including names and addresses. |

| Vehicle Information | Details about the tractor, such as make, model, year, and Vehicle Identification Number (VIN), must be included. |

| Payment Details | The sale price and payment method should be clearly stated in the form. |

| Signatures | Both the seller and buyer must sign the form to validate the transaction. |

Key takeaways

When filling out and using the Texas Tractor Bill of Sale form, consider the following key takeaways:

- Accurate Information: Ensure all details about the tractor, including make, model, year, and Vehicle Identification Number (VIN), are correct. This helps avoid disputes later.

- Seller and Buyer Details: Include full names and addresses of both the seller and buyer. This information is crucial for record-keeping and future reference.

- Sales Price: Clearly state the sale price of the tractor. This figure is important for tax purposes and should reflect the agreed amount.

- Signatures Required: Both the seller and buyer must sign the document. Without signatures, the bill of sale may not be legally binding.