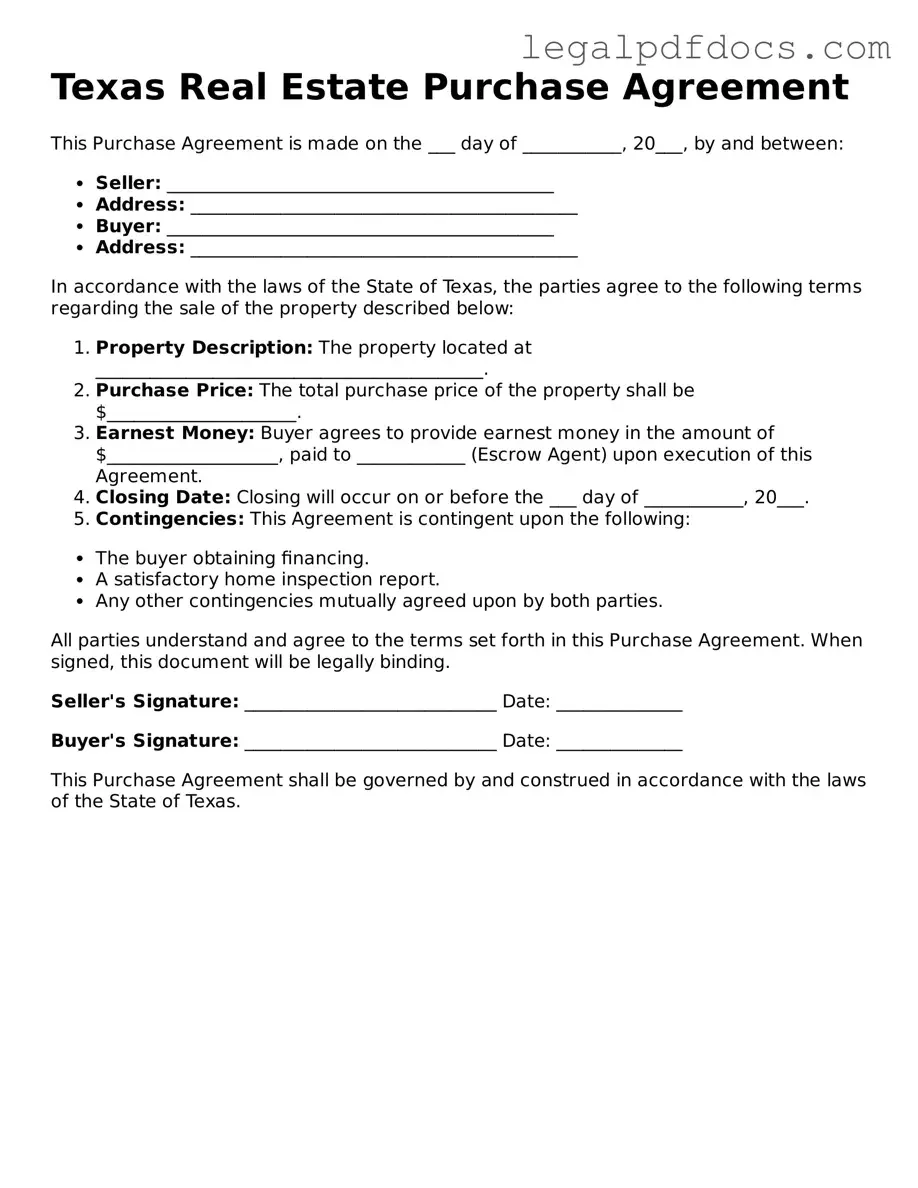

Official Real Estate Purchase Agreement Form for Texas

The Texas Real Estate Purchase Agreement form serves as a crucial document in the home buying and selling process, encapsulating the essential terms and conditions agreed upon by both parties involved in a real estate transaction. This comprehensive form outlines critical elements such as the purchase price, financing details, and earnest money deposit, ensuring that both buyers and sellers have a clear understanding of their obligations. Additionally, it includes provisions related to property disclosures, inspections, and contingencies, which protect the interests of both parties and help facilitate a smooth transaction. The agreement also specifies the closing date and any other pertinent details that may affect the transfer of ownership. By providing a structured framework for negotiations, the Texas Real Estate Purchase Agreement promotes transparency and minimizes potential disputes, making it an indispensable tool for anyone engaged in real estate dealings within the state.

Dos and Don'ts

Here are 10 important dos and don’ts when filling out the Texas Real Estate Purchase Agreement form:

- Do read the entire form carefully before filling it out.

- Do provide accurate information for all parties involved.

- Do include the property address and legal description.

- Do specify the purchase price clearly.

- Do understand the terms and conditions before signing.

- Don't leave any sections blank; fill in all required fields.

- Don't use abbreviations or shorthand that may cause confusion.

- Don't forget to initial any changes made to the agreement.

- Don't sign the document without reviewing it thoroughly.

- Don't assume anything; clarify any uncertainties with your agent.

How to Use Texas Real Estate Purchase Agreement

Once you have the Texas Real Estate Purchase Agreement form in front of you, it is essential to fill it out accurately to ensure a smooth transaction. This process involves providing specific information about the property, the buyer, and the seller. Follow the steps below to complete the form correctly.

- Obtain the Form: Ensure you have the latest version of the Texas Real Estate Purchase Agreement form.

- Fill in the Date: Write the date on which the agreement is being filled out.

- Identify the Parties: Enter the names of the buyer(s) and seller(s) in the designated sections.

- Property Description: Provide a detailed description of the property, including the address and any relevant legal descriptions.

- Purchase Price: Clearly state the agreed-upon purchase price for the property.

- Earnest Money: Indicate the amount of earnest money to be deposited and the name of the escrow agent or title company handling it.

- Financing Information: Specify the type of financing the buyer will use, such as conventional, FHA, or VA loans.

- Closing Date: Enter the anticipated closing date for the transaction.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as inspections or financing approval.

- Signatures: Ensure all parties sign and date the agreement at the end of the document.

After completing the form, review it carefully for any errors or omissions. Once confirmed, provide copies to all parties involved and retain a copy for your records. This step is crucial for ensuring that everyone is on the same page as the transaction moves forward.

Find Popular Real Estate Purchase Agreement Forms for US States

Purchasing Agreements - Defines the process for delivering the property deed at closing.

Florida Purchase Agreement - The document may describe any repairs the seller agrees to make before the sale.

Arizona Real Estate Purchase Contract Pdf - Outlines any property disclosures required by law.

Purchase Agreement Michigan for Sale by Owner - Clarifies terms for financing and payment options available to the buyer.

Documents used along the form

In Texas real estate transactions, the Real Estate Purchase Agreement is a crucial document, but it is not the only one involved in the process. Various other forms and documents accompany the agreement, each serving specific purposes that facilitate a smooth transaction. Understanding these documents can help buyers and sellers navigate the complexities of real estate dealings more effectively.

- Seller's Disclosure Notice: This form requires the seller to disclose any known issues with the property, such as structural problems or past flooding. Transparency is essential, as it protects both parties from future disputes.

- Option Fee Agreement: This document allows the buyer to pay a fee for the right to terminate the contract within a specified period. It provides the buyer with a window to conduct inspections and decide whether to proceed with the purchase.

- Inspection Report: After the buyer conducts a property inspection, this report details the condition of the home. It can reveal necessary repairs and influence negotiations between the buyer and seller.

- Financing Addendum: If the buyer is obtaining a mortgage, this addendum outlines the terms of the financing, including the loan amount and type. It ensures that both parties are aware of the financial arrangements involved.

- Title Commitment: This document is issued by a title company and outlines the current status of the property's title. It confirms that the title is clear of any liens or encumbrances, which is vital for a successful transfer of ownership.

- Closing Disclosure: Provided to the buyer at least three days before closing, this form details the final terms of the loan, including all closing costs. It is designed to ensure that the buyer understands their financial obligations before finalizing the sale.

- Deed: This legal document transfers ownership of the property from the seller to the buyer. It must be executed and recorded to complete the transaction officially.

- Affidavit of Title: This sworn statement by the seller confirms that they hold the title to the property and that there are no undisclosed liens or claims against it. It provides additional assurance to the buyer regarding the legitimacy of the sale.

Each of these documents plays a vital role in the real estate transaction process in Texas. By understanding their purposes and implications, buyers and sellers can engage more confidently in their real estate dealings, ensuring a smoother and more informed transaction experience.

Misconceptions

When it comes to the Texas Real Estate Purchase Agreement form, there are several misconceptions that can lead to confusion. Understanding these misconceptions can help buyers and sellers navigate the process more effectively. Here are eight common misunderstandings:

-

It is a legally binding contract from the moment it is signed. Many believe that simply signing the agreement makes it legally binding. However, it typically requires acceptance by both parties and may also depend on certain conditions being met.

-

All terms are negotiable. While many terms can be negotiated, some elements, such as legal requirements and state regulations, must be adhered to and are not open for negotiation.

-

Only real estate agents can fill out the form. Although real estate agents are often involved, buyers and sellers can fill out the form themselves, provided they understand the implications of the terms included.

-

The form is the same for every property. Each property may have unique characteristics that require specific clauses or adjustments in the agreement, making it crucial to tailor the form accordingly.

-

It covers all aspects of the transaction. The agreement primarily focuses on the sale terms, but it does not cover every detail, such as inspections or financing arrangements, which may require separate agreements.

-

Once signed, it cannot be changed. Amendments can be made to the agreement after it has been signed, as long as both parties agree to the changes and document them properly.

-

It is the only document needed for a real estate transaction. In reality, various documents, such as disclosures and title documents, are also necessary to complete the transaction legally.

-

It guarantees a successful closing. While the agreement is an important step, it does not guarantee that the sale will close. Other factors, such as financing and inspections, can affect the outcome.

By clarifying these misconceptions, both buyers and sellers can approach the Texas Real Estate Purchase Agreement with a better understanding of its purpose and limitations. This knowledge is key to ensuring a smoother real estate transaction.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Real Estate Purchase Agreement is governed by Texas state law. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction in Texas. |

| Parties Involved | The agreement includes the buyer and the seller, both of whom must be clearly identified. |

| Property Description | A detailed description of the property being sold is required, including the address and legal description. |

| Purchase Price | The purchase price must be clearly stated, along with any deposits or earnest money involved. |

| Contingencies | The form allows for contingencies, such as financing or inspection, which must be specified. |

| Closing Date | A closing date is typically included, indicating when the sale will be finalized. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

Key takeaways

When engaging in real estate transactions in Texas, understanding the Real Estate Purchase Agreement form is crucial. Here are some key takeaways to keep in mind:

- Clarity is Key: Ensure that all details, such as the property address, purchase price, and terms of sale, are clearly stated. Ambiguities can lead to misunderstandings and disputes.

- Contingencies Matter: Be aware of the contingencies included in the agreement. These may include financing, inspections, and the sale of another property. They protect both the buyer and seller by allowing them to back out under certain conditions.

- Deadlines are Essential: Pay attention to the timelines specified in the agreement. Missing a deadline can have serious consequences, including losing the right to negotiate or even canceling the contract.

- Seek Professional Guidance: While it is possible to fill out the form independently, consulting with a real estate attorney or agent can provide valuable insights and ensure compliance with local laws.