Official Quitclaim Deed Form for Texas

In the realm of real estate transactions, understanding the tools at your disposal is crucial, and the Texas Quitclaim Deed form stands out as a significant instrument for property transfers. This form allows a property owner, known as the grantor, to transfer their interest in a property to another individual or entity, called the grantee, without making any guarantees about the title's validity. Unlike other deed types, such as warranty deeds, a quitclaim deed does not provide any warranties or promises regarding the ownership status of the property. This means that if there are any claims, liens, or other issues with the property title, the grantee accepts the property "as is." The Texas Quitclaim Deed form is often used in situations where the parties know each other well, such as family transfers, divorce settlements, or to clear up title issues. While the process may seem straightforward, it is essential to ensure that all necessary information is accurately filled out, including the legal description of the property and the names of both the grantor and grantee. Additionally, the form must be properly executed and filed with the county clerk to complete the transfer legally. Understanding these aspects will help individuals navigate the complexities of property transfers in Texas more effectively.

Dos and Don'ts

When filling out the Texas Quitclaim Deed form, it's important to keep a few key points in mind. Here are some dos and don'ts to help ensure the process goes smoothly.

- Do provide accurate information about the property being transferred.

- Do include the names and addresses of both the grantor and grantee.

- Do have the document notarized to ensure its validity.

- Do check for any local requirements or additional paperwork needed.

- Don't leave any sections blank; complete all required fields.

- Don't use abbreviations or shorthand that could cause confusion.

- Don't forget to include the legal description of the property.

- Don't sign the form until you are in the presence of a notary public.

How to Use Texas Quitclaim Deed

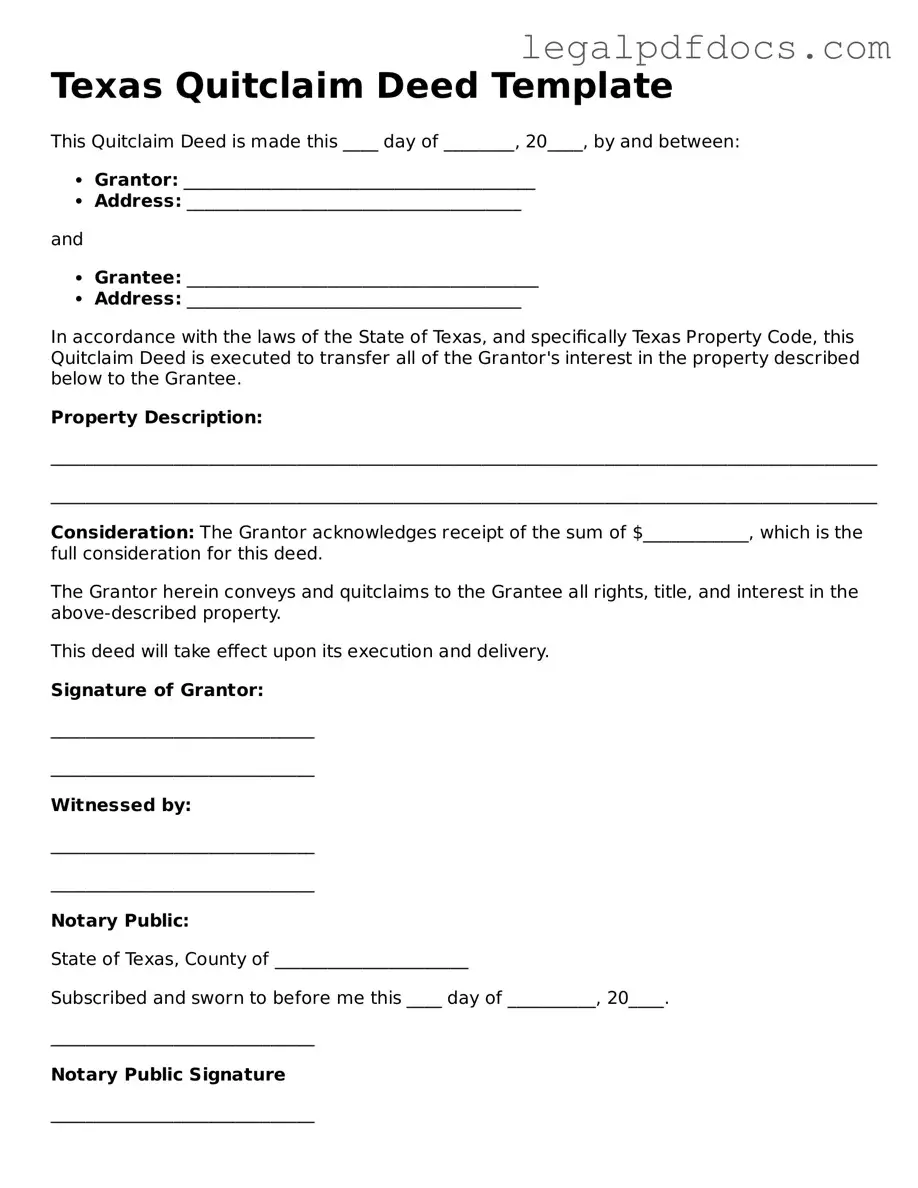

Once you have the Texas Quitclaim Deed form in front of you, it’s time to fill it out. This document allows one party to transfer their interest in a property to another party. Make sure you have all the necessary information ready before you begin. Here are the steps to complete the form:

- Identify the Grantor: Write the full name of the person or entity transferring the property.

- Identify the Grantee: Enter the full name of the person or entity receiving the property.

- Property Description: Provide a detailed description of the property being transferred. This usually includes the address and legal description.

- Consideration: Indicate the amount of money or value exchanged for the property. If it’s a gift, you can state “for love and affection.”

- Date: Write the date when the transfer is taking place.

- Signature of Grantor: The grantor must sign the form. Make sure the signature matches the name provided.

- Notary Public: Have the document notarized. The notary will verify the identity of the grantor and witness the signing.

After completing the form, you’ll need to file it with the county clerk in the county where the property is located. This ensures that the transfer is officially recorded and recognized. Keep a copy for your records.

Find Popular Quitclaim Deed Forms for US States

Who Can Prepare a Quit Claim Deed in Florida - This deed allows the original owner to remove their name from the title.

Illinois Quick Claim Deed - It conveys whatever interest the grantor has, if any, in the property.

Quit Claim Deed Georgia - A Quitclaim Deed is often preferred in informal arrangements.

Free Quit Claim Deed Form Arizona - They can also be used in business partnerships to adjust ownership stakes in properties.

Documents used along the form

When dealing with property transfers in Texas, the Quitclaim Deed form is often accompanied by several other documents to ensure a smooth transaction. Each of these forms serves a specific purpose and can help clarify the details of the property transfer. Below is a list of commonly used forms alongside the Quitclaim Deed.

- Property Transfer Affidavit: This document provides a sworn statement regarding the transfer of property. It typically includes information about the buyer, seller, and the nature of the transaction, which can help establish the legitimacy of the transfer.

- Title Insurance Policy: This policy protects the buyer from potential disputes over property ownership. It ensures that the title is clear and free from liens or other encumbrances, offering peace of mind to the new owner.

- Warranty Deed: Unlike a Quitclaim Deed, a Warranty Deed offers guarantees about the title. It assures the buyer that the seller has the right to transfer ownership and that the property is free of claims, except those disclosed.

- Bill of Sale: This document is used to transfer personal property along with real estate. It details the items being sold and is particularly useful when the sale includes furniture or appliances within the property.

- Real Estate Purchase Agreement: This contract outlines the terms of the sale, including the purchase price, contingencies, and timelines. It serves as a formal agreement between the buyer and seller before the actual transfer occurs.

- Notice of Foreclosure: If the property is in foreclosure, this document informs interested parties about the impending sale. It is essential for potential buyers to be aware of any foreclosure proceedings that may affect the property.

- Affidavit of Heirship: In cases where property is inherited, this document establishes the rightful heirs. It can help clarify ownership when the original owner has passed away without a will.

- Homestead Exemption Application: Homeowners may use this form to apply for tax exemptions on their primary residence. Filing this application can lead to significant savings on property taxes.

Understanding these additional forms can help streamline the property transfer process and protect the interests of both buyers and sellers. Always consider consulting with a legal professional to ensure all necessary documents are correctly completed and filed.

Misconceptions

Understanding the Texas Quitclaim Deed can be challenging due to various misconceptions. Here are eight common misunderstandings, clarified for better comprehension:

- Quitclaim Deeds Transfer Ownership Fully - Many believe that a quitclaim deed transfers full ownership rights. In reality, it only transfers the interest that the grantor has in the property, if any.

- Quitclaim Deeds Are Only for Family Transfers - While often used among family members, quitclaim deeds can be used in various situations, including sales, transfers to trusts, or clearing up title issues.

- Quitclaim Deeds Are Not Legal Documents - Some people think quitclaim deeds are informal agreements. They are, in fact, legal documents that must be properly executed and recorded to be effective.

- Quitclaim Deeds Eliminate All Liabilities - There is a misconception that using a quitclaim deed removes all financial responsibilities related to the property. However, any existing liens or debts associated with the property remain intact.

- Quitclaim Deeds Are Only Used in Texas - Many assume quitclaim deeds are exclusive to Texas. In truth, quitclaim deeds are recognized in many states across the U.S., although the specifics may vary.

- Quitclaim Deeds Can Be Used to Avoid Taxes - Some believe that transferring property via a quitclaim deed avoids tax implications. This is not accurate; tax consequences can still arise from such transfers.

- Quitclaim Deeds Do Not Require Notarization - There is a belief that notarization is unnecessary for quitclaim deeds. However, in Texas, a quitclaim deed must be notarized to be valid.

- Quitclaim Deeds Are Irrevocable - Lastly, people often think that once a quitclaim deed is executed, it cannot be undone. In fact, the grantor can revoke the deed under certain conditions, depending on state laws.

By addressing these misconceptions, individuals can make more informed decisions regarding property transfers in Texas.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of property without any warranties. |

| Governing Law | The Texas Quitclaim Deed is governed by Texas Property Code, Chapter 5. |

| Parties Involved | The form involves a grantor (the person transferring the property) and a grantee (the person receiving the property). |

| No Warranty | Quitclaim deeds do not guarantee that the grantor has clear title to the property. |

| Use Cases | Commonly used among family members or in divorce settlements to transfer property rights. |

| Filing Requirement | To be effective, the deed must be filed with the county clerk's office in the county where the property is located. |

| Consideration | While a quitclaim deed can be executed for no consideration, some form of payment or value is often stated. |

| Revocation | A quitclaim deed cannot be revoked once it has been executed and delivered to the grantee. |

| Signature Requirement | The grantor must sign the quitclaim deed in front of a notary public for it to be valid. |

Key takeaways

When filling out and using the Texas Quitclaim Deed form, keep the following key points in mind:

- Ensure all parties involved are correctly identified. Include full names and addresses.

- Clearly describe the property being transferred. Include the legal description, not just the address.

- Signatures must be present from the grantor (the person transferring the property). Witnesses are not required, but notarization is essential.

- Use the correct form for Texas. The Quitclaim Deed must comply with state-specific requirements.

- File the completed deed with the county clerk's office where the property is located. This step is crucial for public record.

- Consider consulting with a legal professional to ensure all aspects are handled correctly.

- Be aware that a Quitclaim Deed does not guarantee clear title. It simply transfers whatever interest the grantor has.

- Understand that this deed is often used among family members or to clear up title issues.

- Keep a copy of the filed deed for your records. It serves as proof of the transfer.