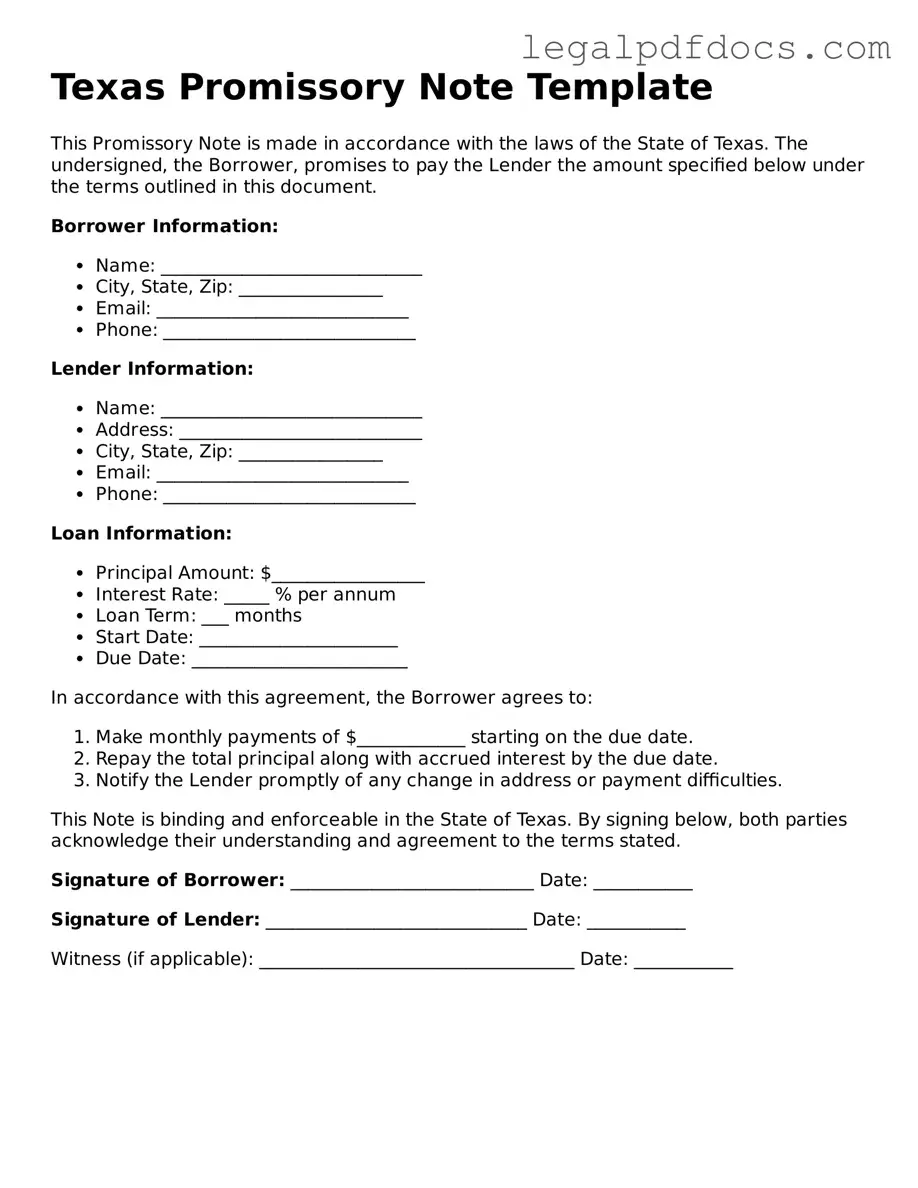

Official Promissory Note Form for Texas

The Texas Promissory Note form serves as a vital financial instrument in various lending scenarios, enabling individuals and businesses to formalize agreements regarding borrowed funds. This document outlines the borrower's promise to repay a specified amount of money to the lender under agreed-upon terms. Key elements include the principal amount, interest rate, payment schedule, and any applicable fees. Additionally, the form often specifies the consequences of default, providing clarity on the lender's rights in such situations. By detailing the obligations of both parties, the Texas Promissory Note fosters transparency and helps prevent misunderstandings. Understanding this form is essential for anyone involved in lending or borrowing in Texas, as it not only protects the interests of the lender but also ensures that the borrower is fully aware of their commitments.

Dos and Don'ts

When filling out the Texas Promissory Note form, it is important to follow certain guidelines to ensure the document is valid and enforceable. Below are five things you should do and five things you should avoid.

Things You Should Do:

- Clearly state the loan amount in both numbers and words.

- Include the names and addresses of both the borrower and the lender.

- Specify the interest rate, if applicable, and how it will be calculated.

- Outline the repayment terms, including the due date and payment schedule.

- Sign and date the document in the presence of a witness or notary, if required.

Things You Shouldn't Do:

- Do not leave any sections blank; fill out all required fields completely.

- Avoid using vague language that could lead to misunderstandings.

- Do not forget to keep a copy of the signed note for your records.

- Do not use outdated or incorrect forms; always use the latest version.

- Refrain from altering the terms after both parties have signed without mutual consent.

How to Use Texas Promissory Note

Once you have the Texas Promissory Note form in front of you, it's time to fill it out carefully. Completing this form correctly is important for ensuring that all parties understand their obligations. Follow these steps to make the process straightforward.

- Identify the Parties: At the top of the form, enter the names and addresses of both the borrower and the lender. Make sure to use full legal names to avoid any confusion.

- Specify the Loan Amount: Clearly write the total amount of money being borrowed. This should be in both numerical and written form for clarity.

- Set the Interest Rate: Indicate the interest rate being charged on the loan. If there is no interest, you can specify that as well.

- Define the Payment Terms: Outline how and when the borrower will repay the loan. Include details about the payment schedule, whether it’s monthly, quarterly, or another arrangement.

- Include the Maturity Date: State the date when the loan must be fully repaid. This is crucial for both parties to know.

- Sign the Document: Both the borrower and lender must sign the form. Ensure that each signature is dated and includes printed names underneath.

- Witness or Notarize (if required): Depending on your situation, you may need a witness or notary to sign the document. Check local requirements to ensure compliance.

After completing the form, keep copies for both the borrower and lender. This will help everyone stay informed about the terms of the agreement. If you have any questions or need further assistance, consider consulting a legal professional.

Find Popular Promissory Note Forms for US States

Promissory Note Florida Pdf - The note can also outline the jurisdiction for resolving any legal issues that may arise.

Promissory Note California - A promissory note is a written promise to pay a specified amount of money at a certain time.

Basic Promissory Note - The note is typically executed in two copies, one for the lender and one for the borrower.

Documents used along the form

When dealing with a Texas Promissory Note, several other forms and documents may be necessary to ensure clarity and legal compliance. Each of these documents serves a specific purpose in the lending process, helping both parties understand their rights and responsibilities. Below is a list of commonly associated forms.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved.

- Security Agreement: Used when the loan is secured by collateral, this agreement details the collateral and the lender's rights in case of default.

- Personal Guarantee: A document where an individual agrees to be personally responsible for the loan, ensuring the lender can seek repayment from them if the borrower defaults.

- Disclosure Statement: This form provides important information about the loan terms, including total costs, interest rates, and any fees, ensuring transparency for the borrower.

- Amortization Schedule: A table that outlines each payment over the life of the loan, showing how much goes toward interest and principal, helping borrowers understand their repayment obligations.

- Default Notice: A document sent to the borrower if they fail to meet payment obligations, outlining the default and the lender's next steps.

- Release of Lien: This form is used to formally release the lender's claim on the collateral once the loan is paid in full.

- Assignment of Note: A document that transfers the rights to the promissory note from one lender to another, ensuring the new lender has the same rights as the original.

- Payment Receipt: A record provided to the borrower after each payment, confirming the amount paid and the remaining balance on the loan.

Understanding these documents can help both lenders and borrowers navigate the lending process with confidence. Each form plays a critical role in protecting the interests of both parties, ensuring a clear understanding of the loan agreement.

Misconceptions

Understanding the Texas Promissory Note form can be challenging, especially with so much information available. Here are ten common misconceptions that people often have about this important financial document.

- All Promissory Notes Are the Same: Many believe that all promissory notes are identical. In reality, they can vary significantly based on state laws and specific terms agreed upon by the parties involved.

- Only Banks Use Promissory Notes: While banks frequently use these notes, individuals and businesses can also create and enforce them for personal loans or business transactions.

- A Promissory Note Must Be Notarized: Some think that notarization is a requirement for all promissory notes. However, in Texas, notarization is not mandatory unless specified by the parties involved.

- Once Signed, a Promissory Note Cannot Be Changed: People often assume that once a promissory note is signed, it is set in stone. In fact, parties can amend the terms if both agree to the changes.

- Promissory Notes Are Only for Large Loans: Many believe that these notes are only necessary for significant amounts of money. However, they can be used for loans of any size, providing clarity and legal protection.

- Interest Rates Must Be Included: Some think that every promissory note must include an interest rate. While it is common to specify one, it is not a legal requirement in Texas.

- Promissory Notes Are Not Legally Binding: A common misconception is that these notes are informal agreements. In truth, a properly executed promissory note is a legally binding document.

- They Are Only Used for Personal Loans: Many people assume promissory notes are only for personal transactions. In reality, they are frequently used in business dealings and real estate transactions.

- Verbal Agreements Are Enough: Some believe that a verbal agreement can replace a written promissory note. However, having a written document is crucial for legal enforceability and clarity.

- They Can’t Be Sold or Transferred: A misconception exists that once a promissory note is created, it cannot be sold or transferred. In fact, promissory notes can be assigned to another party, allowing for flexibility in financial arrangements.

By understanding these misconceptions, you can navigate the world of promissory notes with greater confidence and clarity. Always consider consulting a legal professional for personalized advice tailored to your specific situation.

PDF Specifications

| Fact Name | Details |

|---|---|

| Definition | A Texas Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a defined time or on demand. |

| Governing Law | The Texas Promissory Note is governed by the Texas Business and Commerce Code, specifically Chapter 3, which covers negotiable instruments. |

| Parties Involved | The note typically involves two parties: the borrower (maker) who promises to pay and the lender (payee) who receives the payment. |

| Interest Rates | Interest rates on a Texas Promissory Note can be fixed or variable, but they must comply with state usury laws to avoid excessive charges. |

| Repayment Terms | The repayment terms should clearly outline the schedule, including due dates and any grace periods for late payments. |

| Signatures Required | Both the borrower and lender must sign the note for it to be legally binding, indicating their agreement to the terms. |

| Enforcement | If the borrower fails to repay, the lender can enforce the note through legal action, including seeking a judgment in court. |

Key takeaways

Filling out a Texas Promissory Note form can be straightforward if you keep a few key points in mind. Here are ten essential takeaways to help you navigate the process:

- Understand the Basics: A promissory note is a written promise to pay a specific amount of money at a defined time.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures everyone knows who is involved.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed. This figure is crucial for both parties.

- Set the Interest Rate: If applicable, specify the interest rate. It can be fixed or variable, but it must be clearly defined.

- Define Payment Terms: Outline when payments are due, how often they will be made, and the method of payment.

- Include Maturity Date: State when the loan must be fully repaid. This helps both parties plan accordingly.

- Address Default Conditions: Explain what happens if the borrower fails to make payments. This can include late fees or legal action.

- Consider Collateral: If the loan is secured, specify what collateral backs the loan. This provides security for the lender.

- Sign and Date: Both parties should sign and date the document. This step is essential for the note to be legally binding.

- Keep Copies: Each party should retain a copy of the signed note. This serves as proof of the agreement and terms.

By following these guidelines, you can effectively fill out and use a Texas Promissory Note, ensuring clarity and protection for both the borrower and the lender.