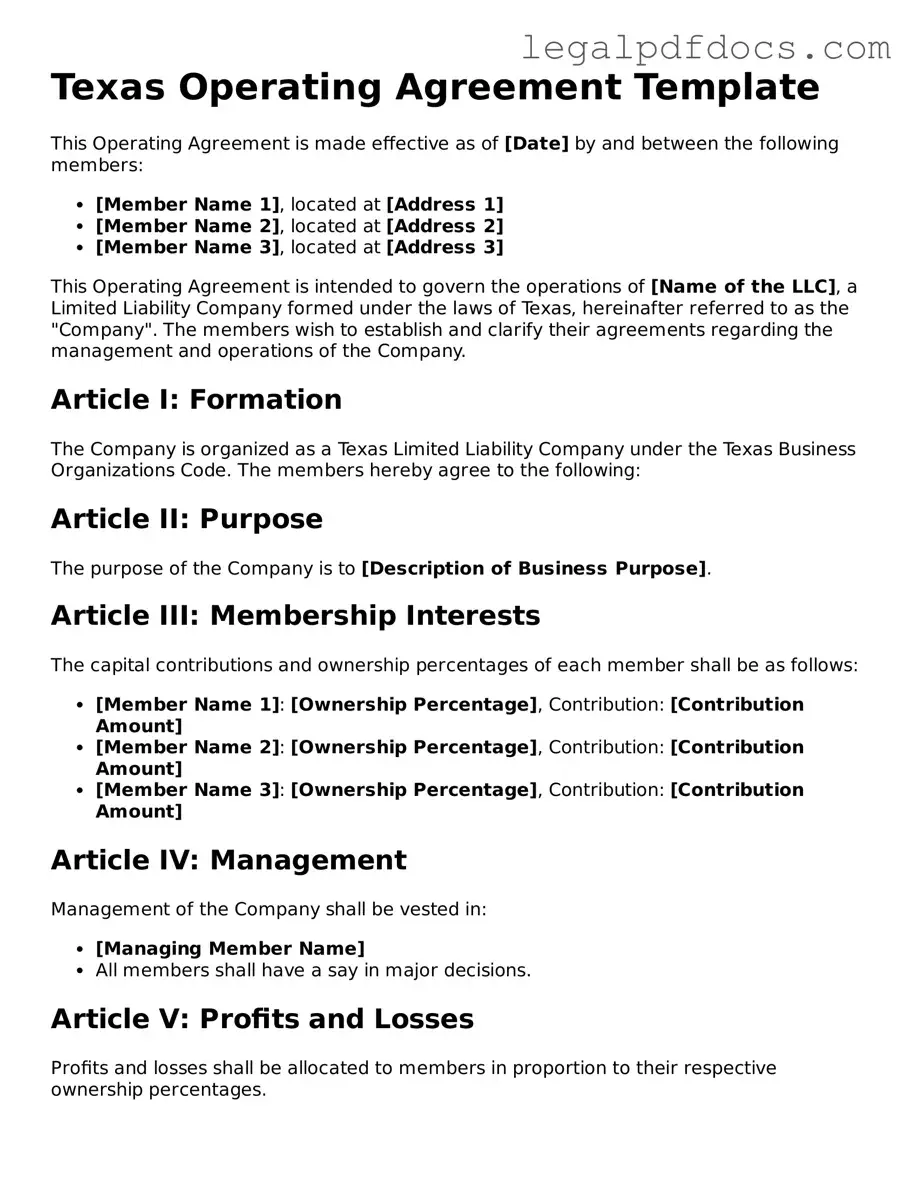

Official Operating Agreement Form for Texas

In the dynamic landscape of business formation, particularly within the realm of limited liability companies (LLCs), the Texas Operating Agreement plays a pivotal role. This essential document serves as the backbone of an LLC, outlining the internal workings and governance of the company. It delineates the rights and responsibilities of members, establishes the framework for decision-making, and provides clarity on profit distribution and management structures. Moreover, the agreement addresses critical aspects such as member contributions, voting procedures, and the process for adding or removing members. By setting forth these guidelines, the Texas Operating Agreement not only helps prevent misunderstandings among members but also serves as a safeguard against potential disputes. Understanding the significance of this document is crucial for anyone looking to establish or operate an LLC in Texas, as it lays the groundwork for a successful and harmonious business relationship.

Dos and Don'ts

When filling out the Texas Operating Agreement form, it's essential to approach the task with care and attention to detail. Below are some important dos and don'ts to keep in mind.

- Do read the entire form carefully before starting. Understanding each section will help you provide accurate information.

- Do include all members' names and addresses. This ensures that everyone involved is officially recognized.

- Do specify the management structure clearly. Decide if it will be member-managed or manager-managed.

- Do review your completed form for accuracy. Double-check all entries to avoid mistakes that could lead to complications.

- Do keep a copy of the completed agreement for your records. This will be useful for future reference.

- Don't leave any sections blank. Incomplete forms may be rejected or cause delays.

- Don't use vague language. Be specific about roles, responsibilities, and financial arrangements.

- Don't forget to date and sign the agreement. An unsigned document is not legally binding.

- Don't rush through the process. Take your time to ensure everything is filled out correctly.

- Don't overlook the importance of legal advice. Consulting with a professional can help you avoid potential pitfalls.

How to Use Texas Operating Agreement

Once you have the Texas Operating Agreement form in front of you, it’s time to get started on filling it out. This document is essential for outlining the management structure and operational procedures of your business. Follow these steps carefully to ensure that you complete the form correctly.

- Begin by entering the name of your business at the top of the form. Make sure it matches the name registered with the state.

- Next, provide the principal office address. This is where official correspondence will be sent.

- Identify the members of the LLC. List each member’s name and address clearly. This section may also include their ownership percentages.

- Outline the management structure. Specify whether the LLC will be managed by its members or by appointed managers.

- Detail the voting rights of each member. Include how decisions will be made and what constitutes a quorum.

- Include information about profit and loss distribution. Clearly state how profits and losses will be allocated among members.

- Address the procedures for adding or removing members. This is crucial for future changes in your business structure.

- Finally, make sure to sign and date the form. All members should sign to indicate their agreement to the terms outlined.

After completing the form, review it for accuracy. Once confirmed, you can proceed with filing it according to Texas state requirements.

Find Popular Operating Agreement Forms for US States

Idaho Llc Operating Agreement - This form helps to formalize the relationship between members.

Sample Florida Llc Operating Agreement - This agreement can specify the duration of the business entity's existence.

Michigan Llc Operating Agreement Template - An Operating Agreement outlines the management structure of an LLC.

Documents used along the form

The Texas Operating Agreement is a vital document for limited liability companies (LLCs) in Texas, outlining the management structure and operational guidelines of the entity. Alongside this agreement, several other forms and documents are commonly utilized to ensure proper compliance and organization. Below is a list of these documents, each serving a unique purpose within the framework of LLC operations.

- Certificate of Formation: This document is filed with the Texas Secretary of State to officially create the LLC. It includes essential information such as the company name, registered agent, and business purpose.

- Bylaws: While not required for LLCs, bylaws outline the internal rules governing the organization. They help in clarifying procedures for meetings, voting, and other operational aspects.

- Membership Certificate: This certificate serves as proof of ownership for members of the LLC. It details the member's share in the company and can be issued to each member upon joining.

- Operating Procedures: This document details the day-to-day operations of the LLC. It can include guidelines on decision-making, financial management, and conflict resolution.

- Member Consent Forms: These forms are used to document decisions made by members outside of formal meetings. They provide a record of agreements reached among members regarding significant actions.

- Annual Report: Some LLCs are required to file an annual report with the state. This document updates the state on the company’s activities and confirms that the LLC is still in operation.

- Tax Forms: Depending on the LLC's structure, various tax forms may be necessary for federal and state tax compliance. These forms ensure that the LLC meets its tax obligations.

- Non-Disclosure Agreement (NDA): This agreement protects sensitive information shared among members or with external parties. It helps maintain confidentiality regarding business operations and strategies.

Each of these documents plays a crucial role in the establishment and operation of an LLC in Texas. Properly managing these forms can lead to smoother operations and compliance with state regulations, ultimately contributing to the success of the business.

Misconceptions

When it comes to the Texas Operating Agreement form, several misconceptions often arise. Understanding these can help business owners navigate the complexities of forming and operating their limited liability companies (LLCs). Here are nine common misconceptions:

- All LLCs are required to have an Operating Agreement. While having an Operating Agreement is highly recommended, Texas law does not mandate it. However, without one, members may face challenges in managing their business and resolving disputes.

- The Operating Agreement is a public document. This is not true. The Operating Agreement is a private document and does not need to be filed with the state, keeping the details of the business's operations confidential.

- Only large LLCs need an Operating Agreement. This is a misconception. Even small LLCs benefit from having an Operating Agreement, as it clarifies roles, responsibilities, and procedures, regardless of the size of the business.

- Once created, the Operating Agreement cannot be changed. In reality, Operating Agreements can be amended. Members can modify the agreement as needed, provided they follow the procedures outlined within the document itself.

- The Operating Agreement is only for multi-member LLCs. This is incorrect. Single-member LLCs also benefit from an Operating Agreement, which helps establish the business as a separate legal entity and outlines operational guidelines.

- The Operating Agreement is the same as the Articles of Organization. These are distinct documents. The Articles of Organization are filed with the state to officially form the LLC, while the Operating Agreement outlines the internal rules and management structure.

- Having an Operating Agreement guarantees legal protection. While it provides a framework for operations and can help protect personal assets, it does not offer absolute legal protection. Proper business practices must still be followed.

- All members must sign the Operating Agreement for it to be valid. While it is best practice for all members to sign, the agreement can still be enforceable even if not all members have signed, depending on the circumstances and state laws.

- The Operating Agreement can be a verbal agreement. A verbal agreement is not sufficient. For clarity and enforceability, an Operating Agreement should be in writing, detailing the terms agreed upon by the members.

Understanding these misconceptions can help business owners make informed decisions about their LLCs and ensure they have the necessary documentation in place for effective management and protection.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Texas Operating Agreement outlines the management and operational procedures of a limited liability company (LLC) in Texas. |

| Governing Law | This agreement is governed by the Texas Business Organizations Code. |

| Members | It specifies the rights and responsibilities of the LLC members. |

| Management Structure | The agreement can establish a member-managed or manager-managed structure. |

| Capital Contributions | It details the capital contributions required from each member. |

| Profit Distribution | The document outlines how profits and losses will be distributed among members. |

| Amendments | It includes provisions for amending the agreement in the future. |

| Dispute Resolution | The agreement may include methods for resolving disputes among members. |

| Duration | The Texas Operating Agreement can specify the duration of the LLC's existence. |

Key takeaways

Understanding the Texas Operating Agreement is crucial for business owners. This document outlines the management structure and operational procedures of a Limited Liability Company (LLC) in Texas.

Clarity in roles is essential. The agreement should specify the duties and responsibilities of each member to prevent misunderstandings and conflicts in the future.

Flexibility is a key feature of the Operating Agreement. Members can customize the terms to suit their specific needs, including profit distribution and decision-making processes.

Regular updates are important. As the business evolves, so should the Operating Agreement. Members should review and amend the document periodically to reflect any changes in the business structure or goals.

Legal protection is enhanced by having a well-drafted Operating Agreement. It serves as a safeguard against disputes among members and provides a clear framework for resolving issues.