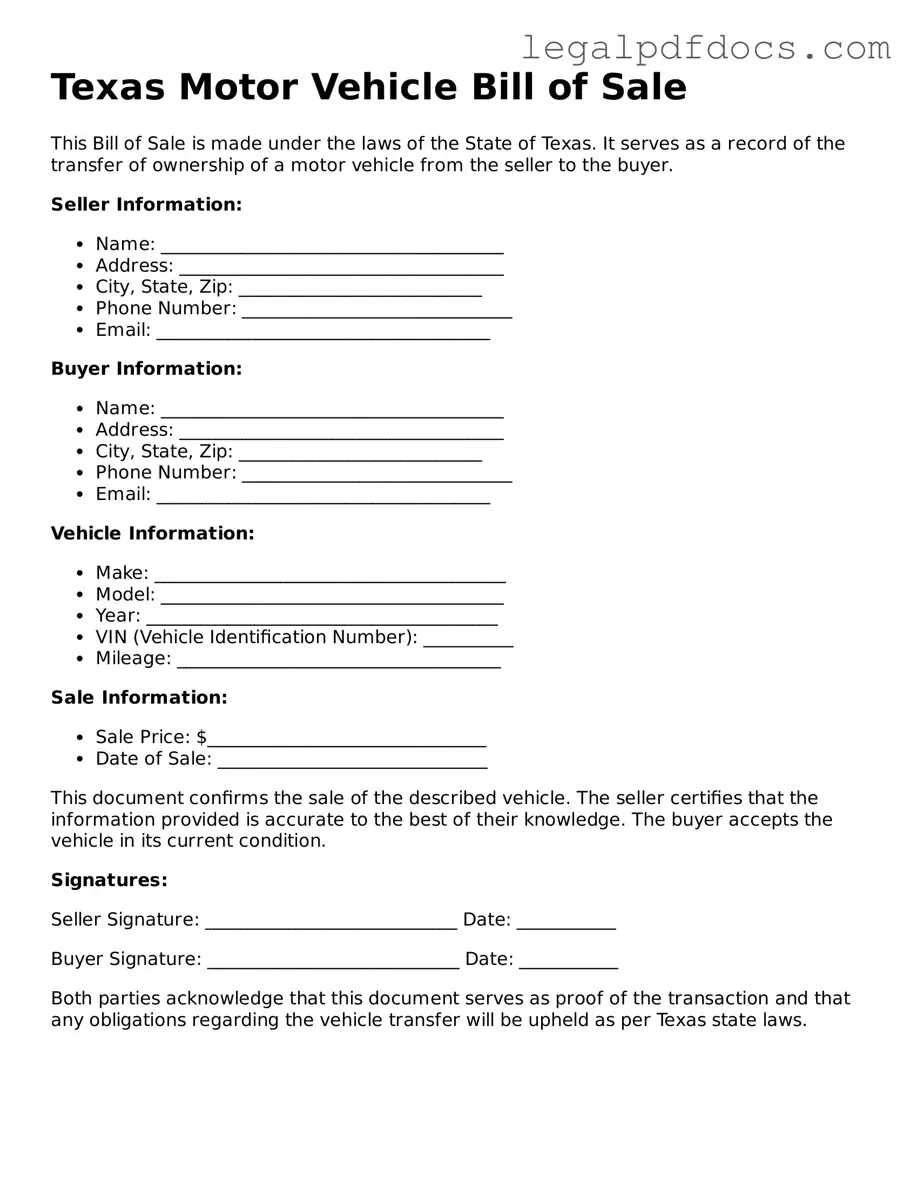

Official Motor Vehicle Bill of Sale Form for Texas

The Texas Motor Vehicle Bill of Sale form serves as an essential document in the process of transferring ownership of a vehicle. This form captures critical information such as the names and addresses of both the buyer and seller, the vehicle's identification number (VIN), make, model, year, and sale price. It also includes details about the date of the transaction, ensuring a clear record of when the ownership change occurred. A properly completed Bill of Sale can protect both parties by providing proof of the transaction, which may be required for registration or title transfer with the Texas Department of Motor Vehicles. Additionally, the form may include spaces for signatures, reinforcing the agreement between the buyer and seller. Understanding the importance of this document can help individuals navigate the complexities of vehicle sales in Texas, ensuring compliance with state regulations and facilitating a smooth transfer process.

Dos and Don'ts

When filling out the Texas Motor Vehicle Bill of Sale form, it's important to approach the process with care. Here’s a list of things you should and shouldn’t do to ensure that the transaction goes smoothly.

- Do include accurate vehicle information, such as the make, model, year, and Vehicle Identification Number (VIN).

- Do provide the full names and addresses of both the buyer and the seller.

- Do specify the sale price clearly to avoid any confusion later on.

- Do sign and date the form to validate the transaction.

- Don't leave any sections blank. Incomplete forms can lead to complications.

- Don't use white-out or any other correction fluid on the form. This can raise questions about the authenticity of the document.

- Don't forget to make copies of the completed form for both parties. Keeping records is essential.

How to Use Texas Motor Vehicle Bill of Sale

Once you have the Texas Motor Vehicle Bill of Sale form in hand, you are ready to document the sale of a vehicle. This form serves as a crucial record for both the buyer and the seller, ensuring that all necessary information is accurately captured. Follow these steps to fill out the form properly.

- Obtain the form: You can find the Texas Motor Vehicle Bill of Sale form online or at your local Department of Motor Vehicles (DMV) office.

- Fill in the date: Write the date of the sale at the top of the form.

- Provide seller information: Enter the full name and address of the seller. This includes the street address, city, state, and zip code.

- Provide buyer information: Enter the full name and address of the buyer, following the same format as the seller's information.

- Describe the vehicle: Fill in the vehicle details, including the make, model, year, vehicle identification number (VIN), and odometer reading at the time of sale.

- State the sale price: Clearly indicate the amount for which the vehicle is being sold.

- Signatures: Both the seller and the buyer must sign and date the form to validate the transaction.

After completing the form, both parties should keep a copy for their records. This documentation is essential for transferring ownership and can help avoid any disputes in the future.

Find Popular Motor Vehicle Bill of Sale Forms for US States

Trailer Bill of Sale Georgia - The form may include odometer disclosure requirements in some jurisdictions.

Florida Bill of Sale Pdf - The form can provide peace of mind to the buyer when purchasing a used vehicle.

Vehicle Bill of Sale Form - Legally binding once signed by both the buyer and seller.

Kansas Title Transfer Form - It typically includes space for both the seller’s and the buyer’s contact information for record-keeping purposes.

Documents used along the form

When buying or selling a vehicle in Texas, several important documents accompany the Motor Vehicle Bill of Sale. These documents help ensure a smooth transaction and provide necessary information for both parties involved. Below are five common forms that are often used alongside the Bill of Sale.

- Texas Title Certificate: This document proves ownership of the vehicle. It must be transferred from the seller to the buyer during the sale. The title includes important details such as the vehicle identification number (VIN) and the names of both parties.

- Application for Texas Title: After the sale, the buyer needs to fill out this application to officially register the vehicle in their name. This form is submitted to the Texas Department of Motor Vehicles (DMV) along with the title certificate.

- Odometer Disclosure Statement: This statement is required for vehicles under 10 years old. It verifies the vehicle's mileage at the time of sale, protecting both the buyer and seller from future disputes regarding the vehicle's condition.

- Vehicle Registration Application: Buyers must complete this application to obtain a license plate and register the vehicle with the state. It includes details about the vehicle and the owner's information.

- Proof of Insurance: Before registering the vehicle, the buyer must provide proof of insurance. This document confirms that the vehicle is covered under a valid insurance policy, which is a requirement in Texas.

Having these documents ready can simplify the process of buying or selling a vehicle in Texas. Ensuring that all paperwork is completed accurately protects both parties and facilitates a successful transaction.

Misconceptions

The Texas Motor Vehicle Bill of Sale form is often misunderstood. Below are six common misconceptions about this form, along with clarifications for each.

- It is not required for all vehicle sales. Many people believe that a bill of sale is mandatory for every vehicle transaction in Texas. However, while it is recommended for record-keeping and legal protection, it is not legally required for all sales.

- It must be notarized. Some assume that the Texas Motor Vehicle Bill of Sale must be notarized to be valid. In reality, notarization is not a requirement for the bill of sale to be effective.

- It only applies to private sales. There is a misconception that the bill of sale is only used in private transactions. In fact, it can be used for both private and dealer sales, providing a record of the transaction.

- It does not need to include a vehicle identification number (VIN). Some people think that including the VIN is optional. However, the VIN is crucial for identifying the vehicle and should always be included on the bill of sale.

- It is the same as a title transfer. Many confuse the bill of sale with the vehicle title transfer process. While the bill of sale documents the transaction, the title transfer is a separate process that officially changes ownership.

- It cannot be used for trade-ins. There is a belief that the bill of sale cannot be used when trading in a vehicle. This is incorrect, as a bill of sale can still be created to document the trade-in value and transaction details.

Understanding these misconceptions can help individuals navigate vehicle transactions more effectively in Texas.

PDF Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Texas Motor Vehicle Bill of Sale form is used to document the sale of a motor vehicle in Texas. |

| Governing Law | This form is governed by Texas Transportation Code, Title 7, Chapter 501. |

| Required Information | It requires details such as the buyer's and seller's names, addresses, and vehicle information. |

| Vehicle Identification Number (VIN) | The VIN must be included to uniquely identify the vehicle being sold. |

| Signatures | Both the buyer and seller must sign the form for it to be valid. |

| Notarization | Notarization is not required for the Texas Motor Vehicle Bill of Sale, but it can be beneficial. |

| Tax Implications | The sale may be subject to sales tax, which the buyer is responsible for paying. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records. |

| Transfer of Title | The Bill of Sale is often used in conjunction with the vehicle title transfer process. |

| Availability | The form can be obtained online or from local county tax offices in Texas. |

Key takeaways

When it comes to buying or selling a vehicle in Texas, using a Motor Vehicle Bill of Sale form is essential. Here are some key takeaways to consider:

- Purpose of the Form: The Bill of Sale serves as a legal document that records the transfer of ownership from the seller to the buyer.

- Required Information: Ensure you include important details such as the vehicle's make, model, year, VIN (Vehicle Identification Number), and the sale price.

- Seller and Buyer Details: Both parties must provide their full names and addresses. This information is crucial for future reference.

- Notarization: While notarization is not required, having the document notarized can add an extra layer of protection and authenticity.

- Condition of the Vehicle: It's advisable to describe the condition of the vehicle clearly. This helps prevent disputes later on.

- As-Is Clause: If the vehicle is sold "as-is," make sure to state this clearly. This means the buyer accepts the vehicle in its current state without warranties.

- Keep Copies: Both the buyer and seller should keep a signed copy of the Bill of Sale for their records. This can be important for future transactions or legal matters.

- Registration and Title: After the sale, the buyer is responsible for transferring the title and registering the vehicle with the Texas Department of Motor Vehicles.

- Consulting Professionals: If there are any uncertainties about the process or the form, seeking advice from a legal professional can be beneficial.

By following these guidelines, you can ensure a smoother transaction when buying or selling a vehicle in Texas.