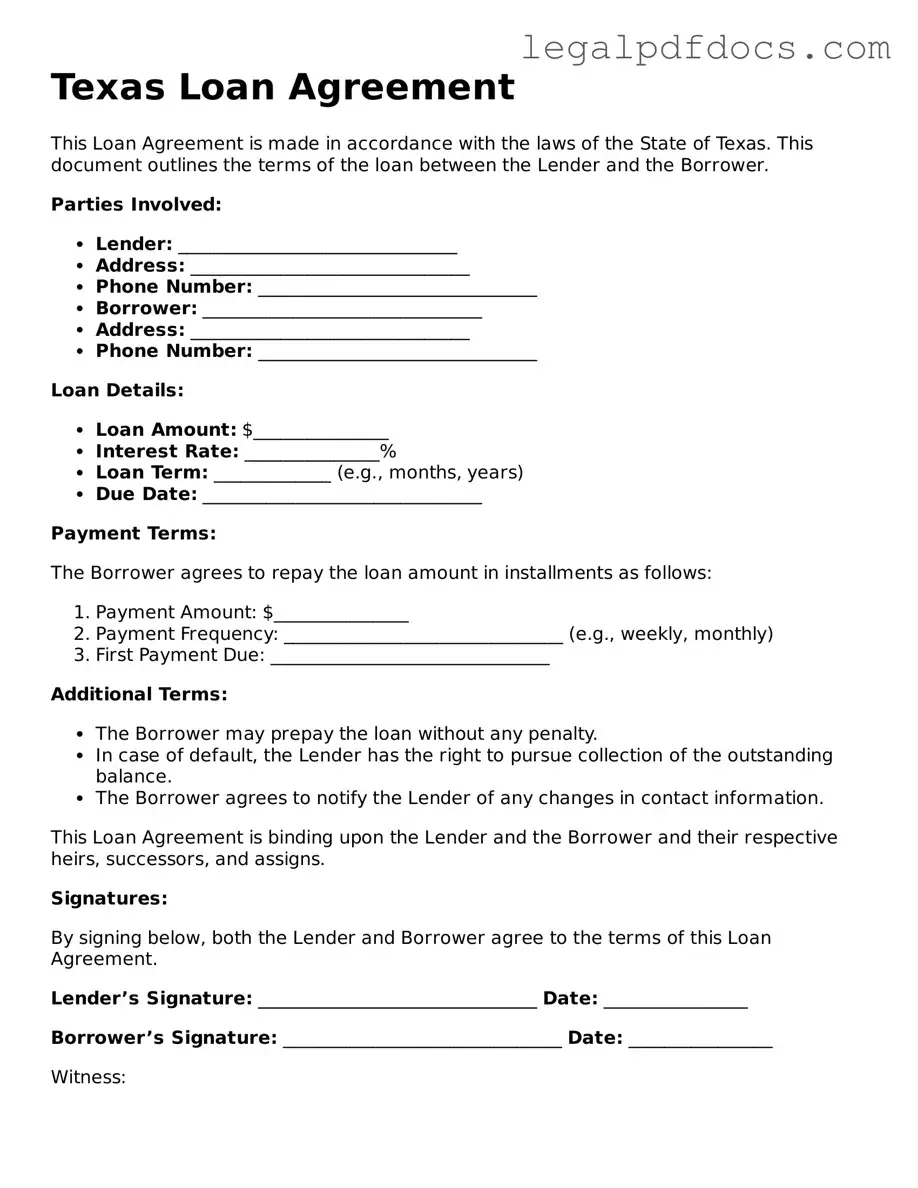

Official Loan Agreement Form for Texas

The Texas Loan Agreement form serves as a vital document in the lending process, outlining the terms and conditions under which funds are borrowed and repaid. This form typically includes essential details such as the names of the borrower and lender, the amount of the loan, the interest rate, and the repayment schedule. It may also specify any collateral involved, ensuring both parties understand their rights and obligations. Additionally, the agreement often addresses potential penalties for late payments and the process for resolving disputes. By providing a clear framework for the transaction, the Texas Loan Agreement form helps protect the interests of both the borrower and the lender, fostering transparency and accountability in financial dealings.

Dos and Don'ts

When filling out the Texas Loan Agreement form, it is essential to approach the process with care. The details you provide can significantly impact the terms of the loan and your responsibilities. Here’s a list of things to keep in mind.

- Do read the entire agreement thoroughly before signing. Understanding all terms is crucial.

- Do provide accurate and complete information. Misinformation can lead to complications.

- Do ask questions if any part of the agreement is unclear. Clarity is vital for a successful agreement.

- Do keep a copy of the signed agreement for your records. Documentation is important for future reference.

- Don't rush through the form. Taking your time can prevent mistakes.

- Don't omit any required information. Incomplete forms may be rejected.

- Don't sign the agreement without understanding your obligations. Know what you are committing to.

- Don't ignore deadlines for submission. Timeliness can affect your loan approval.

How to Use Texas Loan Agreement

Completing the Texas Loan Agreement form requires careful attention to detail. Each section must be filled out accurately to ensure clarity and legal compliance. Follow the steps below to complete the form effectively.

- Begin by entering the date at the top of the form. This establishes when the agreement is made.

- Provide the names and addresses of both the borrower and the lender. Make sure to include full names and current addresses for both parties.

- Clearly state the loan amount. This should be the total amount being borrowed.

- Specify the interest rate. Indicate whether it is fixed or variable and provide the exact percentage.

- Outline the repayment terms. Include details such as the payment schedule, duration of the loan, and any grace periods.

- Include any collateral details, if applicable. Describe the items being used as security for the loan.

- Review any additional terms or conditions. This may include late fees, prepayment penalties, or other relevant clauses.

- Both parties should sign and date the form. Ensure that all signatures are in the designated areas.

After completing these steps, double-check all information for accuracy. It is advisable to keep a copy of the signed agreement for your records. This ensures that both parties have access to the same information should any disputes arise in the future.

Find Popular Loan Agreement Forms for US States

Loan Note Template - Includes necessary disclosures about lending practices.

Promissory Note Georgia - Indicates the governing law that will apply to the contract.

Promissory Note California - This document specifies the loan amount, interest rate, repayment schedule, and any fees involved.

Promissory Note Illinois - The form may specify which party is responsible for fees.

Documents used along the form

When entering into a loan agreement in Texas, several other forms and documents may accompany the Texas Loan Agreement to ensure clarity and legal compliance. Each of these documents serves a specific purpose and can help protect the interests of both the lender and the borrower.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. The promissory note serves as a legal obligation for the borrower.

- Security Agreement: If the loan is secured by collateral, a security agreement will detail the assets that back the loan. This document protects the lender's interests by allowing them to claim the collateral if the borrower defaults on the loan.

- Disclosure Statement: This document provides essential information about the loan terms, including fees, interest rates, and any potential risks. It ensures that borrowers understand the financial obligations they are entering into.

- Loan Application: Before the loan is approved, the borrower typically submits a loan application. This form collects personal and financial information, helping the lender assess the borrower's creditworthiness and ability to repay the loan.

Understanding these documents can help both parties navigate the loan process more effectively. Each plays a crucial role in establishing the terms of the loan and ensuring that all parties are aware of their rights and responsibilities.

Misconceptions

When dealing with the Texas Loan Agreement form, there are several misconceptions that can lead to confusion. Understanding these misconceptions can help individuals navigate the loan process more effectively.

- The Texas Loan Agreement is the same as a promissory note. Many people think these two documents are interchangeable. However, a loan agreement outlines the terms of the loan, while a promissory note is a promise to repay the loan.

- You do not need a lawyer to create a Texas Loan Agreement. While it is possible to draft your own agreement, consulting a legal professional can ensure that all necessary terms are included and that the document complies with state laws.

- All loan agreements must be notarized. Notarization is not always required for a loan agreement in Texas. However, having the document notarized can provide an extra layer of security and authenticity.

- Verbal agreements are sufficient. Some individuals believe that a verbal agreement is enough to secure a loan. In reality, having a written agreement is crucial for clarity and enforceability.

- The Texas Loan Agreement is only for large loans. This form can be used for loans of any size. Whether the amount is small or large, having a written agreement is beneficial.

- Once signed, the terms cannot be changed. While the agreement is binding once signed, parties can negotiate changes. Modifications should be documented in writing to avoid misunderstandings.

- Loan agreements are only for personal loans. This form can be used for various types of loans, including business loans. It is not limited to personal transactions.

- All lenders must use the Texas Loan Agreement form. Lenders may have their own templates or requirements. However, using the Texas Loan Agreement can provide a clear structure for the terms of the loan.

By addressing these misconceptions, individuals can better understand the Texas Loan Agreement form and its importance in the lending process.

PDF Specifications

| Fact Name | Details |

|---|---|

| Definition | The Texas Loan Agreement form is a legal document outlining the terms of a loan between a lender and a borrower in Texas. |

| Governing Law | This form is governed by the Texas Business and Commerce Code, particularly sections related to contracts and loans. |

| Parties Involved | The agreement typically involves two parties: the lender, who provides the funds, and the borrower, who receives the funds. |

| Loan Amount | The form specifies the exact amount of money being borrowed, which is crucial for clarity and legal enforcement. |

| Interest Rate | The Texas Loan Agreement must clearly state the interest rate applicable to the loan, ensuring both parties understand the financial obligations. |

| Repayment Terms | It outlines the repayment schedule, including the frequency of payments and the duration of the loan. |

| Default Provisions | The form includes clauses that describe the consequences of default, protecting the lender's interests in case of non-payment. |

Key takeaways

When filling out and using the Texas Loan Agreement form, it is essential to keep several key points in mind. Understanding these elements can help ensure that the agreement is clear, enforceable, and meets the needs of both parties involved.

- Identify the Parties: Clearly state the names and contact information of both the lender and the borrower. This helps in establishing who is involved in the agreement.

- Loan Amount: Specify the exact amount being loaned. This figure should be precise to avoid any misunderstandings later on.

- Interest Rate: Include the interest rate applicable to the loan. This can be fixed or variable, but it must be clearly defined in the agreement.

- Repayment Terms: Outline how and when the borrower will repay the loan. This includes the payment schedule, due dates, and any late fees that may apply.

- Default Conditions: Clearly state what constitutes a default on the loan. This helps both parties understand the consequences of failing to meet the terms of the agreement.

- Governing Law: Indicate that the agreement is governed by Texas law. This is important for resolving any disputes that may arise.

By paying attention to these key takeaways, both lenders and borrowers can create a solid foundation for their financial agreement. This clarity can help prevent disputes and ensure a smoother transaction process.