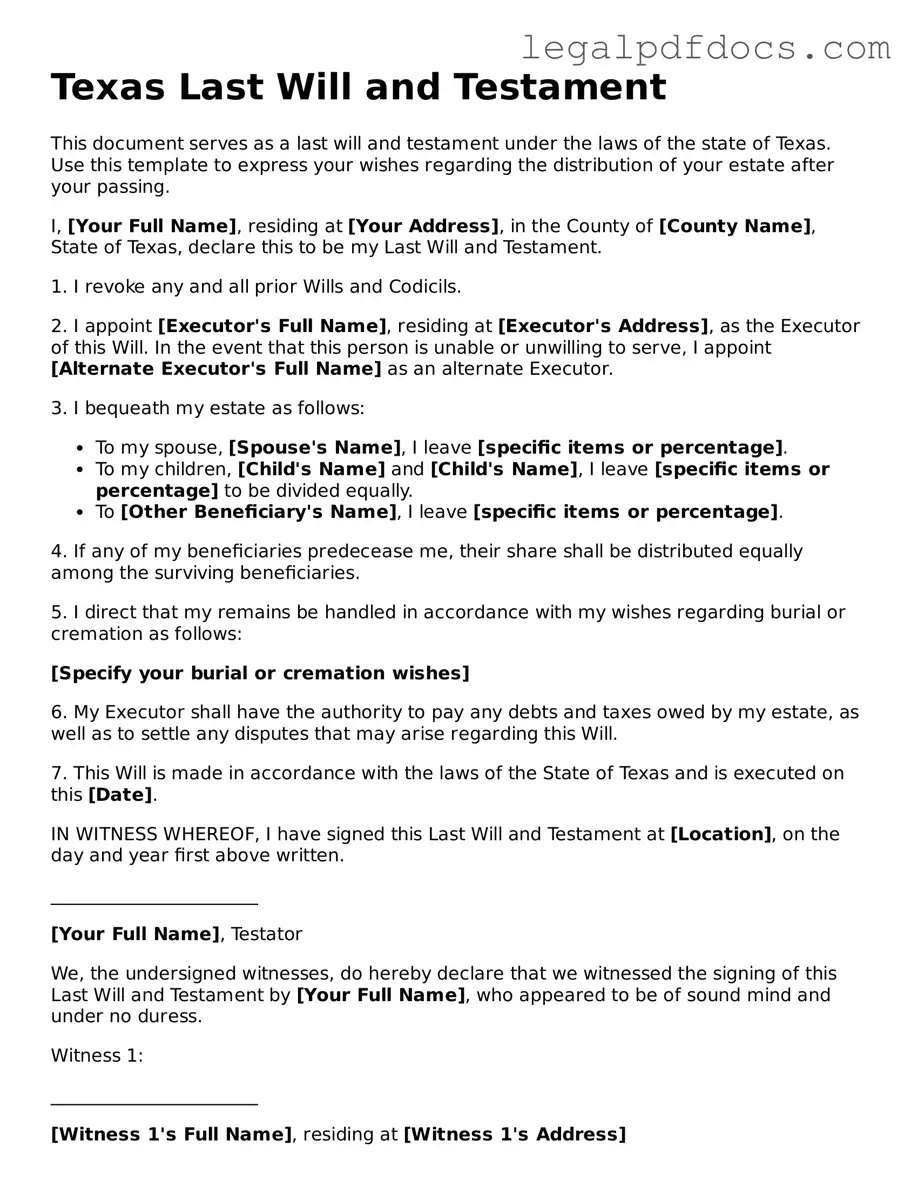

Official Last Will and Testament Form for Texas

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In Texas, this legal document outlines how your assets should be distributed, who will serve as the executor of your estate, and any guardianship provisions for minor children. The Texas Last Will and Testament form includes key elements such as the testator's name, a declaration of the will's validity, and specific bequests to beneficiaries. It also addresses the appointment of an executor, who will be responsible for managing the estate and ensuring that your directives are followed. By clearly stating your intentions, this form helps to minimize potential disputes among family members and provides peace of mind during a difficult time. Understanding the structure and requirements of the Texas Last Will and Testament is crucial for anyone looking to secure their legacy and protect their loved ones. Properly executed, this document can serve as a vital tool in estate planning, guiding the distribution of your property and reflecting your personal values and wishes.

Dos and Don'ts

When filling out the Texas Last Will and Testament form, it's essential to follow certain guidelines to ensure your wishes are clearly expressed and legally valid. Here are some do's and don'ts to consider:

- Do clearly identify yourself by including your full name and address.

- Do specify the beneficiaries who will inherit your assets.

- Do appoint an executor who will carry out your wishes after your passing.

- Do sign the will in the presence of at least two witnesses.

- Don't use vague language that could lead to confusion about your intentions.

- Don't forget to date the will; this establishes its validity.

- Don't leave out specific instructions for your assets, as this can lead to disputes.

- Don't attempt to make changes without following proper legal procedures, such as creating a codicil.

How to Use Texas Last Will and Testament

Filling out the Texas Last Will and Testament form is an important step in ensuring your wishes are honored after your passing. It’s essential to take your time and provide accurate information. Below are the steps to guide you through the process.

- Begin by gathering necessary information. You will need details about your assets, beneficiaries, and any specific wishes you have for distribution.

- Open the Texas Last Will and Testament form. Ensure you have the latest version to avoid any outdated language or requirements.

- Fill in your full legal name at the top of the form. Include your address and any other identifying information requested.

- Designate an executor. This person will be responsible for carrying out your wishes. Write their full name and contact information.

- List your beneficiaries. Clearly state who will receive your assets. Be specific about what each person will inherit.

- Detail any specific bequests. If you have particular items or amounts of money you want to leave to certain individuals, note these clearly.

- Consider including a residuary clause. This addresses any assets not specifically mentioned in your will.

- Sign and date the document in the presence of at least two witnesses. They must also sign the will, confirming they witnessed your signature.

- Store the completed will in a safe place. Inform your executor and loved ones where to find it.

Find Popular Last Will and Testament Forms for US States

Last Will and Testament Arizona - Can clarify ownership of shared property among beneficiaries.

Idaho Last Will and Testament - Having a Will can bring peace of mind, knowing that your affairs will be handled according to your wishes.

Free Will Forms to Print - Your will should be reviewed and possibly updated after major life events.

Kansas Will Template - Available to anyone 18 years or older who is mentally competent.

Documents used along the form

When preparing a Texas Last Will and Testament, several additional forms and documents may be necessary to ensure that your wishes are clearly articulated and legally recognized. Each of these documents serves a specific purpose in the estate planning process.

- Durable Power of Attorney: This document allows you to appoint someone to manage your financial affairs if you become incapacitated. It grants the agent authority to make decisions on your behalf, ensuring that your financial matters are handled according to your wishes.

- Medical Power of Attorney: Similar to the Durable Power of Attorney, this document designates an individual to make healthcare decisions for you if you are unable to do so. It ensures that your medical preferences are respected in times of crisis.

- Living Will: A Living Will outlines your preferences regarding medical treatment in situations where you cannot communicate your wishes. It provides guidance on life-sustaining treatments and end-of-life care, reflecting your personal values and choices.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person when no formal will exists. It provides a legal declaration of the family relationships and can help facilitate the transfer of assets.

- Trust Documents: If you choose to set up a trust as part of your estate plan, you will need specific documents that outline the terms of the trust, the assets it holds, and the responsibilities of the trustee. Trusts can help manage assets and provide for beneficiaries efficiently.

- Codicil: A Codicil is an amendment to an existing will. If changes are needed after the original will has been executed, a Codicil allows you to modify specific provisions without creating an entirely new will.

- Inventory of Assets: This document provides a detailed list of all assets owned by the deceased. It is essential for the probate process, as it helps determine the value of the estate and ensures that all assets are accounted for.

Incorporating these documents into your estate planning can help ensure that your intentions are clearly communicated and legally upheld. Each serves a distinct role in managing your affairs and protecting your loved ones.

Misconceptions

Understanding the Texas Last Will and Testament form is crucial for effective estate planning. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

-

A will is only for the wealthy.

This is not true. Everyone can benefit from having a will, regardless of their financial situation. A will ensures that your wishes are honored and your loved ones are taken care of after your passing.

-

A handwritten will is not valid.

In Texas, a handwritten will, also known as a holographic will, can be valid if it is signed and dated by the testator. However, it is advisable to consult with a legal professional to ensure its validity.

-

Once a will is created, it cannot be changed.

This is a misconception. You can modify or revoke your will at any time, as long as you are mentally competent. Regularly updating your will can reflect changes in your life circumstances.

-

Wills avoid probate.

Wills do not avoid probate; they actually go through the probate process. However, having a will can help streamline the process and clarify your wishes for the distribution of your assets.

-

All assets will automatically go to my spouse.

This is not always the case. Without a will, Texas intestacy laws will determine how your assets are distributed, which may not align with your wishes. A will can specify your preferences clearly.

-

Witnesses are not necessary for a will.

In Texas, having at least two witnesses is required for a will to be valid. These witnesses must be at least 14 years old and cannot be beneficiaries of the will.

-

My will is valid as long as I have it stored safely.

While storing your will safely is important, it must also be properly executed according to Texas laws. This includes having the necessary signatures and witnesses to ensure its validity.

Clearing up these misconceptions can help you make informed decisions about your estate planning. It is always advisable to seek guidance from a qualified professional when creating or updating your will.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Last Will and Testament is governed by the Texas Estates Code. |

| Age Requirement | In Texas, you must be at least 18 years old to create a valid will. |

| Witness Requirement | A will must be signed by at least two witnesses who are at least 14 years old. |

| Signature Requirement | The testator must sign the will, or someone else can sign it in their presence and at their direction. |

| Revocation | A will can be revoked by creating a new will or by physically destroying the original document. |

| Holographic Wills | Texas recognizes holographic wills, which are handwritten and do not require witnesses. |

| Beneficiary Designation | Beneficiaries can be individuals or organizations, and they must be clearly identified. |

| Self-Proving Wills | A self-proving will includes a notarized affidavit from the witnesses, simplifying the probate process. |

| Probate Process | After death, the will must be filed in probate court to be validated and executed. |

| Changes to the Will | Any changes to a will should be made through a formal amendment, known as a codicil. |

Key takeaways

Ensure you are of legal age and sound mind when filling out the Texas Last Will and Testament form. In Texas, you must be at least 18 years old and mentally competent to create a valid will.

Clearly identify your beneficiaries. Specify who will inherit your assets, and consider including alternate beneficiaries in case your primary choices are unable to inherit.

Designate an executor. This person will be responsible for managing your estate after your passing, ensuring that your wishes are carried out as outlined in the will.

Sign the document in the presence of at least two witnesses. Texas law requires that your will be signed by you and witnessed by two individuals who are not beneficiaries.

Consider having your will notarized. While not required in Texas, notarization can help streamline the probate process and provide additional validation of your will.

Store your will in a safe place. Make sure your executor and trusted family members know where to find it. This can help avoid confusion and ensure your wishes are honored.