Official Lady Bird Deed Form for Texas

The Texas Lady Bird Deed is an important legal tool that allows property owners to transfer their real estate while retaining certain rights during their lifetime. This unique type of deed enables individuals to maintain control over their property, including the ability to live in and use the property as they wish. Upon the owner's passing, the property automatically transfers to designated beneficiaries without going through the lengthy and often costly probate process. This form not only simplifies the transfer of ownership but also provides a way to avoid potential complications that can arise from traditional wills or trusts. Additionally, the Lady Bird Deed can help protect the property from being sold to pay for nursing home expenses, offering peace of mind to property owners concerned about their long-term care. Understanding the nuances of this deed is essential for anyone considering their estate planning options in Texas.

Dos and Don'ts

When completing the Texas Lady Bird Deed form, it is essential to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do verify the legal names of all parties involved.

- Do ensure the property description is clear and precise.

- Do include the date of execution on the form.

- Do consult with a legal professional if you have questions.

- Don't leave any sections of the form blank.

- Don't use vague language when describing the property.

- Don't forget to sign the document in front of a notary.

- Don't assume that verbal agreements are sufficient; everything must be in writing.

How to Use Texas Lady Bird Deed

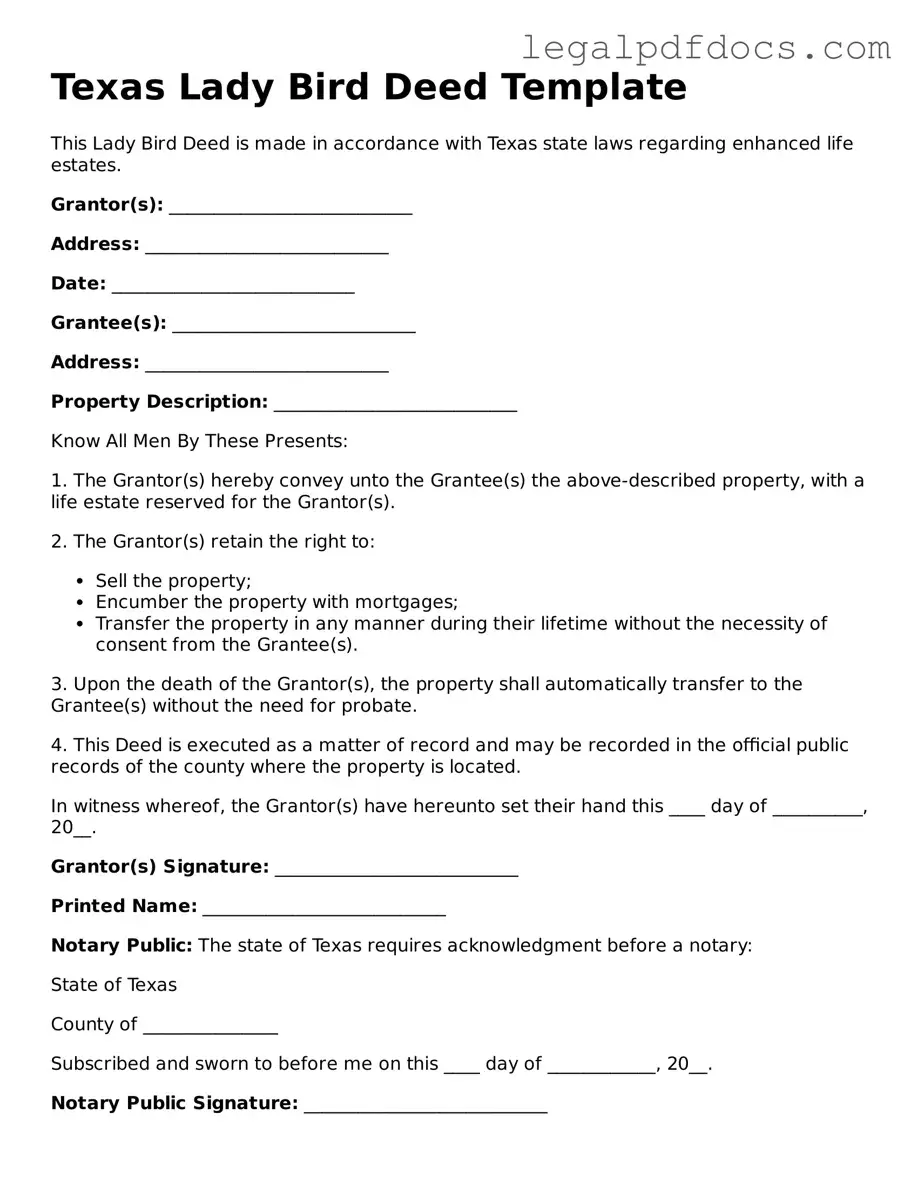

Filling out the Texas Lady Bird Deed form is a straightforward process. After completing the form, you will need to file it with your local county clerk's office to ensure it is legally recognized. Here are the steps to guide you through the process.

- Obtain the Texas Lady Bird Deed form. You can find it online or at your local county clerk's office.

- Fill in the name of the grantor, which is the person transferring the property.

- Provide the grantor's address. This should be the current residential address.

- Enter the name of the grantee, the person who will receive the property.

- List the grantee's address, ensuring it is accurate and complete.

- Describe the property being transferred. Include the legal description, which can usually be found on your property deed.

- Indicate any specific conditions or terms of the transfer, if applicable.

- Sign and date the form. Ensure that the signature matches the name of the grantor.

- Have the form notarized. This step is crucial for the document's validity.

- File the completed form with the county clerk's office in the county where the property is located.

Find Popular Lady Bird Deed Forms for US States

Lady Bird Deed Form Michigan - Beneficiaries receive the property without incurring immediate tax liabilities at the time of the owner's death.

How to Get a Lady Bird Deed in Florida - The Lady Bird Deed can help maintain privacy regarding the owner’s estate plans.

Documents used along the form

The Texas Lady Bird Deed is a useful tool for property owners who want to transfer their property while retaining certain rights. However, there are other forms and documents that often accompany it to ensure a smooth transfer and to address various legal aspects. Here are five common documents that may be used alongside the Lady Bird Deed.

- Durable Power of Attorney: This document allows someone to make decisions on your behalf if you become unable to do so. It can be crucial in managing your property and financial matters.

- Will: A will outlines how you want your assets distributed after your death. It can work in conjunction with a Lady Bird Deed to clarify your wishes regarding your property.

- Transfer on Death Deed: Similar to the Lady Bird Deed, this document allows property to pass directly to a beneficiary upon your death, avoiding probate. It is an alternative that some may prefer.

- Affidavit of Heirship: This document helps establish the heirs of a deceased person. It can be important when determining who inherits property, especially if no will exists.

- Property Tax Exemption Application: If you qualify for certain exemptions, this application can help reduce your property taxes. It is often necessary to file this alongside property transfer documents.

Using these documents in conjunction with the Texas Lady Bird Deed can provide clarity and protection for you and your loved ones. It’s important to consider your unique situation and consult with a professional to ensure everything is in order.

Misconceptions

The Texas Lady Bird Deed is a unique estate planning tool that often leads to misunderstandings. Here are nine common misconceptions about this form:

- It only benefits wealthy individuals. Many people believe that the Lady Bird Deed is exclusively for those with substantial assets. However, it can be useful for anyone who wishes to transfer property while retaining control during their lifetime.

- It avoids probate completely. While the Lady Bird Deed can help simplify the transfer of property and may reduce the likelihood of probate, it does not entirely eliminate the possibility. Certain circumstances can still lead to probate proceedings.

- All property types can be transferred with a Lady Bird Deed. This form is typically used for real estate, but it cannot be used for personal property, bank accounts, or other types of assets. Understanding the limitations is crucial.

- It is a one-size-fits-all solution. Each individual’s financial and family situation is unique. The Lady Bird Deed may not be the best option for everyone, and alternative estate planning tools should be considered.

- It requires a lawyer to complete. While having legal assistance can be beneficial, it is not strictly necessary. Many people successfully complete the form on their own, provided they understand the requirements.

- Once executed, it cannot be changed. Some individuals think that a Lady Bird Deed is permanent. In reality, the grantor can revoke or modify the deed at any time during their lifetime.

- It protects the property from creditors. This misconception suggests that a Lady Bird Deed offers complete protection from creditors. In fact, creditors can still pursue claims against the property during the grantor’s lifetime.

- It only applies to married couples. While married couples often use this deed, it is not limited to them. Single individuals, partners, and other family members can also benefit from a Lady Bird Deed.

- It is recognized in all states. The Lady Bird Deed is specific to Texas and may not be valid or recognized in other states. Those living outside Texas should explore their local laws regarding property transfer.

Understanding these misconceptions can help individuals make informed decisions about using the Texas Lady Bird Deed as part of their estate planning strategy.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed is a type of deed used in Texas to transfer property upon death without going through probate. |

| Governing Law | The Lady Bird Deed is governed by Texas Property Code, Section 111.001. |

| Transfer Mechanism | This deed allows the property owner to retain control of the property during their lifetime while designating a beneficiary to receive the property automatically upon their death. |

| Property Types | Lady Bird Deeds can be used for various types of real estate, including residential homes and vacant land. |

| Tax Benefits | Using a Lady Bird Deed may help avoid capital gains taxes for beneficiaries, as the property receives a step-up in basis. |

| Medicaid Protection | The deed can protect the property from being counted as an asset for Medicaid eligibility purposes, provided certain conditions are met. |

| Revocability | The property owner can revoke or change the Lady Bird Deed at any time during their lifetime without the consent of the beneficiaries. |

| Execution Requirements | To be valid, the Lady Bird Deed must be signed by the property owner and notarized before being filed with the county clerk. |

| Common Uses | It is commonly used by individuals who want to ensure their property passes directly to heirs without the complexities of probate. |

Key takeaways

The Texas Lady Bird Deed is a unique tool for property owners who want to transfer their property while retaining certain rights. Here are some key takeaways to consider when filling out and using this form:

- Retain Control: The property owner can continue to live in and use the property during their lifetime, even after the transfer is executed.

- Transfer Upon Death: The property automatically transfers to the designated beneficiaries without going through probate, simplifying the process for heirs.

- Flexibility: The owner can revoke or change the deed at any time before their death, allowing for adjustments based on personal circumstances.

- Tax Benefits: This type of deed may help avoid certain tax implications that can arise with traditional property transfers.