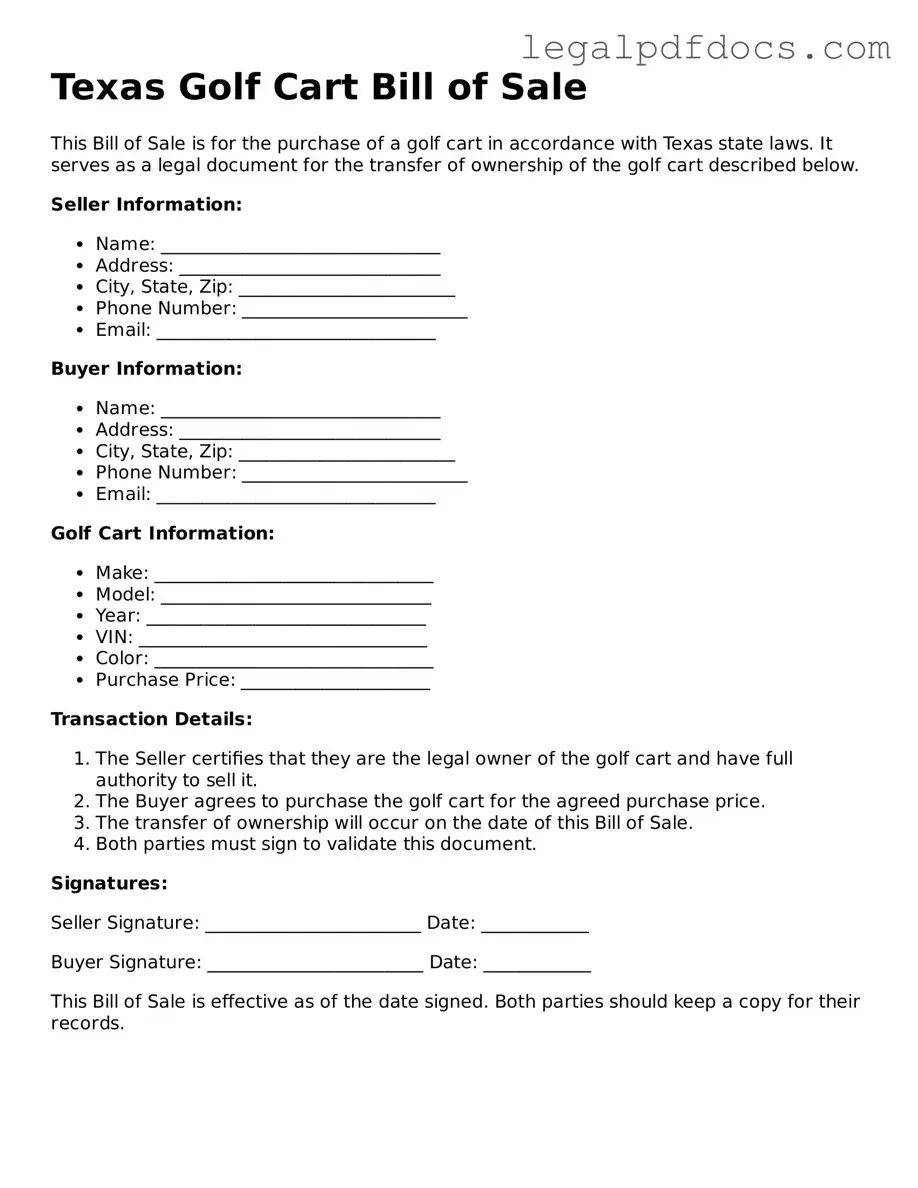

Official Golf Cart Bill of Sale Form for Texas

In Texas, a Golf Cart Bill of Sale form is an essential document for anyone looking to buy or sell a golf cart. This form serves multiple purposes, ensuring that both parties involved in the transaction are protected and that the sale is legally recognized. It typically includes vital information such as the names and addresses of the buyer and seller, a detailed description of the golf cart—including make, model, year, and Vehicle Identification Number (VIN)—and the sale price. Additionally, the form may outline any warranties or conditions related to the sale, providing clarity on the transaction. Properly completing this form not only facilitates a smooth transfer of ownership but also helps in avoiding potential disputes in the future. By documenting the sale, both parties can have peace of mind knowing that their interests are safeguarded, making the Golf Cart Bill of Sale a crucial step in the buying or selling process.

Dos and Don'ts

When filling out the Texas Golf Cart Bill of Sale form, it’s important to ensure that the process goes smoothly. Here’s a list of things you should and shouldn’t do:

- Do provide accurate information about the golf cart, including make, model, and year.

- Do include the Vehicle Identification Number (VIN) to uniquely identify the cart.

- Do ensure both the seller and buyer sign the document to validate the sale.

- Do keep a copy of the completed bill of sale for your records.

- Do check for any local regulations regarding golf cart ownership and operation.

- Don't leave any sections blank; fill out all required fields completely.

- Don't use outdated forms; always use the most current version of the bill of sale.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to include the sale price and payment method in the document.

- Don't overlook the importance of having witnesses if required by local laws.

How to Use Texas Golf Cart Bill of Sale

Once you have the Texas Golf Cart Bill of Sale form in hand, you will need to fill it out carefully. This document serves to record the sale of a golf cart between a buyer and a seller. Ensuring that all information is accurate will help avoid potential disputes in the future.

- Begin by entering the date of the sale at the top of the form.

- Provide the seller's full name and address. This information should be clear and easy to read.

- Next, fill in the buyer's full name and address. Make sure this matches the buyer's identification.

- In the section for the golf cart details, include the make, model, year, and Vehicle Identification Number (VIN) of the golf cart.

- Indicate the sale price of the golf cart. This should be the agreed amount between the buyer and seller.

- Both the buyer and seller must sign and date the form at the bottom. Signatures should be legible.

- If applicable, include any additional terms or conditions of the sale in the designated area.

After completing the form, both parties should retain a copy for their records. This ensures that each has proof of the transaction for future reference.

Find Popular Golf Cart Bill of Sale Forms for US States

Do Golf Carts Have Titles - It can be beneficial to include any warranties or guarantees associated with the golf cart in the form.

Documents used along the form

When purchasing or selling a golf cart in Texas, several additional forms and documents may be necessary to ensure a smooth transaction. These documents help clarify ownership, registration, and legal responsibilities. Below are five important forms that are often used alongside the Texas Golf Cart Bill of Sale.

- Texas Certificate of Title: This document proves ownership of the golf cart. It contains essential information about the vehicle, including the Vehicle Identification Number (VIN) and details about the previous owner.

- Texas Registration Application: This form is required to register the golf cart with the state. It includes information about the owner and the golf cart, ensuring it is legally recognized for use on public roads.

- Odometer Disclosure Statement: If the golf cart is less than ten years old, this statement is necessary to disclose the current mileage. It protects both the buyer and seller from potential fraud regarding the cart's condition.

- Sales Tax Receipt: This document confirms that sales tax has been paid on the transaction. It is crucial for the buyer to keep this receipt for tax purposes and to avoid any future disputes.

- Power of Attorney: In some cases, a power of attorney may be needed if one party cannot be present during the transaction. This document allows another individual to sign on their behalf, ensuring the sale can proceed smoothly.

By utilizing these documents in conjunction with the Texas Golf Cart Bill of Sale, both buyers and sellers can protect their interests and ensure compliance with state regulations. Proper documentation is key to a successful transaction.

Misconceptions

Understanding the Texas Golf Cart Bill of Sale form can be challenging due to various misconceptions. Here are ten common misunderstandings clarified:

- Golf carts do not require a bill of sale. Many people believe that golf carts are exempt from documentation. In Texas, a bill of sale is essential for ownership transfer and registration purposes.

- A bill of sale is only necessary for new golf carts. This is false. Both new and used golf carts require a bill of sale to establish legal ownership.

- Verbal agreements are sufficient. Relying on a verbal agreement can lead to disputes. A written bill of sale provides clear evidence of the transaction.

- Only licensed dealers can provide a bill of sale. Individuals selling their golf carts can also create and sign a bill of sale. It is not limited to dealers.

- The bill of sale must be notarized. While notarization can add an extra layer of authenticity, it is not a legal requirement for a bill of sale in Texas.

- There is a standard form that must be used. Texas does not mandate a specific form. However, the bill of sale should include essential details like buyer and seller information, cart description, and sale price.

- Only the seller needs to sign the bill of sale. Both the buyer and seller should sign the document to confirm their agreement on the terms of the sale.

- A bill of sale is not necessary for insurance purposes. Insurers often require proof of ownership, and a bill of sale serves as that proof.

- Golf carts are not considered vehicles. In Texas, golf carts are classified as vehicles, meaning they are subject to specific regulations and documentation requirements.

- The bill of sale is only for tax purposes. While it can help with taxes, the primary purpose is to document the transfer of ownership and protect both parties in the transaction.

By addressing these misconceptions, individuals can navigate the process of buying or selling a golf cart in Texas more effectively.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Texas Golf Cart Bill of Sale form serves as a legal document to record the sale and transfer of ownership of a golf cart. |

| Governing Law | The sale of golf carts in Texas is governed by the Texas Business and Commerce Code. |

| Required Information | Essential details include the seller's and buyer's names, addresses, and the golf cart's make, model, and Vehicle Identification Number (VIN). |

| Signatures | Both the seller and the buyer must sign the form to validate the transaction. |

| As-Is Clause | The form often includes an "as-is" clause, indicating that the buyer accepts the golf cart in its current condition without warranties. |

| Notarization | While notarization is not required, it can provide additional legal protection for both parties. |

| Record Keeping | It is advisable for both parties to keep a copy of the completed bill of sale for their records. |

| Local Regulations | Buyers should check local ordinances, as some areas may have specific rules regarding golf cart usage on public roads. |

Key takeaways

Ensure that all required information is filled out accurately. This includes details about the seller, buyer, and the golf cart itself.

Both parties should sign the document. This step is crucial for validating the sale.

Include the purchase price clearly. This helps avoid any future disputes regarding the transaction.

Make sure to note the golf cart's Vehicle Identification Number (VIN). This is important for identification purposes.

Keep a copy of the completed Bill of Sale for your records. This serves as proof of the transaction.

Check local regulations regarding golf cart ownership and operation. Compliance is essential to avoid legal issues.

Consider having the Bill of Sale notarized. While not required, it can add an extra layer of security to the transaction.