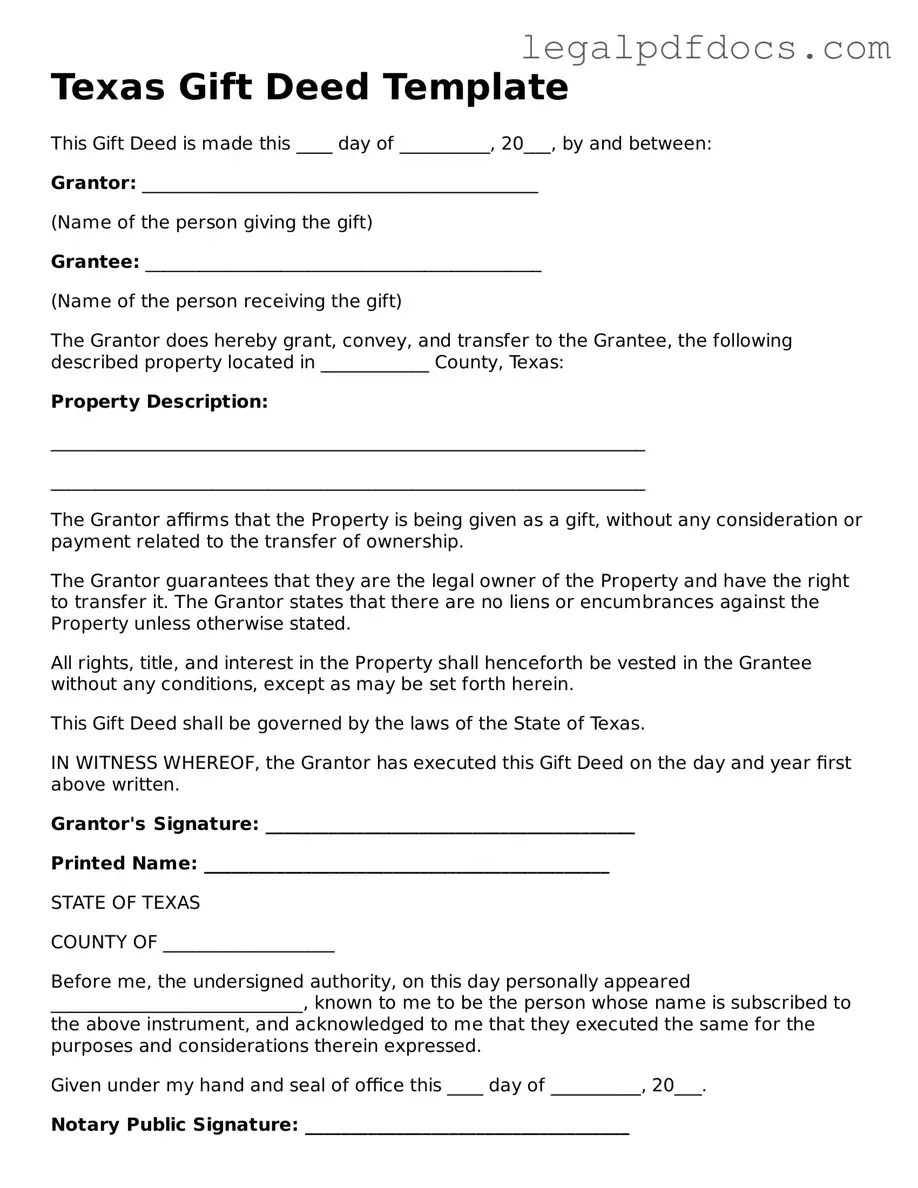

Official Gift Deed Form for Texas

In Texas, the Gift Deed form serves as a crucial legal instrument for individuals wishing to transfer property without any exchange of money. This document enables a property owner, often referred to as the donor, to give their real estate to another person, known as the recipient or donee, as a gift. The process is straightforward, yet it carries significant implications for both parties involved. To ensure the transfer is valid, specific requirements must be met, including the need for the donor to have the legal capacity to make the gift and the necessity of clear intent to convey ownership. Additionally, the Gift Deed must be signed by the donor and typically requires notarization to be legally binding. Importantly, this form also outlines any conditions or restrictions that may apply to the gift, safeguarding the interests of both the donor and the recipient. Understanding these components is essential for anyone considering making a property gift in Texas, as it helps to prevent potential disputes and ensures compliance with state laws.

Dos and Don'ts

When filling out the Texas Gift Deed form, it is essential to approach the task with care and attention to detail. Here are some important do's and don'ts to keep in mind:

- Do ensure that the form is filled out completely. Missing information can lead to delays or complications in the transfer of property.

- Do clearly identify the donor and the recipient. Full names and addresses should be provided to avoid any confusion.

- Do include a detailed description of the property being gifted. This helps to clearly define what is being transferred.

- Do sign the document in the presence of a notary public. This adds a layer of authenticity to the deed.

- Don't use vague language when describing the property. Specificity is crucial to ensure that the gift is legally recognized.

- Don't forget to check for any local regulations that may apply. Different counties may have additional requirements for property transfers.

- Don't neglect to keep a copy of the completed deed for your records. This serves as proof of the transaction and can be useful in the future.

How to Use Texas Gift Deed

After obtaining the Texas Gift Deed form, you will need to complete it carefully. Make sure to have all necessary information ready before you start filling out the form. Follow these steps to ensure that you complete the form correctly.

- Begin by entering the date at the top of the form. This is the date when the gift deed is being executed.

- Provide the full name and address of the Grantor (the person giving the gift). Make sure to include any middle names or initials.

- Next, enter the full name and address of the Grantee (the person receiving the gift). Again, include any middle names or initials.

- Describe the property being gifted. Include details such as the property address, legal description, and any identifying information that helps specify the property.

- If applicable, indicate any conditions or terms of the gift. This may include stipulations about the use of the property.

- Both the Grantor and Grantee should sign and date the form in the designated areas. Ensure that signatures are clear and legible.

- Have the form notarized. A notary public must witness the signatures and provide their seal to validate the document.

- Finally, make copies of the completed and notarized gift deed for your records. It’s important to keep a copy for future reference.

Find Popular Gift Deed Forms for US States

How to Transfer Property Deed in Georgia - Can be an important part of a larger estate strategy.

Transfer Deed to Family Member - Consulting a local attorney might clarify any questions about the Gift Deed.

Documents used along the form

When transferring property as a gift in Texas, the Gift Deed form is a key document. However, several other forms and documents often accompany it to ensure the process is smooth and legally sound. Below is a list of common documents that you might encounter in this context.

- Warranty Deed: This document provides a guarantee that the grantor has clear title to the property and the right to transfer it. It offers protection to the grantee against any future claims on the property.

- Quitclaim Deed: Unlike a warranty deed, this form transfers whatever interest the grantor has in the property without making any guarantees. It's often used between family members or in situations where the title is not in dispute.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased property owner. It can help clarify ownership in the absence of a will and is particularly useful for gifting property that was inherited.

- Property Tax Exemption Application: If the gifted property is intended to be used for a specific purpose, such as a homestead, this application may be necessary to ensure the new owner receives any applicable tax benefits.

- Title Insurance Policy: This policy protects the new owner against any title issues that may arise after the transfer. It’s a safeguard that can provide peace of mind regarding the property’s history.

- Gift Tax Return (Form 709): If the value of the gift exceeds the annual exclusion limit, the donor may need to file this form with the IRS to report the gift for tax purposes.

- Notice of Gift: While not always required, this document can be useful for notifying interested parties or financial institutions about the transfer of property as a gift.

- Closing Statement: This document outlines all the financial details of the transaction, including any costs associated with the gift transfer. It serves as a record of the transaction for both parties.

Understanding these documents can help you navigate the gifting process more effectively. Each serves a unique purpose, ensuring that the transfer is legally recognized and that both parties are protected. Taking the time to prepare and review these forms can make a significant difference in the outcome of your property gift.

Misconceptions

When it comes to the Texas Gift Deed form, many people hold misconceptions that can lead to confusion or mistakes. Here are five common misunderstandings:

- Gift Deeds Are Only for Family Members: Many believe that a gift deed can only be used to transfer property between family members. In reality, anyone can use a gift deed to transfer property to another person, regardless of their relationship.

- Gift Deeds Require Payment: Some think that a gift deed must involve some form of payment or consideration. However, the essence of a gift deed is that it is a transfer of property without any expectation of payment in return.

- All Gift Deeds Are Tax-Free: While it's true that gifts may not incur income tax for the recipient, gift tax rules can apply. Individuals should be aware of the federal gift tax exemption limits to avoid unexpected tax liabilities.

- Verbal Agreements Are Enough: A common misconception is that a verbal agreement to gift property is sufficient. In Texas, a gift deed must be in writing and signed by the person making the gift to be legally valid.

- Gift Deeds Cannot Be Revoked: Some believe that once a gift deed is executed, it cannot be changed or revoked. While it is generally difficult to revoke a gift deed, it is possible under certain circumstances, such as the consent of the recipient or if the deed was executed under duress.

Understanding these misconceptions can help ensure that property transfers are completed smoothly and legally. Always consider consulting with a professional if you have questions about the process.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Texas Gift Deed is a legal document that transfers ownership of property from one person to another without any exchange of money. |

| Governing Law | The Texas Gift Deed is governed by the Texas Property Code, specifically Sections 5.021 to 5.027. |

| Requirements | The deed must be in writing, signed by the donor (the person giving the gift), and must be acknowledged by a notary public. |

| Consideration | No monetary consideration is required. The transfer is made voluntarily and without compensation. |

| Tax Implications | Gift taxes may apply if the value of the gift exceeds the annual exclusion limit set by the IRS. |

| Revocation | Once executed, a gift deed generally cannot be revoked without the consent of the recipient. |

| Recording | To provide public notice of the transfer, the deed should be recorded in the county where the property is located. |

Key takeaways

When filling out and using the Texas Gift Deed form, there are several important points to keep in mind. Here are key takeaways to consider:

- Understand the Purpose: A Gift Deed is used to transfer ownership of property without any exchange of money. It is essential for documenting gifts of real estate.

- Identify the Parties: Clearly state the names of the giver (donor) and the receiver (grantee). This ensures that the transfer is legally recognized.

- Describe the Property: Provide a detailed description of the property being gifted. This includes the address and legal description to avoid any confusion.

- Consider Tax Implications: Be aware that gifting property may have tax consequences. Consult with a tax professional to understand potential gift tax liabilities.

- Signatures Required: The donor must sign the deed in front of a notary public. This step is crucial for the deed to be valid.

- Record the Deed: After signing, the Gift Deed should be filed with the county clerk’s office where the property is located. This makes the transfer public record.

- Revocation Possibility: Once the Gift Deed is executed, it cannot be revoked easily. Ensure that the decision to gift is final.

- Legal Advice Recommended: While the process can be straightforward, seeking legal advice can help ensure that all aspects are handled correctly.

- Understand Limitations: A Gift Deed may not be suitable for all situations. Evaluate whether other forms of property transfer might be more appropriate.

By keeping these key points in mind, you can navigate the process of using a Texas Gift Deed more effectively.