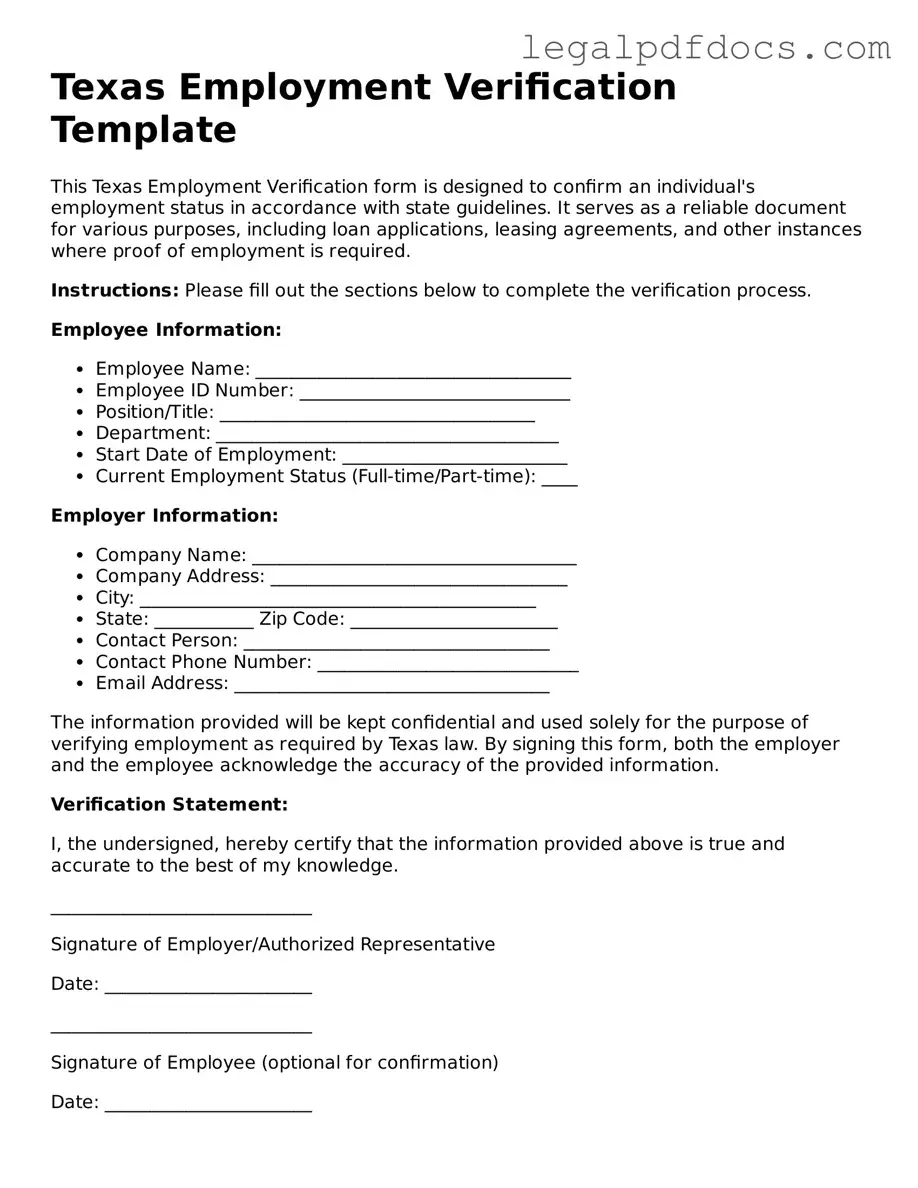

Official Employment Verification Form for Texas

The Texas Employment Verification form is an essential document that serves multiple purposes in the employment landscape of the state. This form is primarily used by employers to confirm the employment status of their current or former employees. It provides crucial information such as the employee’s job title, dates of employment, and salary details. Employers often use this verification process when a worker applies for loans, rental agreements, or other situations where proof of income is required. Additionally, the form helps streamline the hiring process by ensuring that potential candidates have accurately represented their work history. Understanding the significance of the Texas Employment Verification form is vital for both employers and employees, as it plays a key role in maintaining transparency and trust in the workplace. By familiarizing oneself with the requirements and implications of this form, individuals can better navigate the complexities of employment verification in Texas.

Dos and Don'ts

When filling out the Texas Employment Verification form, it is essential to follow specific guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid during this process.

Things You Should Do:

- Provide accurate and complete information about the employee.

- Double-check all entries for spelling and numerical accuracy.

- Sign and date the form to validate the information provided.

- Include any required documentation that supports the employment verification.

- Submit the form by the specified deadline to avoid delays.

Things You Shouldn't Do:

- Do not leave any sections of the form blank unless instructed.

- Avoid using ambiguous language or abbreviations that may cause confusion.

- Do not submit the form without reviewing it for errors.

- Refrain from providing false information or misrepresenting facts.

- Do not forget to keep a copy of the completed form for your records.

How to Use Texas Employment Verification

Once you have the Texas Employment Verification form in hand, the next step is to complete it accurately. This form requires specific information about your employment status and can be essential for various purposes, such as applying for loans or verifying your income. Follow the steps below to ensure that you fill it out correctly.

- Begin by entering your full name in the designated field at the top of the form.

- Provide your current address, including city, state, and zip code.

- Fill in your Social Security number. This information is crucial for identification purposes.

- Indicate your job title and the name of your employer.

- Include the start date of your employment and, if applicable, the end date.

- List your current salary or hourly wage, along with the frequency of payment (weekly, bi-weekly, monthly).

- Sign and date the form to confirm that the information provided is accurate and complete.

After completing the form, ensure that you keep a copy for your records. Submit the form to the appropriate party as instructed, whether that be an employer, lender, or other entity requiring employment verification.

Find Popular Employment Verification Forms for US States

Snap Income Verification - Essential for compliance with federal or state hiring regulations.

Documents used along the form

The Texas Employment Verification form is a crucial document for verifying employment status. However, it is often used alongside other forms and documents that provide additional context or information. Below are some commonly associated documents that can complement the Employment Verification form.

- W-2 Form: This form summarizes an employee's annual wages and the taxes withheld. It is often requested to confirm income and employment history.

- Pay Stubs: Recent pay stubs provide a snapshot of an employee's earnings over a specific period. They can help verify current employment status and income level.

- Employment Offer Letter: This letter outlines the terms of employment, including job title, salary, and start date. It serves as proof of the employment agreement between the employer and employee.

- Tax Returns: Personal tax returns can provide a comprehensive view of an individual's income over the past years. They are often used to verify income when applying for loans or other financial services.

Using these documents in conjunction with the Texas Employment Verification form can provide a clearer picture of an individual's employment status and financial situation. Each document serves a unique purpose, making it easier for employers, lenders, or other parties to assess information accurately.

Misconceptions

Misconceptions about the Texas Employment Verification form can lead to confusion for both employers and employees. Here are seven common misunderstandings:

- It’s only for new hires. Many believe the form is only necessary for new employees. In reality, it can be used for any employment verification purpose.

- It’s optional. Some think that completing the form is optional. However, employers must provide this verification when requested by the employee or other authorized parties.

- Only certain employers need to use it. There’s a misconception that only large companies need to complete the form. All employers in Texas, regardless of size, must comply with employment verification requirements.

- It doesn’t require specific information. Some believe that any information can be provided. The form has specific requirements regarding the employee’s job title, dates of employment, and salary information.

- It’s the same as other states’ forms. Many assume that Texas’s form is identical to those in other states. Each state has its own requirements and format, so it’s crucial to use the Texas-specific form.

- It can be submitted verbally. Some think they can provide employment verification over the phone. The form must be completed in writing to ensure proper documentation.

- It’s only for full-time employees. There’s a belief that the form is only applicable to full-time workers. However, it can also be used for part-time or temporary employees.

Understanding these misconceptions can help streamline the employment verification process and ensure compliance with Texas laws.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Texas Employment Verification form is used to confirm an employee's work history and eligibility for employment. |

| Governing Law | The form is governed by Texas Labor Code § 61.051, which outlines employer responsibilities for verifying employment. |

| Who Uses It? | Employers in Texas use this form to verify the employment status of current and former employees. |

| Information Required | The form typically requires the employee's name, Social Security number, job title, and dates of employment. |

| Submission Method | Employers can submit the form electronically, by mail, or in person, depending on their policies. |

| Confidentiality | All information provided on the form must be kept confidential and used solely for employment verification. |

| Response Time | Employers are encouraged to respond to verification requests within a reasonable timeframe, usually within 3 to 5 business days. |

| Legal Implications | Failure to provide accurate information on the form can lead to legal consequences for the employer. |

| Accessibility | The Texas Employment Verification form should be readily available to employees upon request. |

Key takeaways

When filling out and using the Texas Employment Verification form, it is essential to keep several key points in mind. The form is designed to confirm an individual's employment status and details, which can be crucial for various purposes, including loan applications and government benefits.

- Accurate Information: Ensure all information provided is correct. This includes the employee's name, job title, and dates of employment.

- Signature Requirement: The form must be signed by an authorized representative of the employer to validate the information.

- Timeliness: Submit the form promptly to avoid delays in processing requests related to employment verification.

- Confidentiality: Handle the form with care, as it contains sensitive personal information. Share it only with authorized parties.

- Format Compliance: Follow any specific formatting guidelines provided for the form to ensure acceptance by the requesting party.