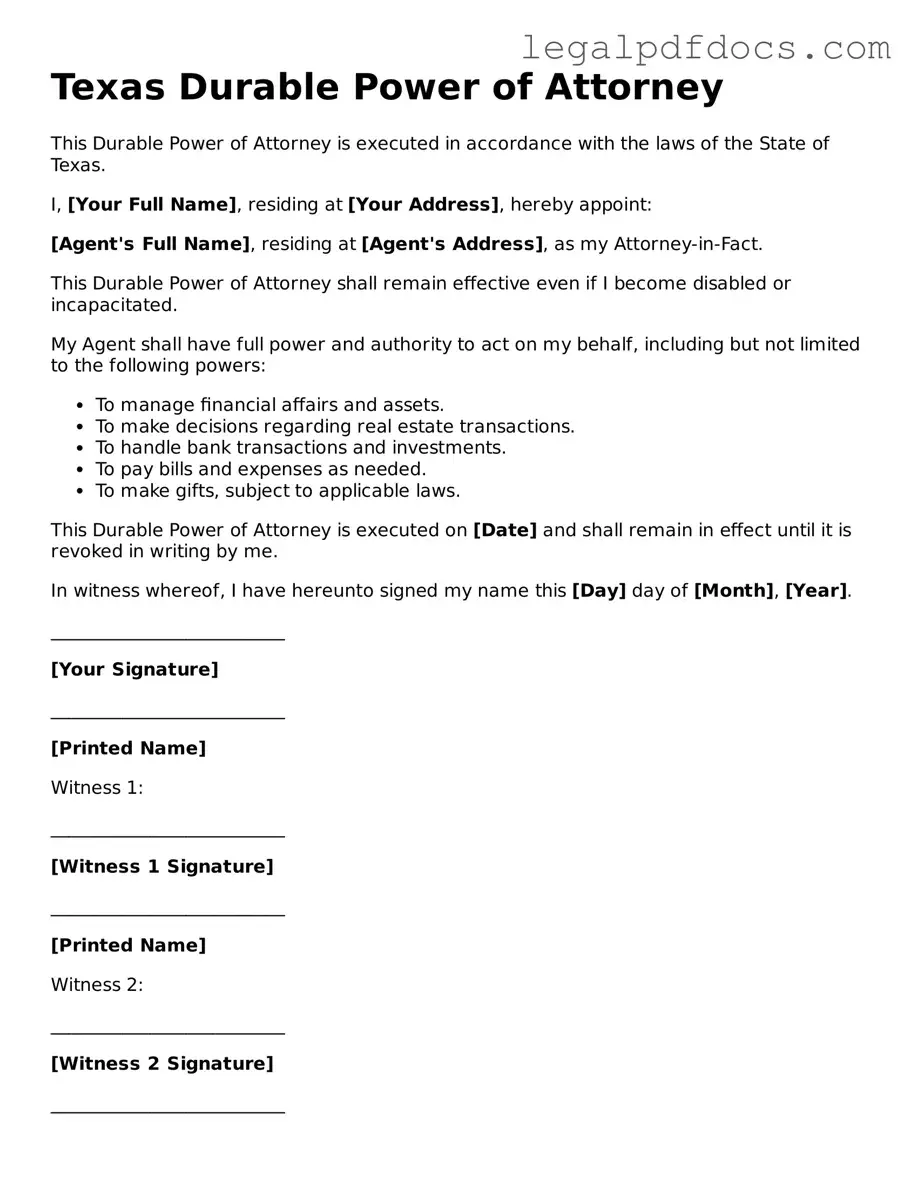

Official Durable Power of Attorney Form for Texas

The Texas Durable Power of Attorney form is an essential legal document that allows individuals to appoint someone they trust to make decisions on their behalf when they are unable to do so. This form is particularly important for managing financial matters, healthcare decisions, and other personal affairs. By designating an agent, or attorney-in-fact, the principal ensures that their wishes are respected even in times of incapacity. The durable aspect of the power of attorney means that it remains effective even if the principal becomes mentally or physically incapacitated. It is crucial to understand the responsibilities and powers granted to the agent, as well as the limitations that may be set within the document. Additionally, the form must be properly executed, which includes signing in the presence of a notary public, to ensure its validity. Knowing how to use this form effectively can provide peace of mind and security for both the principal and their loved ones.

Dos and Don'ts

When filling out the Texas Durable Power of Attorney form, it's important to approach the task carefully. Here are five things you should and shouldn't do:

- Do ensure you understand the powers you are granting. Clearly define what decisions your agent can make on your behalf.

- Do choose a trusted individual as your agent. This person should be someone you trust to act in your best interest.

- Do sign the document in front of a notary public. This step adds an extra layer of validity to your form.

- Do keep copies of the signed document. Share these copies with your agent and any relevant institutions.

- Do review the document periodically. Life changes, and so might your preferences regarding your agent's powers.

- Don't rush through the form. Take your time to ensure all information is accurate and complete.

- Don't choose an agent who might have conflicts of interest. Avoid someone who may benefit from your decisions inappropriately.

- Don't forget to discuss your wishes with your agent. Open communication is key to ensuring your intentions are understood.

- Don't neglect to revoke any previous power of attorney documents. This prevents confusion about which document is valid.

- Don't ignore state-specific requirements. Familiarize yourself with Texas laws regarding power of attorney forms.

How to Use Texas Durable Power of Attorney

Completing the Texas Durable Power of Attorney form is a critical step in ensuring your financial and legal decisions are managed according to your wishes. Follow these steps carefully to ensure the form is filled out correctly.

- Obtain the Texas Durable Power of Attorney form. You can find it online or through legal offices.

- Begin by filling in your name and address in the designated section. This identifies you as the principal.

- Next, select an agent. This person will act on your behalf. Provide their full name and address.

- Decide on the powers you wish to grant your agent. Check the appropriate boxes that outline these powers.

- Include any specific limitations or instructions regarding the powers granted, if necessary.

- Sign and date the form in the presence of a notary public. This step is crucial for the form's validity.

- Provide copies of the signed form to your agent and any relevant institutions or individuals.

After completing these steps, store the original document in a safe place. Ensure that your agent knows where to find it and understands your wishes. Taking these actions now can prevent complications in the future.

Find Popular Durable Power of Attorney Forms for US States

Durable Power of Attorney Forms - A Durable Power of Attorney can simplify financial transactions when the principal is not present.

What Does a Durable Power of Attorney Allow You to Do - The choice of agent is critical; choose someone who understands your wishes thoroughly.

How to Get Power of Attorney in Florida - Equality in healthcare decision-making is facilitated through the Durable Power of Attorney.

Documents used along the form

A Texas Durable Power of Attorney form allows an individual to designate someone to manage their financial affairs if they become unable to do so. Several other documents often accompany this form to ensure comprehensive planning and protection of an individual's interests. Below are five key documents that may be used alongside the Durable Power of Attorney.

- Medical Power of Attorney: This document allows a person to appoint someone to make healthcare decisions on their behalf if they are unable to communicate their wishes.

- Living Will: A living will outlines an individual's preferences regarding medical treatment in situations where they cannot express their wishes, particularly at the end of life.

- HIPAA Release Form: This form authorizes healthcare providers to share medical information with designated individuals, ensuring that the appointed agents have access to necessary health records.

- Will: A will specifies how a person's assets will be distributed upon their death and can designate guardians for minor children, providing clarity and direction for loved ones.

- Trust Document: A trust document establishes a legal entity to hold and manage assets for the benefit of specified beneficiaries, often used to avoid probate and provide for efficient asset management.

These documents work together to create a robust plan for managing both financial and healthcare decisions, ensuring that an individual's preferences are honored and that their affairs are handled according to their wishes.

Misconceptions

- Misconception 1: A Durable Power of Attorney is only for elderly individuals.

- Misconception 2: A Durable Power of Attorney becomes invalid if the principal becomes incapacitated.

- Misconception 3: A Durable Power of Attorney can only be used for financial matters.

- Misconception 4: The agent must be a lawyer or a professional.

- Misconception 5: A Durable Power of Attorney can be used to make healthcare decisions.

- Misconception 6: A Durable Power of Attorney cannot be revoked once created.

- Misconception 7: All Durable Power of Attorney forms are the same across states.

- Misconception 8: A Durable Power of Attorney allows the agent to change the principal's will.

This is incorrect. Anyone over the age of 18 can create a Durable Power of Attorney. It is a useful tool for anyone who wants to ensure their financial and legal affairs are managed according to their wishes, regardless of age.

This is a misunderstanding of the term "durable." A Durable Power of Attorney remains effective even if the principal becomes incapacitated. This is its primary purpose—to allow someone to act on behalf of another when they cannot do so themselves.

While it is often used for financial decisions, a Durable Power of Attorney can also grant authority over legal matters, such as signing contracts or managing real estate. The scope can be tailored to fit the principal's needs.

This is not true. The principal can designate any trusted person as their agent. It could be a family member, friend, or anyone the principal believes will act in their best interest.

This is a common confusion. A Durable Power of Attorney primarily addresses financial and legal matters. For healthcare decisions, a separate document called a Medical Power of Attorney is necessary.

This is false. The principal retains the right to revoke a Durable Power of Attorney at any time, as long as they are mentally competent. Revocation should be done in writing and communicated to the agent.

This is misleading. Each state has its own laws and requirements regarding Durable Power of Attorney forms. It is essential to use the correct form that complies with Texas law if you are in Texas.

This is incorrect. An agent under a Durable Power of Attorney does not have the authority to change the principal's will. Their powers are limited to the authority granted in the Durable Power of Attorney document.

PDF Specifications

| Fact Name | Details |

|---|---|

| Definition | A Texas Durable Power of Attorney allows an individual to appoint someone to make financial decisions on their behalf if they become incapacitated. |

| Governing Law | The Texas Durable Power of Attorney is governed by Chapter 751 of the Texas Estates Code. |

| Durability | This document remains effective even if the principal becomes incapacitated, distinguishing it from regular power of attorney forms. |

| Agent's Authority | The agent can manage financial matters, including banking, real estate, and investments, as specified in the document. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent. |

| Signature Requirement | The document must be signed by the principal and acknowledged by a notary public to be valid. |

| Important Considerations | It is crucial for individuals to choose a trustworthy agent, as they will have significant control over financial decisions. |

Key takeaways

Filling out and using the Texas Durable Power of Attorney form is a significant step in ensuring that your financial and legal affairs are managed according to your wishes. Here are key takeaways to consider:

- The form allows you to designate an agent to act on your behalf, giving them the authority to make decisions regarding your finances and property.

- It is crucial to choose someone you trust as your agent, as they will have considerable power over your financial matters.

- The document remains effective even if you become incapacitated, which distinguishes it from a regular power of attorney.

- You can specify the powers you grant to your agent, which can range from managing bank accounts to selling real estate.

- Ensure the form is signed in the presence of a notary public to validate its legality in Texas.

- Review the document periodically to ensure it still reflects your wishes, especially if your circumstances change.

- Keep copies of the signed form in a safe place and provide a copy to your agent and any relevant financial institutions.