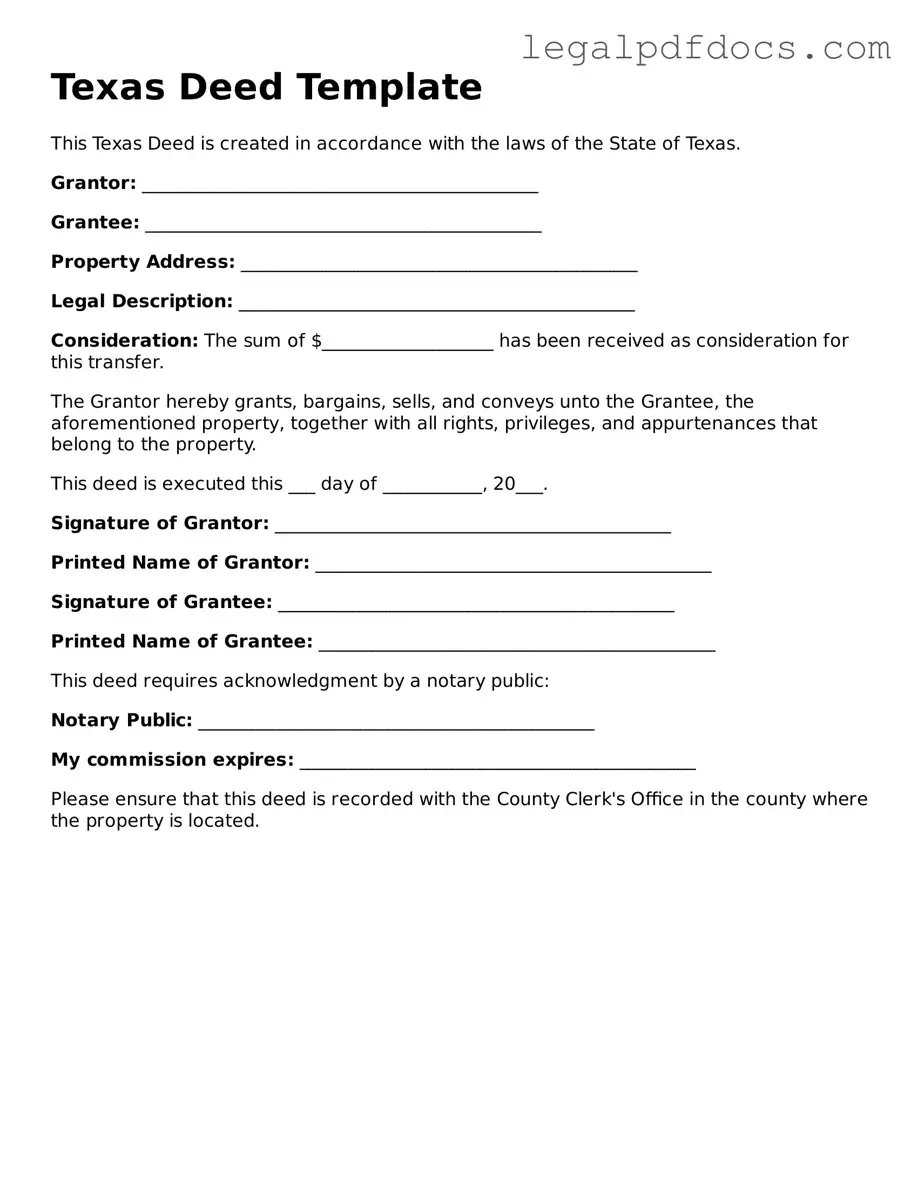

Official Deed Form for Texas

The Texas Deed form serves as a crucial document in real estate transactions, facilitating the transfer of property ownership from one party to another. It is essential for both buyers and sellers to understand its components and implications. This form outlines vital information, including the names of the grantor and grantee, a legal description of the property, and any specific terms or conditions related to the transfer. Additionally, it often includes details about any liens or encumbrances that may affect the property. By ensuring that all relevant information is accurately captured, the Texas Deed form helps to safeguard the interests of both parties involved in the transaction. Understanding the nuances of this form can significantly streamline the process of property transfer and prevent potential disputes down the line.

Dos and Don'ts

When filling out the Texas Deed form, it's important to follow specific guidelines to ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do: Double-check all names and addresses for accuracy.

- Do: Use clear and legible handwriting or type the information.

- Do: Include the correct legal description of the property.

- Do: Sign the form in front of a notary public.

- Do: Keep a copy of the completed deed for your records.

- Don't: Leave any required fields blank.

- Don't: Alter or erase any information on the form.

Follow these guidelines to ensure your Texas Deed form is filled out correctly and efficiently.

How to Use Texas Deed

After you have gathered the necessary information, you will be ready to fill out the Texas Deed form. Ensure that all details are accurate to avoid any issues in the future.

- Begin by entering the name of the grantor (the person transferring the property) at the top of the form.

- Next, provide the name of the grantee (the person receiving the property) immediately below the grantor's name.

- Fill in the current address of the grantee. This should include the street address, city, state, and zip code.

- Describe the property being transferred. Include details such as the legal description, lot number, and any other identifying information.

- Specify the date of the transaction. This is the date when the deed is being executed.

- Sign the deed. The grantor must sign the document in the presence of a notary public.

- Have the deed notarized. The notary will verify the identity of the grantor and affix their seal.

- Make copies of the completed deed for your records.

- File the original deed with the county clerk’s office in the county where the property is located.

Find Popular Deed Forms for US States

Quit Claim Deed Georgia - This form may have implications for tax assessments.

Property Deed Form - A deed can include easements or rights of way that affect the property.

Deed for Property - Commercial properties may involve more complex deeds, given the nature of the transaction.

Documents used along the form

When transferring property in Texas, the Deed form is a crucial document, but it is not the only one involved in the process. Various other forms and documents often accompany the Deed to ensure a smooth and legally sound transaction. Below is a list of some of these important documents.

- Title Commitment: This document outlines the terms under which a title insurance company agrees to insure the title of the property. It provides details about any liens, encumbrances, or other claims against the property.

- Bill of Sale: When personal property is included in the sale, a Bill of Sale is used to transfer ownership of those items. This document details what personal property is being sold alongside the real estate.

- Property Disclosure Statement: Sellers often provide this document to inform buyers about the condition of the property. It includes information about any known issues, repairs, or improvements made to the property.

- Closing Statement: Also known as a HUD-1 statement, this document summarizes the financial aspects of the transaction. It outlines all costs, fees, and credits associated with the sale, ensuring transparency for both parties.

- Affidavit of Heirship: In cases where property is inherited, this affidavit can establish the rightful heirs to the property. It is a sworn statement that helps clarify ownership when a formal probate process may not have occurred.

- Power of Attorney: If one party cannot be present to sign the Deed, a Power of Attorney allows another person to act on their behalf. This document grants the designated individual the authority to sign legal documents related to the property transfer.

- Survey: A property survey provides a detailed map of the land and its boundaries. It helps identify property lines and can reveal any encroachments or easements that may affect the property.

Understanding these accompanying documents is essential for anyone involved in a property transaction in Texas. Each document plays a specific role in ensuring that the transfer is clear, legal, and beneficial for all parties involved. Familiarity with these forms can help navigate the complexities of real estate transactions more effectively.

Misconceptions

When it comes to the Texas Deed form, there are several misconceptions that can lead to confusion. Here are seven common misunderstandings:

- All Deeds are the Same: Many people think that all deed forms are identical. In reality, different types of deeds serve different purposes, such as warranty deeds, quitclaim deeds, and special warranty deeds.

- Only Lawyers Can Prepare a Deed: While it’s advisable to consult a lawyer, especially for complex transactions, many individuals can complete a Texas Deed form on their own, provided they understand the requirements.

- A Deed is the Same as a Title: Some believe that a deed and a title are interchangeable. A deed is a legal document that transfers ownership, while a title is the legal right to own the property.

- Deeds Don’t Need to Be Recorded: It’s a common myth that recording a deed is optional. In Texas, recording a deed is crucial for protecting ownership rights against claims from third parties.

- Once a Deed is Signed, It Cannot Be Changed: People often think that once a deed is executed, it’s set in stone. However, deeds can be amended or revoked through proper legal processes.

- Only Property Owners Can Sign a Deed: Some assume that only the current property owner can sign a deed. In fact, anyone can prepare a deed, but it must be signed by the owner to be valid.

- A Deed Must Be Notarized to Be Valid: While notarization is recommended to ensure authenticity, a deed can still be valid without a notary in certain situations, depending on local laws.

Understanding these misconceptions can help clarify the process of transferring property in Texas and ensure that individuals are well-informed when dealing with deeds.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Texas Deed is a legal document used to transfer property ownership in Texas. |

| Types of Deeds | Common types include General Warranty Deed, Special Warranty Deed, and Quitclaim Deed. |

| Governing Law | The Texas Property Code governs the execution and validity of deeds in Texas. |

| Signature Requirement | The deed must be signed by the grantor (the person transferring the property). |

| Witnesses | Texas does not require witnesses for the execution of a deed. |

| Notarization | A deed must be notarized to be recorded in the county clerk’s office. |

| Recording | Recording the deed provides public notice of the property transfer. |

| Legal Description | A legal description of the property must be included in the deed. |

| Consideration | The deed should state the consideration (price or value) for the property transfer. |

| Transfer Tax | Texas does not impose a state transfer tax on property transfers. |

Key takeaways

Filling out and using a Texas Deed form is an important step in transferring property ownership. Here are key takeaways to consider:

- Understand the Purpose: A Texas Deed is a legal document that transfers ownership of real property from one party to another.

- Identify the Parties: Clearly state the names of the grantor (the seller) and the grantee (the buyer) to avoid any confusion.

- Describe the Property: Provide a detailed description of the property being transferred, including its legal description, to ensure clarity.

- Include Consideration: Mention the amount of money or other value exchanged for the property. This is known as "consideration" and is a crucial element of the deed.

- Signatures Matter: Both the grantor and grantee should sign the deed. In Texas, the grantor’s signature must be notarized to validate the document.

- File with the County: After completion, the deed must be filed with the county clerk in the county where the property is located to make the transfer official.

- Keep Copies: Always retain copies of the signed deed for your records. This can be helpful for future reference or legal purposes.

By following these guidelines, you can ensure a smoother process when dealing with property transfers in Texas.