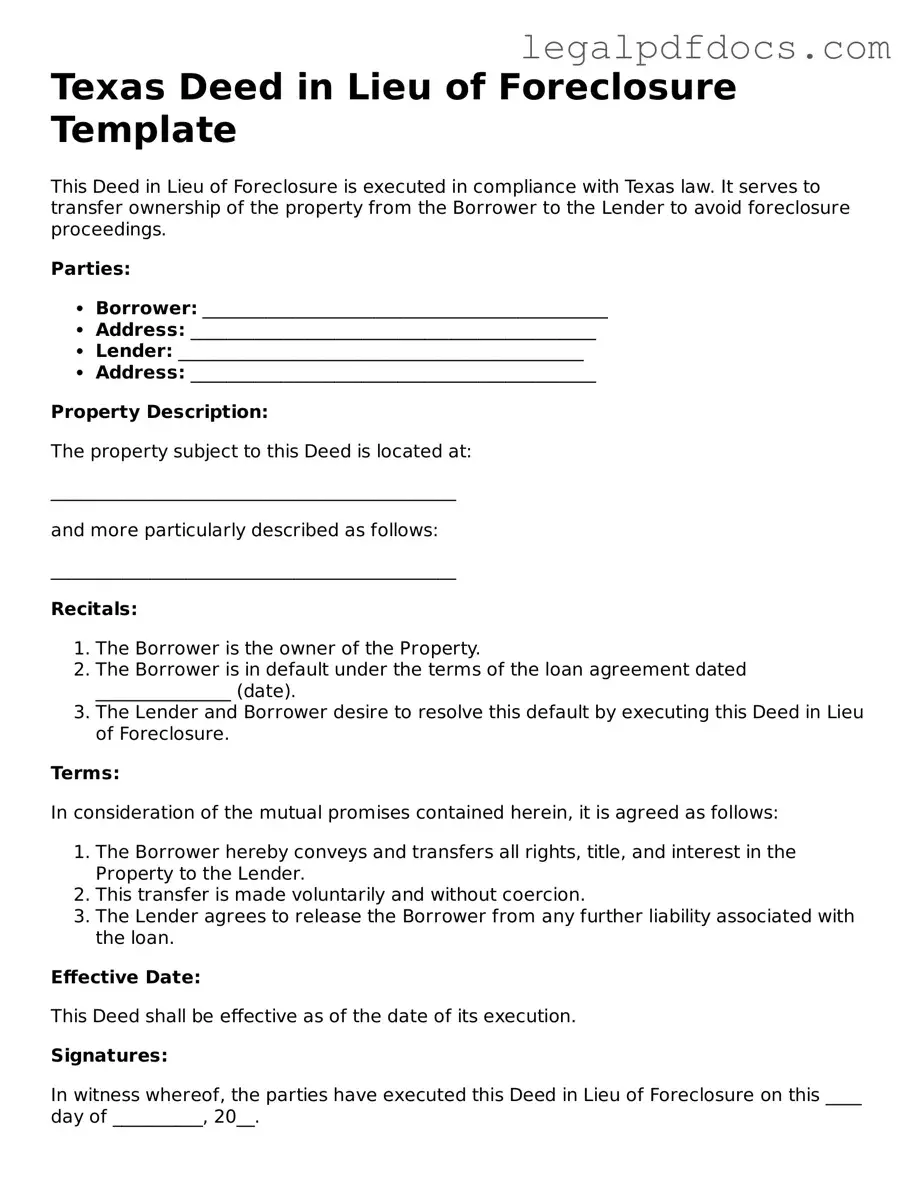

Official Deed in Lieu of Foreclosure Form for Texas

In Texas, homeowners facing financial difficulties may find relief through the Deed in Lieu of Foreclosure form. This legal document allows a homeowner to voluntarily transfer ownership of their property to the lender, effectively bypassing the lengthy and often stressful foreclosure process. By signing this form, homeowners can mitigate the negative impact on their credit score and avoid the public auction of their home. The Deed in Lieu of Foreclosure can provide a more dignified exit from homeownership, allowing individuals to start fresh. However, it is crucial to understand the implications of this decision, including potential tax consequences and the need for the lender's approval. Homeowners should also be aware that this option may not be available if there are multiple liens on the property or if the mortgage is backed by certain government programs. Overall, this form serves as a practical solution for those looking to navigate the challenges of financial hardship while minimizing the fallout associated with foreclosure.

Dos and Don'ts

When filling out the Texas Deed in Lieu of Foreclosure form, it is essential to approach the task with care and attention to detail. Here are seven important guidelines to follow:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and legal descriptions.

- Do consult with a legal professional if you have questions or uncertainties about the process.

- Do sign the form in the presence of a notary public to ensure its validity.

- Do keep copies of the completed form and any related documents for your records.

- Don't rush through the form. Take your time to avoid mistakes that could delay the process.

- Don't leave any sections blank unless explicitly instructed. Missing information can lead to complications.

- Don't forget to communicate with your lender throughout the process to keep them informed of your intentions.

How to Use Texas Deed in Lieu of Foreclosure

Once you have the Texas Deed in Lieu of Foreclosure form in hand, it's time to fill it out carefully. Completing this form accurately is essential to ensure a smooth process. After filling out the form, you will typically need to submit it to the lender for their review and acceptance.

- Begin by entering the date at the top of the form.

- Provide the name of the borrower(s) in the designated space. Ensure that the names match those on the mortgage.

- Next, include the address of the property being conveyed. This should be the same address associated with the mortgage.

- Indicate the name of the lender or the entity receiving the deed. This is usually your mortgage company.

- Fill in the legal description of the property. This can often be found in your mortgage documents or property tax statements.

- Sign the form where indicated. If there are multiple borrowers, all must sign.

- Have the signatures notarized. This step is crucial for the document's validity.

- Make copies of the completed form for your records before submitting it to the lender.

After submitting the form, the lender will review it and may contact you for additional information or clarification. Be prepared to follow up if necessary.

Find Popular Deed in Lieu of Foreclosure Forms for US States

Deed in Lieu Vs Foreclosure - This option can be a breath of fresh air for those weighed down by mortgage stress.

Will I Owe Money After a Deed in Lieu of Foreclosure - A Deed in Lieu may provide a clear path towards starting fresh without the burden of mortgage debt.

Documents used along the form

When navigating the complexities of real estate transactions, especially in situations involving foreclosure, several important documents often accompany the Texas Deed in Lieu of Foreclosure. Understanding these forms can help clarify the process and ensure that all parties are informed and protected. Below is a list of commonly used documents that may be relevant in conjunction with the Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines the new terms of a loan after a borrower and lender agree to modify the existing loan conditions, often to make payments more manageable.

- Notice of Default: A formal notification sent to the borrower indicating that they have fallen behind on mortgage payments and may face foreclosure if the situation is not resolved.

- Foreclosure Sale Notice: A notice that informs the borrower of the scheduled sale of the property at a public auction, typically occurring after a default period.

- Release of Liability: This document releases the borrower from any further obligation to the lender after the property is transferred, ensuring that they are no longer responsible for the mortgage debt.

- Property Inspection Report: A report detailing the condition of the property, which may be required by the lender to assess its value and any necessary repairs before accepting a deed in lieu.

- Title Search Report: A document that provides information about the legal ownership of the property, including any liens or encumbrances that may affect the transaction.

- Settlement Statement: This statement outlines the financial details of the transaction, including any fees, costs, and the final amounts due to both parties involved.

Each of these documents plays a crucial role in the process surrounding a Deed in Lieu of Foreclosure. Familiarity with them can empower homeowners and lenders alike, ensuring a smoother transition and a clearer understanding of their rights and responsibilities.

Misconceptions

Many people have misunderstandings about the Texas Deed in Lieu of Foreclosure. Here are ten common misconceptions:

- A Deed in Lieu of Foreclosure eliminates all debt. This is not true. While it can help you avoid foreclosure, it does not automatically erase your mortgage debt. You may still owe money if the property's sale does not cover the full amount of the loan.

- It is a quick process. The process can take time. While it may be faster than a foreclosure, it still involves negotiations and paperwork that can delay the resolution.

- You can only use it if you are in foreclosure. This is incorrect. You can pursue a Deed in Lieu of Foreclosure even if you are not yet in foreclosure, as long as you are struggling to make payments.

- All lenders accept a Deed in Lieu of Foreclosure. Not all lenders will agree to this option. Some may prefer to go through the foreclosure process instead.

- You will not face any tax consequences. This is misleading. Depending on your situation, you may face tax implications, especially if the lender forgives any part of your debt.

- Your credit score will not be affected. This is false. A Deed in Lieu of Foreclosure can still negatively impact your credit score, though it may be less damaging than a foreclosure.

- You can keep your home. This is a misconception. By signing a Deed in Lieu of Foreclosure, you are voluntarily giving up ownership of your home.

- You will receive cash for the property. This is not the case. Typically, you will not receive any cash when you transfer the deed to the lender.

- It is a simple form to fill out. While the form may seem straightforward, it often requires careful consideration and understanding of your financial situation.

- Once you sign, you cannot change your mind. While it is difficult to reverse the decision, there may be some limited options to negotiate with the lender before the process is finalized.

Understanding these misconceptions can help you make informed decisions about your options if you are facing financial difficulties with your home.

PDF Specifications

| Fact Name | Details |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Purpose | This process allows homeowners to avoid the lengthy and stressful foreclosure process, potentially preserving their credit score. |

| Governing Law | The Texas Deed in Lieu of Foreclosure is governed by Texas Property Code, specifically Chapter 51. |

| Eligibility | Homeowners must be in default on their mortgage payments and must be willing to hand over the property to the lender. |

| Benefits | Benefits include a quicker resolution, potential debt forgiveness, and less impact on credit compared to a foreclosure. |

| Considerations | Homeowners should consult with a legal or financial advisor to fully understand the implications before proceeding. |

Key takeaways

Filling out and using the Texas Deed in Lieu of Foreclosure form requires careful consideration. Here are key takeaways to keep in mind:

- Understanding Purpose: A Deed in Lieu of Foreclosure allows a borrower to transfer property ownership to the lender to avoid foreclosure.

- Eligibility: Not all borrowers qualify. Lenders typically require that the borrower is facing financial hardship and has exhausted other options.

- Property Condition: The property should be in good condition. Lenders may conduct an inspection before accepting the deed.

- Loan Documentation: Borrowers must provide all relevant loan documents to the lender to facilitate the process.

- Legal Review: It is advisable for borrowers to consult with a legal professional before signing the deed to understand all implications.

- Tax Implications: Transferring property through a deed in lieu may have tax consequences. Borrowers should seek advice from a tax professional.

- Clear Title: The borrower must ensure that the title is clear of any liens or encumbrances before executing the deed.

- Written Agreement: A written agreement outlining the terms and conditions of the deed should be created and signed by both parties.

- Impact on Credit: A deed in lieu of foreclosure may still negatively affect the borrower’s credit score, although it is typically less damaging than a foreclosure.

Careful consideration of these factors can help ensure a smoother process when dealing with a Deed in Lieu of Foreclosure in Texas.