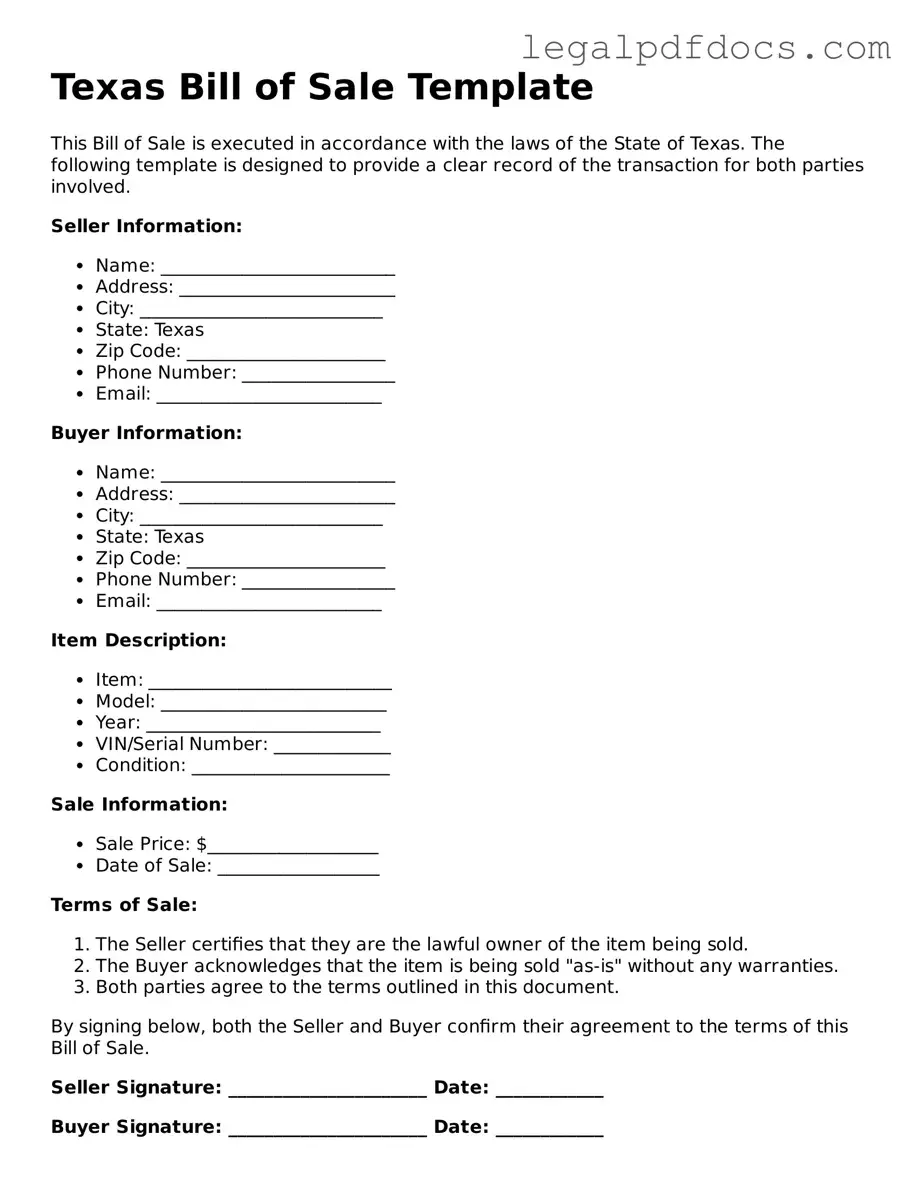

Official Bill of Sale Form for Texas

The Texas Bill of Sale form serves as a crucial document for individuals engaging in the sale or transfer of personal property within the state. This form captures essential details, such as the names and addresses of both the seller and buyer, as well as a clear description of the item being sold, which could range from vehicles to household goods. It also includes the sale price and the date of the transaction, ensuring that both parties have a record of the agreement. In Texas, this document not only acts as proof of ownership transfer but also provides legal protection to both the seller and buyer by outlining the terms of the sale. Additionally, it may require signatures from both parties to validate the agreement, and in certain cases, witnesses or notarization may be necessary to enhance its authenticity. Understanding the components and significance of the Texas Bill of Sale form is essential for anyone looking to navigate the process of property transfer smoothly and legally.

Dos and Don'ts

When filling out the Texas Bill of Sale form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do provide accurate information about the buyer and seller, including full names and addresses.

- Do include a detailed description of the item being sold, including its make, model, and identification number.

- Do specify the purchase price clearly to avoid any misunderstandings.

- Do sign and date the form to make it legally binding.

- Don't leave any fields blank; incomplete forms can lead to issues later on.

- Don't use vague language; clarity is key in legal documents.

- Don't forget to keep a copy of the signed Bill of Sale for your records.

- Don't rush through the process; take your time to ensure everything is correct.

How to Use Texas Bill of Sale

Completing the Texas Bill of Sale form is a straightforward process that requires careful attention to detail. Once the form is filled out correctly, it can be used to document the transfer of ownership for various items, such as vehicles or personal property. Follow these steps to ensure accuracy.

- Obtain the Form: Download the Texas Bill of Sale form from a reliable source or visit your local government office to get a physical copy.

- Enter the Date: Write the date of the transaction at the top of the form.

- Provide Seller Information: Fill in the seller's full name, address, and contact information in the designated fields.

- Provide Buyer Information: Enter the buyer's full name, address, and contact information.

- Describe the Item: Clearly describe the item being sold, including details such as make, model, year, and VIN (for vehicles).

- State the Sale Price: Write the agreed-upon sale price for the item in the appropriate section.

- Sign the Form: Both the seller and buyer must sign and date the form to validate the transaction.

- Make Copies: After signing, make copies for both the seller and buyer for their records.

Find Popular Bill of Sale Forms for US States

Do I Need a Bill of Sale in Kansas - A Bill of Sale can potentially expedite the return process for defective items.

Bill of Sale Idaho Pdf - A Bill of Sale is handy when purchasing items at flea markets or garage sales.

Bill of Sale Form Free - A Bill of Sale can also describe the payment schedule if the buyer is financing a purchased item.

Dmv Bill of Sale California - A Bill of Sale could potentially affect warranties that apply to the item sold.

Documents used along the form

A Texas Bill of Sale is a crucial document for transferring ownership of personal property. When completing a transaction, several other forms and documents may be necessary to ensure a smooth and legally binding process. Below is a list of commonly used documents that complement the Texas Bill of Sale.

- Title Transfer Document: This document is essential for vehicles and certain types of property. It officially transfers ownership from the seller to the buyer and is often required for registration purposes.

- Odometer Disclosure Statement: Required for vehicle sales, this form records the mileage on the vehicle at the time of sale. It helps prevent fraud and ensures transparency in the transaction.

- Purchase Agreement: This document outlines the terms of the sale, including price, payment methods, and any conditions that must be met before the sale is finalized. It serves as a binding contract between the buyer and seller.

- Affidavit of Heirship: In cases where property is inherited, this affidavit helps establish the rightful ownership of the property and can be necessary for the sale of inherited assets.

- Notarized Signatures: While not a specific form, having signatures notarized adds an extra layer of authenticity to the Bill of Sale and other related documents, ensuring they are legally recognized.

- Sales Tax Form: Depending on the type of property sold, a sales tax form may be required to report and pay any applicable taxes to the state.

- Release of Liability: This document protects the seller from any future claims related to the property after the sale. It confirms that the buyer assumes all responsibility once the transaction is completed.

Using these documents alongside the Texas Bill of Sale can help facilitate a clear and legally sound transaction. Always ensure that all forms are completed accurately and retained for your records to avoid any future complications.

Misconceptions

When it comes to the Texas Bill of Sale form, several misconceptions often arise. Understanding these can help ensure a smoother transaction process. Here are seven common misunderstandings:

-

A Bill of Sale is only necessary for vehicle transactions.

This is not true. While a Bill of Sale is commonly used for vehicle sales, it can also be used for other personal property transactions, such as boats, trailers, and even furniture.

-

A Bill of Sale must be notarized to be valid.

Notarization is not required for a Bill of Sale in Texas. However, having it notarized can provide an additional layer of security and proof of the transaction.

-

All Bills of Sale are the same.

Each Bill of Sale can be tailored to fit the specific needs of the transaction. Different items may require different information, and it’s important to include all relevant details.

-

A verbal agreement is sufficient without a Bill of Sale.

While verbal agreements can be legally binding, they are difficult to enforce. A written Bill of Sale provides clear documentation of the transaction and protects both parties.

-

You don’t need a Bill of Sale if you’re giving something away.

Even if an item is being given as a gift, a Bill of Sale can be useful. It serves as proof of the transfer and can help avoid disputes in the future.

-

Only the seller needs to sign the Bill of Sale.

Both the buyer and the seller should sign the Bill of Sale. This ensures that both parties acknowledge the terms of the sale and the transfer of ownership.

-

A Bill of Sale is only for used items.

This is a misconception. A Bill of Sale can be used for both new and used items. It’s a good practice to document any sale, regardless of the condition of the item.

By addressing these misconceptions, individuals can better navigate the process of buying and selling items in Texas, ensuring a more secure and efficient transaction.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Texas Bill of Sale form is used to document the sale of personal property between a buyer and a seller. |

| Governing Law | This form is governed by Texas law, specifically under the Texas Business and Commerce Code. |

| Types of Property | The form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Consideration | The Bill of Sale should state the amount paid for the property, known as consideration. |

| Signatures | Both the buyer and seller must sign the document for it to be legally binding. |

| Notarization | While notarization is not required, it is recommended to enhance the document's validity. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records, as it serves as proof of the transaction. |

Key takeaways

When filling out and using the Texas Bill of Sale form, there are several important points to keep in mind. These takeaways will help ensure that the process is smooth and that all necessary information is accurately documented.

- Identify the Parties: Clearly state the names and addresses of both the seller and the buyer. This information establishes who is involved in the transaction.

- Describe the Item: Provide a detailed description of the item being sold. This should include the make, model, year, and any identifying numbers, such as a VIN for vehicles.

- Include Sale Terms: Specify the sale price and any payment terms. This helps clarify the financial aspect of the transaction and prevents misunderstandings.

- Signatures Required: Both the seller and the buyer must sign the Bill of Sale. This signature indicates that both parties agree to the terms outlined in the document.

- Keep Copies: After completing the Bill of Sale, ensure that both parties retain a copy for their records. This serves as proof of the transaction and can be useful for future reference.