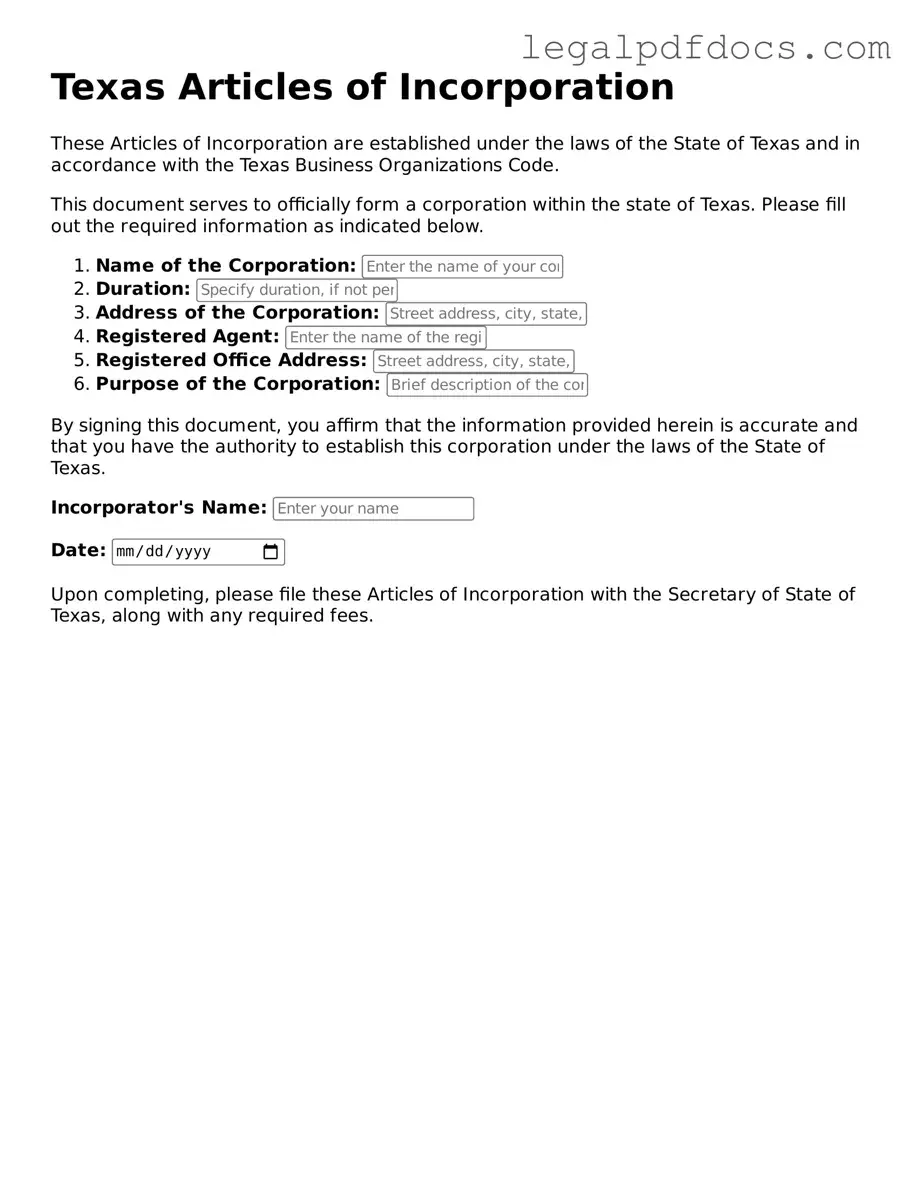

Official Articles of Incorporation Form for Texas

Starting a business in Texas involves several essential steps, one of which is filing the Articles of Incorporation. This important document lays the foundation for your corporation and outlines key details about its structure and purpose. When completing the form, you will need to provide the corporation's name, which must be unique and comply with state naming requirements. Additionally, the Articles require you to specify the corporation's duration, whether it is intended to exist perpetually or for a limited time. You will also need to include the address of the corporation's registered office and the name of its registered agent, who will receive legal documents on behalf of the corporation. Furthermore, the form requires information about the number of shares the corporation is authorized to issue and the par value of those shares, if applicable. Understanding these components is crucial for ensuring that your incorporation process goes smoothly and that your business is set up for success.

Dos and Don'ts

When filling out the Texas Articles of Incorporation form, it is important to follow certain guidelines to ensure that the process goes smoothly. Here are some dos and don’ts to keep in mind:

- Do provide accurate and complete information about the corporation.

- Do include the name of the corporation, ensuring it complies with Texas naming requirements.

- Do specify the purpose of the corporation clearly.

- Do sign and date the form before submitting it.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use a name that is too similar to an existing corporation.

- Don't forget to include the registered agent's information.

- Don't submit the form without the appropriate filing fee.

- Don't assume that electronic submissions are the only option; check for paper filing if needed.

How to Use Texas Articles of Incorporation

Once you have gathered all necessary information, you are ready to fill out the Texas Articles of Incorporation form. This document is essential for establishing your corporation in Texas. After completing the form, you will submit it to the Texas Secretary of State along with the required filing fee. Following submission, you will receive confirmation of your corporation's formation.

- Begin by entering the name of your corporation. Ensure it complies with Texas naming requirements.

- Provide the duration of your corporation. Most corporations are set up to exist perpetually unless otherwise specified.

- Indicate the purpose of your corporation. Be clear and concise about what your business will do.

- Fill in the registered agent's name and address. This person or entity will receive legal documents on behalf of your corporation.

- List the initial directors of the corporation. Include their names and addresses. Typically, a minimum of one director is required.

- State the number of shares your corporation is authorized to issue. Specify the par value of the shares, if applicable.

- Include any additional provisions that may be relevant to your corporation, such as limitations on director liability or management structure.

- Sign and date the form. The incorporator, who may be you or another individual, must sign the document.

- Review the form for accuracy and completeness. Ensure all required fields are filled out correctly.

- Prepare the filing fee. Check the current fee schedule on the Texas Secretary of State's website to ensure you include the correct amount.

- Submit the completed form and fee to the Texas Secretary of State, either by mail or online, depending on your preference.

Find Popular Articles of Incorporation Forms for US States

Business Formation - A corporation's ability to operate can be affected by the way it chooses to define its purpose.

How Do I Get a Certificate of Good Standing - Incorporators should keep copies of the filed Articles for future reference and compliance assurance.

Articles of Incorporation Michigan - They establish the corporation's registered agent for legal purposes.

Georgia Secretary of State Forms - Nonprofit organizations also need to file Articles of Incorporation.

Documents used along the form

When forming a corporation in Texas, the Articles of Incorporation is a key document. However, several other forms and documents are commonly used in conjunction with it to ensure compliance with state laws and regulations. Below is a list of these important documents, each serving a specific purpose in the incorporation process.

- These are the internal rules that govern how the corporation will operate. Bylaws outline the roles of directors and officers, meeting procedures, and other important operational guidelines.

- After incorporation, the initial meeting of the board of directors is documented. This record includes decisions made regarding the corporation’s structure and operations.

- This number is issued by the IRS and is necessary for tax purposes. It allows the corporation to hire employees, open bank accounts, and file tax returns.

- Depending on the nature of the business, registration with the Texas Comptroller may be required for state taxes, including sales and franchise taxes.

- While similar to the Articles of Incorporation, this document may be required for specific types of entities, such as limited liability companies (LLCs), detailing their formation.

- For LLCs, this document outlines the management structure and operational procedures. It is essential for clarifying member roles and responsibilities.

- Depending on the industry, various licenses and permits may be required to operate legally within Texas. These vary by city and state regulations.

- Corporations must designate a registered agent to receive legal documents. This can be an individual or a business entity authorized to conduct business in Texas.

- If the corporation issues stock, certificates may be created to represent ownership. These documents are important for tracking ownership and shareholder rights.

- Many corporations must file annual reports with the state to maintain their good standing. These reports often include updated information about the corporation's activities and finances.

Understanding these documents and their purposes can help streamline the incorporation process in Texas. Ensuring that all necessary forms are completed and filed correctly will help establish a solid foundation for your corporation.

Misconceptions

When it comes to the Texas Articles of Incorporation form, many people hold misconceptions that can lead to confusion. Here are eight common misunderstandings:

- All businesses must file Articles of Incorporation. Not every business needs to file this document. Only corporations, not sole proprietorships or partnerships, are required to submit Articles of Incorporation.

- Filing Articles of Incorporation guarantees business success. While this document is essential for legal recognition, it does not ensure that the business will thrive. Success depends on various factors, including management and market conditions.

- The Articles of Incorporation are the same as a business license. These are different documents. The Articles establish the corporation's existence, while a business license permits operation within a specific jurisdiction.

- Once filed, Articles of Incorporation cannot be changed. This is not true. Amendments can be made to the Articles if changes are necessary, such as altering the business name or purpose.

- All information in the Articles is public. While many details are accessible to the public, certain sensitive information may be kept confidential, depending on state regulations.

- You can file Articles of Incorporation without any legal help. Although it is possible to file without assistance, consulting a professional can help avoid mistakes and ensure compliance with state laws.

- The filing fee is the same for all corporations. Fees can vary based on the type of corporation and other factors. It is important to check the current fee schedule before filing.

- Once filed, the corporation is automatically compliant with all laws. Filing Articles of Incorporation is just the first step. Ongoing compliance with state and federal laws is necessary to maintain good standing.

Understanding these misconceptions can help individuals and businesses navigate the process of incorporating in Texas more effectively.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Texas Articles of Incorporation form is used to create a corporation in Texas. |

| Governing Law | This form is governed by the Texas Business Organizations Code. |

| Filing Requirement | Filing the Articles of Incorporation with the Texas Secretary of State is mandatory for incorporation. |

| Information Required | The form requires details such as the corporation's name, registered agent, and purpose. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the corporation type. |

Key takeaways

When preparing to fill out the Texas Articles of Incorporation form, it is essential to keep several key points in mind. This document serves as the foundation for establishing your business entity in Texas. Here are five important takeaways:

- Accurate Information is Crucial: Ensure that all details provided, such as the name of the corporation, registered agent, and principal office address, are correct and up to date. Mistakes can lead to delays or rejections.

- Understand the Purpose: Clearly define the purpose of your corporation. This will not only help in the filing process but also guide your business operations moving forward.

- Filing Fees Apply: Be prepared to pay the required filing fee when submitting the Articles of Incorporation. Check the current fee structure to avoid any surprises.

- Compliance with State Laws: Familiarize yourself with Texas state laws regarding corporations. Compliance is necessary to maintain your corporation's good standing and avoid potential legal issues.

- Keep Copies for Your Records: After filing, retain copies of the Articles of Incorporation and any related documents. These will be important for future reference and may be required for various business transactions.

Taking these steps will help ensure a smooth incorporation process and lay a solid foundation for your business in Texas.