Fill Out a Valid Tax POA dr 835 Template

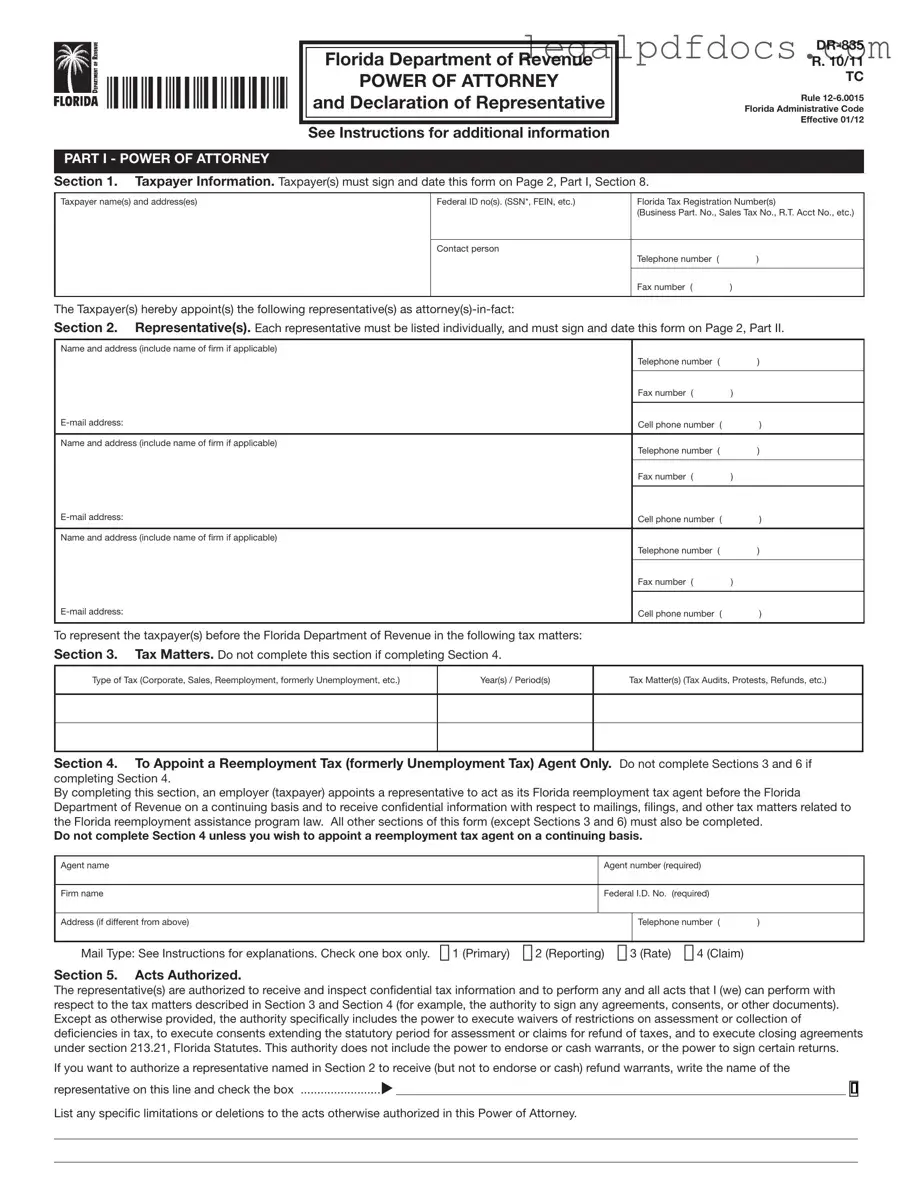

The Tax Power of Attorney (POA) DR 835 form is an essential document for individuals and businesses navigating the complexities of tax matters. This form allows taxpayers to designate a representative, such as an attorney or tax professional, to act on their behalf in dealings with the state tax authority. By completing the DR 835, taxpayers can grant their representatives the authority to receive confidential tax information, make decisions, and represent them during audits or disputes. The form is designed to streamline communication and ensure that taxpayers have support in understanding their tax obligations and rights. It is important to fill out the form accurately, as any errors could lead to delays or complications in representation. Understanding the purpose and process of the DR 835 can empower taxpayers to manage their tax affairs more effectively and with greater peace of mind.

Dos and Don'ts

When filling out the Tax POA DR 835 form, it is essential to approach the task with care and attention to detail. Below are some important guidelines to follow, as well as common pitfalls to avoid.

Things You Should Do:

- Read the instructions carefully to ensure you understand the requirements.

- Provide accurate and complete information about yourself and the representative.

- Sign and date the form where required to validate your request.

- Double-check all entries for errors before submitting the form.

- Keep a copy of the completed form for your records.

- Submit the form to the appropriate tax authority in a timely manner.

- Consider consulting with a tax professional if you have questions.

Things You Shouldn't Do:

- Do not leave any required fields blank, as this may delay processing.

- Avoid using incorrect or outdated forms, as they may not be accepted.

- Do not submit the form without your signature, as it will be considered invalid.

- Refrain from providing false information, as this can lead to legal issues.

- Do not forget to check the submission deadline to avoid penalties.

- Do not assume the form has been received unless you have confirmation.

- Do not hesitate to reach out for help if you encounter difficulties.

How to Use Tax POA dr 835

Completing the Tax POA DR 835 form requires attention to detail and accuracy. After filling out the form, it will need to be submitted to the appropriate tax authority. Ensure that all information is current and that the form is signed where required. Follow these steps to fill out the form correctly.

- Obtain a copy of the Tax POA DR 835 form. This can typically be downloaded from the relevant tax authority's website.

- Begin by entering your personal information in the designated fields. This includes your name, address, and Social Security number or taxpayer identification number.

- Provide the name and address of the person or entity you are authorizing to represent you. This should be the individual or organization you wish to grant power of attorney to.

- Specify the tax matters that the authorized person can handle on your behalf. Be clear and concise in this section to avoid any misunderstandings.

- Indicate the tax years or periods for which the authorization is valid. This ensures that the power of attorney is limited to specific time frames.

- Review the form for accuracy. Check that all names, numbers, and dates are correct and legible.

- Sign and date the form in the appropriate sections. Ensure that the signature matches the name provided at the top of the form.

- Submit the completed form to the appropriate tax authority. Be sure to keep a copy for your records.

More PDF Templates

Corrective Deed California - The Scrivener’s Affidavit reinforces the credibility of the scrivener’s work in legal matters.

Dnd 5e Form Fillable Character Sheet - Current conditions affecting your character, such as being blinded or poisoned.

Cash Reciept - Can be customized to meet specific business needs and branding.

Documents used along the form

The Tax Power of Attorney (POA) DR 835 form is a crucial document that allows an individual to designate another person to represent them in tax matters. However, there are several other forms and documents that may be used in conjunction with the Tax POA to ensure a comprehensive approach to tax representation and compliance. Below is a list of these forms, each serving a unique purpose.

- Form 2848: This is the IRS Power of Attorney and Declaration of Representative form. It allows taxpayers to appoint someone to represent them before the IRS, covering a wide range of tax matters.

- Form 8821: This form is used to authorize the IRS to disclose tax information to a designated individual. Unlike Form 2848, it does not allow the representative to act on behalf of the taxpayer.

- Form 4506: This form requests a copy of a tax return from the IRS. Taxpayers may need it for various reasons, including verifying income or preparing for audits.

- Form 1040: The individual income tax return form. It is essential for reporting income, calculating tax liability, and determining eligibility for certain tax credits.

- Form 1065: This is the U.S. Return of Partnership Income. Partnerships must file this form to report income, deductions, and other tax-related information.

- Form 1120: The U.S. Corporation Income Tax Return is used by corporations to report their income, gains, losses, and deductions to the IRS.

- Form 990: Nonprofit organizations use this form to provide the IRS with information about their activities, governance, and financial health.

- Form W-9: This form is used to provide a taxpayer identification number to a requester. It is often required by businesses that need to report payments made to individuals or entities.

- Form 9465: This is an Installment Agreement Request form. Taxpayers use it to request a payment plan for their tax liabilities if they cannot pay in full.

Understanding these forms can greatly assist individuals in navigating their tax responsibilities. Each document plays a specific role in ensuring compliance and effective communication with tax authorities. By utilizing the appropriate forms, taxpayers can manage their tax situations more efficiently and with greater confidence.

Misconceptions

The Tax Power of Attorney (POA) Form DR 835 is often surrounded by misconceptions that can lead to confusion. Understanding the truth behind these myths is essential for anyone navigating the tax landscape. Here’s a list of common misconceptions:

- 1. The Tax POA form is only for businesses. Many believe that only businesses need a Tax POA. In reality, individuals can also designate a representative to handle their tax matters.

- 2. Once filed, the POA is permanent. Some think that submitting the form means the authority lasts forever. In fact, a Tax POA can be revoked at any time by the taxpayer.

- 3. You can only use the POA for federal taxes. This is incorrect. The Tax POA can be used for both federal and state tax matters, depending on the jurisdiction.

- 4. The form must be notarized. Many assume that notarization is a requirement. However, notarization is not necessary for the Tax POA DR 835 to be valid.

- 5. Only tax professionals can be appointed. It’s a common belief that only CPAs or tax attorneys can represent you. In reality, you can appoint anyone you trust, including family members or friends.

- 6. The IRS automatically accepts the POA. Some taxpayers think that once they submit the form, it’s automatically accepted. However, the IRS must review and approve it before it takes effect.

- 7. You can’t limit the powers granted. Many believe that the POA grants unlimited powers. In fact, you can specify the exact powers you want to give your representative.

- 8. Filing the POA means you won’t be contacted by the IRS. This is a misconception. Even with a POA in place, the IRS may still contact you directly regarding your tax matters.

Understanding these misconceptions can empower you to make informed decisions about your tax representation. Always consider consulting with a knowledgeable advisor if you have questions or concerns about the Tax POA DR 835 form.

File Specs

| Fact Name | Details |

|---|---|

| Purpose | The Tax POA DR 835 form allows individuals to designate a representative to act on their behalf for tax matters. |

| Governing Law | This form is governed by the Internal Revenue Code and applicable state tax laws. |

| Eligibility | Any individual or business can use this form to appoint a tax representative. |

| Required Information | Taxpayer's name, address, taxpayer identification number, and representative's information are required. |

| Submission Method | The form can be submitted electronically or via mail, depending on the state’s requirements. |

| Revocation | Taxpayers can revoke the POA at any time by submitting a written notice to the tax authority. |

| Duration | The authority granted remains in effect until revoked or until the specific tax matter is resolved. |

| State-Specific Forms | Some states may have their own versions of the POA form, which must be used for state tax matters. |

Key takeaways

Filling out and using the Tax POA DR 835 form can seem daunting, but understanding its key elements can simplify the process. Here are some important takeaways to consider:

- Purpose of the Form: The Tax POA DR 835 form allows a taxpayer to designate a representative to act on their behalf regarding tax matters.

- Eligibility: Any individual or entity can be appointed as a representative, provided they have the taxpayer's consent.

- Information Required: The form requires basic information about the taxpayer and the representative, including names, addresses, and Social Security numbers or Employer Identification Numbers.

- Signature Requirement: The taxpayer must sign the form to validate the appointment of the representative.

- Submission Process: Once completed, the form should be submitted to the appropriate tax authority to ensure it is on file.

- Scope of Authority: The representative's authority can be limited to specific tax matters or time periods, depending on the taxpayer's preferences.

- Revocation: The taxpayer can revoke the POA at any time by submitting a written notice to the tax authority.

- Duration: The authority granted by the form remains in effect until the taxpayer revokes it or until the representative withdraws.

- Record Keeping: It is important for both the taxpayer and the representative to keep a copy of the completed form for their records.

- Consultation: If there are any uncertainties about filling out the form, seeking assistance from a tax professional can be beneficial.

By keeping these key points in mind, individuals can effectively navigate the process of appointing a representative for tax matters.