Fill Out a Valid Stock Transfer Ledger Template

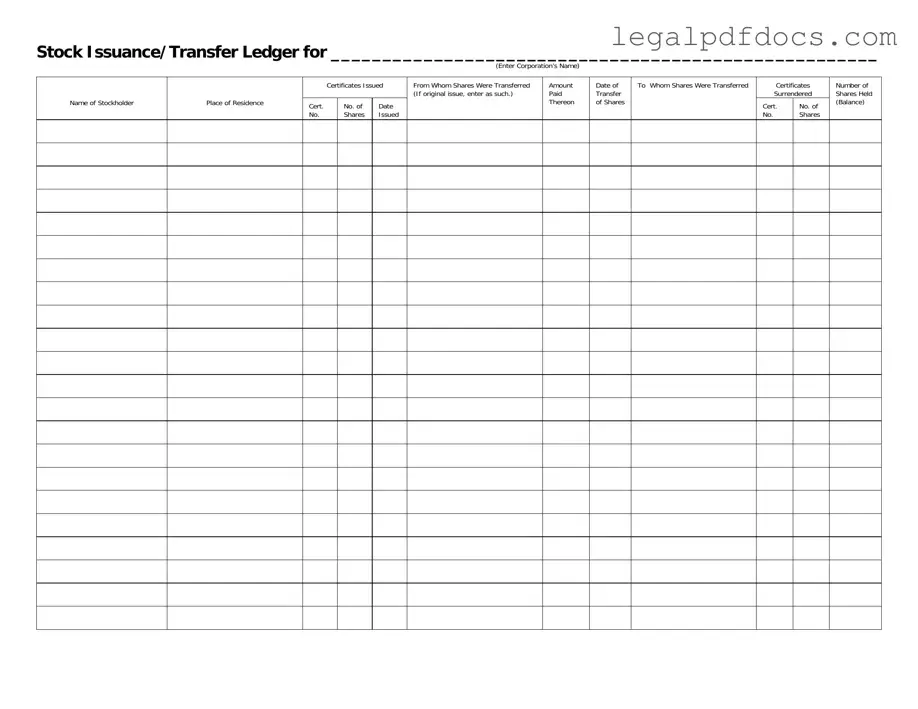

The Stock Transfer Ledger form serves as a crucial document for corporations managing their stock issuance and transfers. This form captures essential information about the corporation's name and the stockholder involved in the transaction. It records the details of the certificates issued, including their unique certificate numbers and the dates on which shares were issued. Additionally, the form outlines the origins of the shares, indicating from whom the shares were transferred or noting if it is an original issue. Important financial details, such as the amount paid for the shares, are also documented. The date of transfer is a key element, as it marks the official change of ownership. Furthermore, the form includes information about the recipient of the shares, ensuring clarity in ownership records. Certificates surrendered during the transfer process are noted, along with the corresponding certificate numbers. Finally, the ledger provides a summary of the number of shares held after the transfer, offering a clear picture of the stockholder's current balance. This comprehensive structure ensures that all pertinent details are systematically recorded, facilitating transparency and accuracy in stock management.

Dos and Don'ts

When filling out the Stock Transfer Ledger form, it is essential to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do enter the corporation’s name clearly at the top of the form.

- Do provide accurate information for each stockholder, including their full name and place of residence.

- Do ensure that the certificate numbers and dates are correctly recorded.

- Do specify the number of shares issued and transferred without any errors.

- Do indicate the amount paid for the shares to maintain transparency.

- Don't leave any fields blank; every section must be completed.

- Don't use abbreviations or shorthand that may confuse the reader.

Following these guidelines will help maintain an accurate and effective Stock Transfer Ledger.

How to Use Stock Transfer Ledger

Completing the Stock Transfer Ledger form is essential for maintaining accurate records of stock transfers within a corporation. This process ensures that all transactions are documented properly, allowing for transparency and accountability in stock ownership.

- Enter the Corporation’s Name: In the designated space at the top of the form, write the full legal name of the corporation.

- Fill in Stockholder Information: List the name of the stockholder and their place of residence in the appropriate fields.

- Certificates Issued: Indicate the number of stock certificates that have been issued to the stockholder.

- Certificate Number: Write the certificate number corresponding to the issued shares.

- Date: Provide the date on which the shares were issued.

- Shares Transferred From: If applicable, note the name of the individual or entity from whom the shares were transferred. If this is an original issue, write "original issue."

- Amount Paid: Specify the amount paid for the shares being transferred.

- Date of Transfer: Enter the date on which the transfer of shares occurred.

- To Whom Shares Were Transferred: List the name of the individual or entity receiving the shares.

- Certificates Surrendered: Indicate the certificate number of any shares that were surrendered during the transfer.

- Number of Shares: Write the number of shares being transferred.

- Balance: Finally, record the total number of shares held by the stockholder after the transfer.

More PDF Templates

Hiv-1 and 2 Test Normal Range - All test results are confidential and handled per health regulations.

Western Union Money Transfer Receipt PDF - Keep track of exchange rates before transferring.

Documents used along the form

The Stock Transfer Ledger form is an essential document for tracking the issuance and transfer of stock within a corporation. However, several other forms and documents are commonly used in conjunction with it. Each of these documents plays a vital role in ensuring proper record-keeping and compliance with regulations.

- Stock Certificate: This document serves as proof of ownership for shares in a corporation. It includes details such as the stockholder's name, the number of shares owned, and the corporation's name.

- Shareholder Agreement: A contract between shareholders that outlines their rights and obligations. It often includes provisions on how shares can be transferred and the process for resolving disputes.

- Stock Power Form: This form allows a stockholder to transfer shares to another individual or entity. It must be signed by the stockholder to authorize the transfer.

- Board Resolution: A formal document that records decisions made by a corporation's board of directors. It may include resolutions regarding stock issuance or transfers.

- Bylaws: These are the rules governing the internal management of a corporation. Bylaws typically include provisions on stockholder meetings, voting rights, and share transfers.

- Form 10-K: An annual report required by the SEC that provides a comprehensive overview of a corporation's financial performance. It includes information on stockholder equity and stock transactions.

- Form 8-K: A report filed with the SEC to announce major events that shareholders should know about, including stock transfers or changes in ownership.

- Transfer Agent Agreement: A contract between a corporation and a transfer agent, who manages the transfer of shares and maintains the stockholder records.

- Dividend Declaration Form: This document is used to announce the payment of dividends to shareholders. It includes details on the amount per share and the payment date.

Using these documents alongside the Stock Transfer Ledger form helps maintain accurate records and ensures compliance with legal requirements. Proper documentation is essential for protecting both the corporation and its shareholders.

Misconceptions

Misconceptions about the Stock Transfer Ledger form can lead to confusion. Here are ten common misunderstandings:

- The form is only for new stock issuances. Many believe the Stock Transfer Ledger is solely for new issuances. In reality, it also tracks transfers of existing shares.

- Only large corporations need to use this form. This form is essential for any corporation, regardless of size, to maintain accurate records of stock ownership.

- It’s not necessary to update the ledger for small transfers. Every transfer, no matter how small, should be documented to ensure accurate ownership records.

- Only the corporation's secretary can fill out the form. While the secretary often manages this task, anyone authorized by the corporation can complete the form.

- The form is only relevant during annual meetings. The Stock Transfer Ledger should be updated continuously, not just during annual meetings.

- Once filled, the ledger doesn't need to be checked. Regular reviews are necessary to ensure the accuracy of stockholder information and transactions.

- It’s optional to include the amount paid for shares. Including the amount paid is crucial for maintaining a clear financial history of each stockholder.

- The ledger is not a legal document. The Stock Transfer Ledger is a legal record that can be used in disputes over ownership or transfers.

- Only physical certificates need to be recorded. Electronic shares also require documentation in the ledger to maintain complete records.

- Once shares are transferred, the ledger can be discarded. The ledger must be retained for a specified period, even after shares have been transferred.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The Stock Transfer Ledger form tracks the issuance and transfer of stock shares within a corporation. |

| Required Information | It requires details such as the corporation’s name, stockholder information, certificates issued, and transfer dates. |

| Governing Law | In many states, corporate laws govern stock transfers. For example, in Delaware, Title 8, Chapter 158 outlines relevant regulations. |

| Stockholder Details | The form must include the stockholder's name and place of residence for proper identification. |

| Transfer Documentation | When shares are transferred, the form must document the amount paid and the date of transfer. |

| Certificate Information | It includes certificate numbers and the number of shares issued, ensuring accurate record-keeping. |

| Balance Tracking | The ledger also shows the number of shares held after transfers, helping maintain clarity on ownership. |

Key takeaways

Filling out the Stock Transfer Ledger form is a critical step in managing stock ownership. Here are key takeaways to ensure accuracy and compliance:

- Accurate Corporation Name: Clearly enter the corporation’s name at the top of the form. This ensures that the ledger is correctly associated with the right entity.

- Stockholder Information: Provide the name and place of residence of each stockholder. This information is vital for record-keeping and communication.

- Certificate Details: List the certificates issued, including the certificate number and the number of shares. This helps track ownership accurately.

- Transfer Information: If shares are being transferred, indicate from whom they were transferred. If it’s an original issue, note that clearly.

- Payment Confirmation: Record the amount paid for the shares. This information is essential for financial records and compliance.

- Date of Transfer: Enter the date on which the shares were transferred. This establishes a clear timeline for ownership changes.

- Recipient Information: Specify to whom the shares were transferred. This ensures that ownership records are updated correctly.

- Certificate Surrender: Include details about any certificates surrendered during the transfer process. This maintains a clear record of stock certificates in circulation.

- Balance of Shares: Finally, indicate the number of shares held after the transfer. This helps in tracking the remaining ownership accurately.

By following these guidelines, you can ensure that the Stock Transfer Ledger is filled out correctly and serves its purpose effectively.