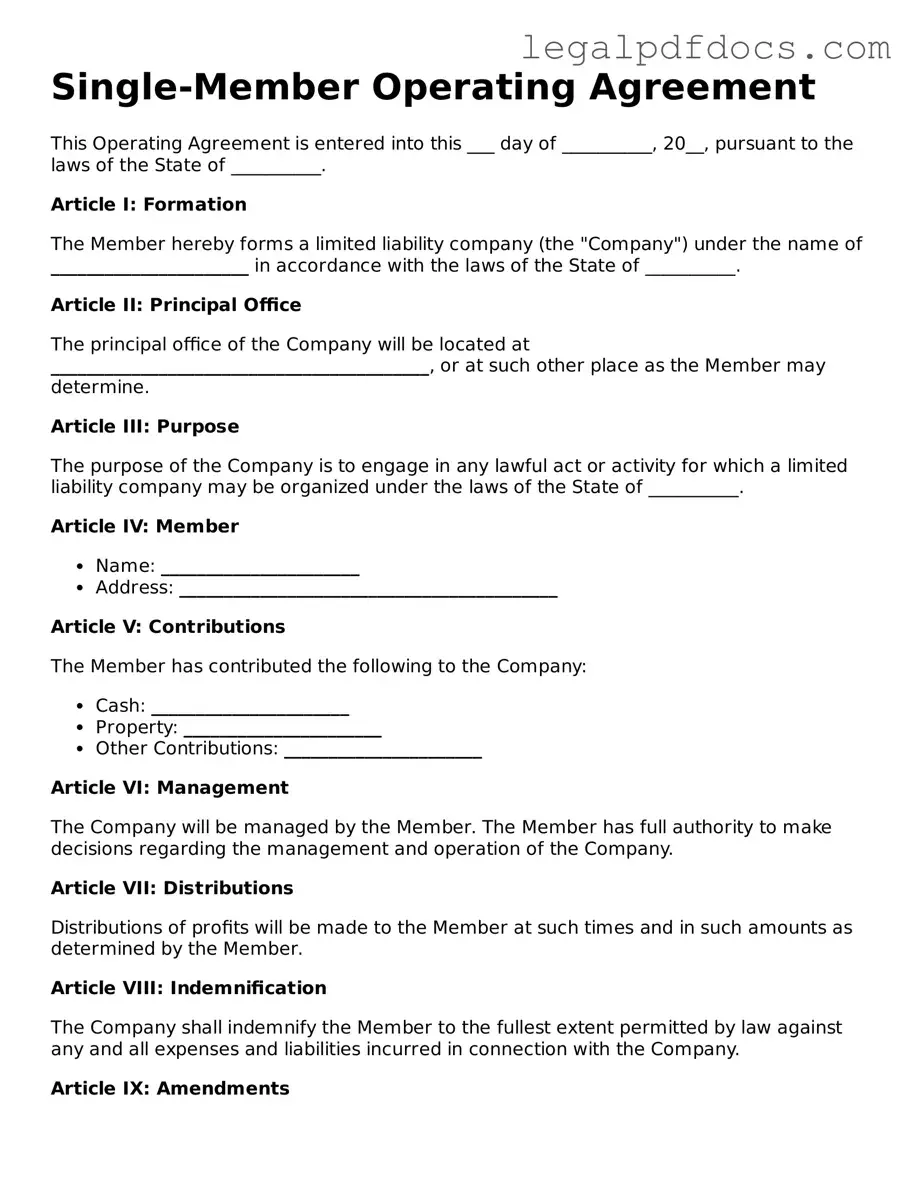

Single-Member Operating Agreement Template

When you operate a single-member LLC, having a solid foundation is essential for both legal protection and business clarity. The Single-Member Operating Agreement is a crucial document that outlines the structure and rules of your business. It serves as an internal guide, detailing how the LLC will be managed and how decisions will be made. This agreement not only clarifies the owner's responsibilities but also helps separate personal and business liabilities, offering a layer of protection for your personal assets. Additionally, it can address important topics such as how profits and losses are handled, what happens in the event of the owner’s death or incapacity, and how the business may be dissolved. By having this agreement in place, you establish clear expectations and procedures, which can be beneficial if you ever need to resolve disputes or attract investors. Overall, the Single-Member Operating Agreement is a vital tool for anyone looking to ensure their business runs smoothly and remains compliant with state regulations.

Dos and Don'ts

When filling out the Single-Member Operating Agreement form, it's important to approach the task thoughtfully. Here are some guidelines to help you navigate the process.

- Do: Read the entire form carefully before starting.

- Do: Provide accurate information about your business.

- Do: Include your name and contact details clearly.

- Do: Keep a copy of the completed form for your records.

- Do: Review your agreement regularly to ensure it remains up to date.

- Don't: Rush through the form without understanding the requirements.

- Don't: Use vague language or leave important sections blank.

- Don't: Forget to sign and date the agreement.

- Don't: Ignore state-specific regulations that may apply.

- Don't: Assume the form is only a one-time task; it may need updates.

How to Use Single-Member Operating Agreement

Filling out the Single-Member Operating Agreement form is an important step in establishing the structure and rules for your business. This document will outline your rights and responsibilities as the sole owner. After completing the form, you will have a clear framework for operating your business, which can help avoid misunderstandings in the future.

- Begin by entering your name as the sole member of the business.

- Provide the name of your business. Ensure that it complies with state naming requirements.

- Fill in the principal office address. This should be the primary location where your business operates.

- State the purpose of your business. Describe what products or services you will offer.

- Include the date when the agreement is being executed.

- Sign the agreement. As the sole member, your signature will validate the document.

- Consider having the document notarized, if required by your state.

Documents used along the form

The Single-Member Operating Agreement is a crucial document for individuals forming a single-member limited liability company (LLC). It outlines the structure, management, and operational guidelines for the business. However, several other forms and documents are often utilized alongside this agreement to ensure comprehensive legal compliance and operational clarity. Below is a list of these documents, each described succinctly.

- Articles of Organization: This document officially establishes the LLC with the state. It includes essential information such as the company name, address, and the registered agent's details.

- Employer Identification Number (EIN): Issued by the IRS, the EIN is necessary for tax purposes. It allows the LLC to open bank accounts, hire employees, and file taxes.

- Initial Resolution: This document records the initial decisions made by the single member regarding the formation and operation of the LLC, including the appointment of officers, if applicable.

- Membership Certificate: While not always required, this certificate serves as proof of ownership in the LLC. It details the member's ownership interest and can be useful for financial transactions.

- Bylaws: Although typically more relevant for corporations, bylaws can also be beneficial for LLCs. They outline the rules and procedures for managing the business, including meetings and voting rights.

- Business License: Depending on the location and nature of the business, a local or state business license may be required to operate legally.

- Operating Procedures: This document details the day-to-day operational guidelines and policies for the LLC, ensuring clarity in business practices.

- Bank Resolution: This resolution authorizes the opening of a bank account in the name of the LLC, specifying who has the authority to manage the account.

- Non-Disclosure Agreement (NDA): If the LLC will be handling sensitive information, an NDA can protect proprietary information from being disclosed to outside parties.

- Annual Report: Many states require LLCs to file an annual report to maintain good standing. This document provides updated information about the business and its operations.

In summary, while the Single-Member Operating Agreement is foundational for a single-member LLC, the accompanying documents play a vital role in establishing a legally compliant and well-structured business. Each document serves a specific purpose, contributing to the overall functionality and protection of the LLC and its owner.

Misconceptions

Understanding the Single-Member Operating Agreement is essential for anyone operating a single-member LLC. However, several misconceptions often cloud this important document. Here are seven common misconceptions explained:

- It is unnecessary for single-member LLCs. Many believe that a formal operating agreement is not needed for single-member LLCs. In reality, having an operating agreement can help clarify ownership and management structures, even if there is only one member.

- It must be filed with the state. Some people think that the operating agreement needs to be submitted to the state. This is not true. The agreement is an internal document that does not require state filing.

- It is a one-size-fits-all document. A common misconception is that a single-member operating agreement can be a generic template. Each agreement should be tailored to reflect the specific needs and goals of the business.

- It only covers financial aspects. While financial details are important, the operating agreement also addresses management roles, decision-making processes, and procedures for transferring ownership, among other things.

- It is only needed for legal protection. Some may think that the agreement serves solely to protect personal assets. Although it provides legal protection, it also helps establish clear guidelines for operations, which can prevent disputes.

- It cannot be changed once created. Many assume that once the operating agreement is drafted, it cannot be modified. In fact, it can be amended as the business evolves or as needs change.

- It is not legally binding. There is a belief that the operating agreement holds no legal weight. However, it is a binding contract that can be enforced in court, provided it complies with state laws.

Addressing these misconceptions can lead to better management and understanding of a single-member LLC's operations. Taking the time to create a thoughtful operating agreement is a valuable step for any business owner.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement outlines the management structure and operational guidelines for a single-member LLC. |

| Purpose | This document helps clarify the owner’s rights and responsibilities, protecting personal assets from business liabilities. |

| State-Specific Forms | Each state may have its own specific requirements for the operating agreement, so it's important to check local laws. |

| Governing Laws | The agreement is generally governed by the laws of the state where the LLC is formed, such as Delaware or California. |

| Flexibility | The operating agreement can be tailored to fit the unique needs of the business and its owner. |

| Not Mandatory | While not required by all states, having an operating agreement is highly recommended for clarity and legal protection. |

| Amendments | The agreement can be amended as the business grows or changes, ensuring it remains relevant over time. |

Key takeaways

Filling out and using a Single-Member Operating Agreement is an important step for anyone running a single-member LLC. Here are some key takeaways to keep in mind:

- Clarifies Ownership: This agreement clearly outlines that you are the sole owner of the LLC, eliminating any confusion about ownership stakes.

- Establishes Business Operations: It details how your business will operate, including decision-making processes and how profits will be distributed.

- Protects Limited Liability: Having an operating agreement can help maintain your limited liability status, shielding your personal assets from business debts.

- Facilitates Banking Relationships: Banks often require an operating agreement to open a business account, making it easier to manage your finances.

- Provides Legal Clarity: In the event of disputes or legal issues, this document serves as a reference point, helping to clarify your intentions and business structure.

- Enhances Credibility: A well-drafted operating agreement demonstrates professionalism and can enhance your business's credibility with clients and partners.

By understanding these key points, you can effectively fill out and utilize your Single-Member Operating Agreement to support your business's success.