Fill Out a Valid Sample Tax Return Transcript Template

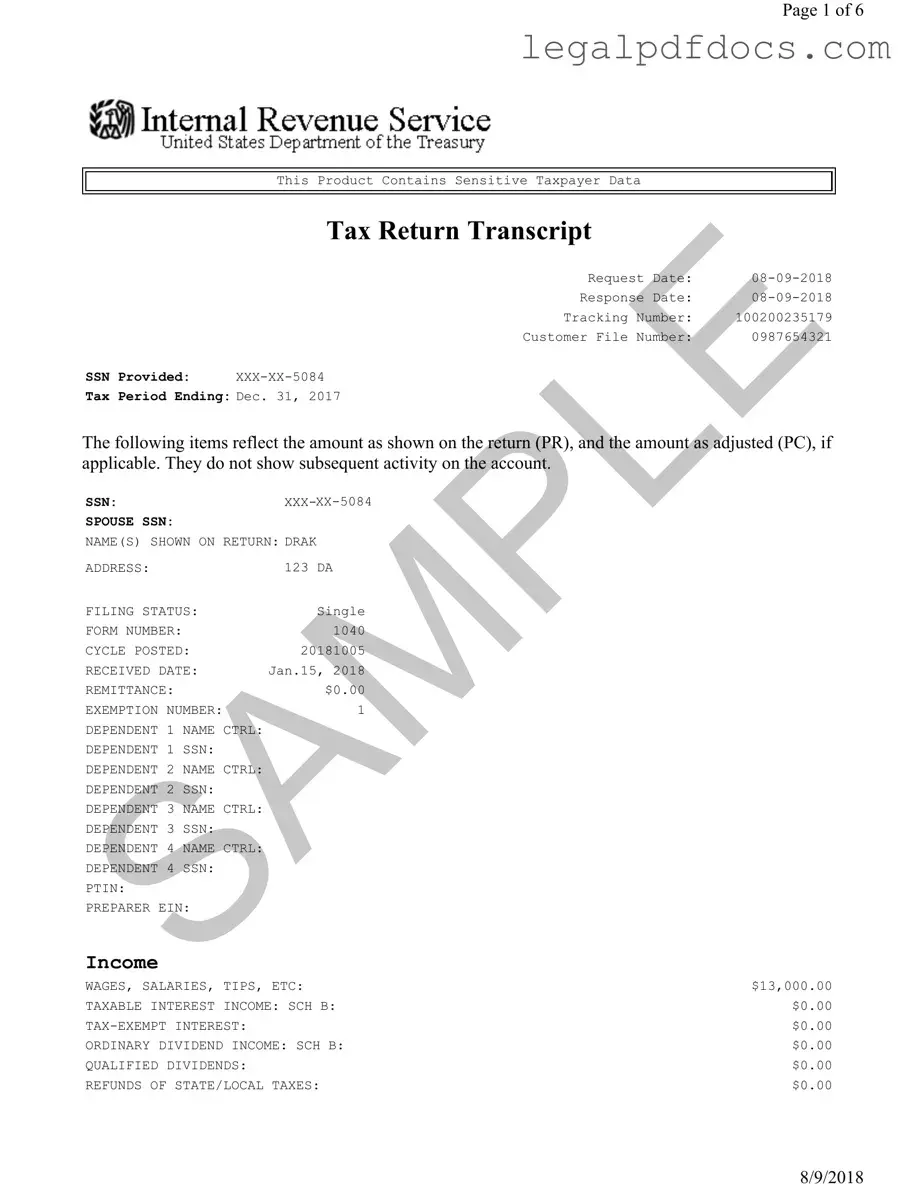

The Sample Tax Return Transcript form serves as a crucial document for individuals seeking to verify their tax information. It contains sensitive taxpayer data, including Social Security Numbers (SSNs), filing status, and income details. For example, the transcript reflects income from various sources such as wages, salaries, and business income, along with any adjustments made to the reported amounts. Taxable income, deductions, and credits are also outlined, providing a comprehensive overview of the taxpayer's financial situation for the specified tax period. This particular transcript, dated August 9, 2018, pertains to the tax year ending December 31, 2017, and includes important figures like total income, adjustments, and tax liability. Furthermore, it indicates any payments made, refunds expected, or amounts owed. Understanding this form can greatly assist individuals in managing their tax obligations and ensuring compliance with IRS requirements.

Dos and Don'ts

When filling out the Sample Tax Return Transcript form, it is important to follow certain guidelines to ensure accuracy and completeness.

- Double-check all personal information, including Social Security Numbers and names, for accuracy.

- Use clear and legible handwriting or type the information to avoid any misinterpretations.

- Ensure that all required fields are filled out completely before submission.

- Keep a copy of the completed form for your records in case you need to reference it later.

Conversely, there are also common mistakes to avoid while completing this form.

- Do not leave any sections blank unless specifically instructed to do so.

- Avoid using correction fluid or tape; if an error is made, cross it out neatly and write the correct information next to it.

- Do not forget to sign and date the form before submitting it.

- Refrain from submitting the form without reviewing it for any potential errors or omissions.

How to Use Sample Tax Return Transcript

Filling out the Sample Tax Return Transcript form can seem overwhelming, but breaking it down into manageable steps can make the process easier. Once you have completed the form, you can submit it for review or keep it for your records. Follow these steps carefully to ensure that all necessary information is accurately recorded.

- Begin by entering the Request Date at the top of the form. This is the date you are filling out the transcript.

- Next, fill in the Response Date, which is typically the date you expect to receive the transcript.

- Record the Tracking Number provided on the form. This helps in tracking your request.

- Input the Customer File Number, which is unique to your tax account.

- Enter your Social Security Number (SSN) in the designated field.

- Fill in the Tax Period Ending date, which indicates the end of the tax year for the return.

- Provide your name as it appears on the tax return in the Name(s) Shown on Return section.

- Complete your Address information, ensuring it is current and accurate.

- Indicate your Filing Status (e.g., Single, Married Filing Jointly).

- Fill in the Form Number you are using, which is usually 1040 for individual income tax returns.

- Record the Cycle Posted date, which indicates when your return was processed.

- Input the Received Date, which is when the IRS received your tax return.

- Fill in the Remittance amount, if applicable, indicating any payment made with the return.

- Complete the Exemption Number section, which indicates how many exemptions you are claiming.

- List any Dependents you are claiming, including their names and SSNs, if applicable.

- Provide your PTIN (Preparer Tax Identification Number) if you are using a paid preparer.

- Fill in the Income section with all relevant amounts, such as wages, interest income, and business income.

- Record any Adjustments to Income, including educator expenses or self-employment tax deductions.

- Complete the Tax and Credits section, indicating any credits or deductions you are eligible for.

- Fill in the Other Taxes section, including self-employment tax or any other applicable taxes.

- Provide details in the Payments section, including federal income tax withheld and any estimated tax payments.

- Finally, review the Refund or Amount Owed section to determine if you owe money or are due a refund.

More PDF Templates

Employee Change Form Template - Use for any changes in work location or hours.

P 45 Meaning - Employers need to ensure they complete all fields accurately to prevent issues.

D2 Application Form - The signature box on the form must be filled in black ink and kept within the designated area.

Documents used along the form

The Sample Tax Return Transcript is an important document for taxpayers, often used alongside other forms to provide a comprehensive view of one's tax situation. Below is a list of documents commonly associated with it. Each serves a specific purpose in the tax preparation and filing process.

- Form 1040: This is the standard individual income tax return form used to report income, claim deductions, and calculate tax liability.

- Schedule C: This form details profit or loss from a business operated by the taxpayer, allowing for the reporting of income and expenses related to self-employment.

- Schedule E: Used to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, and trusts.

- Form W-2: Issued by employers, this form reports annual wages and the taxes withheld from employee paychecks, crucial for accurate tax filing.

- Form 1099: Various versions of this form report income received from sources other than an employer, such as freelance work or interest income.

- Form 8862: This form is used to claim the Earned Income Credit after it was disallowed in a previous year, providing necessary information to re-establish eligibility.

- Form 4868: This is the application for an automatic extension of time to file a federal income tax return, allowing taxpayers additional time to prepare their documents.

Understanding these documents can simplify the tax filing process and ensure that all necessary information is accurately reported. Each form plays a vital role in presenting a complete financial picture to the IRS.

Misconceptions

When it comes to the Sample Tax Return Transcript form, there are several misconceptions that can lead to confusion. Here are eight common misunderstandings, along with clarifications to help you navigate this important document.

- Misconception 1: The transcript shows all transactions related to the tax account.

- Misconception 2: A Tax Return Transcript is the same as a full tax return.

- Misconception 3: The transcript is only useful for tax preparation.

- Misconception 4: I need to request a new transcript each time I need one.

- Misconception 5: The transcript contains sensitive information that can be accessed by anyone.

- Misconception 6: The transcript reflects current tax liabilities.

- Misconception 7: A transcript can be used as proof of income.

- Misconception 8: The transcript is only available in paper format.

This is not true. The Sample Tax Return Transcript only displays amounts as reported on the return and any adjustments made. It does not include subsequent activity or transactions on the account.

While both documents relate to your tax filing, a Tax Return Transcript summarizes key information from your return, whereas a full tax return includes all supporting schedules and forms.

In reality, this document can be used for various purposes, including applying for loans, verifying income, or resolving tax issues with the IRS.

You can obtain your transcript online through the IRS website, and it is available for the previous three tax years. This makes it easier to access without needing to submit a new request every time.

This is a misconception. The transcript contains sensitive taxpayer data, and access is restricted. Only authorized individuals, such as the taxpayer or a designated third party, can view it.

The Tax Return Transcript only shows amounts as reported or adjusted. It does not reflect any current tax liabilities, payments, or refunds that may have occurred after the tax period.

While it summarizes your income, some institutions may require a full tax return as proof of income, especially for loans or mortgages.

The IRS offers electronic access to transcripts, allowing you to view and print them directly from their website. This is often faster and more convenient than waiting for a paper copy.

File Specs

| Fact Name | Description |

|---|---|

| Request Date | The request for the tax return transcript was made on August 9, 2018. |

| Response Date | The response to the request was also dated August 9, 2018. |

| Tax Period Ending | The tax period covered by this transcript ended on December 31, 2017. |

| Filing Status | The filing status of the taxpayer is categorized as Single. |

| Total Income | The total income reported on the transcript is $15,500.00. |

| Adjusted Gross Income | The adjusted gross income is listed as $15,323.00. |

| Total Tax Liability | The total tax liability calculated is $1,103.00. |

| Payments Made | The total payments made towards taxes amount to $1,000.00. |

| Amount Owed | The amount owed by the taxpayer is $103.00. |

| Dependent Information | No dependents were reported on this tax return transcript. |

Key takeaways

- Understand the Purpose: The Sample Tax Return Transcript form provides a summary of your tax return information. It includes details such as income, deductions, and credits, which are essential for verifying your tax status.

- Review Personal Information: Ensure that your name, Social Security Number (SSN), and other personal details are accurate. Any discrepancies could lead to issues with your tax records.

- Identify Key Figures: Pay attention to important figures like total income, adjusted gross income, and tax liability. These numbers are crucial for understanding your overall tax situation.

- Check for Adjustments: Review any adjustments to income and deductions listed on the form. This can impact your taxable income and, ultimately, your tax bill or refund.

- Use for Verification: The transcript can be used to verify income for loans, financial aid, or other applications. Keep it handy for any situations where proof of income is required.