Rental Application Template

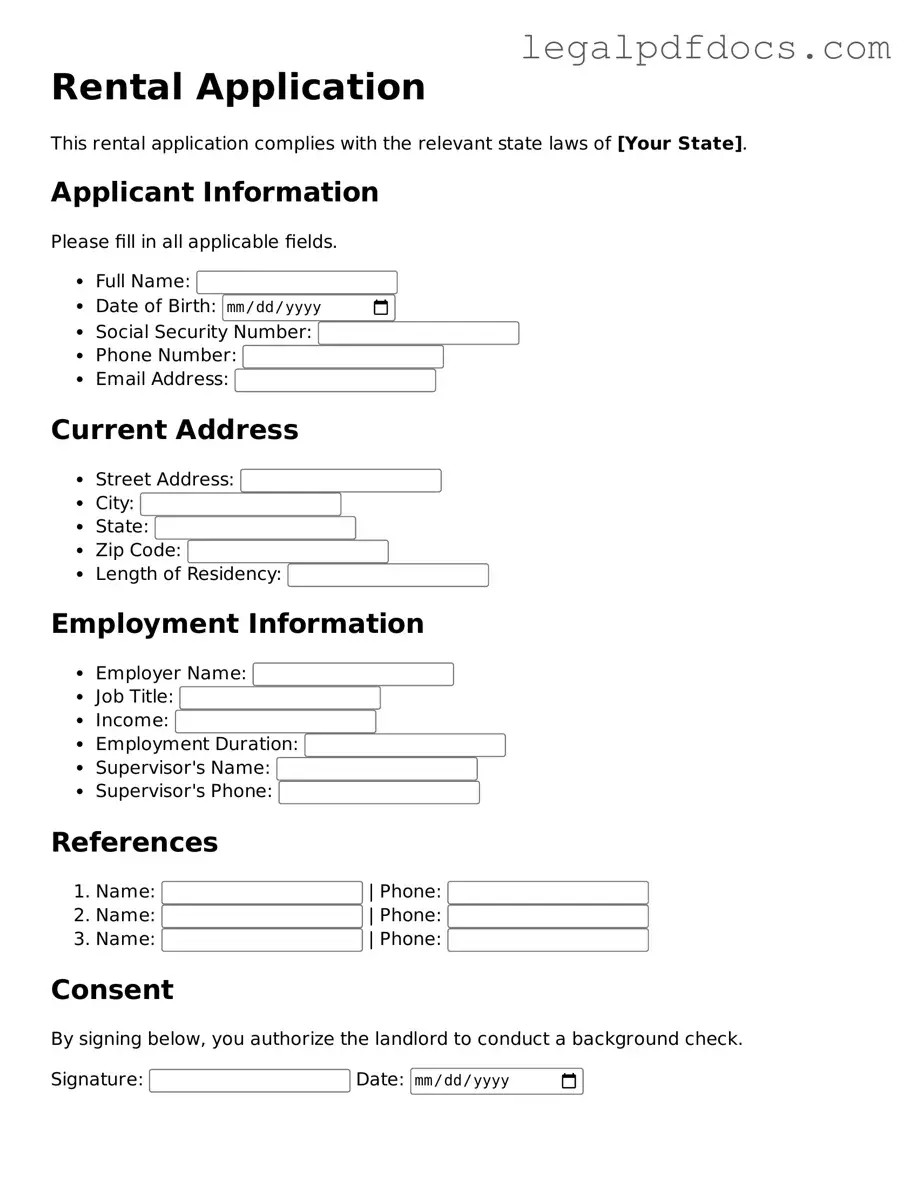

When searching for a new place to call home, the rental application form is a crucial step in the process. This document serves as a gateway for potential tenants to demonstrate their suitability to landlords or property managers. Typically, it includes personal information such as your name, contact details, and social security number, which help verify your identity. Financial details, including your income and employment history, play a significant role as they give landlords insight into your ability to pay rent on time. Additionally, the form often requests references from previous landlords or personal contacts to vouch for your reliability as a tenant. Some applications may even ask about your rental history, pet ownership, and any criminal background, ensuring that landlords can make informed decisions. By understanding the various components of a rental application form, you can better prepare yourself and increase your chances of securing your desired rental property.

Dos and Don'ts

When filling out a rental application form, attention to detail is crucial. Here are some dos and don'ts to keep in mind:

- Do provide accurate and complete information. Ensure that all sections of the application are filled out thoroughly.

- Do include references. Having personal or professional references can strengthen your application.

- Do proofread your application. Check for any spelling or grammatical errors before submission.

- Do be honest about your rental history. Disclosing any past issues can build trust with the landlord.

- Don't leave any questions unanswered. Incomplete applications may be disregarded.

- Don't provide false information. Misrepresentation can lead to denial of your application or future legal issues.

By following these guidelines, you can enhance your chances of securing the rental you desire.

How to Use Rental Application

Completing the Rental Application form is an important step in securing your desired rental property. Once you have filled out the form, it will be reviewed by the landlord or property manager. They will assess your application and determine your eligibility for the rental. Follow these steps to ensure you fill out the form correctly.

- Begin by providing your personal information, including your full name, current address, and contact details.

- List your employment history. Include your current employer's name, address, and your position, along with your income.

- Fill in your rental history. Provide the addresses of previous rentals, the names of landlords, and the duration of your stay at each property.

- Disclose any additional sources of income. This could include alimony, child support, or other financial support.

- Provide references. Include at least two personal or professional references who can vouch for your character and reliability.

- Complete the section on pets if applicable. Indicate whether you have pets and provide details about them.

- Sign and date the application to confirm that all information is accurate and complete.

- Submit the application along with any required fees or documentation as specified by the landlord or property manager.

Check out Popular Types of Rental Application Templates

Salon Booth Rental Lease Agreement Pdf - Establishes rules for guests and additional staff in the booth.

Hunting Lease Word Document - Provides a space for additional comments or terms specific to the agreement.

Simple Rental Agreement Between Family Members - Use this to formalize rental arrangements without the stress.

Documents used along the form

When applying for a rental property, several documents often accompany the Rental Application form. These documents help landlords and property managers assess potential tenants more thoroughly. Below is a list of commonly used forms and documents that can enhance your rental application.

- Credit Report: A detailed report showing your credit history, including your credit score, outstanding debts, and payment history. Landlords use this to evaluate your financial reliability.

- Proof of Income: This may include recent pay stubs, bank statements, or tax returns. It demonstrates your ability to pay rent on time.

- Rental History: A document outlining your previous rental agreements, including landlord contact information. This helps verify your past rental behavior.

- Employment Verification: A letter from your employer confirming your job title, salary, and length of employment. This assures landlords of your job stability.

- Personal References: A list of individuals who can vouch for your character and reliability. These may include friends, family, or previous landlords.

- Pet Agreement: If you have pets, this document outlines any pet-related terms and conditions. It ensures both parties understand pet policies.

- Identification: A copy of your government-issued ID, such as a driver’s license or passport. This helps verify your identity.

- Application Fee Receipt: Proof of payment for any application fees charged by the landlord or property management company. This shows you are serious about your application.

- Background Check Consent: A signed form allowing the landlord to conduct a background check. This is often required to assess your criminal history.

- Guarantor Agreement: If applicable, this document outlines the responsibilities of a guarantor who agrees to cover your rent if you cannot. It provides additional security for landlords.

Having these documents ready can streamline the application process and improve your chances of securing your desired rental. Being organized and transparent shows landlords that you are a responsible and trustworthy tenant.

Misconceptions

When it comes to rental applications, many people hold misconceptions that can lead to confusion and frustration. Here are eight common misunderstandings about the rental application process:

- All rental applications are the same. Many believe that every rental application follows a standard format. In reality, each landlord or property management company may have its own specific requirements and questions.

- Only credit history matters. While credit history is important, landlords also consider income, rental history, and personal references. A strong overall profile can offset a less-than-perfect credit score.

- Once submitted, the application cannot be changed. Applicants often think they cannot modify their information after submission. However, many landlords allow updates if new information arises before a decision is made.

- Paying the application fee guarantees approval. Some individuals believe that paying the fee means they will secure the rental. The fee is simply for processing the application and does not influence the approval decision.

- All landlords require the same documentation. Many assume that documentation requirements are uniform across the board. In truth, different landlords may ask for various documents, such as pay stubs, tax returns, or identification.

- Application approval is immediate. Applicants often expect quick approval. However, thorough checks can take time, and landlords may need to contact references or verify information before making a decision.

- Co-signers are not allowed. Some people think that having a co-signer is not an option. In many cases, landlords will accept a co-signer to help secure the lease, especially if the primary applicant has limited credit history.

- Once denied, you cannot apply again. Many believe that a denial is final. However, applicants can often reapply after addressing the issues that led to the denial, such as improving their credit score or securing a steady income.

Understanding these misconceptions can help potential renters navigate the application process more effectively and improve their chances of securing a rental property.

PDF Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Rental Application form is used by landlords to screen potential tenants. |

| Information Collected | This form typically collects personal information, rental history, and financial details. |

| State-Specific Forms | Some states require specific forms that comply with local laws, such as California's Civil Code § 1950.6. |

| Application Fees | Landlords may charge a non-refundable application fee to cover the cost of screening. |

| Legal Compliance | Landlords must comply with Fair Housing laws when using the Rental Application form. |

Key takeaways

Filling out a rental application can seem daunting, but it’s a crucial step in securing your next home. Here are some key takeaways to keep in mind:

- Be honest about your rental history. Landlords appreciate transparency.

- Provide accurate contact information. This ensures timely communication.

- Include all required documentation. Missing documents can delay the process.

- Check your credit report beforehand. Understanding your credit can help you address any issues.

- Prepare to pay an application fee. This is often non-refundable but necessary for processing.

- Be ready for a background check. Landlords often conduct these to ensure tenant reliability.

- List all sources of income. This helps demonstrate your ability to pay rent.

- Have references available. Good references can strengthen your application.

- Follow up after submitting your application. A simple check-in shows your interest and initiative.

By keeping these points in mind, you can navigate the rental application process more effectively and increase your chances of securing the rental you desire.