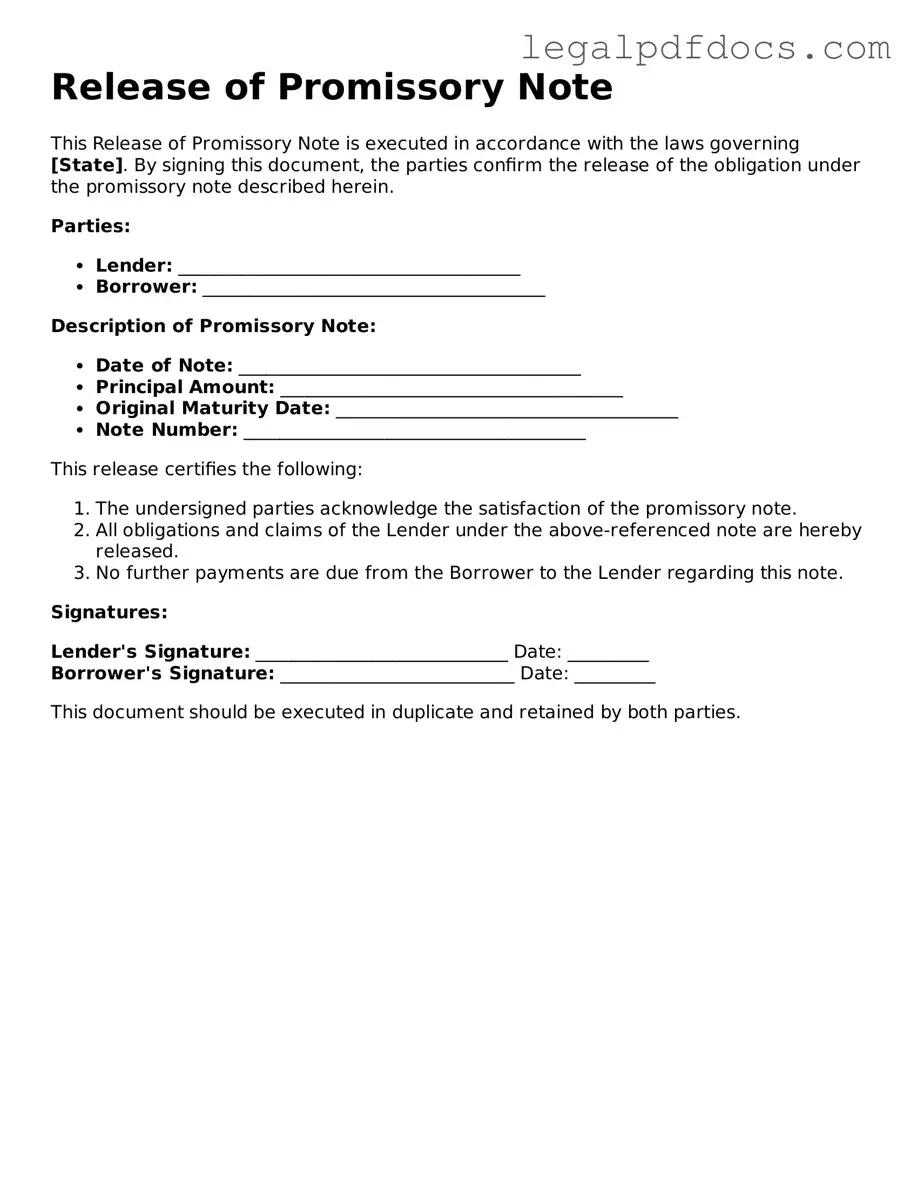

Release of Promissory Note Template

The Release of Promissory Note form serves as a vital document in the realm of financial transactions, particularly in the context of loans and debts. This form signifies the completion of a loan agreement, indicating that the borrower has fulfilled their obligations and that the lender acknowledges this fulfillment. By executing this release, both parties can ensure that the debt is officially settled, eliminating any future claims related to the promissory note. The form typically includes essential details such as the names of the borrower and lender, the original amount of the loan, and the date of repayment. Additionally, it may contain a statement affirming that the lender relinquishes any rights to collect on the note, thereby providing peace of mind to the borrower. Clarity in the language and structure of this document is crucial, as it serves not only as a record of the transaction but also as a safeguard against potential disputes. Understanding the nuances of this form is essential for anyone involved in lending or borrowing, as it encapsulates the conclusion of a financial relationship and the mutual agreement to move forward without further obligations.

Dos and Don'ts

When filling out the Release of Promissory Note form, it's essential to follow certain guidelines to ensure accuracy and legality. Here’s a list of things you should and shouldn't do:

- Do read the entire form carefully before filling it out.

- Do provide accurate information regarding the parties involved.

- Do ensure that the date of release is clearly indicated.

- Do sign the form in the presence of a witness or notary, if required.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use abbreviations or shorthand when filling out the form.

- Don't rush through the process; take your time to review your entries.

- Don't forget to check for any specific state requirements that may apply.

How to Use Release of Promissory Note

Once you have gathered all necessary information, you’re ready to complete the Release of Promissory Note form. This form is essential for formally acknowledging the satisfaction of a debt, allowing both parties to move forward without lingering obligations. Follow these steps carefully to ensure accuracy and completeness.

- Obtain the Form: Access the Release of Promissory Note form from a reliable source, such as a legal website or your attorney.

- Fill in Your Information: Start by entering your name and address in the designated fields at the top of the form.

- Provide the Borrower’s Information: Next, input the name and address of the borrower, the individual or entity that originally took out the loan.

- Include the Details of the Promissory Note: Specify the date the promissory note was executed, the original principal amount, and any relevant interest rates.

- State the Release: Clearly indicate that you are releasing the borrower from the obligations of the promissory note. This may be a simple statement, such as “This release acknowledges that the borrower has fulfilled all obligations under the promissory note.”

- Sign and Date the Form: Both parties must sign and date the form to make it legally binding. Ensure that the signatures are dated appropriately.

- Make Copies: After signing, make copies of the completed form for your records and for the borrower.

With the form filled out and signed, it’s essential to provide a copy to the borrower. This step not only confirms the release but also serves as a record for both parties. Keep your copy in a safe place for future reference, should the need arise.

Check out Popular Types of Release of Promissory Note Templates

Promissary Note Template - It establishes a legal obligation which can be enforced in court if needed.

Documents used along the form

The Release of Promissory Note form is an important document that signifies the conclusion of a loan agreement. It releases the borrower from any further obligation to repay the loan, provided all terms have been met. Several other documents often accompany this form to ensure clarity and legal compliance. Below is a list of these documents, each serving a unique purpose in the loan process.

- Promissory Note: This is the original document that outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any penalties for late payment. It serves as a legal promise to repay the loan.

- Loan Agreement: This comprehensive document details the rights and obligations of both the lender and borrower. It may include terms related to collateral, default conditions, and dispute resolution processes.

- Security Agreement: If the loan is secured by collateral, this document specifies what the collateral is and the lender's rights to it in case of default. It provides protection for the lender.

- Payoff Statement: This document provides the total amount required to pay off the loan early. It includes principal, interest, and any fees. It is often requested by the borrower when seeking to close the loan.

- Release of Lien: When a loan is secured by property, this document releases the lender's claim on the property once the loan is paid off. It is crucial for clearing the title of the property.

- Loan Payment History: This record details all payments made on the loan, including dates and amounts. It can be useful for both parties to verify that payments have been made as agreed.

- Amendment or Modification Agreement: If any terms of the original loan agreement need to be changed, this document outlines those modifications. It ensures that both parties are in agreement regarding the new terms.

Understanding these accompanying documents can help borrowers and lenders navigate the loan process more effectively. Each document plays a vital role in ensuring that all parties are protected and informed throughout the lending relationship.

Misconceptions

The Release of Promissory Note form is often misunderstood, leading to confusion for those involved in financial transactions. Here are six common misconceptions about this important document:

-

The Release of Promissory Note form is only necessary for large loans.

This is not true. Regardless of the loan amount, the release form is essential for documenting the fulfillment of the loan agreement. It provides clarity and legal assurance to both parties.

-

Once a promissory note is signed, it cannot be changed or canceled.

While a promissory note is a binding agreement, it can be modified or canceled through mutual consent. The release form serves as a formal acknowledgment that the debt has been settled.

-

The release form is only needed when the borrower pays off the loan.

This misconception overlooks situations where the loan may be forgiven or settled through other means. A release form is still necessary to document that the lender has relinquished their claim to the debt.

-

Signing a release form means the borrower has no further obligations.

This can be misleading. While the release indicates that the specific debt is settled, it does not absolve the borrower of any other potential obligations unless explicitly stated in the agreement.

-

The release form does not need to be notarized.

In many cases, notarization adds an extra layer of validity and can be required for the release to be legally binding. It is wise to check local regulations regarding notarization requirements.

-

The release form is only relevant to the borrower.

This is a common misunderstanding. The release form is crucial for both the borrower and the lender. It protects the lender’s interests by confirming that the debt has been resolved.

Understanding these misconceptions can help individuals navigate the complexities of financial agreements more effectively. It is always advisable to seek guidance if there are uncertainties regarding the release of a promissory note.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Release of Promissory Note form is used to formally acknowledge the repayment of a loan and the cancellation of the promissory note. |

| Purpose | This form serves to protect both the lender and borrower by documenting that the debt has been settled. |

| Signature Requirement | Typically, the lender must sign the form to confirm that the debt has been paid in full. |

| State Variations | Each state may have its own version of the form, reflecting local laws and requirements. |

| Governing Law | In California, for example, the form is governed by the California Civil Code, Section 2953. |

| Filing Requirements | Some states may require the form to be filed with a local government office, while others do not. |

| Record Keeping | Both parties should keep a copy of the signed form for their records to prevent future disputes. |

| Notarization | In some states, notarization of the form may be required to ensure its validity. |

Key takeaways

When filling out and using the Release of Promissory Note form, there are several important considerations to keep in mind. Below are key takeaways to ensure proper completion and understanding of this document.

- The form serves to officially document the release of a promissory note, indicating that the borrower has fulfilled their obligation.

- Ensure all parties involved in the transaction are accurately identified, including names and addresses.

- Include the date of the release to establish a clear timeline for the transaction.

- Both the lender and borrower must sign the form to validate the release.

- Retain copies of the signed form for personal records and future reference.

- Consult legal counsel if there are any uncertainties regarding the terms of the promissory note or the release.

- Be aware that a Release of Promissory Note may be required for future transactions, such as applying for additional loans.

By following these guidelines, individuals can effectively navigate the process of using a Release of Promissory Note form.