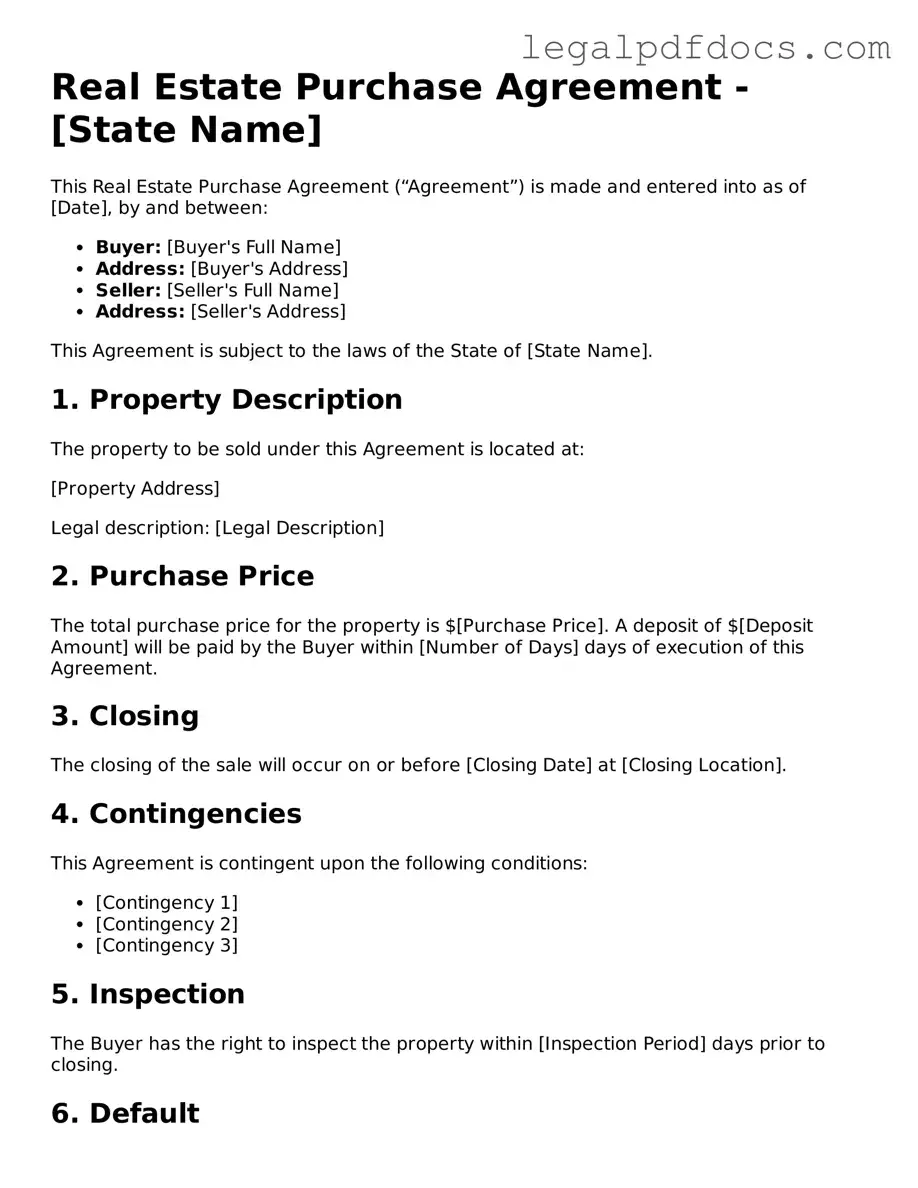

Real Estate Purchase Agreement Template

When engaging in the process of buying or selling property, the Real Estate Purchase Agreement (REPA) serves as a critical document that outlines the terms and conditions of the transaction. This comprehensive agreement typically includes essential details such as the purchase price, financing arrangements, and the closing date. It also delineates the responsibilities of both the buyer and the seller, ensuring that each party understands their obligations throughout the transaction. Key elements often covered in the REPA include contingencies, which protect buyers by allowing them to withdraw from the deal under certain conditions, such as unsatisfactory inspections or the inability to secure financing. Additionally, the agreement addresses the inclusion of personal property, such as appliances or fixtures, that may be part of the sale. By clearly articulating these aspects, the Real Estate Purchase Agreement not only facilitates a smoother transaction but also helps to mitigate potential disputes, providing a framework within which both parties can operate with confidence. Understanding the nuances of this document is essential for anyone involved in real estate, as it lays the groundwork for a successful transfer of ownership.

Real Estate Purchase Agreement Document Categories

Dos and Don'ts

When filling out the Real Estate Purchase Agreement form, it is important to follow certain guidelines to ensure the process goes smoothly. Here are some dos and don'ts to consider:

- Do read the entire agreement carefully before signing.

- Do provide accurate information about the property and the parties involved.

- Do consult with a real estate professional if you have questions.

- Do keep a copy of the signed agreement for your records.

- Don't leave any sections blank; fill in all required fields.

- Don't rush through the process; take your time to understand each clause.

- Don't sign the agreement without ensuring all terms are acceptable to you.

How to Use Real Estate Purchase Agreement

Filling out the Real Estate Purchase Agreement form is a critical step in the property buying process. This form requires accurate information to ensure all parties are clear on the terms of the transaction. Following the steps outlined below will help streamline the completion of the form.

- Begin by entering the date at the top of the form.

- Provide the full names and contact information of the buyer(s) and seller(s).

- Clearly identify the property by including the address and legal description.

- Specify the purchase price and any earnest money deposit amount.

- Outline the terms of financing, including any contingencies.

- Indicate the closing date and any conditions that must be met before closing.

- Include any additional terms or conditions that apply to the sale.

- Ensure all parties sign and date the agreement at the designated areas.

After completing the form, review all entries for accuracy. Each party should retain a copy for their records. This agreement will guide the transaction moving forward.

More Forms:

Weekly Lease Agreement - Detail the procedures for notifying about repairs.

Ucc 1-308 Explained - It can protect individuals from being assumed to have accepted hidden obligations.

Electrical Panel Schedule Template - The schedule enhances understanding of how energy flows through the structure.

Documents used along the form

When engaging in a real estate transaction, the Real Estate Purchase Agreement is a pivotal document. However, several other forms and documents often accompany it to ensure a smooth process. Each of these documents serves a specific purpose, providing clarity and protection for both buyers and sellers.

- Property Disclosure Statement: This document requires the seller to disclose any known issues or defects with the property. It helps buyers make informed decisions by revealing the property's condition and any potential problems that may arise after the purchase.

- Title Report: A title report is essential in confirming the ownership of the property. It outlines any liens, easements, or other claims against the property, ensuring that the buyer receives clear title upon purchase.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document summarizes the final financial transactions involved in the sale. It details all costs, including closing costs, taxes, and any other fees, ensuring transparency for both parties.

- Home Inspection Report: Often conducted after the purchase agreement is signed, this report provides a thorough examination of the property's condition. It highlights any necessary repairs, allowing buyers to negotiate or reconsider their purchase based on the findings.

Understanding these accompanying documents can significantly enhance the real estate transaction experience. Each serves to protect interests and facilitate a smoother transfer of ownership, making the process clearer for everyone involved.

Misconceptions

The Real Estate Purchase Agreement (RPA) is a crucial document in the home buying process. However, several misconceptions surround its use and implications. Understanding these misconceptions can help buyers and sellers navigate real estate transactions more effectively.

- Misconception 1: The RPA is a standard form that cannot be altered.

- Misconception 2: Signing the RPA guarantees the sale will go through.

- Misconception 3: The RPA is only for residential properties.

- Misconception 4: All real estate agents use the same RPA.

- Misconception 5: The RPA does not require legal review.

- Misconception 6: The RPA is only important for the buyer.

- Misconception 7: Once signed, the RPA cannot be changed.

- Misconception 8: The RPA does not cover closing costs.

Many believe the RPA is a rigid document that must be used as is. In reality, parties can negotiate and modify terms to fit their specific needs, provided both agree to the changes.

While the RPA is a binding agreement, it does not guarantee a successful transaction. Contingencies, inspections, and financing can still derail the process.

Some people think the RPA applies solely to residential real estate. However, it can also be used for commercial properties, land sales, and other types of real estate transactions.

While many agents use a standard form, variations exist based on local laws, brokerage practices, and specific transaction needs. Buyers and sellers should review the form carefully.

Some individuals believe that the RPA is straightforward enough to forego legal counsel. However, having a lawyer review the agreement can help identify potential issues and protect interests.

Both buyers and sellers should recognize the importance of the RPA. It outlines the terms of the sale and protects the rights of both parties, making it essential for all involved.

Many assume that the RPA is final once signed. However, amendments can be made if both parties agree, allowing for flexibility throughout the transaction.

Some people think the RPA only addresses the purchase price. In reality, it can specify who is responsible for various closing costs, making it an important part of the financial negotiations.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Purchase Agreement is a legally binding contract between a buyer and a seller for the sale of real property. |

| Key Components | This agreement typically includes the purchase price, property description, contingencies, and closing date. |

| Governing Law | The agreement is governed by the laws of the state in which the property is located, which may vary significantly. |

| Contingencies | Common contingencies include financing, inspections, and appraisal requirements, protecting the buyer's interests. |

| Earnest Money | Buyers often provide earnest money to demonstrate commitment, which is typically held in escrow until closing. |

| Disclosure Requirements | Sellers are usually required to disclose known defects or issues with the property, depending on state laws. |

| Closing Process | The closing process involves finalizing the sale, transferring the title, and disbursing funds, often facilitated by a title company. |

| Modification | Any modifications to the agreement must be made in writing and signed by both parties to be enforceable. |

| Legal Advice | It is advisable for both parties to seek legal advice before signing the agreement to ensure all terms are understood. |

Key takeaways

When it comes to filling out and using the Real Estate Purchase Agreement form, there are several important points to keep in mind. This document is crucial for both buyers and sellers in a real estate transaction. Here are some key takeaways:

- Understand the Basics: Familiarize yourself with the purpose of the Real Estate Purchase Agreement. It outlines the terms of the sale, including price, property details, and conditions.

- Complete All Sections: Ensure every section of the form is filled out accurately. Missing information can lead to delays or complications later in the process.

- Specify Contingencies: Clearly outline any contingencies, such as financing or inspection requirements. This protects both parties and clarifies the conditions under which the sale can proceed.

- Review Dates and Deadlines: Pay close attention to important dates, including the closing date and any deadlines for contingencies. Timeliness is essential in real estate transactions.

- Seek Professional Guidance: Consider consulting with a real estate attorney or agent. Their expertise can help ensure that the agreement is fair and legally sound.

- Keep Copies: After signing the agreement, make sure to keep copies for your records. This documentation is important for future reference and any potential disputes.

By keeping these takeaways in mind, you can navigate the Real Estate Purchase Agreement process with confidence and clarity.