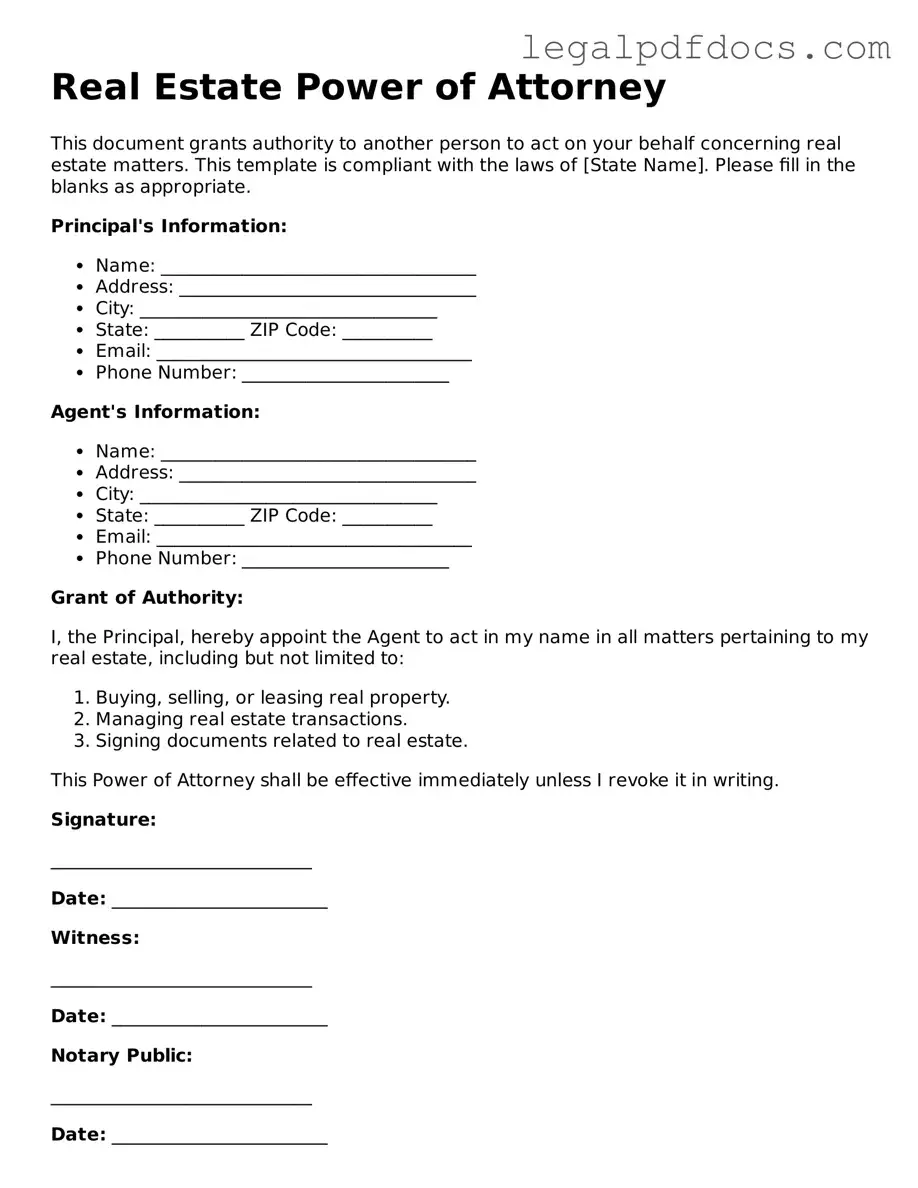

Real Estate Power of Attorney Template

In the realm of real estate transactions, the Real Estate Power of Attorney form serves as a vital tool, empowering individuals to delegate authority to another person to act on their behalf. This legal document is particularly useful when the principal, or the person granting the power, is unable to be present for important dealings, such as buying, selling, or managing property. By executing this form, the principal can designate an agent—often a trusted friend, family member, or legal professional—who will handle specific tasks related to their real estate interests. Key aspects of the form include the identification of the parties involved, a clear outline of the powers being granted, and any limitations or conditions that may apply. Additionally, the form typically requires notarization to ensure its validity, thereby providing an extra layer of protection for all parties. Understanding the nuances of this document can significantly streamline real estate processes and help avoid potential disputes, making it an essential consideration for anyone engaged in property transactions.

Dos and Don'ts

When filling out a Real Estate Power of Attorney form, attention to detail is crucial. Here are ten important dos and don’ts to consider.

- Do ensure that you understand the powers you are granting.

- Do clearly identify the agent you are appointing.

- Do specify the property involved in the transaction.

- Do include your signature and date the document.

- Do consult with a legal professional if you have questions.

- Don't leave any sections blank; complete all required fields.

- Don't use vague language; be specific about the authority granted.

- Don't forget to have the document notarized if required.

- Don't sign the form without fully understanding its implications.

- Don't overlook local laws that may affect the validity of the form.

How to Use Real Estate Power of Attorney

Filling out a Real Estate Power of Attorney form is a straightforward process that allows you to designate someone to act on your behalf regarding real estate transactions. Follow these steps carefully to ensure the form is completed accurately.

- Obtain the Form: Acquire the Real Estate Power of Attorney form from a trusted source, such as a legal website or local attorney's office.

- Fill in Your Information: Start by entering your full name, address, and contact information at the top of the form.

- Designate the Agent: Clearly write the name, address, and contact information of the person you are appointing as your agent.

- Specify Powers Granted: Indicate the specific powers you are granting to your agent. This may include buying, selling, or managing property.

- Set the Duration: Decide if the power of attorney is effective immediately or if it should only take effect under certain conditions. Indicate this on the form.

- Sign the Form: Sign and date the form in the designated area. Ensure your signature matches the name you provided at the top.

- Notarize the Document: Have the form notarized to validate your signature. This step may be required for the document to be legally binding.

- Distribute Copies: Make copies of the signed and notarized form for your records and provide a copy to your agent.

After completing the form, ensure that all parties involved understand their roles and responsibilities. This will help facilitate smooth transactions in the future.

Check out Popular Types of Real Estate Power of Attorney Templates

Revoking Power of Attorney Form - Submitting the Revocation of Power of Attorney prevents any future actions by the designated agent.

How to Write a Notarized Letter for a Vehicle - Use this form to delegate vehicle responsibilities to another person to manage in your name.

Power of Attorney Forms California - You can tailor the Durable Power of Attorney to grant specific powers or broad authority to your agent.

Documents used along the form

When engaging in real estate transactions, several documents often accompany the Real Estate Power of Attorney form. Each document plays a crucial role in ensuring that the transaction proceeds smoothly and legally. Below is a list of commonly used forms and documents in conjunction with a Real Estate Power of Attorney.

- Property Deed: This document transfers ownership of the property from one party to another. It outlines the legal description of the property and is recorded with the local government.

- Purchase Agreement: This is a contract between the buyer and seller detailing the terms of the sale, including the purchase price and contingencies.

- Disclosure Statements: Sellers must provide these documents to inform buyers of any known issues with the property, such as defects or environmental hazards.

- Title Insurance Policy: This protects the buyer and lender against potential defects in the property title, ensuring that the title is clear of any claims.

- Closing Statement: This document summarizes the final financial transaction, including the purchase price, closing costs, and any adjustments made prior to closing.

- Mortgage Agreement: If the buyer is financing the purchase, this document outlines the terms of the loan, including interest rates and repayment schedules.

- Affidavit of Title: This sworn statement confirms that the seller has the right to sell the property and that there are no undisclosed liens or claims against it.

These documents collectively facilitate the real estate transaction process, ensuring that all parties understand their rights and obligations. It is essential to review each document carefully to avoid potential legal issues down the line.

Misconceptions

When it comes to the Real Estate Power of Attorney form, many people hold misconceptions that can lead to confusion and potential pitfalls. Understanding these misconceptions can empower you to make informed decisions. Here’s a list of common misunderstandings:

- It’s only for wealthy individuals. Many believe that a Power of Attorney is only necessary for those with significant assets. In reality, anyone can benefit from this document, regardless of their financial status.

- It can only be used for buying and selling property. While a Real Estate Power of Attorney is often associated with transactions, it can also be used for managing rental properties, handling repairs, or even dealing with property taxes.

- It must be notarized to be valid. Although notarization adds an extra layer of authenticity, some states allow a Power of Attorney to be valid without it. Always check your state’s requirements.

- It gives away all control over my property. This form allows you to designate someone to act on your behalf, but you retain the ability to revoke it at any time, as long as you are mentally competent.

- It’s only useful during emergencies. While it can be a lifesaver in urgent situations, a Real Estate Power of Attorney is also a proactive tool for planning ahead, especially if you travel frequently or have health concerns.

- It’s the same as a general Power of Attorney. A Real Estate Power of Attorney is specific to real estate transactions, while a general Power of Attorney covers a broader range of financial and legal matters.

- Once it’s signed, it can’t be changed. You can modify or revoke a Power of Attorney as your circumstances change, as long as you follow the proper legal procedures.

- It’s only needed if I’m incapacitated. This document is beneficial even when you are fully capable, allowing someone you trust to handle real estate matters on your behalf when you cannot be present.

Understanding these misconceptions is crucial. With the right knowledge, you can navigate the complexities of real estate transactions with confidence.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Power of Attorney allows one person to authorize another to act on their behalf in real estate transactions. |

| Purpose | This form is commonly used when the principal is unable to manage their property due to absence, illness, or other reasons. |

| Types | There are two main types: General Power of Attorney and Limited Power of Attorney, each varying in the scope of authority granted. |

| State-Specific Forms | Each state may have its own specific requirements and forms, so it's important to check local laws. |

| Governing Laws | In the U.S., the Uniform Power of Attorney Act provides a framework, but states like California and Texas have their own specific laws. |

| Execution Requirements | Typically, the form must be signed in the presence of a notary public and may require witnesses, depending on state law. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are mentally competent. |

| Risks | Granting someone Power of Attorney can pose risks, as it gives them significant control over your real estate decisions. |

Key takeaways

Filling out and using a Real Estate Power of Attorney form can be a crucial step in managing real estate transactions. Here are some key takeaways to consider:

- Understand the Purpose: A Real Estate Power of Attorney allows you to designate someone to act on your behalf in real estate matters, such as buying, selling, or managing property.

- Choose the Right Agent: Select a trustworthy individual who is knowledgeable about real estate transactions. This person will have significant authority over your property decisions.

- Be Specific: Clearly outline the powers you are granting. This can include the ability to sign documents, negotiate terms, or handle financial transactions related to your property.

- Consider Duration: Decide whether the power of attorney will be effective immediately, for a specific period, or only under certain conditions, such as incapacity.

- Legal Requirements: Ensure that the form complies with your state’s laws. Some states may require notarization or witnesses for the document to be valid.

- Revocation: Remember that you can revoke the power of attorney at any time, as long as you are mentally competent. Notify your agent and any relevant parties in writing.

- Review Regularly: Periodically assess whether the power of attorney still meets your needs, especially if your circumstances change.

- Consult Professionals: If you have questions or concerns, consider seeking advice from a legal professional or a real estate expert to ensure you are making informed decisions.

- Document Storage: Keep the signed document in a safe place and provide copies to your agent and any institutions that may need it, such as banks or real estate offices.

By following these guidelines, you can navigate the process of using a Real Estate Power of Attorney with greater confidence and clarity.