Quitclaim Deed Template

A Quitclaim Deed is a valuable tool in real estate transactions, often used to transfer ownership of property without the complexities that accompany other types of deeds. This form allows an individual, known as the grantor, to relinquish any claim they may have to a property, transferring those rights to another party, referred to as the grantee. Unlike warranty deeds, which guarantee the grantor's clear title to the property, a Quitclaim Deed provides no such assurances. It simply conveys whatever interest the grantor holds, if any, at the time of the transfer. This form is commonly utilized in situations such as divorce settlements, property transfers between family members, or clearing up title issues. Importantly, while it is straightforward and can often be executed without the need for legal assistance, parties involved should understand the implications of using a Quitclaim Deed, particularly regarding liability and ownership rights. The simplicity of the Quitclaim Deed makes it appealing, but it is essential to approach its use with caution and awareness of the potential risks involved.

Dos and Don'ts

When filling out a Quitclaim Deed form, it is essential to approach the process carefully. Here are seven important do's and don'ts to consider:

- Do ensure that all names are spelled correctly. Accuracy is crucial in legal documents.

- Don't leave any blank spaces on the form. Fill in all required fields to avoid delays.

- Do include a clear description of the property. This helps prevent disputes later on.

- Don't forget to sign the document in front of a notary public. A notarized signature is often required.

- Do check local laws regarding filing requirements. Different states may have unique rules.

- Don't use outdated forms. Always obtain the latest version of the Quitclaim Deed.

- Do keep a copy of the completed form for your records. This is important for future reference.

How to Use Quitclaim Deed

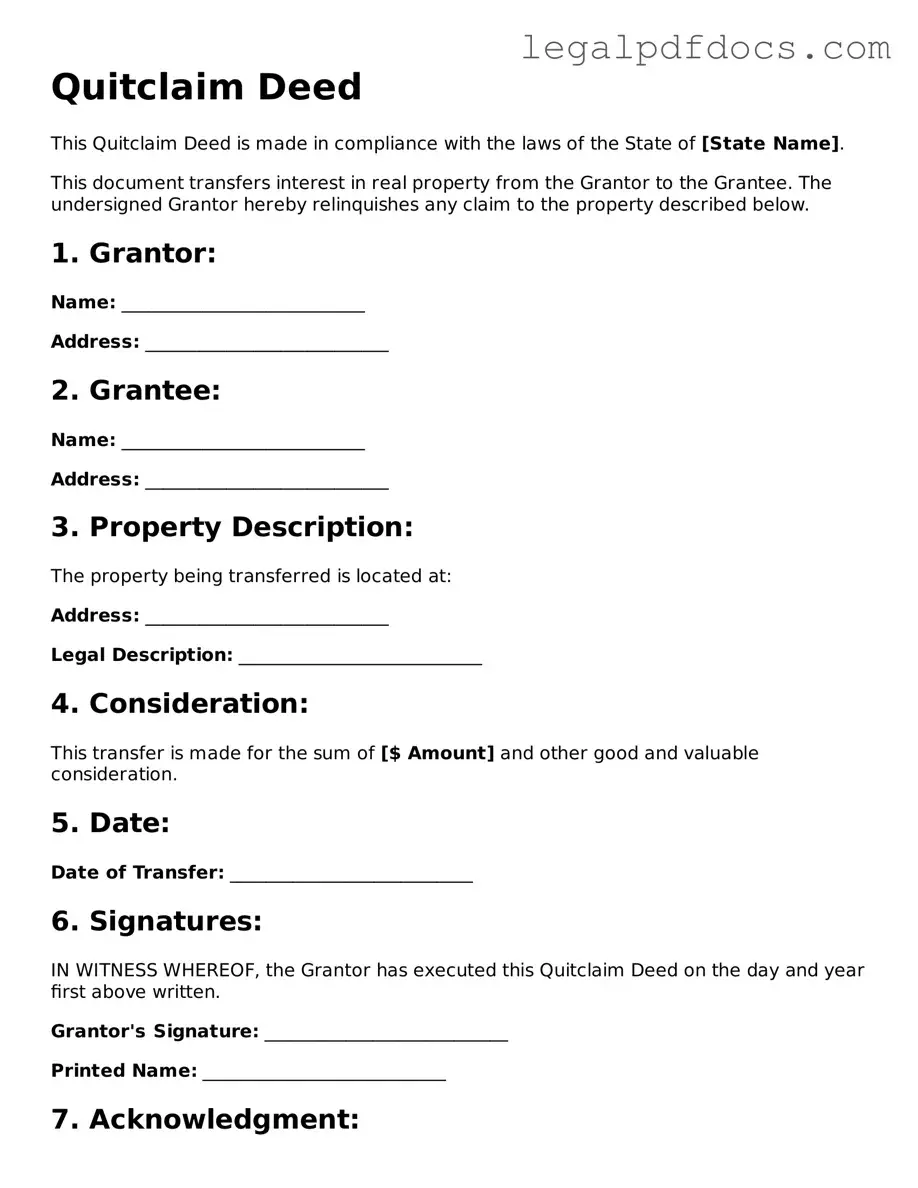

After completing the Quitclaim Deed form, it is important to ensure that all necessary steps are followed for proper filing and recording. This will help to finalize the transfer of property ownership. Below are the steps to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Identify the grantor, which is the person transferring the property. Write their full name and address.

- Next, provide the name and address of the grantee, the person receiving the property.

- Clearly describe the property being transferred. Include the legal description, which can often be found in the property’s deed or tax records.

- Indicate the consideration, or the amount of money exchanged for the property, if applicable. If it is a gift, you can write "for love and affection."

- Both the grantor and grantee should sign the form. The grantor’s signature must be notarized. Make sure to include the notary's information and seal.

- Review the completed form for accuracy. Check that all names, addresses, and property descriptions are correct.

- Finally, file the completed Quitclaim Deed with the appropriate local government office, typically the county recorder or clerk's office.

Check out Popular Types of Quitclaim Deed Templates

Free Printable Michigan Lady Bird Deed Form - This deed allows for additional privacy compared to traditional wills since court involvement is minimized.

What Is a Gift Deed in Real Estate - It reflects the true intent of the donor without pressure.

California Corrective Deed - A Corrective Deed is necessary to rectify issues that may arise during a sale.

Documents used along the form

A Quitclaim Deed is an important document used to transfer ownership of property. Along with this deed, several other forms and documents may be necessary to ensure a smooth transaction. Below are some commonly used documents that often accompany a Quitclaim Deed.

- Property Title Search: This document provides a history of the property’s ownership. It helps identify any existing liens or claims against the property, ensuring the buyer is aware of any issues before the transfer.

- Affidavit of Identity: This form verifies the identity of the parties involved in the transaction. It is often used to confirm that the individuals signing the Quitclaim Deed are indeed who they claim to be, preventing fraud.

- Transfer Tax Declaration: This document is required in many jurisdictions to report the sale or transfer of property. It helps local governments assess taxes based on the value of the property being transferred.

- Notice of Completion: This form may be filed after the property transfer is complete. It serves to inform the public and relevant authorities that the transfer has taken place, providing a record of the new ownership.

Understanding these accompanying documents can help facilitate a successful property transfer. Each plays a vital role in ensuring that all legal requirements are met and that the interests of all parties are protected.

Misconceptions

Understanding the Quitclaim Deed can be tricky. Here are some common misconceptions that people often have about this form:

-

A Quitclaim Deed transfers ownership of a property.

This is true, but it only transfers whatever interest the grantor has. If the grantor has no ownership, the grantee receives nothing.

-

A Quitclaim Deed guarantees clear title.

This is a misconception. A Quitclaim Deed does not guarantee that the title is free of liens or other claims.

-

Quitclaim Deeds are only for family transfers.

While they are often used in family situations, anyone can use a Quitclaim Deed to transfer property, regardless of the relationship.

-

You cannot use a Quitclaim Deed for a sale.

This is incorrect. A Quitclaim Deed can be used in a sale, but it is more common for transferring property without a sale.

-

Quitclaim Deeds are complicated to create.

In reality, they are relatively simple. You just need to fill out the form correctly and have it signed and notarized.

-

A Quitclaim Deed is the same as a Warranty Deed.

This is not true. A Warranty Deed offers more protection to the grantee, including guarantees about the title.

-

You need an attorney to create a Quitclaim Deed.

While having legal advice can be helpful, it is not legally required to create a Quitclaim Deed.

-

A Quitclaim Deed is permanent and cannot be revoked.

This is misleading. Once a Quitclaim Deed is executed, it generally cannot be undone without legal action.

-

All states have the same rules for Quitclaim Deeds.

This is false. Each state has its own laws and requirements regarding Quitclaim Deeds, so it's important to check local regulations.

Being aware of these misconceptions can help you make informed decisions when dealing with property transfers.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership of real estate from one party to another without any warranties. |

| Purpose | It is commonly used to transfer property between family members, resolve title issues, or clear up property disputes. |

| State-Specific Forms | Each state may have its own version of a quitclaim deed form, which can vary in format and requirements. |

| Governing Law | In the United States, quitclaim deeds are governed by state law. For example, in California, it is governed by the California Civil Code Section 1092. |

| Consideration | While a quitclaim deed can be executed without monetary consideration, it is often accompanied by a nominal fee. |

| Limitations | This type of deed does not guarantee that the property is free of liens or other claims. Buyers should conduct due diligence. |

| Filing Requirements | After signing, the quitclaim deed must be filed with the appropriate county recorder's office to be effective. |

| Revocation | A quitclaim deed cannot be revoked once it is executed and recorded, as it permanently transfers ownership. |

| Use Cases | Common scenarios include divorce settlements, inheritance transfers, and property transfers among family members. |

Key takeaways

When filling out and using a Quitclaim Deed form, it is important to understand its purpose and implications. Here are nine key takeaways to consider:

- Definition: A Quitclaim Deed is a legal document that transfers ownership of real estate from one party to another without any guarantees regarding the title.

- Use Cases: This form is commonly used among family members, in divorce settlements, or when transferring property between trusts.

- Parties Involved: The person transferring the property is known as the grantor, while the person receiving the property is referred to as the grantee.

- Property Description: A clear and accurate description of the property must be included to avoid any confusion about what is being transferred.

- Signature Requirement: The grantor must sign the deed in the presence of a notary public for the document to be valid.

- Recording the Deed: After signing, the Quitclaim Deed should be filed with the appropriate county office to make the transfer official.

- Potential Risks: Since a Quitclaim Deed offers no warranties, the grantee assumes the risk of any title issues that may arise.

- Tax Implications: Transferring property via a Quitclaim Deed may have tax consequences. Consulting a tax professional is advisable.

- State-Specific Laws: Requirements for Quitclaim Deeds can vary by state. It is essential to review local laws to ensure compliance.