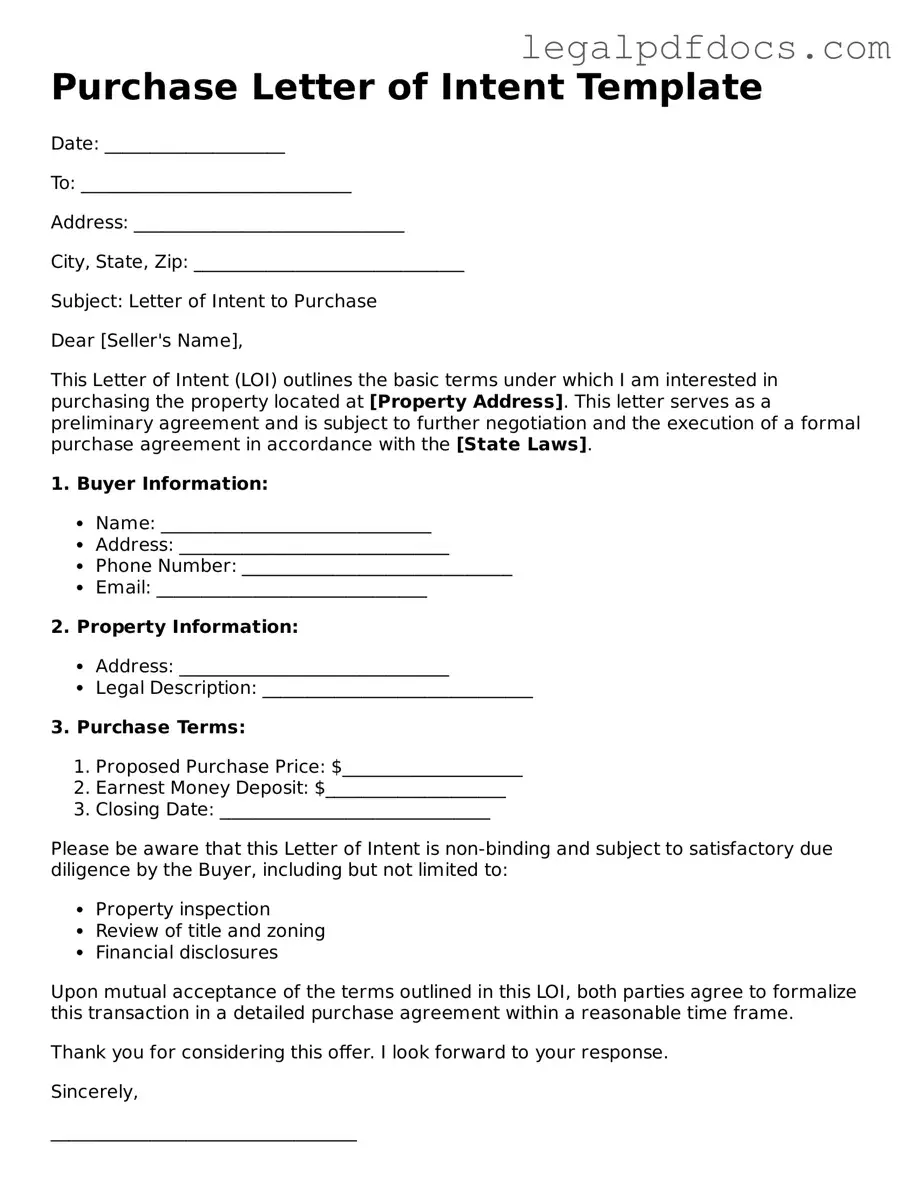

Purchase Letter of Intent Template

The Purchase Letter of Intent (LOI) serves as a critical preliminary document in the process of buying or selling a business or property. This form outlines the basic terms and conditions that both parties agree upon before entering into a more detailed purchase agreement. It typically includes key elements such as the purchase price, the proposed timeline for the transaction, and any contingencies that must be met for the sale to proceed. Additionally, the LOI often specifies whether the agreement is binding or non-binding, which can significantly impact the obligations of the parties involved. By clearly stating the intentions of the buyer and seller, the LOI helps to facilitate negotiations and sets the groundwork for a successful transaction. It is important for both parties to carefully consider the terms laid out in the LOI, as it can influence the direction of future discussions and the overall outcome of the deal.

Dos and Don'ts

When filling out a Purchase Letter of Intent form, it is crucial to approach the task with care and attention. Here are some important dos and don'ts to consider:

- Do ensure all information is accurate and complete. Double-check names, addresses, and any financial figures.

- Don't leave any sections blank. If a section is not applicable, clearly indicate that instead of skipping it.

- Do use clear and concise language. Avoid overly complex sentences that may confuse the reader.

- Don't make assumptions. If you're unsure about a term or requirement, seek clarification before proceeding.

- Do review the form multiple times. Take the time to read through your entries to catch any potential errors.

- Don't rush the process. Completing the form thoughtfully can prevent misunderstandings later on.

- Do keep a copy of the completed form for your records. This can be helpful for future reference or discussions.

How to Use Purchase Letter of Intent

After you have gathered all necessary information and documents, you are ready to fill out the Purchase Letter of Intent form. This form serves as a formal expression of interest in purchasing a property or asset. Completing it accurately will help facilitate the next steps in the purchasing process.

- Provide your contact information: Fill in your name, address, phone number, and email at the top of the form.

- Identify the seller: Include the seller's name and contact information. Make sure to verify these details for accuracy.

- Describe the property or asset: Clearly state the address or description of the property or asset you wish to purchase.

- State your offer: Indicate the price you are willing to pay for the property or asset. Be specific and clear.

- Outline any contingencies: If applicable, list any conditions that must be met for the purchase to proceed, such as financing or inspections.

- Set a timeline: Specify any important dates, such as when you would like to close the deal or when you expect a response from the seller.

- Include additional terms: If there are any other terms or agreements you wish to include, write them in this section.

- Sign and date the form: Ensure that you sign and date the document to validate your intent.

Once you have completed the form, review it carefully for any errors or omissions. After confirming that all information is correct, you can submit it to the seller. This will initiate the negotiation process and move you closer to finalizing your purchase.

Check out Popular Types of Purchase Letter of Intent Templates

Letter of Intent to Hire - A Letter of Intent can highlight any unique arrangements or conditions related to the job offer.

Documents used along the form

A Purchase Letter of Intent (LOI) serves as a preliminary agreement between parties interested in a transaction. It outlines the basic terms and intentions of the potential deal. Along with the LOI, several other forms and documents often accompany this process to ensure clarity and legal protection. Below are some commonly used documents.

- Purchase Agreement: This is a detailed contract that formalizes the terms of the sale, including the price, payment methods, and any contingencies. It serves as the final agreement once both parties have agreed to the terms laid out in the LOI.

- Confidentiality Agreement: Also known as a non-disclosure agreement (NDA), this document protects sensitive information shared between parties during negotiations. It ensures that proprietary information remains confidential.

- Due Diligence Checklist: This is a comprehensive list of items that need to be reviewed before finalizing a purchase. It typically includes financial statements, legal documents, and operational details to assess the viability of the transaction.

- Financing Commitment Letter: This letter from a financial institution confirms the buyer’s ability to secure funds for the purchase. It provides assurance to the seller that the buyer has the necessary financial backing to proceed.

- Letter of Authorization: This document grants permission for a third party to act on behalf of one of the parties involved in the transaction. It is often used when representatives are handling negotiations or transactions.

- Escrow Agreement: This agreement outlines the terms under which a neutral third party will hold funds or documents until certain conditions are met. It helps ensure that both parties fulfill their obligations before the transaction is completed.

Understanding these documents can help facilitate a smoother transaction process. Each one plays a vital role in protecting the interests of all parties involved and ensuring that the deal is executed properly.

Misconceptions

The Purchase Letter of Intent (LOI) is a critical document in real estate and business transactions. However, several misconceptions surround its purpose and function. Below are six common misunderstandings about the Purchase Letter of Intent form.

- Misconception 1: The LOI is a legally binding contract.

- Misconception 2: The LOI is unnecessary in negotiations.

- Misconception 3: The LOI is only for large transactions.

- Misconception 4: The LOI must include all terms of the agreement.

- Misconception 5: An LOI guarantees the completion of a deal.

- Misconception 6: The LOI is only relevant to buyers.

Many people believe that once an LOI is signed, it creates a legally binding agreement. In reality, an LOI typically outlines the terms and conditions for a future contract but does not itself constitute a binding contract unless explicitly stated.

Some individuals think that an LOI is just an extra step in the negotiation process. However, it serves as a valuable tool to clarify intentions and establish a framework for further discussions.

While LOIs are often associated with significant deals, they can be beneficial for transactions of any size. They help all parties understand the basic terms before committing resources to detailed negotiations.

Some may think that an LOI should cover every detail of the transaction. In fact, it is meant to outline key points and express the intent of the parties, leaving room for further negotiation.

People often assume that signing an LOI means the deal is as good as done. However, an LOI does not guarantee that a final agreement will be reached; it merely indicates that the parties are interested in moving forward.

Lastly, there is a belief that only buyers benefit from an LOI. In reality, both buyers and sellers can use it to clarify their positions and ensure that both parties are on the same page regarding the transaction.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Purchase Letter of Intent (LOI) outlines the preliminary agreement between parties interested in a transaction. |

| Purpose | The LOI serves to express the intention of the parties to enter into a formal purchase agreement. |

| Non-Binding Nature | Generally, the LOI is non-binding, meaning it does not create enforceable obligations. |

| Key Components | Common elements include purchase price, terms of sale, and timeline for completion. |

| Confidentiality Clause | Many LOIs include a confidentiality clause to protect sensitive information shared during negotiations. |

| State-Specific Forms | Some states may have specific forms or requirements for Purchase LOIs, governed by local laws. |

| Governing Law | The governing law for the LOI may vary by state, affecting how disputes are resolved. |

| Expiration Date | LOIs often include an expiration date, indicating how long the offer remains valid. |

| Negotiation Tool | The LOI can act as a negotiation tool, helping to clarify terms before a formal contract is drafted. |

Key takeaways

When filling out and using the Purchase Letter of Intent form, keep these key takeaways in mind:

- Understand the Purpose: This document outlines your intention to purchase a property and sets the stage for negotiations.

- Be Clear and Concise: Clearly state your offer and any terms you want to include. Avoid vague language.

- Include Essential Details: Provide important information such as the property address, purchase price, and any contingencies.

- Express Your Seriousness: A well-prepared letter shows the seller that you are committed and serious about the purchase.

- Consult Professionals: Consider seeking advice from a real estate agent or attorney to ensure your letter is effective.

- Review Before Sending: Double-check for any errors or missing information. A polished letter reflects professionalism.

- Follow Up: After sending the letter, be proactive in following up with the seller to discuss the next steps.

- Use It as a Negotiation Tool: The letter can help you negotiate terms and conditions before drafting a formal purchase agreement.