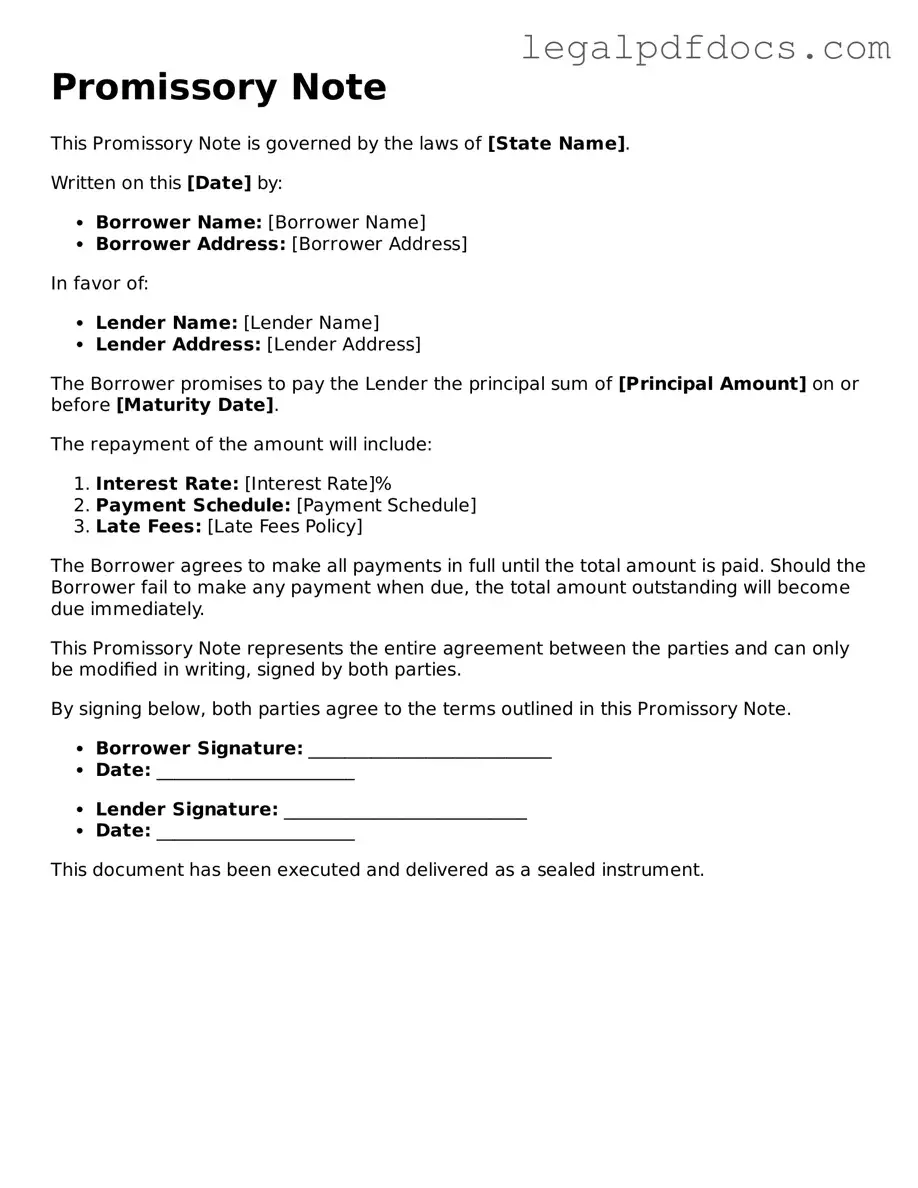

Promissory Note Template

The Promissory Note form serves as a fundamental instrument in financial transactions, encapsulating the terms of a loan agreement between a borrower and a lender. This document is not merely a piece of paper; it represents a legally binding promise to repay a specified amount of money, along with any agreed-upon interest, within a defined timeframe. Typically, it includes essential details such as the principal amount, the interest rate, the payment schedule, and the maturity date, providing clarity and structure to the borrowing process. Moreover, the form often outlines the consequences of default, ensuring that both parties understand their rights and obligations. By establishing clear terms, the Promissory Note helps to mitigate potential disputes, fostering a sense of trust and accountability in financial dealings. Whether used in personal loans, business financing, or real estate transactions, this document plays a crucial role in facilitating economic interactions, making it an indispensable tool in the realm of finance and law.

Promissory Note Document Categories

Dos and Don'ts

When filling out a Promissory Note form, it’s essential to ensure accuracy and clarity. Here are some important dos and don’ts to keep in mind:

- Do provide accurate personal information, including names and addresses.

- Do clearly state the loan amount and the interest rate, if applicable.

- Do specify the repayment schedule, including due dates and payment amounts.

- Do read the entire document carefully before signing.

- Don’t leave any sections blank; incomplete forms can lead to misunderstandings.

- Don’t use ambiguous language; clarity is key to avoid disputes later.

- Don’t forget to date the document; a date is crucial for legal validity.

- Don’t rush through the process; take your time to ensure everything is correct.

How to Use Promissory Note

After obtaining the Promissory Note form, you will need to complete it accurately to ensure it reflects the terms of the loan agreement. Carefully follow the steps outlined below to fill out the form correctly.

- Identify the parties involved: Enter the full legal names of both the borrower and the lender at the top of the form.

- Specify the loan amount: Clearly state the total amount of money being borrowed.

- Set the interest rate: Indicate the interest rate applicable to the loan, if any.

- Determine the repayment schedule: Outline the repayment terms, including the frequency of payments (monthly, quarterly, etc.) and the due date for each payment.

- Include the maturity date: Specify the date by which the loan must be fully repaid.

- State any late fees: If applicable, mention the fees that will be charged for late payments.

- Provide a signature line: Ensure there is a space for both the borrower and lender to sign and date the document.

- Review the completed form: Double-check all entries for accuracy and completeness before finalizing.

More Forms:

Property Bill of Sale - Details buyer and seller information for future reference.

Temporary Power of Attorney for Child - Establish parameters for care to ensure your child's welfare while you are away.

Documents used along the form

When dealing with a Promissory Note, several other forms and documents may be necessary to ensure clarity and legality in the agreement. These documents help outline the terms of the loan, protect the lender, and provide a clear understanding of the borrower's obligations. Here are some commonly used documents:

- Loan Agreement: This document details the terms of the loan, including the amount borrowed, interest rates, repayment schedule, and any collateral involved. It serves as a comprehensive guide to the expectations of both the lender and the borrower.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what the collateral is and the rights of the lender in case of default. It provides protection for the lender by ensuring they have a claim to the collateral if the borrower fails to repay.

- Personal Guarantee: This is a document where a third party agrees to take responsibility for the loan if the borrower defaults. It adds an extra layer of security for the lender, as it provides assurance that someone else will cover the debt if necessary.

- Disclosure Statement: This document outlines the terms of the loan in a clear and concise manner. It typically includes information about fees, interest rates, and any other costs associated with the loan, helping the borrower understand their financial obligations.

These documents work together to create a solid foundation for a lending agreement. Having them in place can help avoid misunderstandings and protect both parties involved in the transaction.

Misconceptions

Understanding a Promissory Note is crucial for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are eight common misunderstandings about the Promissory Note form:

- All Promissory Notes are the same. Many people think that all promissory notes have a standard format. In reality, they can vary significantly based on the terms agreed upon by the parties involved.

- A Promissory Note is a legally binding contract. While a promissory note is generally enforceable, it must meet specific legal requirements to be considered binding in court.

- You don’t need to specify a repayment schedule. Some believe that a repayment schedule is optional. However, clearly outlining the repayment terms is essential to avoid misunderstandings.

- Only banks can issue Promissory Notes. Many assume that only financial institutions can create these documents. In fact, any individual or business can issue a promissory note.

- Promissory Notes are only for large loans. People often think that these notes are only used for significant amounts. They can be used for any amount, large or small.

- Interest rates are not necessary. Some individuals believe that they can create a promissory note without specifying an interest rate. Including this detail helps clarify the agreement.

- A verbal agreement is sufficient. Many think that a verbal agreement can replace a written promissory note. However, having a written document provides clear evidence of the terms.

- Once signed, a Promissory Note cannot be changed. People often believe that the terms of a promissory note are set in stone. In reality, parties can amend the note if both agree to the changes.

Addressing these misconceptions can help ensure that both lenders and borrowers understand their rights and obligations. Clear communication and proper documentation are key to successful financial agreements.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated party at a certain time or on demand. |

| Legal Status | Promissory notes are governed by the Uniform Commercial Code (UCC), which standardizes financial transactions across states. |

| Essential Elements | The essential components of a promissory note include the principal amount, interest rate, payment schedule, and signatures of the parties involved. |

| State-Specific Regulations | While the UCC provides a framework, individual states may have specific laws regarding the enforcement and requirements of promissory notes. |

| Enforceability | A properly executed promissory note is legally enforceable in a court of law, provided it meets the necessary legal standards. |

Key takeaways

When it comes to filling out and using a Promissory Note form, understanding the essentials can make all the difference. Here are some key takeaways to keep in mind:

- Clarity is Crucial: Ensure that the terms of the loan, including the amount, interest rate, and repayment schedule, are clearly stated. Ambiguity can lead to misunderstandings.

- Identify the Parties: Clearly list the names and addresses of both the borrower and the lender. This establishes who is involved in the agreement.

- Specify the Loan Amount: Write the loan amount in both numerical and written form. This helps prevent any potential disputes over the amount borrowed.

- Detail the Interest Rate: Indicate whether the interest is fixed or variable. This clarity will help both parties understand the total repayment amount.

- Include Payment Terms: Outline how and when payments will be made. Specify the due dates and the method of payment to avoid confusion.

- Address Default Conditions: Clearly state what constitutes a default on the loan. This could include missed payments or bankruptcy, which can protect the lender's interests.

- Signatures Matter: Both parties must sign and date the document. This step is essential for the agreement to be legally binding.

By following these key points, you can create a Promissory Note that is effective and serves the needs of both the borrower and the lender. Don’t underestimate the importance of a well-crafted agreement—it can save time and stress in the long run.