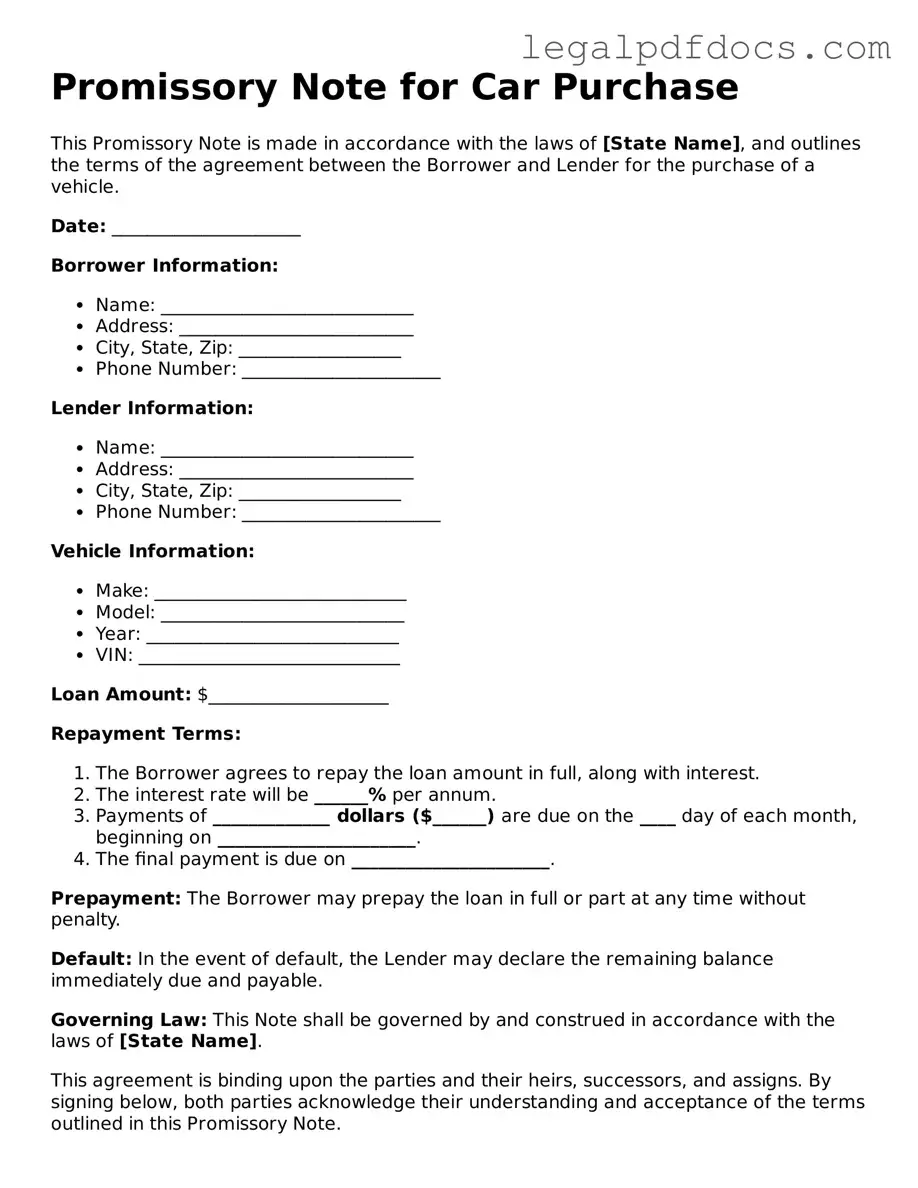

Promissory Note for a Car Template

The Promissory Note for a Car form serves as a crucial document in the financing process of purchasing a vehicle. This form outlines the borrower's commitment to repay a specified amount over a designated period. It includes essential details such as the loan amount, interest rate, payment schedule, and the consequences of default. By clearly stating the terms of the loan, the form protects both the lender and the borrower, ensuring that both parties understand their obligations. Additionally, it may include provisions for late fees, prepayment options, and the rights of the lender in case of non-payment. Understanding the components of this form is vital for anyone involved in a vehicle financing agreement, as it establishes the legal framework for the transaction and helps prevent misunderstandings down the road.

Dos and Don'ts

When filling out a Promissory Note for a Car form, it is important to follow certain guidelines to ensure accuracy and clarity. Below are some essential dos and don’ts to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information about both the borrower and the lender.

- Do clearly specify the loan amount and the terms of repayment.

- Do sign and date the document in the appropriate places.

- Don't leave any sections blank; incomplete forms can lead to confusion.

- Don't use abbreviations or shorthand that may not be understood.

- Don't alter the terms of the agreement without mutual consent.

- Don't forget to keep a copy of the signed note for your records.

How to Use Promissory Note for a Car

Filling out the Promissory Note for a Car form is an important step in securing your loan agreement. After completing the form, you will need to provide it to the lender, who will review it before finalizing the loan. Make sure to double-check your entries for accuracy to avoid any delays.

- Begin by writing the date at the top of the form. This marks when the agreement is made.

- Next, enter your name and address in the designated sections. This identifies you as the borrower.

- Include the name and address of the lender. This ensures that the lender is clearly identified in the agreement.

- Specify the amount of money you are borrowing. This should be the total loan amount for the car.

- Detail the interest rate. If it’s a fixed rate, write that down clearly. If it’s variable, explain how it will change over time.

- Indicate the repayment schedule. Will you be making monthly payments? Specify the amount and frequency.

- State the maturity date. This is when the loan will be fully paid off.

- Sign the document. Your signature confirms your agreement to the terms laid out in the note.

- Have the lender sign the form as well. This makes the agreement valid and binding.

Check out Popular Types of Promissory Note for a Car Templates

What Happens to a Promissory Note When the Lender Dies - Facilitates the transfer of ownership of any related collateral if applicable.

Documents used along the form

When entering into a financial agreement for a car purchase, several important documents accompany the Promissory Note for a Car. Each of these documents serves a specific purpose, helping to ensure that both the buyer and seller are protected throughout the transaction. Below is a list of commonly used forms that are often associated with the Promissory Note.

- Sales Agreement: This document outlines the terms of the sale, including the purchase price, vehicle details, and any warranties or representations made by the seller.

- Title Transfer Document: This form is necessary for transferring ownership of the vehicle from the seller to the buyer. It includes information about the vehicle and both parties involved.

- Bill of Sale: A legal document that serves as proof of the transaction, detailing the sale price and date of the sale. It is important for both parties for record-keeping purposes.

- Loan Application: If financing is involved, this document is used by the buyer to apply for a loan. It includes personal and financial information to assess creditworthiness.

- Credit Disclosure Statement: This statement provides details about the terms of the loan, including interest rates, payment schedules, and any fees associated with the loan.

- Insurance Verification: Before finalizing the sale, buyers must typically show proof of insurance coverage for the vehicle. This document confirms that the buyer has obtained the necessary insurance.

- Odometer Disclosure Statement: This form records the vehicle's mileage at the time of sale, ensuring that the buyer is aware of the car's condition and history.

- Payment Receipt: After making a payment, the buyer should receive a receipt. This document serves as proof of payment and is important for both parties for record-keeping.

- Power of Attorney: In some cases, the seller may grant power of attorney to another individual to handle the sale on their behalf. This document outlines the authority given.

- Financing Agreement: If the buyer is financing the vehicle, this document details the terms of the financing arrangement, including payment amounts and timelines.

Understanding these documents is crucial for ensuring a smooth and legally compliant transaction. Each form plays a vital role in protecting the interests of both the buyer and seller, making it essential to review and complete them carefully.

Misconceptions

Understanding the Promissory Note for a Car can be tricky, and there are several misconceptions that people often have. Here are eight common misunderstandings:

-

It’s the same as a car loan agreement.

A promissory note is not the same as a car loan agreement. While both involve borrowing money for a vehicle, a promissory note is a simple document that outlines the borrower's promise to repay the loan, whereas a loan agreement typically includes detailed terms and conditions.

-

Only banks can issue a promissory note.

Many people think that only banks or financial institutions can issue a promissory note. In reality, individuals can also create a promissory note when lending money to someone for a car purchase.

-

A promissory note guarantees the loan will be paid back.

While a promissory note is a legal commitment to repay the borrowed amount, it does not guarantee payment. If the borrower fails to repay, the lender may need to pursue legal action to recover the funds.

-

It must be notarized to be valid.

Many believe that a promissory note must be notarized to be valid. However, notarization is not a requirement in most cases. It is more important that both parties sign the document.

-

Once signed, it cannot be modified.

Some think that once a promissory note is signed, it cannot be changed. In fact, both parties can agree to modify the terms later, but this should be documented in writing and signed again.

-

It only applies to car purchases.

A common misconception is that promissory notes are only for car purchases. They can actually be used for various types of loans, including personal loans, business loans, and more.

-

Interest rates are always included.

Many people assume that a promissory note must include interest rates. While it is common to include them, it is not a requirement. The terms can be set based on the agreement between the lender and borrower.

-

It doesn’t need to be in writing.

Some believe that a verbal agreement is sufficient for a promissory note. However, having a written document is crucial for clarity and to provide evidence of the agreement in case of disputes.

By understanding these misconceptions, individuals can better navigate the process of creating and using a promissory note for a car. It’s essential to approach this financial tool with clear knowledge and awareness.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount of money for the purchase of a vehicle. |

| Legal Status | This document is legally binding, meaning both parties must adhere to its terms. |

| State-Specific Laws | In the United States, each state has its own laws governing promissory notes. For example, California follows the Uniform Commercial Code (UCC). |

| Payment Terms | The note typically includes details about the payment schedule, interest rate, and total amount due. |

| Default Consequences | If the borrower fails to make payments, the lender has the right to take legal action to recover the owed amount. |

| Transferability | Promissory notes can often be transferred to other parties, allowing the lender to sell the note to someone else. |

Key takeaways

When filling out and using the Promissory Note for a Car form, keep these key takeaways in mind:

- Clearly state the loan amount. Ensure the total amount borrowed is prominently displayed to avoid any confusion later.

- Include payment terms. Specify the repayment schedule, including due dates and the amount of each payment.

- Document interest rates. If applicable, clearly outline the interest rate on the loan to prevent misunderstandings.

- Signatures are essential. Both the borrower and lender must sign the document for it to be legally binding.