Fill Out a Valid Profit And Loss Template

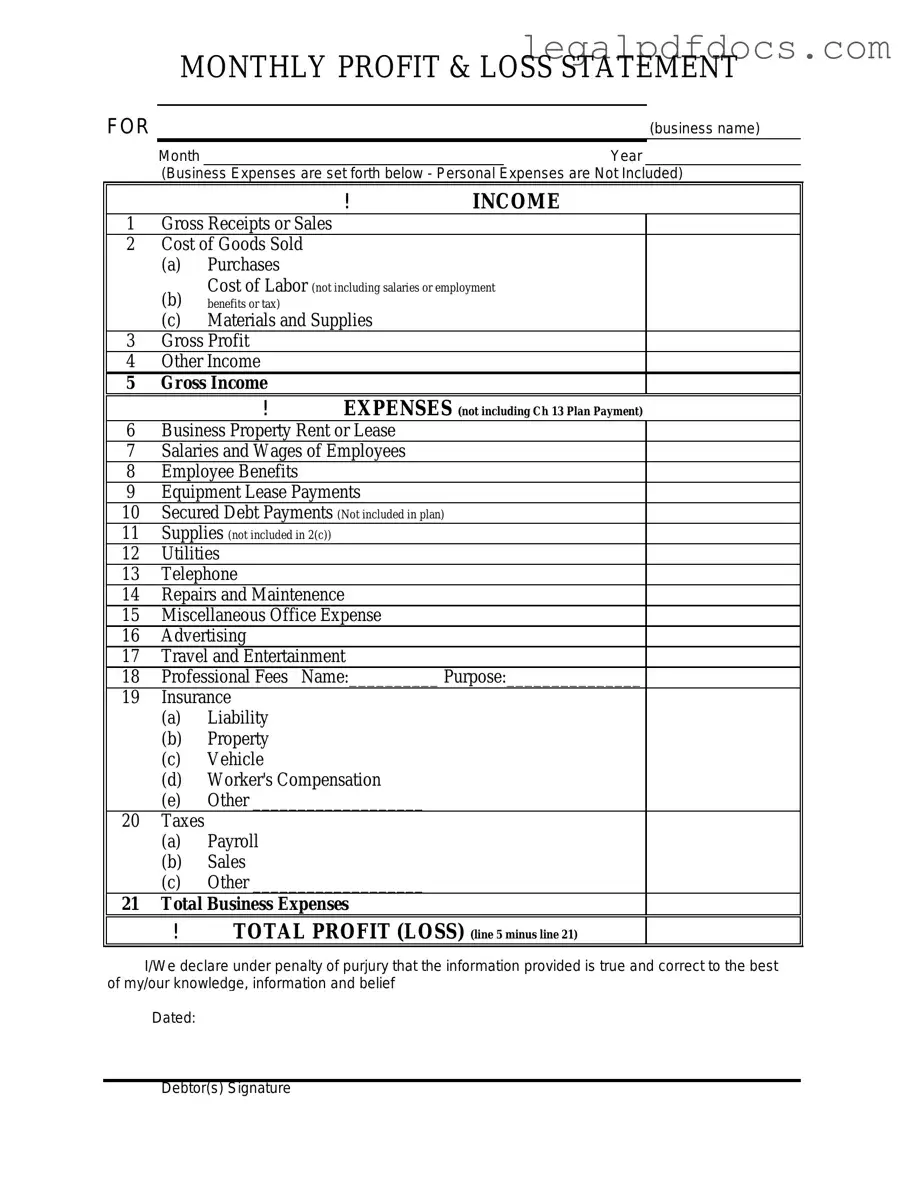

The Profit and Loss form, often referred to as the P&L statement, serves as a crucial financial document for businesses of all sizes. This form provides a detailed overview of a company's revenues, costs, and expenses over a specific period, typically a month, quarter, or year. By summarizing the financial performance, it allows stakeholders to gauge profitability and make informed decisions. The P&L statement includes key components such as total revenue, cost of goods sold, gross profit, operating expenses, and net income. Each section plays a vital role in illustrating how effectively a company generates profit relative to its costs. Moreover, the P&L form can highlight trends in revenue growth or expense management, offering valuable insights for future planning. Understanding this document is essential for business owners, investors, and financial analysts alike, as it encapsulates the financial health of an organization in a clear and concise manner.

Dos and Don'ts

When filling out the Profit and Loss form, it is essential to approach the task with care. Here are some important do's and don'ts to keep in mind:

- Do ensure that all income sources are accurately reported. This includes sales revenue, interest income, and any other earnings.

- Do double-check your calculations. Errors can lead to significant discrepancies in your financial reporting.

- Do maintain consistency in your reporting period. Whether you are reporting monthly, quarterly, or annually, keep the time frame uniform.

- Do keep detailed records of all expenses. This includes receipts and invoices, as they may be required for verification.

- Don't omit any expenses. Even small costs can add up and impact your overall profit.

- Don't use estimates for income or expenses. Always provide actual figures to ensure accuracy.

- Don't ignore the importance of categorizing your income and expenses correctly. Misclassification can lead to confusion and errors in reporting.

- Don't wait until the last minute to fill out the form. Allow ample time for review and corrections.

Taking these steps seriously will help ensure that your Profit and Loss form is completed accurately and effectively.

How to Use Profit And Loss

Completing the Profit and Loss form is a straightforward process that requires careful attention to detail. Following the steps below will help ensure that all necessary information is accurately captured.

- Gather all financial documents related to your income and expenses for the specified period.

- Start with the section for Income. List all sources of income, including sales revenue and any other earnings.

- Next, move to the Expenses section. Document all business-related expenses, such as rent, utilities, salaries, and supplies.

- Calculate the total income by adding up all the entries in the income section.

- Calculate the total expenses by summing all the entries in the expenses section.

- Determine the net profit or loss by subtracting total expenses from total income.

- Review all entries for accuracy and completeness before finalizing the form.

- Sign and date the form to confirm that all information is correct.

By following these steps, you can ensure that the Profit and Loss form is filled out correctly, providing a clear picture of financial performance for the specified period.

More PDF Templates

Florida Association of Realtors Forms - Provisions for third party financing ensure buyers have adequate options for funding their purchase.

Childcare Invoice Template - Providers can quickly fill out this form after receiving payment.

Documents used along the form

When managing finances, several documents complement the Profit and Loss form to provide a comprehensive view of a business's financial health. Each of these forms serves a unique purpose, contributing valuable insights for decision-making and strategic planning.

- Balance Sheet: This document offers a snapshot of a company's assets, liabilities, and equity at a specific point in time. It helps stakeholders understand the financial position and stability of the business.

- Cash Flow Statement: This statement tracks the flow of cash in and out of the business. It highlights how well the company generates cash to cover its debts and fund its operating expenses.

- Budget: A budget outlines expected revenues and expenses over a specific period. It serves as a financial plan that helps businesses allocate resources effectively and monitor performance against goals.

- Accounts Receivable Aging Report: This report categorizes outstanding invoices based on how long they have been unpaid. It assists in managing cash flow and identifying potential collection issues.

- Accounts Payable Aging Report: Similar to the receivable report, this document tracks outstanding bills and payments owed to suppliers. It helps businesses manage their obligations and maintain good vendor relationships.

- Sales Report: This report summarizes sales activity over a certain period. It provides insights into revenue trends, product performance, and customer behavior, aiding in strategic decision-making.

- Expense Report: This document details business expenses incurred during a specific timeframe. It helps in tracking spending, ensuring budget compliance, and identifying areas for cost reduction.

By utilizing these documents alongside the Profit and Loss form, businesses can gain a clearer understanding of their financial landscape. This holistic view aids in making informed decisions that drive growth and sustainability.

Misconceptions

Understanding the Profit and Loss (P&L) form is crucial for businesses and individuals alike. However, several misconceptions can lead to confusion. Here are eight common misconceptions about the P&L form:

- It only applies to large businesses. Many people believe that only large corporations need to prepare a P&L statement. In reality, any business, regardless of size, can benefit from tracking income and expenses through a P&L.

- It shows cash flow. Some assume that the P&L statement reflects cash flow. However, it primarily records revenues and expenses over a specific period, not the actual cash that flows in and out.

- It's the same as a balance sheet. The P&L is often confused with a balance sheet. While both are financial statements, the P&L focuses on profitability over time, whereas the balance sheet provides a snapshot of a company's assets, liabilities, and equity at a specific moment.

- All expenses are deductible. There is a belief that all expenses listed in the P&L are fully deductible for tax purposes. In truth, some expenses may not be fully deductible, depending on tax laws and regulations.

- It is only useful for tax preparation. Many think the P&L is solely for tax purposes. While it is beneficial during tax season, it also serves as a valuable tool for assessing business performance and making informed decisions.

- Profit equals cash in hand. Some individuals mistakenly equate profit with cash available. Profit is an accounting measure that includes all revenues and expenses, but it does not necessarily reflect the cash available for immediate use.

- It is a one-time document. Many believe that the P&L form is only created once a year. In reality, it can be prepared monthly, quarterly, or annually, providing ongoing insights into financial performance.

- Only accountants can prepare it. There is a misconception that only accountants can create a P&L statement. In fact, business owners and managers can prepare it themselves, especially with the help of accounting software.

Addressing these misconceptions can lead to better financial understanding and management for businesses of all sizes.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The Profit and Loss form is used to summarize revenues, costs, and expenses over a specific period, providing a clear overview of financial performance. |

| Components | This form typically includes sections for total revenue, cost of goods sold, gross profit, operating expenses, and net income. |

| State-Specific Forms | Some states may require specific formats or additional information under state laws, such as California's Corporations Code, which mandates certain disclosures for corporations. |

| Usage Frequency | Businesses often prepare Profit and Loss statements monthly, quarterly, or annually to monitor financial health and inform decision-making. |

Key takeaways

When filling out and using the Profit and Loss form, consider the following key takeaways:

- Ensure all income sources are accurately recorded. This includes sales revenue and any additional income streams.

- Track all expenses diligently. Categories may include operational costs, salaries, and overheads.

- Use consistent time periods for reporting. Monthly, quarterly, or yearly reports should align for accurate comparisons.

- Double-check calculations for accuracy. Errors can lead to misleading financial insights.

- Include non-operating income and expenses where applicable. This provides a complete picture of financial health.

- Review your Profit and Loss form regularly. Frequent reviews help identify trends and areas for improvement.

- Utilize the data for budgeting and forecasting. Historical data can inform future financial planning.

- Share the completed form with relevant stakeholders. Transparency is crucial for informed decision-making.

- Understand the implications of your profit margins. This can guide pricing strategies and cost management.

- Keep a copy of the form for your records. This is essential for tax purposes and future reference.