Prenuptial Agreement Template

A prenuptial agreement, often referred to as a prenup, serves as a crucial financial roadmap for couples preparing to marry. This legal document outlines the division of assets and financial responsibilities in the event of a divorce or separation. By addressing issues such as property ownership, debt management, and spousal support, a prenup helps to clarify expectations and protect individual interests. It can also include provisions for the treatment of future income and inheritance, ensuring that both parties are on the same page regarding their financial futures. While discussing such matters may feel uncomfortable, establishing a prenup can foster open communication and mutual understanding, ultimately strengthening the relationship. Couples should consider various factors, including their individual financial situations and long-term goals, when drafting this agreement. With the right approach, a prenuptial agreement can provide peace of mind and a solid foundation for a lasting partnership.

Dos and Don'ts

When filling out a Prenuptial Agreement form, it is essential to approach the process with care and consideration. Here are some guidelines to follow:

- Do communicate openly with your partner about your financial situation and expectations.

- Do consult with a qualified attorney who specializes in family law to ensure your agreement is legally sound.

- Do be honest about your assets, debts, and income. Transparency is crucial.

- Do consider including provisions for future changes, such as children or significant financial changes.

- Don't rush the process. Take the time necessary to discuss and negotiate terms.

- Don't overlook the importance of fairness. An agreement that is heavily one-sided may be challenged later.

- Don't forget to review and update the agreement as your financial situation or relationship evolves.

- Don't use the agreement as a tool for manipulation or control over your partner.

How to Use Prenuptial Agreement

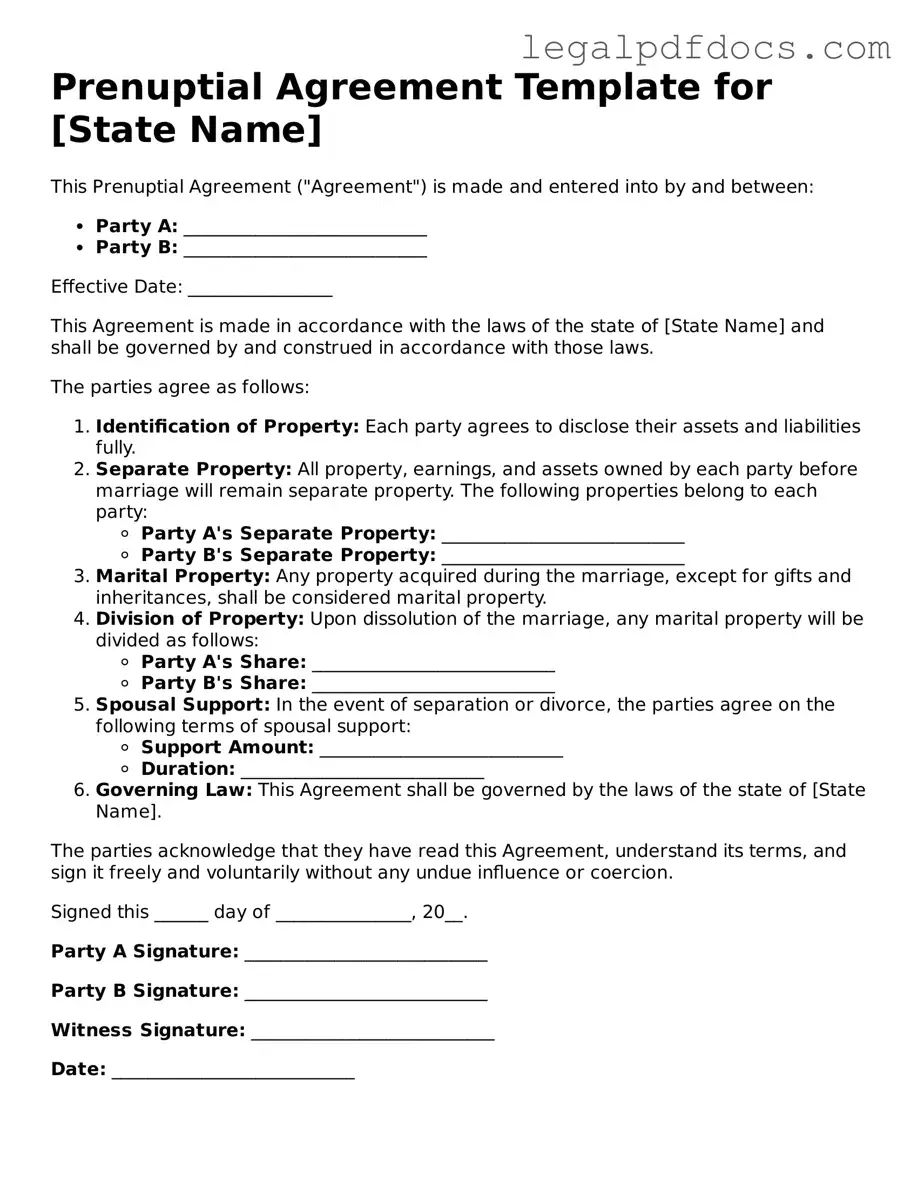

Completing the Prenuptial Agreement form is an important step in preparing for your upcoming marriage. This document helps outline the financial arrangements and responsibilities of both parties. Follow these steps carefully to ensure that the form is filled out accurately and completely.

- Begin by entering the full legal names of both parties at the top of the form.

- Provide the date of the agreement. This is usually the date you are filling out the form.

- List the addresses of both parties. Ensure that the addresses are current and correct.

- Detail the assets owned by each party. Include real estate, bank accounts, investments, and any other significant property.

- Clearly state any debts that each party has. This may include loans, credit card debt, or other financial obligations.

- Discuss how you will handle property acquired during the marriage. Specify whether it will be considered joint or separate property.

- Include any provisions for spousal support or alimony in the event of a divorce.

- Both parties should sign and date the form in the designated areas. Ensure that you do this in the presence of a notary public.

- Make copies of the signed agreement for both parties to keep for their records.

Once you have completed these steps, you will have a fully executed Prenuptial Agreement. This document can help provide clarity and peace of mind as you enter into your marriage.

More Forms:

Consolation Bracket - The excitement of potential comebacks keeps anticipation high.

California State Disability - The form includes sections specific to personal and medical information.

Documents used along the form

A prenuptial agreement is an important document that outlines the financial and personal arrangements between partners before marriage. However, several other forms and documents often accompany it to provide additional clarity and legal protection. Below is a list of these documents, each serving a specific purpose.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It addresses the same issues, such as asset division and financial responsibilities, in the event of a divorce or separation.

- Financial Disclosure Statement: This form requires both parties to disclose their financial situations, including assets, debts, and income. Transparency is crucial for the enforceability of a prenuptial agreement.

- Separation Agreement: This document outlines the terms of separation if the couple decides to live apart. It covers issues like property division, child custody, and spousal support.

- Will: A will specifies how a person's assets will be distributed upon death. It can work in conjunction with a prenuptial agreement to ensure that both partners' wishes are honored.

- Power of Attorney: This document allows one partner to make financial or medical decisions on behalf of the other in case of incapacity. It is essential for ensuring that both partners' interests are protected.

- Trust Documents: If either partner has a trust, these documents outline how assets within the trust will be managed and distributed. They can complement the terms of a prenuptial agreement.

- Child Custody Agreement: If the couple has children or plans to have children, this agreement specifies custody arrangements and responsibilities. It can be part of the prenuptial or postnuptial agreement.

- Marital Settlement Agreement: This document is often created during divorce proceedings. It details the terms of the divorce, including asset division, spousal support, and child custody arrangements.

These documents collectively enhance the legal framework surrounding a marriage, ensuring that both partners have a clear understanding of their rights and responsibilities. Proper preparation can prevent misunderstandings and disputes down the line.

Misconceptions

Prenuptial agreements often come with a cloud of misunderstanding. Here are five common misconceptions about these legal documents:

- Prenuptial agreements are only for the wealthy. Many people think that only those with significant assets need a prenup. In reality, anyone can benefit from a prenup, regardless of their financial situation. It can help clarify financial responsibilities and protect individual interests.

- Prenups are only about money. While financial matters are a significant aspect, prenuptial agreements can also cover other important issues, such as property rights, debt responsibilities, and even how to handle future children’s education costs.

- Prenuptial agreements are unromantic. Some believe that discussing a prenup is a sign of distrust. However, having open conversations about finances and expectations can strengthen a relationship. It’s about planning for the future together.

- Once signed, a prenup cannot be changed. Many think that prenuptial agreements are set in stone. In fact, they can be modified or revoked later on, as long as both parties agree to the changes and follow the proper legal procedures.

- Prenups are only enforceable in divorce cases. Some people believe that prenuptial agreements only come into play during a divorce. However, they can also be useful in situations like the death of a spouse, helping to clarify asset distribution and protect surviving partners.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement is a legal document that outlines the financial and personal rights of each spouse in the event of a divorce or separation. |

| Purpose | The primary purpose is to protect individual assets and clarify financial responsibilities during the marriage. |

| State-Specific Forms | Each state may have its own requirements for prenuptial agreements, and specific forms may vary. It is essential to consult state laws. |

| Governing Law | In California, for example, the Uniform Premarital Agreement Act governs prenuptial agreements. |

| Voluntary Agreement | Both parties must enter into the agreement voluntarily, without coercion or undue pressure. |

| Disclosure Requirement | Full financial disclosure is typically required for the agreement to be enforceable. |

| Modification | Prenuptial agreements can be modified after marriage, but both parties must agree to any changes in writing. |

| Enforceability | Courts generally enforce prenuptial agreements unless they are found to be unconscionable or signed under duress. |

| Legal Representation | It is advisable for each party to seek independent legal counsel before signing the agreement to ensure fairness. |

| Common Misconceptions | Many believe prenuptial agreements are only for the wealthy, but they can benefit anyone entering a marriage. |

Key takeaways

Filling out a Prenuptial Agreement form is an important step for couples considering marriage. Here are key takeaways to keep in mind:

- Understand the purpose: A prenuptial agreement outlines how assets will be divided in the event of a divorce or separation.

- Full disclosure is crucial: Both parties must provide a complete and honest account of their financial situation.

- Consult a lawyer: Having legal guidance can help ensure that the agreement is fair and enforceable.

- Be clear and specific: Vague terms can lead to misunderstandings. Clearly define all assets and obligations.

- Review and update regularly: Life changes, such as the birth of children or significant financial shifts, may necessitate updates to the agreement.

- Sign well in advance: Avoid last-minute pressure by finalizing the agreement well before the wedding date.

- Consider emotional aspects: Discussing a prenuptial agreement can be sensitive. Approach the conversation with care and understanding.

Taking these steps can help ensure that both parties feel secure and informed as they enter marriage.