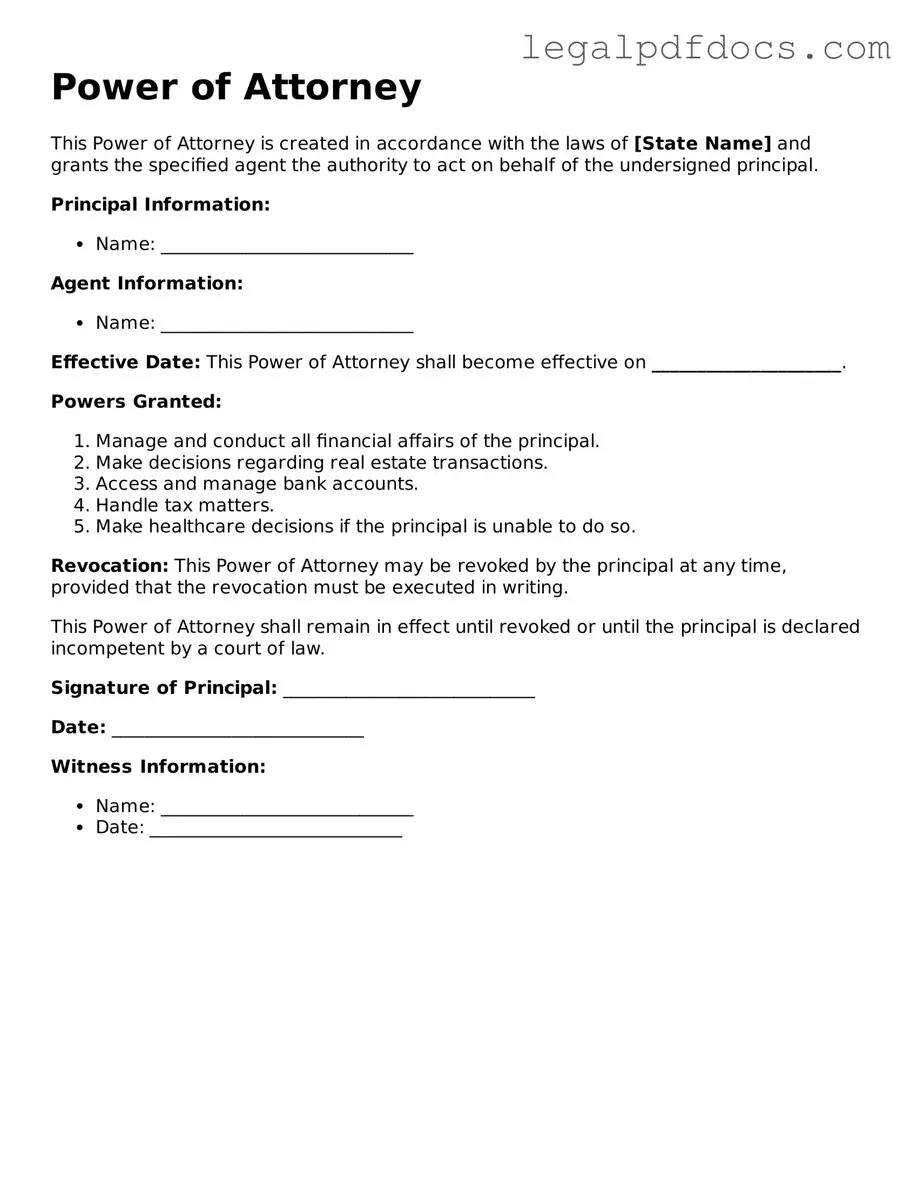

Power of Attorney Template

When it comes to managing personal affairs, the Power of Attorney (POA) form stands out as a vital legal tool. This document allows individuals, known as principals, to designate trusted individuals, referred to as agents or attorneys-in-fact, to make decisions on their behalf. The scope of authority granted can vary significantly, ranging from handling financial transactions to making healthcare decisions, depending on the type of POA established. There are several forms of Power of Attorney, including durable, non-durable, and medical, each serving different purposes and providing varying levels of authority. The durable Power of Attorney remains effective even if the principal becomes incapacitated, ensuring that their wishes are respected during challenging times. On the other hand, a non-durable Power of Attorney typically becomes void if the principal is unable to make decisions. Additionally, the medical Power of Attorney specifically empowers an agent to make healthcare decisions when the principal is unable to communicate their wishes. Understanding the nuances of these forms is crucial, as it enables individuals to make informed choices about their legal and healthcare preferences. By establishing a Power of Attorney, individuals can gain peace of mind, knowing that their affairs will be managed by someone they trust, even in their absence.

Power of Attorney Document Categories

Dos and Don'ts

When filling out a Power of Attorney form, certain best practices can help ensure that the document is valid and effective. Here are nine things to consider:

- Do: Clearly identify the principal and the agent in the document.

- Do: Specify the powers being granted to the agent.

- Do: Use clear and unambiguous language throughout the form.

- Do: Sign the document in the presence of a notary public, if required by your state.

- Do: Keep a copy of the signed document for your records.

- Don't: Leave any sections of the form blank, as this can lead to confusion.

- Don't: Use vague terms that could be misinterpreted.

- Don't: Forget to date the document when signing.

- Don't: Assume that a Power of Attorney is permanent; know the conditions for revocation.

How to Use Power of Attorney

After obtaining the Power of Attorney form, it’s important to fill it out correctly to ensure it meets your needs. Follow these steps to complete the form accurately.

- Start by entering the date at the top of the form.

- Provide your full name and address in the designated section.

- Next, fill in the name and address of the person you are appointing as your agent.

- Clearly specify the powers you wish to grant to your agent. This may include financial decisions, health care decisions, or other specific actions.

- Sign and date the form at the bottom. Make sure to do this in the presence of a notary public if required.

- Have your agent sign the form as well, if necessary.

- Check if any witnesses are needed. If so, have them sign in the appropriate section.

- Make copies of the completed form for your records and for your agent.

More Forms:

Death Certificate Affidavit - It provides clear evidence of the decedent's death for real estate matters.

Medical Prescription Paper - Working with this document can help streamline your healthcare experience.

Documents used along the form

When establishing a Power of Attorney (POA), several other forms and documents may be necessary to ensure comprehensive legal authority and clarity in decision-making. Each of these documents serves a specific purpose and complements the POA by addressing different aspects of legal and financial matters. Below are five commonly used forms that often accompany a Power of Attorney.

- Durable Power of Attorney: This document is similar to a standard Power of Attorney but remains effective even if the principal becomes incapacitated. It provides ongoing authority to the agent, ensuring that decisions can still be made on behalf of the principal when they are unable to do so themselves.

- Advance Healthcare Directive: Also known as a living will, this document outlines an individual's preferences regarding medical treatment in the event they are unable to communicate their wishes. It often works in tandem with a Power of Attorney for healthcare, which designates someone to make medical decisions on behalf of the individual.

- Financial Power of Attorney: This form specifically grants authority to an agent to handle financial matters, such as managing bank accounts, paying bills, and making investment decisions. It can be limited to specific tasks or broad in scope, depending on the principal's needs.

- HIPAA Release Form: The Health Insurance Portability and Accountability Act (HIPAA) restricts the sharing of medical information. A HIPAA release form allows the designated agent to access the principal's medical records and communicate with healthcare providers, ensuring informed decision-making regarding health care.

- Will: While not directly related to a Power of Attorney, a will outlines how an individual's assets should be distributed after their death. It is essential for ensuring that the principal's wishes are honored and can work alongside a POA to provide a complete estate plan.

Understanding these accompanying documents can provide clarity and security in legal and medical decision-making. By having the right forms in place, individuals can ensure their wishes are respected and that their affairs are managed according to their preferences.

Misconceptions

Understanding the Power of Attorney (POA) form is crucial for making informed decisions. However, several misconceptions can lead to confusion. Here are ten common misconceptions:

- A Power of Attorney is only for the elderly. Many people think that only seniors need a POA. In reality, anyone can benefit from having one, especially if they face health issues or travel frequently.

- A Power of Attorney gives someone complete control over your life. This is not true. A POA grants specific powers that you define. You can limit what decisions your agent can make.

- You cannot revoke a Power of Attorney. This is a misconception. You can revoke a POA at any time, as long as you are mentally competent to do so.

- All Power of Attorney forms are the same. There are different types of POAs, such as durable, springing, and limited. Each serves different purposes and has different implications.

- A Power of Attorney is only valid in your home state. While laws vary by state, a valid POA from one state is generally recognized in others. However, it’s wise to check local laws.

- You need an attorney to create a Power of Attorney. While having legal assistance can be beneficial, it’s not always necessary. Many states allow individuals to create a POA using templates.

- A Power of Attorney is permanent. A POA can be temporary or permanent, depending on how you set it up. You can specify the duration in the document.

- Your agent must be a lawyer. This is incorrect. You can choose anyone you trust as your agent, such as a family member or friend, as long as they are of legal age.

- A Power of Attorney can be used to make medical decisions only. While there are medical POAs, a general POA can also include financial and legal decisions.

- You don’t need a Power of Attorney if you have a will. A will only takes effect after your death. A POA is essential for making decisions while you are still alive but unable to do so.

Being aware of these misconceptions can help you make better decisions regarding your legal documents and ensure that your wishes are honored.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another in legal or financial matters. |

| Types | There are several types of POA, including General, Limited, Durable, and Springing, each serving different purposes. |

| Durability | A Durable Power of Attorney remains effective even if the principal becomes incapacitated, unlike a regular POA. |

| State-Specific Forms | Each state has its own requirements for POA forms, and using the correct state-specific form is essential for validity. |

| Governing Laws | In the United States, the Uniform Power of Attorney Act provides a framework, but individual states may have additional laws that govern POAs. |

| Revocation | A Power of Attorney can be revoked at any time by the principal, provided they are mentally competent. |

| Importance | Having a POA in place can ensure that your financial and legal affairs are managed according to your wishes, especially during emergencies. |

Key takeaways

Understanding the Power of Attorney (POA) form is crucial for ensuring your wishes are respected when you cannot make decisions for yourself. Here are some key takeaways to consider:

- Choose the right agent: Select someone you trust to act on your behalf. This person will have significant authority over your affairs.

- Be clear about powers: Specify what powers you are granting. This can include financial, medical, or legal decisions.

- Consider limitations: If desired, you can limit the agent's authority to certain tasks or time frames.

- Discuss your wishes: Have open conversations with your agent about your preferences. This helps avoid confusion later.

- Check state laws: Each state has different rules regarding POAs. Make sure your form complies with local regulations.

- Sign and date properly: Ensure that you sign the document in the presence of a notary or witnesses, if required by your state.

- Keep copies accessible: Share copies of the signed POA with your agent, healthcare providers, and family members.

- Review regularly: Life changes, such as moving or changes in relationships, may require you to update your POA.

- Understand revocation: You have the right to revoke the POA at any time, as long as you are mentally competent.

Taking these steps can help ensure that your Power of Attorney works effectively when you need it most. Your well-being and peace of mind are paramount.