Fill Out a Valid Payroll Check Template

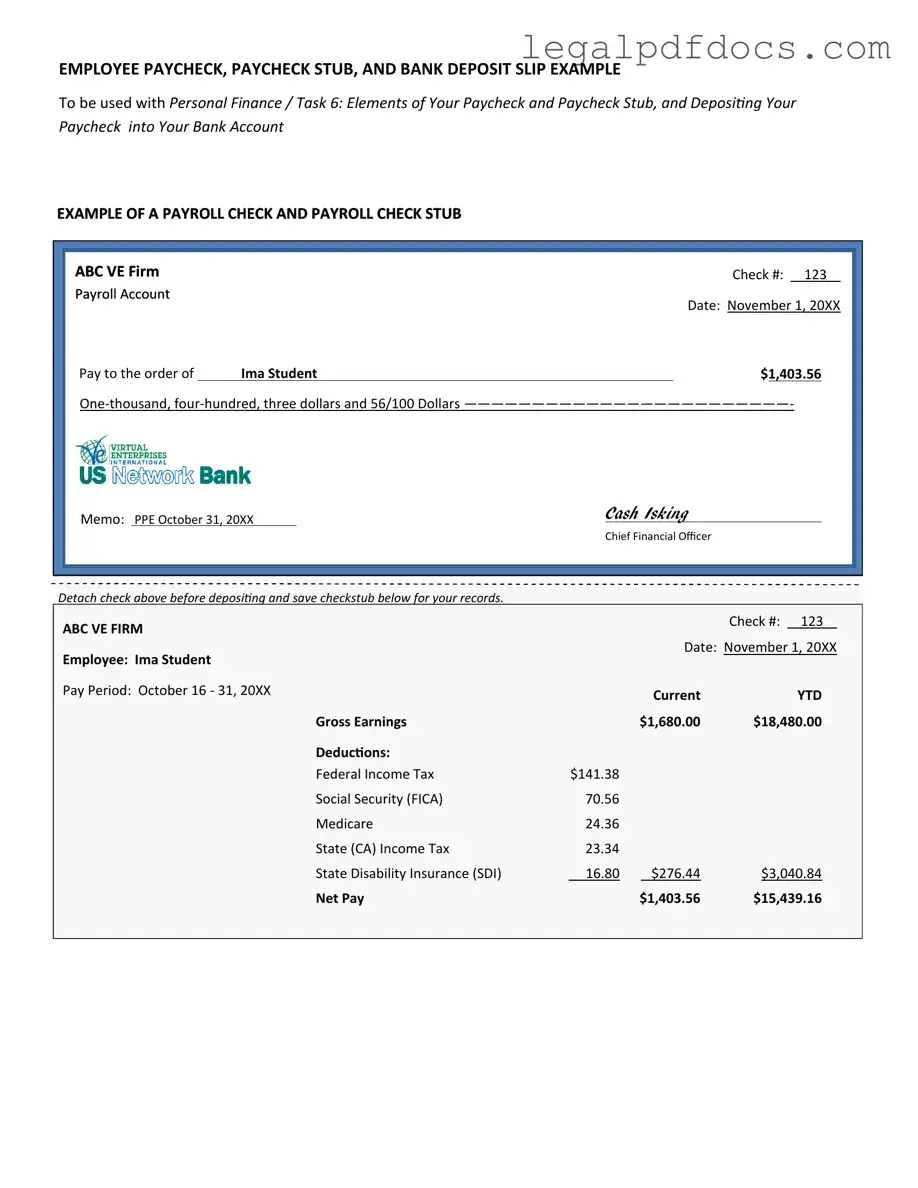

The Payroll Check form is an essential document for both employers and employees in the workplace. It serves as a record of payment made to employees for their work during a specific pay period. This form includes important details such as the employee's name, the amount paid, and the date of payment. Additionally, it typically outlines deductions for taxes, benefits, and any other withholdings. Understanding the components of the Payroll Check form can help ensure that employees receive accurate compensation while also keeping employers compliant with labor laws. By familiarizing yourself with this form, you can better navigate payroll processes and maintain clear communication regarding earnings and deductions.

Dos and Don'ts

When filling out the Payroll Check form, it’s important to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do double-check all personal information for accuracy.

- Do ensure that the hours worked are correctly calculated.

- Do verify that any deductions are properly listed.

- Do sign the form where required.

- Do submit the form by the designated deadline.

- Don't leave any fields blank unless specified.

- Don't use illegible handwriting; clarity is key.

- Don't forget to keep a copy for your records.

- Don't submit the form if you notice errors; correct them first.

- Don't ignore the instructions provided with the form.

How to Use Payroll Check

Filling out the Payroll Check form is a straightforward process that ensures employees receive their earnings accurately. Follow these steps carefully to complete the form correctly.

- Begin by entering the employee's name in the designated field at the top of the form.

- Next, provide the employee's identification number or Social Security number in the appropriate section.

- Indicate the pay period for which the check is being issued. This is typically the start and end dates of the pay period.

- Fill in the gross pay amount. This is the total earnings before any deductions.

- List any deductions that apply, such as taxes or benefits, in the specified area of the form.

- Calculate the net pay by subtracting the total deductions from the gross pay. Write this amount in the net pay field.

- Sign and date the form at the bottom to authorize the payroll check.

More PDF Templates

Employee Change Form Template - Collects necessary details for employee status adjustments.

Dnd 5e Form Fillable Character Sheet - Your character’s background, which can include past experiences and personal history.

Dd Form 2656 March 2022 Pdf - Accurate completion of the DD 2656 leads to effective management of retirement options.

Documents used along the form

When managing employee compensation, several forms and documents complement the Payroll Check form. Each of these documents plays a crucial role in ensuring accurate payroll processing and compliance with regulations.

- W-4 Form: This form allows employees to indicate their tax withholding preferences. It helps employers calculate the correct amount of federal income tax to withhold from each paycheck.

- Payroll Register: This document provides a summary of all payroll transactions for a specific period. It includes details such as employee names, hours worked, gross pay, and deductions.

- Direct Deposit Authorization Form: Employees use this form to authorize their employer to deposit their pay directly into their bank account. It streamlines the payment process and ensures timely access to funds.

- Time Sheet: A time sheet records the hours an employee has worked during a pay period. It serves as a basis for calculating pay and verifying attendance.

- Employee Pay Stub: This document accompanies the Payroll Check and details an employee's earnings for the pay period. It outlines gross pay, deductions, and net pay, providing transparency to employees.

- State Tax Withholding Form: Similar to the W-4, this form is specific to state taxes. Employees fill it out to specify their state tax withholding preferences, ensuring compliance with local tax laws.

Understanding these documents can enhance payroll accuracy and ensure compliance with tax regulations. Proper management of payroll-related forms contributes to a smooth payroll process and employee satisfaction.

Misconceptions

Understanding the Payroll Check form is essential for both employers and employees. However, several misconceptions can lead to confusion. Here are eight common misconceptions:

- Payroll checks are only for hourly employees. Many believe that payroll checks are exclusively issued to hourly workers. In reality, both salaried and hourly employees receive payroll checks.

- Payroll checks are always issued weekly. Some think that payroll checks must be distributed on a weekly basis. However, the frequency of payroll checks can vary by company policy and may be bi-weekly, semi-monthly, or monthly.

- All deductions are mandatory. There is a misconception that all deductions taken from payroll checks are required by law. While some deductions, like taxes, are mandatory, others, such as retirement contributions, may be optional.

- Payroll checks are the same as pay stubs. Many people confuse payroll checks with pay stubs. A payroll check is the actual payment, while a pay stub provides a breakdown of earnings and deductions.

- Employers can change pay rates at any time. Some believe that employers can adjust pay rates without notice. However, changes typically require proper communication and may be subject to contractual obligations.

- Payroll checks can be issued without proper documentation. It is a misconception that payroll checks can be processed without any supporting documentation. Employers must maintain accurate records of hours worked, pay rates, and any deductions.

- Employees have no say in their payroll deductions. Many think that employees cannot influence their payroll deductions. In fact, employees often have the ability to choose certain deductions, such as health insurance or retirement plans.

- Payroll checks are always printed. There is a belief that payroll checks must be physically printed. However, many companies now utilize electronic payroll systems, allowing for direct deposit into employees' bank accounts.

Being aware of these misconceptions can help individuals better understand the payroll process and ensure they receive accurate compensation for their work.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | A Payroll Check form is used to issue payments to employees for their work, detailing hours worked, wages, and deductions. |

| Frequency | Payroll checks are typically issued on a regular schedule, such as weekly, bi-weekly, or monthly, depending on the employer's policies. |

| Components | The form usually includes the employee's name, pay period dates, gross pay, deductions, and net pay. |

| State-Specific Regulations | Each state has its own laws governing payroll checks, including minimum wage requirements and pay frequency. For example, California's Labor Code Section 204 mandates timely payment of wages. |

| Record Keeping | Employers are required to maintain payroll records for a specified period, often three to four years, to comply with labor laws. |

| Direct Deposit Option | Many employers offer direct deposit as an alternative to physical payroll checks, allowing employees to receive their pay directly into their bank accounts. |

| Tax Deductions | Payroll checks reflect various tax deductions, such as federal income tax, Social Security, and Medicare, ensuring compliance with tax laws. |

Key takeaways

When filling out and using the Payroll Check form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are key takeaways to consider:

- Always verify employee details before completing the form. Accurate names and identification numbers prevent payment errors.

- Ensure that the pay period is clearly stated. This informs employees of the time frame for which they are being compensated.

- Double-check the payment amount. Mistakes in calculations can lead to financial discrepancies.

- Use clear and legible handwriting or type the information. Clarity helps avoid confusion and ensures that the form is processed correctly.

- Keep a copy of each Payroll Check form for your records. This documentation can be useful for future reference and audits.

- Submit the completed form to the appropriate department on time. Timeliness ensures that employees receive their payments without delay.