Fill Out a Valid P 45 It Template

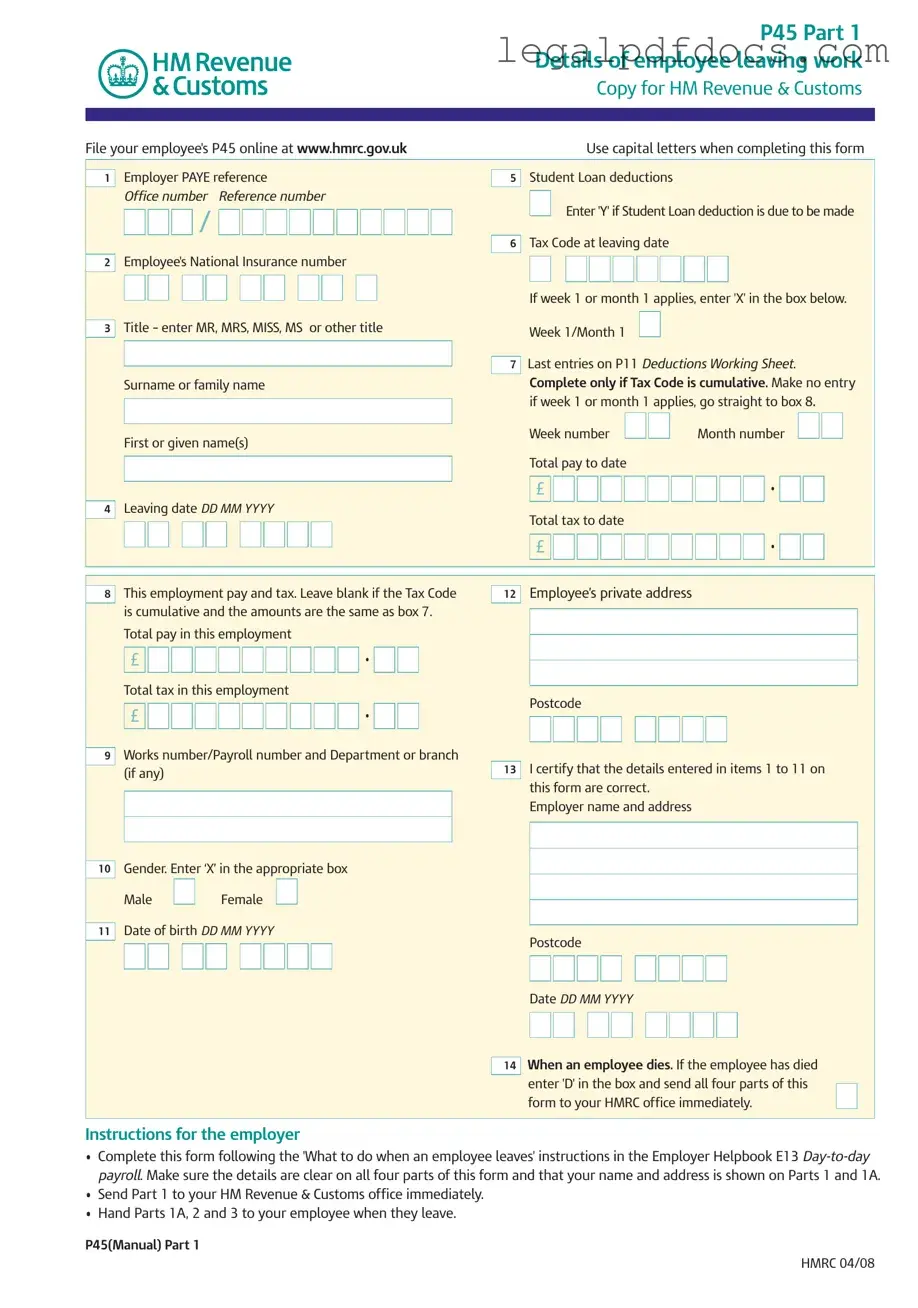

The P45 It form is an essential document used in the UK payroll system when an employee leaves a job. It consists of three main parts, each serving a distinct purpose for the employer, the employee, and the new employer. Part 1 provides the necessary details for HM Revenue & Customs (HMRC), including the employee's National Insurance number, tax code, and total pay and tax to date. This information is crucial for ensuring that the employee's tax records are accurately maintained. Part 1A is a copy for the employee, who should keep it safe as it may be needed for tax returns or when applying for benefits. Part 2 is intended for the new employer and contains similar information to assist in the correct calculation of tax deductions moving forward. Completing the P45 form accurately is vital, as it helps prevent issues such as overpayment of taxes or incorrect tax codes being applied in future employment. Employers are required to submit the form promptly to HMRC, while employees must ensure they understand the implications of the information contained within it, especially if they are transitioning to new employment or claiming benefits.

Dos and Don'ts

When filling out the P45 IT form, here are five things you should do:

- Use capital letters throughout the form to ensure clarity.

- Double-check the employee's National Insurance number for accuracy.

- Ensure the leaving date is clearly stated in the correct format (DD MM YYYY).

- Complete all relevant sections, especially if the Tax Code is cumulative.

- Send Part 1 to HM Revenue & Customs immediately after completion.

Conversely, here are five things you should avoid when filling out the P45 IT form:

- Do not leave any required fields blank, as this may cause delays.

- Avoid using abbreviations or informal language; be precise.

- Do not forget to certify that the details entered are correct.

- Refrain from altering any parts of the form once completed.

- Do not delay in handing Parts 1A, 2, and 3 to the employee upon their departure.

How to Use P 45 It

When an employee leaves a job, completing the P45 form is essential for both the employer and the employee. This form provides crucial information regarding the employee's tax situation and ensures that proper tax codes are applied moving forward. Below are the steps to accurately fill out the P45 form.

- Gather Necessary Information: Collect the employee's personal details, including their name, National Insurance number, and leaving date.

- Complete Employer Details: Fill in your employer PAYE reference, office number, and reference number at the top of the form.

- Input Employee Information: Enter the employee's title, surname, first name(s), and National Insurance number in the designated boxes.

- Specify Leaving Date: Clearly write the employee's leaving date in the format DD MM YYYY.

- Fill in Pay and Tax Details: Provide the total pay to date and total tax to date for the employee. If the tax code is cumulative, ensure the amounts match those listed in the previous entries.

- Indicate Student Loan Deductions: If applicable, enter 'Y' in the appropriate box to indicate that student loan deductions are due.

- Complete Gender and Date of Birth: Mark the gender of the employee and enter their date of birth in the format DD MM YYYY.

- Sign and Date the Form: Certify that the information provided is correct by signing and dating the form.

- Distribute Copies: Send Part 1 to HM Revenue & Customs and provide Parts 1A, 2, and 3 to the employee when they leave.

More PDF Templates

How to Fix Written Mistake on Car Title When Selling - This form serves as an integral step in closing construction contracts decisively.

Da 638 Pdf - This form guides the submission process for valor and heroism awards in the Army.

Passport Ds-11 - Keep a copy of your completed DS-11 for your records.

Documents used along the form

The P45 form is an important document for employees leaving a job, but it often goes hand-in-hand with other forms and documents. These additional items can help ensure a smooth transition for both the employee and the employer. Below is a list of documents commonly associated with the P45 form, along with brief descriptions of each.

- P60: This document summarizes an employee's total pay and deductions for the tax year. It is provided by the employer at the end of the tax year and is essential for tax returns.

- P50: If an employee stops working and wants to claim a tax refund, they can use this form. It is specifically for those who have paid too much tax and need to request a refund.

- P85: This form is for individuals leaving the UK to live or work abroad. It helps to inform HMRC about the change in residency and can assist with tax matters while overseas.

- P11D: Employers use this form to report benefits and expenses provided to employees. It is important for tax purposes and helps employees understand their taxable benefits.

- Jobseeker's Allowance (JSA) Claim Form: If an employee is seeking unemployment benefits, they must complete this form at their local Jobcentre Plus office to claim JSA.

- Employment and Support Allowance (ESA) Claim Form: This form is for individuals who are unable to work due to illness or disability. It helps them apply for financial support.

- Tax Return: Employees may need to file a tax return, especially if they have additional income or have been self-employed. This document summarizes income and tax owed.

- Self-Assessment Registration: New self-employed individuals must register with HMRC to ensure they are paying the correct taxes. This form is crucial for compliance.

- National Insurance Number Application: If an employee does not have a National Insurance number, they may need to apply for one. This number is essential for tax and benefit purposes.

- Reference Request Form: When moving to a new job, an employee may need to provide references. This form can help facilitate the process of obtaining references from previous employers.

Understanding these documents can make the process of leaving a job much easier. Each form serves a specific purpose and helps ensure that both the employee and employer are compliant with tax regulations and employment laws. It's always a good idea to keep copies of these documents for personal records.

Misconceptions

- Misconception 1: The P45 is only for employees who are leaving their job voluntarily.

- Misconception 2: The P45 must be submitted to HMRC immediately by the employee.

- Misconception 3: The P45 is not important and can be discarded.

- Misconception 4: Employees do not need to provide the P45 to their new employer.

- Misconception 5: The P45 is only relevant for tax purposes.

This is incorrect. The P45 is issued to any employee leaving a job, regardless of the reason, including layoffs, resignations, or even termination.

Actually, it is the employer's responsibility to submit Part 1 of the P45 to HMRC right away. Employees should keep Parts 1A, 2, and 3 for their records.

This is a mistake. The P45 contains crucial information about earnings and tax paid, which is necessary for future employment and tax returns.

In reality, employees should present Parts 2 and 3 of the P45 to their new employer. This helps ensure correct tax codes are applied and prevents overtaxing.

While it does serve tax functions, the P45 is also important for other benefits, such as claiming Jobseeker's Allowance or Employment and Support Allowance.

File Specs

| Fact Name | Details |

|---|---|

| Purpose | The P45 form records details of an employee leaving their job. |

| Parts | The P45 consists of three parts: Part 1, Part 1A, and Part 2. |

| HMRC Filing | Employers must file Part 1 with HM Revenue & Customs (HMRC) immediately. |

| Employee Copy | Parts 1A, 2, and 3 are given to the employee upon leaving. |

| National Insurance Number | Employees must provide their National Insurance number on the form. |

| Tax Code | The tax code at the leaving date must be entered; it affects tax deductions. |

| Student Loan Deductions | Employers should indicate if student loan deductions apply. |

| Leaving Date | The date of leaving must be clearly stated in the form. |

| Governing Law | The P45 form is governed by UK tax laws as enforced by HMRC. |

Key takeaways

Filling out and using the P45 form is an important process for both employers and employees when an individual leaves a job. Here are some key takeaways:

- Understand the P45 Structure: The P45 consists of three parts: Part 1 for HM Revenue & Customs (HMRC), Part 1A for the employee, and Parts 2 and 3 for the new employer. Each part serves a specific purpose.

- Accuracy is Crucial: Ensure all details, such as the employee's name, National Insurance number, and tax code, are filled out accurately. Mistakes can lead to tax complications.

- Timely Submission: Employers must send Part 1 to HMRC immediately after an employee leaves. Delays can affect the employee’s tax status and future payments.

- Keep Parts Safe: Employees should retain Part 1A securely. This part may be needed for future tax returns or if they apply for benefits.

- Handle Student Loans Properly: If applicable, indicate whether student loan deductions should continue. This is crucial for ensuring the correct amount is deducted from future earnings.

- Know What to Do Next: Employees should follow the instructions provided in Part 2 of the P45. This includes guidance on what to do with Parts 2 and 3 and how to claim any tax refunds if necessary.