Owner Financing Contract Template

Owner financing can be an attractive option for both buyers and sellers in real estate transactions, allowing for a more flexible approach to financing a property. This arrangement often involves the seller acting as the lender, which can streamline the buying process for individuals who may face challenges securing traditional financing. The Owner Financing Contract form serves as a critical document in this scenario, outlining the terms and conditions of the financing agreement. Key elements typically included in the form are the purchase price, down payment amount, interest rate, repayment schedule, and any specific conditions or contingencies that may apply. Additionally, it addresses the responsibilities of both parties, such as maintenance of the property and insurance requirements. By clearly defining these aspects, the Owner Financing Contract helps to protect the interests of both the buyer and seller, ensuring a smoother transaction and reducing the potential for disputes down the line. Understanding this form is essential for anyone considering owner financing, as it lays the groundwork for a successful and mutually beneficial agreement.

Dos and Don'ts

When filling out the Owner Financing Contract form, attention to detail is crucial. Here are some important dos and don’ts to keep in mind:

- Do read the entire contract thoroughly before filling it out.

- Do ensure all parties involved have their correct legal names listed.

- Do clearly outline the terms of the financing, including interest rates and payment schedules.

- Do consult with a legal professional if you have any questions or concerns.

- Don’t rush through the form; take your time to avoid mistakes.

- Don’t leave any blank spaces; if a section doesn’t apply, indicate that clearly.

- Don’t use vague language; be specific about all terms and conditions.

- Don’t forget to have all parties sign the contract in the appropriate places.

How to Use Owner Financing Contract

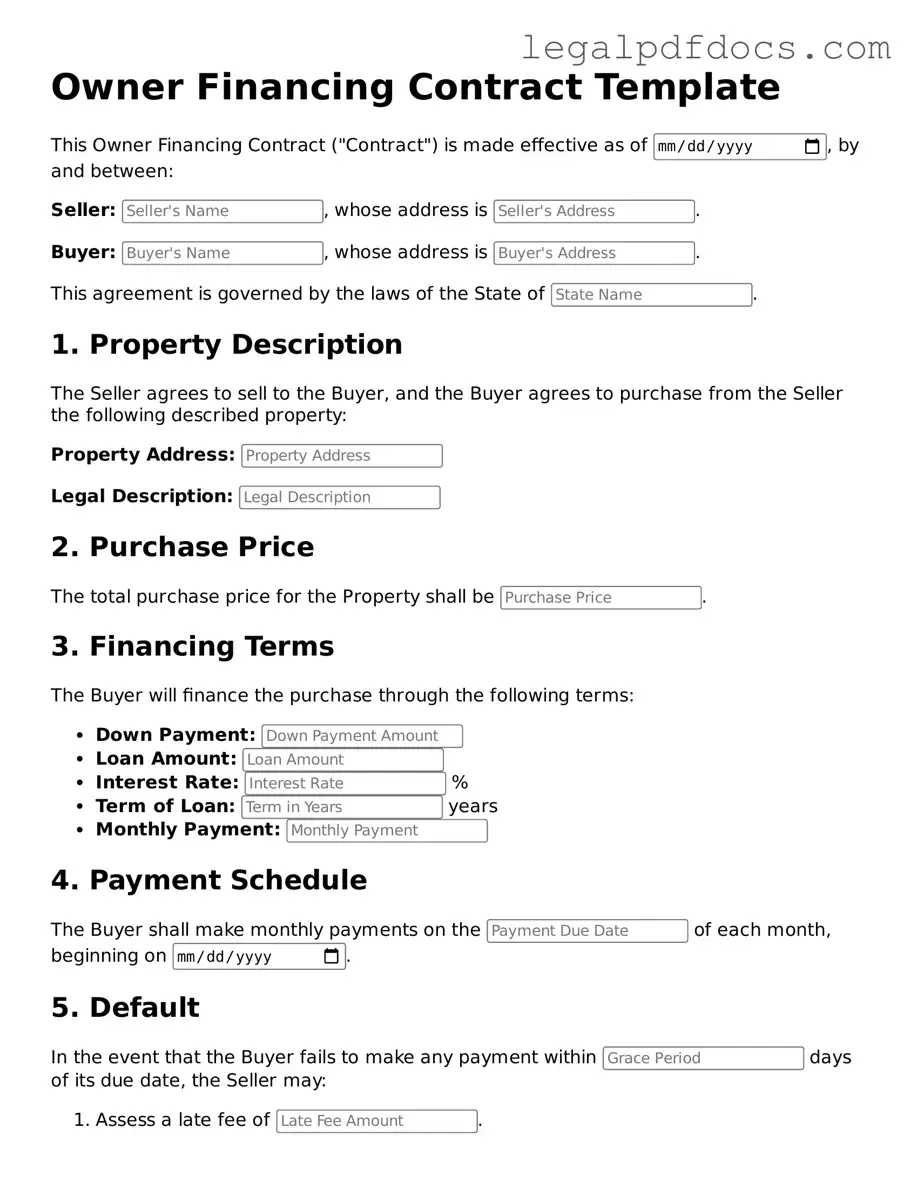

Filling out the Owner Financing Contract form is an important step in establishing the terms of a property sale where the seller provides financing to the buyer. This process ensures that both parties understand their obligations and rights. Follow the steps below to complete the form accurately.

- Gather Necessary Information: Collect all relevant details about the property, including the address, legal description, and any existing liens or encumbrances.

- Identify the Parties: Clearly write the names and contact information of both the seller and the buyer. Make sure to include any co-signers or additional parties involved in the transaction.

- Specify the Purchase Price: Enter the total purchase price of the property. This should reflect the agreed-upon amount between the seller and the buyer.

- Outline Financing Terms: Detail the financing terms, including the down payment amount, interest rate, and repayment schedule. Be clear about whether payments will be monthly, quarterly, or on another schedule.

- Include Default Terms: Specify what happens if the buyer defaults on the loan. This may include the seller's rights to reclaim the property or pursue other legal actions.

- Sign and Date the Form: Both the seller and the buyer must sign and date the contract. Ensure that all signatures are in the appropriate places and that the date is accurate.

- Review the Document: Before finalizing, review the entire contract for any errors or omissions. It's crucial that all information is correct and complete.

- Make Copies: After signing, make copies of the completed contract for both the seller and the buyer. Each party should keep a copy for their records.

Check out Popular Types of Owner Financing Contract Templates

Real Estate Agent Termination Letter - The Termination form is a vital step forward in the real estate transaction process.

Purchase Agreement Addendum - Clarifies the shared responsibilities of both parties after the agreement.

Documents used along the form

When engaging in owner financing, several important documents complement the Owner Financing Contract. Each of these forms plays a crucial role in protecting the interests of both the buyer and the seller. Understanding these documents can help ensure a smooth transaction.

- Promissory Note: This document outlines the borrower's promise to repay the loan under specific terms, including the interest rate, repayment schedule, and consequences for default.

- Deed of Trust: This secures the loan by giving the lender a claim to the property if the borrower fails to repay. It involves a third party, known as a trustee, who holds the title until the loan is paid off.

- Disclosure Statement: This form provides essential information about the financing arrangement, including any risks involved and the rights of both parties. Transparency is key in any transaction.

- Purchase Agreement: This outlines the terms of the sale, including the purchase price and any contingencies. It serves as the foundation for the owner financing arrangement.

- Title Report: This document reveals any liens, encumbrances, or claims against the property. It ensures that the seller has clear title to sell and protects the buyer from unexpected issues.

- Property Inspection Report: A thorough inspection of the property can uncover potential problems. This report helps buyers make informed decisions and negotiate repairs or price adjustments.

- Insurance Policy: Buyers should obtain homeowners insurance to protect their investment. Lenders may require proof of insurance as part of the financing agreement.

- Closing Statement: This document summarizes the final financial details of the transaction, including closing costs and any adjustments. It provides a clear picture of what each party owes or receives at closing.

Each of these documents serves a specific purpose in the owner financing process. Together, they help create a clear and secure transaction, ensuring that both the buyer and seller understand their rights and responsibilities. Being well-informed about these forms can lead to a more successful and satisfying experience for everyone involved.

Misconceptions

Owner financing can be a great option for both buyers and sellers, but several misconceptions can lead to misunderstandings. Here are ten common misconceptions about the Owner Financing Contract form, along with clarifications for each.

- Owner financing is only for buyers with poor credit. Many people believe that owner financing is a last resort for those with bad credit. In reality, it can be a viable option for anyone looking for flexible financing terms.

- All owner financing agreements are the same. Each owner financing contract can vary significantly in terms of interest rates, payment schedules, and other conditions. It’s essential to review each agreement carefully.

- Owner financing eliminates the need for a real estate agent. While some buyers and sellers choose to work directly with each other, many still benefit from the expertise of a real estate agent in negotiating terms and navigating the process.

- The seller has no legal recourse if the buyer defaults. In an owner financing arrangement, the seller retains certain rights, including the ability to reclaim the property if the buyer fails to meet payment obligations.

- Owner financing is always a short-term arrangement. While some agreements may be short-term, owner financing can also be structured as a long-term loan, depending on the needs of both parties.

- Buyers do not need to conduct due diligence. Buyers should always conduct thorough research on the property and the seller, regardless of the financing method. This includes checking property titles and understanding the terms of the agreement.

- Owner financing is too risky for sellers. While there are risks involved, sellers can mitigate them by carefully screening potential buyers and structuring the contract to include protections.

- All owner financing contracts require a large down payment. Down payment amounts can vary widely. Some sellers may accept lower down payments to facilitate a sale.

- Interest rates in owner financing are always higher than traditional loans. Interest rates can be competitive and may even be lower than those offered by banks, depending on the agreement and market conditions.

- Owner financing is not a legitimate option. Owner financing is a legal and recognized method of financing real estate transactions in many states. It offers an alternative to traditional lending methods.

Understanding these misconceptions can help buyers and sellers make informed decisions regarding owner financing. Always seek professional guidance when navigating real estate transactions.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract allows a buyer to purchase property directly from the seller, bypassing traditional mortgage lenders. |

| Governing Law | The contract is governed by state-specific laws, which can vary. For example, in California, the relevant laws include the California Civil Code. |

| Payment Terms | Payment terms are typically outlined in the contract, including the interest rate, payment schedule, and any penalties for late payments. |

| Default Consequences | If the buyer defaults on the agreement, the seller may have the right to reclaim the property through foreclosure or other legal means. |

Key takeaways

Filling out and utilizing the Owner Financing Contract form can be a straightforward process if you keep a few key points in mind. Here are some important takeaways to consider:

- Understand the Terms: Before signing, ensure you fully understand the terms of the agreement. This includes the interest rate, repayment schedule, and any penalties for late payments.

- Clearly Define Responsibilities: Both parties should clearly outline their responsibilities in the contract. This includes maintenance obligations and property taxes to avoid future disputes.

- Consult a Professional: It is advisable to consult with a legal professional or real estate expert before finalizing the contract. Their guidance can help prevent misunderstandings and protect your interests.

- Document Everything: Keep thorough records of all communications and transactions related to the owner financing agreement. This documentation can be invaluable in case of any disputes.

By keeping these points in mind, you can navigate the owner financing process with greater confidence and clarity.