Operating Agreement Template

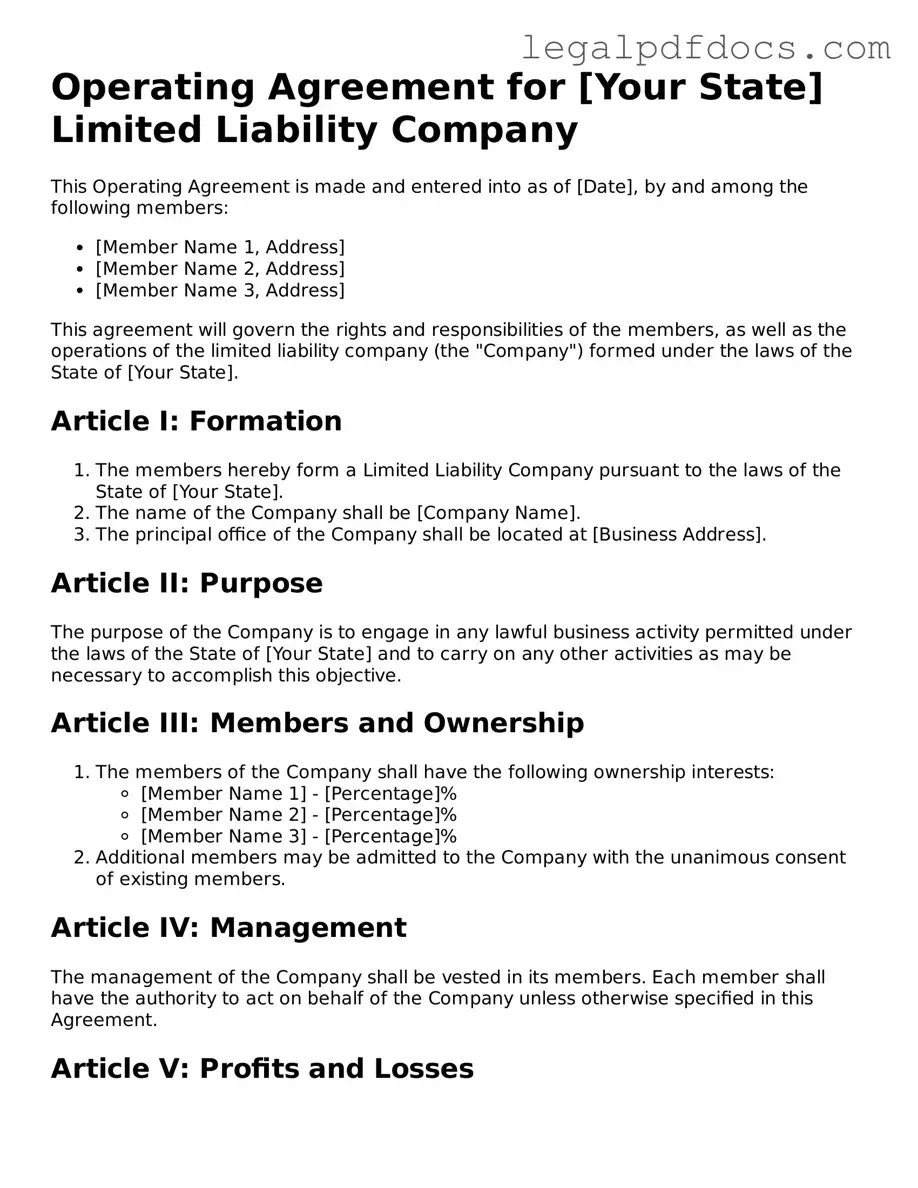

An Operating Agreement is a crucial document for any limited liability company (LLC), serving as the backbone of its internal governance. This form outlines the structure and operational procedures of the LLC, detailing the roles and responsibilities of members, management guidelines, and profit-sharing arrangements. It clarifies how decisions are made and establishes protocols for resolving disputes, ensuring that all members are on the same page regarding the company's operations. Additionally, the Operating Agreement can address the process for adding new members or handling the exit of existing ones, thus providing a roadmap for the future. By defining the rights and obligations of each member, this document not only protects individual interests but also enhances the overall stability and credibility of the business. Overall, the Operating Agreement is not merely a formality; it is an essential tool for fostering clear communication and accountability within the LLC.

Operating Agreement Document Categories

Dos and Don'ts

When filling out the Operating Agreement form, it’s important to be thorough and accurate. Here are some essential do's and don'ts to consider:

- Do read the entire form carefully before starting.

- Do provide accurate information about all members and their roles.

- Do ensure that all members sign the agreement.

- Do consult with a legal professional if you have questions.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any sections blank unless instructed to do so.

- Don't use vague language; be clear and specific.

- Don't forget to update the agreement if there are changes in membership.

How to Use Operating Agreement

Filling out the Operating Agreement form is an important step in establishing the structure and rules for your business. This document will help clarify the roles and responsibilities of the members involved. Follow these steps to complete the form accurately.

- Gather necessary information: Collect details about the business, including its name, address, and the names of all members.

- Identify the purpose: Clearly state the purpose of your business in a few sentences.

- Outline member contributions: Specify what each member is contributing to the business, whether it’s cash, property, or services.

- Define ownership percentages: Indicate the ownership percentage for each member based on their contributions.

- Establish management structure: Decide how the business will be managed. Will it be member-managed or manager-managed?

- Set voting rights: Determine how voting will work among members. Specify what decisions require a vote and how voting power is allocated.

- Include profit and loss distribution: Describe how profits and losses will be shared among members.

- Outline procedures for adding or removing members: Establish guidelines for how new members can join or how existing members can leave.

- Include dispute resolution methods: Decide how disputes among members will be resolved, whether through mediation, arbitration, or another method.

- Review and sign: Once all sections are completed, review the document for accuracy and have all members sign it.

More Forms:

Living Will Registry - Completing this directive could save your loved ones from having to make difficult choices for you.

Intent Proposal Letter for Renting Space - Each party’s key responsibilities may also be briefly outlined in the LOI.

Documents used along the form

An Operating Agreement is a crucial document for LLCs, outlining the management structure and operational procedures. However, it often works in conjunction with several other forms and documents that help establish and maintain the business. Below is a list of commonly used documents that complement the Operating Agreement.

- Articles of Organization: This is the foundational document that you file with the state to officially create your LLC. It includes basic information such as the business name, address, and the names of the members.

- Member Consent Forms: These forms are used to document decisions made by the members of the LLC. They serve as a record of important decisions and can help avoid disputes in the future.

- Bylaws: While more common in corporations, bylaws can also be beneficial for LLCs. They outline the rules governing the internal management of the business, including how meetings are conducted and how decisions are made.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. Issuing them can help clarify ownership stakes and make it easier to transfer ownership if needed.

- Operating Procedures Manual: This document details the day-to-day operations of the business. It can include policies on employee conduct, customer service protocols, and more.

- Financial Agreements: These agreements outline the financial responsibilities of each member, including profit sharing, capital contributions, and how losses will be handled.

- Tax Forms: Depending on the structure of your LLC, you may need to file specific tax forms with the IRS and your state. These documents ensure compliance with tax regulations and can help prevent future issues.

Each of these documents plays a vital role in the overall functioning of an LLC. By understanding their purpose and ensuring they are properly completed, you can create a solid foundation for your business and help it thrive.

Misconceptions

Operating agreements are crucial documents for limited liability companies (LLCs), yet many misconceptions surround them. Understanding these misconceptions can help business owners make informed decisions. Here are five common misunderstandings:

- Operating agreements are optional for all LLCs. While some states do not require an operating agreement, it is highly recommended for all LLCs. This document outlines the management structure and operational procedures, providing clarity and protection for all members.

- All operating agreements are the same. This is far from the truth. Each operating agreement should be tailored to fit the specific needs and goals of the LLC. Factors such as the number of members, the nature of the business, and state laws can influence the content significantly.

- Once created, an operating agreement cannot be changed. In reality, operating agreements are flexible. Members can amend the agreement as needed, provided they follow the procedures outlined within the document. Regular reviews and updates can ensure that the agreement remains relevant.

- Operating agreements are only necessary for multi-member LLCs. Even single-member LLCs benefit from having an operating agreement. It helps establish the separation between personal and business assets, reinforcing the limited liability protection that LLCs offer.

- Having an operating agreement guarantees protection in all situations. While an operating agreement is essential for protecting members' interests, it does not shield the LLC from all legal issues. Compliance with state laws and proper business practices are equally important to maintain liability protection.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC). |

| Flexibility | Members can customize the terms of the agreement to fit their specific needs, allowing for various management styles and profit-sharing arrangements. |

| State Requirement | Not all states require an Operating Agreement, but having one is highly recommended to clarify roles and responsibilities. |

| Governing Law | In California, the governing law is the California Corporations Code, while in New York, it is the New York Limited Liability Company Law. |

| Legal Protection | An Operating Agreement can help protect members' personal assets by reinforcing the LLC's limited liability status. |

Key takeaways

Filling out and using the Operating Agreement form is a crucial step for any business entity, especially for LLCs. Here are some key takeaways to keep in mind:

- Clarify Ownership Structure: The Operating Agreement clearly outlines the ownership percentages and responsibilities of each member. This clarity helps prevent disputes among members down the line.

- Define Management Roles: It specifies who will manage the business and how decisions will be made. This can help streamline operations and ensure everyone understands their role.

- Establish Procedures for Changes: The agreement should include procedures for adding or removing members. This flexibility is vital for adapting to future changes in the business structure.

- Protect Personal Assets: Having an Operating Agreement in place can help reinforce the limited liability status of the LLC, protecting personal assets from business liabilities.

Understanding these key aspects can significantly enhance the effectiveness of your Operating Agreement and contribute to the overall success of your business.