Fill Out a Valid Netspend Dispute Template

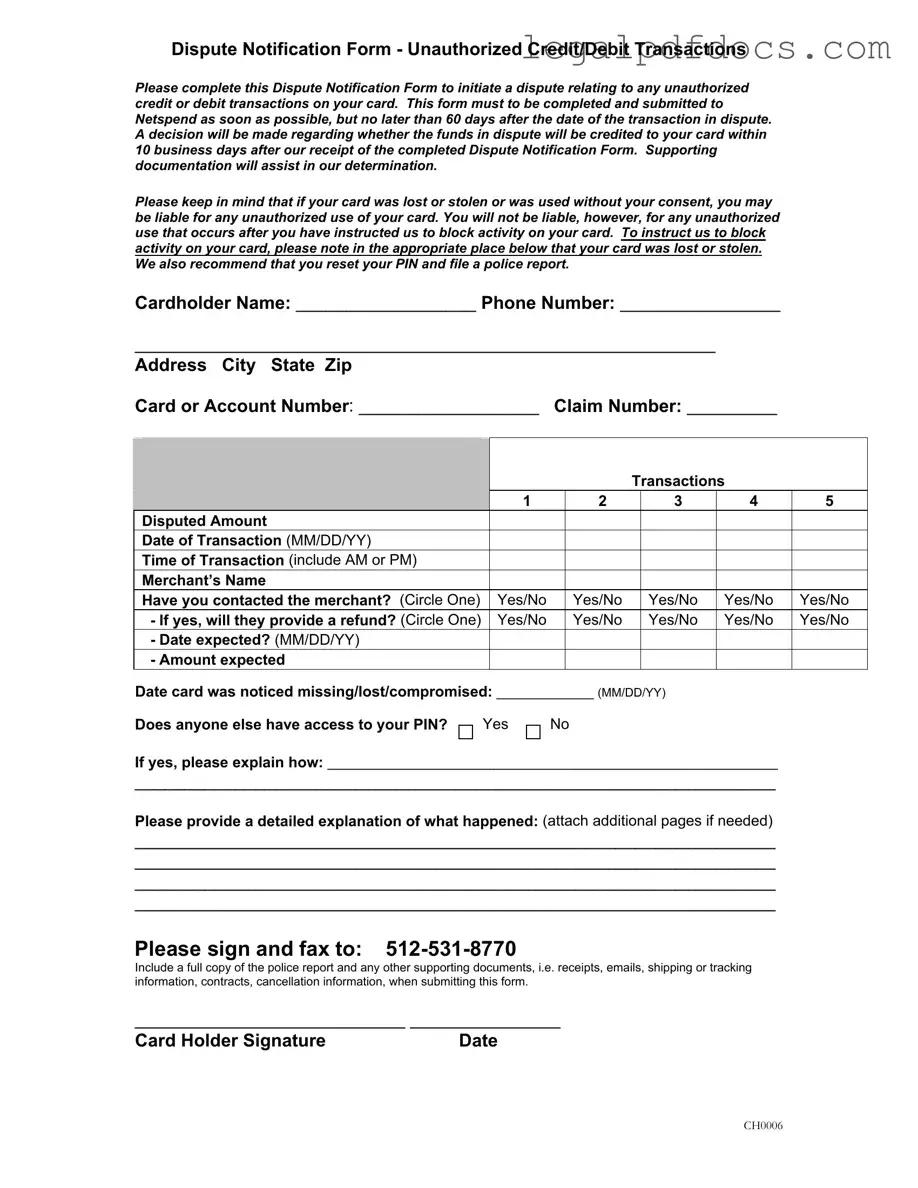

When it comes to managing your finances, unexpected unauthorized transactions can be particularly distressing. The Netspend Dispute Notification Form serves as a crucial tool for cardholders who need to address these issues promptly. By completing this form, you can initiate a dispute regarding any unauthorized credit or debit transactions on your card. It’s important to act quickly; you must submit the form within 60 days of the transaction in question. Once Netspend receives your completed form, they will review your case and typically provide a decision within 10 business days regarding whether the disputed funds will be credited back to your account. To strengthen your case, including supporting documents is highly recommended. If your card was lost or stolen, you may need to indicate this on the form, as it impacts your liability for unauthorized transactions. Additionally, resetting your PIN and filing a police report can further protect your interests. The form requires essential details such as your cardholder information, the specific transactions you are disputing, and any communication you’ve had with the merchant involved. By providing a detailed explanation of the situation, you can help expedite the resolution process. Completing the Netspend Dispute Notification Form is a vital step in reclaiming your funds and ensuring your financial security.

Dos and Don'ts

When filling out the Netspend Dispute form, it is essential to follow specific guidelines to ensure a smooth process. Below are nine recommendations on what to do and what to avoid.

- Do complete the form as soon as possible, ideally within the 60-day window.

- Do provide accurate information for each disputed transaction, including amounts and dates.

- Do attach supporting documentation such as receipts or police reports to strengthen your case.

- Do clearly explain the circumstances surrounding the dispute in the designated section.

- Do sign and date the form before submission to validate your request.

- Don't submit the form without reviewing it for accuracy and completeness.

- Don't forget to indicate if your card was lost or stolen, as this may affect your liability.

- Don't leave out any required fields, such as your card number or contact information.

- Don't wait too long to file your dispute, as delays may hinder your chances of recovery.

By adhering to these guidelines, you can facilitate a more efficient resolution to your dispute.

How to Use Netspend Dispute

Completing the Netspend Dispute form is essential for addressing unauthorized transactions on your card. It’s crucial to act quickly, as you have 60 days from the transaction date to submit this form. Once submitted, Netspend will review your claim and provide a decision within 10 business days. Gather any supporting documents to strengthen your case.

- Download the Netspend Dispute Notification Form from the official website or obtain a physical copy.

- Fill in your personal information: Write your name, phone number, and address, including city, state, and zip code.

- Enter your card or account number and claim number, if applicable.

- List the transactions you are disputing: You can dispute up to five transactions on one form. For each transaction, provide the disputed amount, date, time, and merchant’s name.

- Indicate whether you contacted the merchant for each transaction by circling 'Yes' or 'No.' If you did contact them, circle 'Yes' or 'No' for whether they will provide a refund, and note the expected refund date if applicable.

- Provide the date when you noticed your card was missing, lost, or compromised.

- Answer the question about whether anyone else has access to your PIN. If yes, briefly explain how.

- Write a detailed explanation of what happened regarding the unauthorized transactions. Attach additional pages if necessary.

- Sign the form and include the date of your signature.

- Fax the completed form to 512-531-8770, including a full copy of the police report and any supporting documents, such as receipts or emails.

More PDF Templates

Geico Supplement Request Form Pdf - Prompt attention to this form can prevent delays in customer service delivery.

Immunization Records Florida - Penalties may be enacted for non-compliance with immunization documentation requirements, reinforcing the need for adherence.

Documents used along the form

The Netspend Dispute form is an essential document for initiating disputes related to unauthorized transactions. When submitting this form, it is often necessary to include additional forms and documents to support the claim. Below is a list of commonly used documents that may accompany the Netspend Dispute form.

- Police Report: This document is crucial if the card was lost or stolen. It serves as official evidence of the incident and may be required by Netspend to process the dispute.

- Transaction Receipts: Providing receipts for the transactions in question can help substantiate claims. These documents show proof of the original purchase and can clarify discrepancies.

- Email Correspondence: Any emails exchanged with the merchant regarding the disputed transaction should be included. This can demonstrate efforts made to resolve the issue directly with the merchant.

- Cancellation Confirmation: If the transaction was for a service or product that was canceled, a confirmation of that cancellation can support the dispute claim.

- Shipping or Tracking Information: For items that were ordered online, including shipping details can provide context for the dispute, especially if the item was never received.

- Account Statements: Recent statements from the Netspend account can help highlight the disputed transactions and provide a broader context of account activity.

- PIN Access Explanation: If someone else had access to the PIN, an explanation of how this occurred may be necessary. This helps clarify liability issues.

- Affidavit of Unauthorized Use: A sworn statement detailing the unauthorized use of the card can reinforce the claim and provide additional legal weight.

- Identity Theft Report: If identity theft is suspected, a report from an identity theft protection service can provide further evidence and context for the dispute.

- Dispute Resolution Documentation: Any forms or communications related to prior attempts to resolve the dispute with the merchant can be relevant and helpful.

Including these documents with the Netspend Dispute form can enhance the chances of a successful resolution. Each piece of evidence helps to build a clearer picture of the situation, aiding in the investigation process.

Misconceptions

Misconceptions about the Netspend Dispute form can lead to confusion and delays. Here are seven common misunderstandings:

- It’s too late to dispute a transaction after 60 days. Many believe they can dispute transactions beyond the 60-day window. However, disputes must be initiated within this timeframe to be considered.

- Submitting the form guarantees a refund. Some think that simply filling out the form will result in immediate reimbursement. A decision is made after reviewing the case, which may take up to 10 business days.

- All transactions can be disputed. Not every transaction qualifies for a dispute. Only unauthorized credit or debit transactions can be contested using this form.

- Documentation is optional. Many assume that supporting documents are not necessary. In reality, providing evidence can significantly help in resolving the dispute.

- Liability is always on the cardholder. Some believe they are responsible for all unauthorized transactions. If a card is reported lost or stolen, liability may be limited.

- Contacting the merchant is not required. It's a misconception that you don’t need to reach out to the merchant first. The form asks if you have contacted them, which is an important step in the dispute process.

- Only one transaction can be disputed at a time. Some think they can only dispute one transaction per form. In fact, you can submit up to five disputes on a single form.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | This form is used to report unauthorized credit or debit transactions on your Netspend card. |

| Submission Deadline | Complete and submit the form within 60 days of the transaction date in dispute. |

| Decision Timeline | Netspend will make a decision regarding your dispute within 10 business days after receiving the completed form. |

| Supporting Documentation | Including supporting documents can help Netspend in determining the outcome of your dispute. |

| Liability for Unauthorized Use | You may be liable for unauthorized transactions if your card was lost or stolen, unless you reported it in time. |

| Blocking Card Activity | To block activity on your card, indicate that it was lost or stolen on the form. |

| Recommended Actions | Reset your PIN and file a police report if your card is compromised. |

Key takeaways

1. Complete the Dispute Notification Form promptly. You must submit it within 60 days of the transaction date to ensure your dispute is processed.

2. Provide accurate and detailed information. Include your cardholder name, phone number, address, and card or account number to avoid delays.

3. List all disputed transactions clearly. You can submit up to five transactions on one form. Include the disputed amount, date, time, and merchant's name for each transaction.

4. Indicate whether you have contacted the merchant. This information is crucial for the dispute process. If you have, note if a refund is expected.

5. If your card was lost or stolen, report it immediately. Mark the appropriate section on the form to instruct Netspend to block activity on your card.

6. Attach supporting documentation. Include a police report, receipts, emails, and any relevant documents to strengthen your claim.

7. Sign and date the form before submission. An unsigned form may lead to processing delays or denial of your dispute.

8. Fax the completed form to the designated number. Ensure that all pages are clear and legible to facilitate a smooth review process.