Fill Out a Valid Mortgage Statement Template

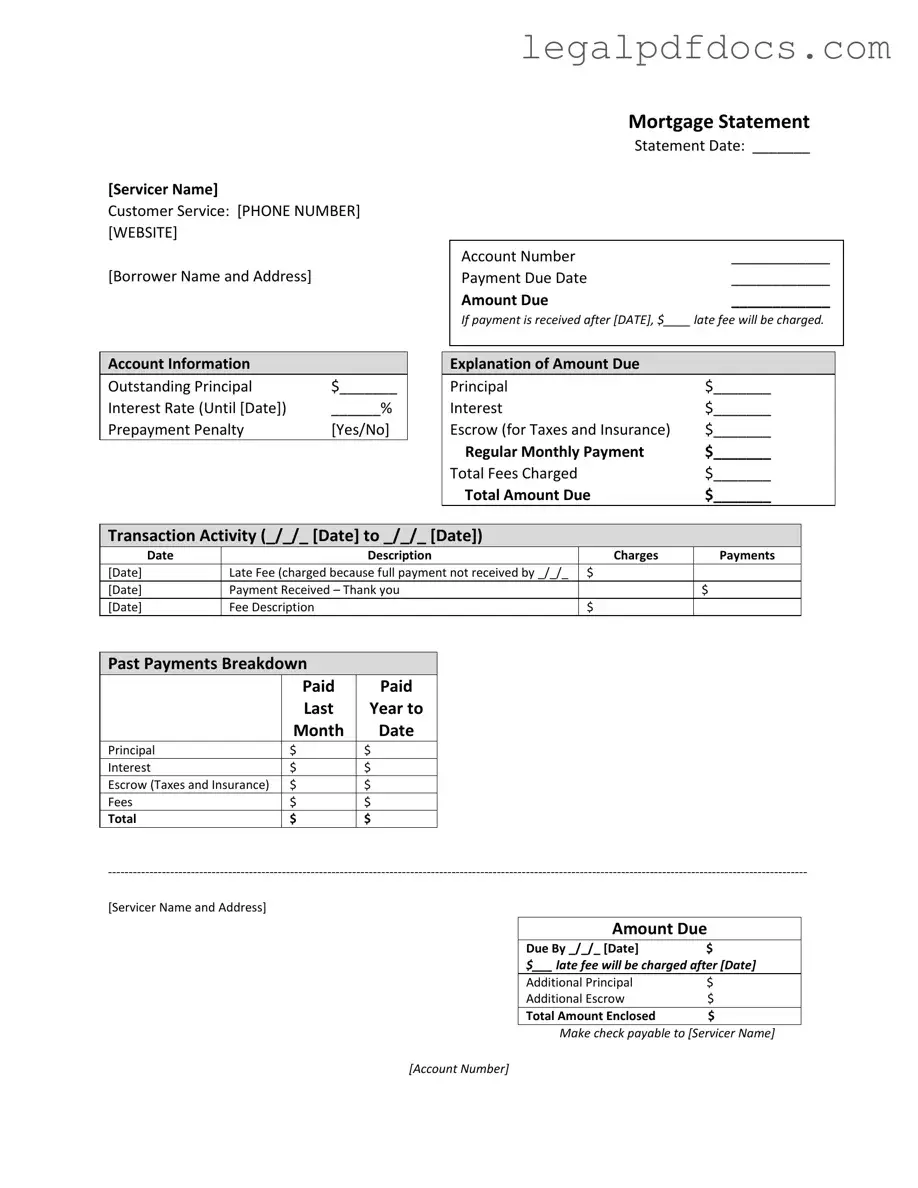

The Mortgage Statement form serves as a crucial document for homeowners, providing a comprehensive overview of their mortgage account. It begins with essential contact information, including the servicer's name, customer service phone number, and website, ensuring borrowers have access to support when needed. The statement highlights key details such as the borrower’s name and address, the statement date, account number, and payment due date, all of which are vital for tracking payment schedules. Additionally, the form outlines the amount due and specifies any late fees that may be incurred if payments are not made on time. A section dedicated to account information reveals the outstanding principal, interest rate, and whether a prepayment penalty applies. This transparency is further enhanced by a breakdown of the amount due, including principal, interest, and escrow for taxes and insurance. Transaction activity is meticulously documented, showcasing a history of charges and payments over a specified period. Importantly, the form also addresses potential issues, such as delinquency notices and the consequences of late payments, while offering guidance for those experiencing financial difficulties. Through this structured format, the Mortgage Statement not only keeps borrowers informed but also emphasizes the importance of timely payments and financial responsibility.

Dos and Don'ts

When filling out the Mortgage Statement form, keep the following tips in mind:

- Do double-check all personal information for accuracy.

- Do ensure the payment amount is clearly stated.

- Do keep a copy of the completed form for your records.

- Do review the payment due date and late fee information.

- Don't leave any sections blank; fill in all required fields.

- Don't ignore the delinquency notice; take it seriously.

- Don't forget to sign and date the form before submission.

How to Use Mortgage Statement

Filling out the Mortgage Statement form is an important step in managing your mortgage obligations. This form provides essential information about your account, including payment details and outstanding balances. Follow the steps below to complete the form accurately.

- Begin by entering the Servicer Name at the top of the form.

- Provide the Customer Service Phone Number and Website for the servicer.

- Fill in your Borrower Name and Address.

- Record the Statement Date.

- Enter your Account Number.

- Indicate the Payment Due Date.

- Write down the Amount Due.

- Specify the date after which a late fee will be charged and the amount of that fee.

- Fill in the Outstanding Principal amount.

- Enter the Interest Rate and the date it is valid until.

- Indicate if there is a Prepayment Penalty (Yes/No).

- Break down the Amount Due into Principal, Interest, Escrow (for Taxes and Insurance), Regular Monthly Payment, Total Fees Charged, and Total Amount Due.

- Document the Transaction Activity for the specified date range, including Date, Description, Charges, and Payments.

- List any Late Fees charged and the date they were incurred.

- Provide details of any Payment Received and the corresponding date.

- Complete the Past Payments Breakdown for the last year, including amounts paid for Principal, Interest, Escrow, Fees, and Total.

- At the bottom, include the Servicer Name and Address again.

- State the Amount Due and the date it is due by.

- Indicate any additional amounts for Principal and Escrow.

- Fill in the Total Amount Enclosed if you are making a payment.

- Make sure to write the check payable to the Servicer Name and include your Account Number.

Once you have completed the form, review it for accuracy before submitting. Ensure that all sections are filled out clearly to avoid any processing delays.

More PDF Templates

Faa Form 8050-2 - It is advisable for both parties to retain legal counsel when completing the bill of sale.

Gf Application Form - Share your favorite types of food for potential dinner dates.

Is Certificate of Live Birth the Same as Birth Certificate - The form requires details about the pregnancy and any complications.

Documents used along the form

When managing a mortgage, several important documents accompany the Mortgage Statement form. Each of these documents plays a crucial role in understanding your mortgage and ensuring that you stay informed about your financial obligations. Below is a list of forms and documents that are commonly used alongside the Mortgage Statement.

- Loan Agreement: This document outlines the terms and conditions of your mortgage, including the loan amount, interest rate, repayment schedule, and any fees associated with the loan. It serves as the foundational contract between you and the lender.

- Truth in Lending Disclosure: This disclosure provides essential information about the cost of your loan. It includes details such as the annual percentage rate (APR), total finance charges, and the total amount you will pay over the life of the loan.

- Payment History: A detailed record of all payments made towards your mortgage. This document helps you track your payments over time and can be useful in addressing any discrepancies with your lender.

- Escrow Account Statement: If your mortgage includes an escrow account for property taxes and insurance, this statement details the amounts collected, disbursed, and the current balance in the account. It ensures transparency regarding how your funds are being managed.

- Property Tax Statements: These statements provide information about the property taxes owed on your home. They are important for understanding your financial obligations and can affect your escrow account if you have one.

- Insurance Policy Documents: These documents outline the coverage of your homeowner's insurance policy. Lenders typically require proof of insurance to protect their investment in the property.

- Forbearance Agreement: If you experience financial difficulties, this agreement outlines the terms under which your lender allows you to temporarily reduce or suspend your mortgage payments without incurring penalties.

- Loan Modification Agreement: This document details any changes made to the original loan terms, such as interest rate adjustments or extended repayment periods. It is crucial for borrowers seeking to make their payments more manageable.

- Delinquency Notice: This notice informs you if your mortgage payments are late. It outlines the amount due and any late fees that may apply, as well as the potential consequences of continued delinquency.

Understanding these documents is essential for effective mortgage management. Each form contributes to a clearer picture of your financial responsibilities and rights as a borrower. Staying organized and informed can help you navigate the complexities of homeownership with confidence.

Misconceptions

Understanding your mortgage statement is essential, but there are many misconceptions that can lead to confusion. Here are six common misconceptions:

- My mortgage statement shows my current balance. Many believe the amount listed is their total remaining mortgage balance. In reality, it often reflects the amount due for the current billing cycle, not the total owed.

- Late fees are automatically applied. Some think that if they miss a payment, late fees will be charged immediately. However, late fees are only assessed after a specified grace period has passed.

- Partial payments are applied to my mortgage. It’s a common belief that partial payments help reduce the mortgage balance. In fact, these payments are typically held in a suspense account until the full payment is made.

- The escrow amount is optional. Many homeowners think they can skip escrow payments for taxes and insurance. However, most lenders require these to ensure property taxes and insurance are paid on time.

- My mortgage statement includes all my payment history. Some assume that the statement provides a complete history of their payments. In reality, it usually only shows recent transactions and not a full account history.

- Ignoring the statement will not affect my credit. A misconception exists that if you do not look at your mortgage statement, it won't impact your credit score. In truth, missed payments and delinquencies reported by the lender can severely affect your credit rating.

Being informed about these misconceptions can help homeowners manage their mortgage more effectively.

File Specs

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for borrower inquiries. |

| Account Details | Key account information is presented, such as the account number, outstanding principal, interest rate, and payment due date. |

| Late Fees | A late fee is applicable if payment is not received by a specified date, emphasizing the importance of timely payments. |

| Transaction Activity | The statement details transaction activity, including dates, descriptions, charges, and payments made during a specified period. |

| Delinquency Notice | A section alerts borrowers about delinquency, warning that failure to pay may lead to fees or foreclosure. |

| Financial Assistance | The statement provides information about mortgage counseling or assistance for borrowers experiencing financial difficulties. |

Key takeaways

Understanding your Mortgage Statement is essential for managing your home loan effectively. Here are some key takeaways to help you navigate this important document:

- Review the Statement Date: This date indicates when the statement was issued. Always check it to ensure you are looking at the most current information.

- Know Your Payment Due Date: This is the date by which your payment must be received to avoid late fees. Mark it on your calendar.

- Understand Late Fees: If your payment is not received by the due date, a late fee will be charged. Familiarize yourself with the specific amount and the date it applies.

- Check Account Information: Review your outstanding principal, interest rate, and any prepayment penalties. This information is crucial for understanding your loan terms.

- Transaction Activity: Look at the transaction history for the specified dates. This section shows charges, payments, and any late fees applied.

- Seek Help if Needed: If you find yourself in financial difficulty, reach out for mortgage counseling or assistance. Resources are available to help you.

By keeping these points in mind, you can manage your mortgage more effectively and avoid potential issues. Take the time to review your Mortgage Statement regularly.