Mobile Home Purchase Agreement Template

When buying a mobile home, having a clear and comprehensive Mobile Home Purchase Agreement is essential. This document outlines the terms of the sale, ensuring both the buyer and seller understand their rights and responsibilities. Key aspects include the purchase price, payment terms, and any contingencies that may apply. Additionally, the agreement typically covers the condition of the mobile home, details about the title transfer, and any warranties or representations made by the seller. It may also specify the responsibilities for repairs and maintenance prior to the sale. By addressing these important elements, the Mobile Home Purchase Agreement serves as a protective measure for both parties, helping to prevent misunderstandings and disputes down the line. Understanding this form can facilitate a smoother transaction and provide peace of mind throughout the buying process.

Dos and Don'ts

When filling out a Mobile Home Purchase Agreement form, attention to detail is crucial. Here’s a list of ten essential dos and don’ts to guide you through the process.

- Do read the entire agreement carefully before signing.

- Do ensure all personal information is accurate and up-to-date.

- Do specify the purchase price clearly.

- Do include any contingencies, such as financing or inspections.

- Do check for any additional fees associated with the purchase.

- Don't rush through the form; take your time to understand each section.

- Don't leave any blank spaces; fill in all required fields.

- Don't ignore the fine print; it may contain important terms.

- Don't forget to keep a copy of the signed agreement for your records.

- Don't hesitate to ask questions if something is unclear.

Following these guidelines can help ensure a smoother transaction and protect your interests in the mobile home purchase process.

How to Use Mobile Home Purchase Agreement

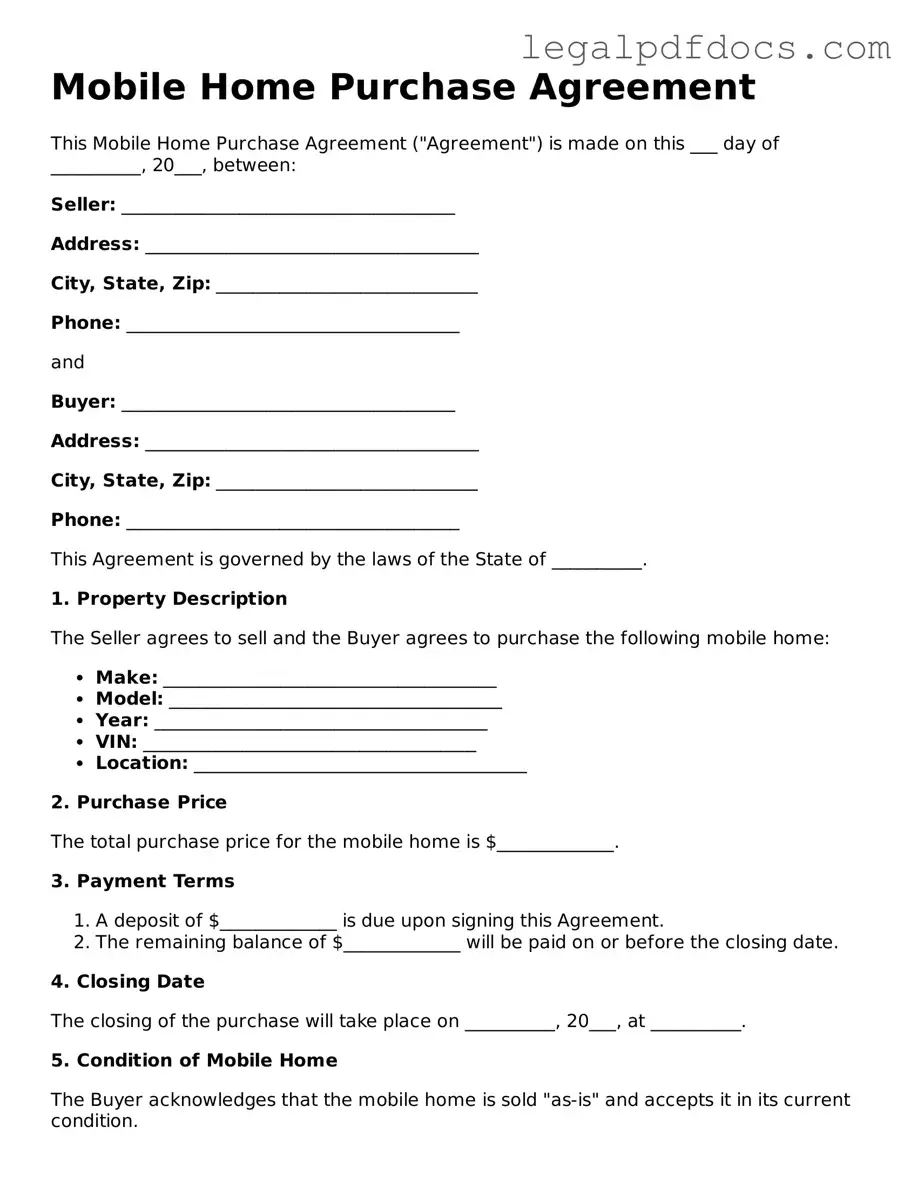

Once you have the Mobile Home Purchase Agreement form in hand, you’ll need to carefully fill it out to ensure all necessary details are included. This form is essential for documenting the sale of a mobile home, and accuracy is key. Follow these steps to complete the form correctly.

- Start with the date: Write the current date at the top of the form.

- Seller Information: Fill in the name and contact details of the seller. Include their address and phone number.

- Buyer Information: Enter the name and contact details of the buyer, just like you did for the seller.

- Property Description: Provide a detailed description of the mobile home. Include the make, model, year, and VIN (Vehicle Identification Number).

- Purchase Price: Clearly state the total purchase price for the mobile home.

- Deposit Amount: Specify the amount of any deposit that the buyer will pay upfront.

- Payment Terms: Outline the payment terms, including how the remaining balance will be paid and any financing details if applicable.

- Closing Date: Indicate the date when the sale will be finalized.

- Signatures: Both the seller and buyer must sign and date the agreement at the bottom of the form.

After completing the form, make sure to keep a copy for your records. It’s also a good idea to have a witness or notary present when signing to add an extra layer of protection and validity to the agreement.

More Forms:

Codicil Template - State laws may impose specific requirements for codicils.

How to Write a Character Letter - The defendant approaches situations with an open mind and a willingness to understand different perspectives.

Is Certificate of Live Birth the Same as Birth Certificate - It may sometimes require both parents' signatures for verification.

Documents used along the form

When purchasing a mobile home, several important documents complement the Mobile Home Purchase Agreement. Each of these documents plays a crucial role in ensuring a smooth transaction and protecting the interests of both the buyer and the seller. Here’s a list of common forms you might encounter:

- Bill of Sale: This document serves as proof of the transaction. It outlines the details of the sale, including the purchase price and the specific mobile home being sold. Both parties typically sign this to confirm the transfer of ownership.

- Title Certificate: The title is a legal document that establishes ownership of the mobile home. It must be transferred from the seller to the buyer during the sale. Ensuring that the title is clear of any liens is vital for a smooth transaction.

- Purchase Agreement Addendum: Sometimes, additional terms or conditions may need to be added after the main agreement is signed. This addendum allows both parties to agree on these changes formally.

- Disclosure Statement: Sellers are often required to provide a disclosure statement that details the condition of the mobile home. This includes any known defects or issues. Transparency in this document helps buyers make informed decisions.

- Financing Agreement: If the buyer is financing the purchase, this document outlines the terms of the loan. It includes details such as interest rates, repayment schedules, and any conditions that must be met.

- Home Inspection Report: This report is generated after a thorough inspection of the mobile home. It identifies any potential problems that could affect the value or safety of the home. Buyers should review this report carefully before finalizing their purchase.

Understanding these documents can empower both buyers and sellers in the mobile home transaction process. Each form plays a distinct role in ensuring that the sale is conducted fairly and legally. Being informed about these essential documents can lead to a more confident and successful purchase experience.

Misconceptions

Understanding the Mobile Home Purchase Agreement form is essential for anyone considering purchasing a mobile home. However, several misconceptions can lead to confusion. Below is a list of common misconceptions along with clarifications.

- It is the same as a traditional home purchase agreement. Many people believe that a mobile home purchase agreement functions identically to a traditional real estate purchase agreement. While both documents serve the purpose of outlining the terms of a sale, they differ in specific legal requirements and regulations.

- Mobile homes cannot be financed. A common misconception is that mobile homes are not eligible for financing. In reality, many lenders offer loans specifically for mobile home purchases, provided the home meets certain criteria.

- All mobile homes are personal property. Some assume that all mobile homes are classified as personal property. However, if a mobile home is permanently affixed to land, it may be considered real property, which can affect the purchase agreement.

- Buyers are not entitled to inspections. Many believe that inspections are not necessary for mobile home purchases. In fact, buyers should always consider having the home inspected to identify potential issues before finalizing the agreement.

- Mobile homes do not come with warranties. Some buyers think that mobile homes do not include warranties. However, many manufacturers offer warranties on new mobile homes, and it is advisable to check for any existing warranties on used homes.

- The seller must disclose all defects. There is a misconception that sellers are required to disclose every defect in the home. While sellers must disclose known issues, they may not be held responsible for defects that they are unaware of.

- Mobile home purchase agreements are non-negotiable. Some believe that the terms of a mobile home purchase agreement cannot be negotiated. In reality, buyers and sellers can negotiate various terms before signing the agreement.

- Closing costs are minimal or nonexistent. Many assume that closing costs for mobile home purchases are low or do not exist. However, closing costs can vary significantly and may include fees for inspections, title searches, and financing.

- Once signed, the agreement cannot be changed. A common belief is that a signed mobile home purchase agreement is final and unchangeable. In fact, parties can amend the agreement if both sides agree to the changes before closing.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Mobile Home Purchase Agreement form is used to outline the terms and conditions of the sale of a mobile home between the buyer and seller. |

| Governing Laws | In the United States, the laws governing mobile home transactions can vary by state. It's essential to refer to state-specific regulations for compliance. |

| Key Components | This agreement typically includes details such as the purchase price, payment terms, and any contingencies related to the sale. |

| Signatures Required | Both the buyer and seller must sign the agreement for it to be legally binding, indicating their acceptance of the terms outlined. |

| Disclosure Obligations | Sellers may be required to disclose certain information about the mobile home, such as existing liens or structural issues, depending on state laws. |

Key takeaways

When filling out and using the Mobile Home Purchase Agreement form, several important points should be considered to ensure a smooth transaction.

- Complete all sections: Ensure that every part of the form is filled out accurately. Missing information can lead to delays or complications.

- Review the terms: Carefully read the terms and conditions outlined in the agreement. Understanding these details is crucial for both the buyer and seller.

- Include all necessary parties: Make sure that all relevant individuals are listed in the agreement. This includes both the buyer and the seller, as well as any agents involved.

- Document any agreements: If there are additional agreements or conditions outside the standard form, document them clearly within the agreement to avoid misunderstandings.

- Sign and date: Both parties must sign and date the form to validate the agreement. Without signatures, the document is not legally binding.

- Keep copies: After the agreement is signed, make copies for all parties involved. This ensures that everyone has access to the same information.

Following these guidelines can help facilitate a successful mobile home purchase. Clear communication and thorough documentation are key to preventing disputes and ensuring that all parties are on the same page.