Official Transfer-on-Death Deed Form for Michigan

The Michigan Transfer-on-Death Deed form serves as a vital tool for individuals seeking to streamline the transfer of real estate upon their death, thereby bypassing the often lengthy and costly probate process. This form allows property owners to designate one or more beneficiaries who will automatically inherit their property, ensuring a smooth transition of ownership without the need for court intervention. Importantly, the deed remains revocable during the property owner’s lifetime, providing flexibility should circumstances change. It is essential for individuals to understand the specific requirements for executing this form, including the necessity for proper notarization and recording with the local register of deeds. Additionally, potential tax implications and the impact on existing debts or liens must be considered, making it imperative for property owners to consult with legal professionals before proceeding. By utilizing the Transfer-on-Death Deed, property owners can take proactive steps to secure their legacy, while also alleviating potential burdens for their loved ones during an already challenging time.

Dos and Don'ts

When filling out the Michigan Transfer-on-Death Deed form, it's crucial to ensure accuracy and compliance with legal requirements. Here’s a list of what you should and shouldn't do:

- Do ensure that you are eligible to use the Transfer-on-Death Deed.

- Do clearly identify the property you wish to transfer.

- Do include the full names and addresses of all beneficiaries.

- Do sign the deed in the presence of a notary public.

- Do record the deed with the county clerk's office after signing.

- Don't forget to check for any local requirements that may apply.

- Don't leave out important details about the property or beneficiaries.

- Don't assume that a verbal agreement is sufficient; written documentation is necessary.

- Don't wait until the last minute; allow time for processing and potential issues.

Completing this form accurately can prevent complications in the future. Take your time, double-check your work, and seek assistance if needed. Your peace of mind is worth it.

How to Use Michigan Transfer-on-Death Deed

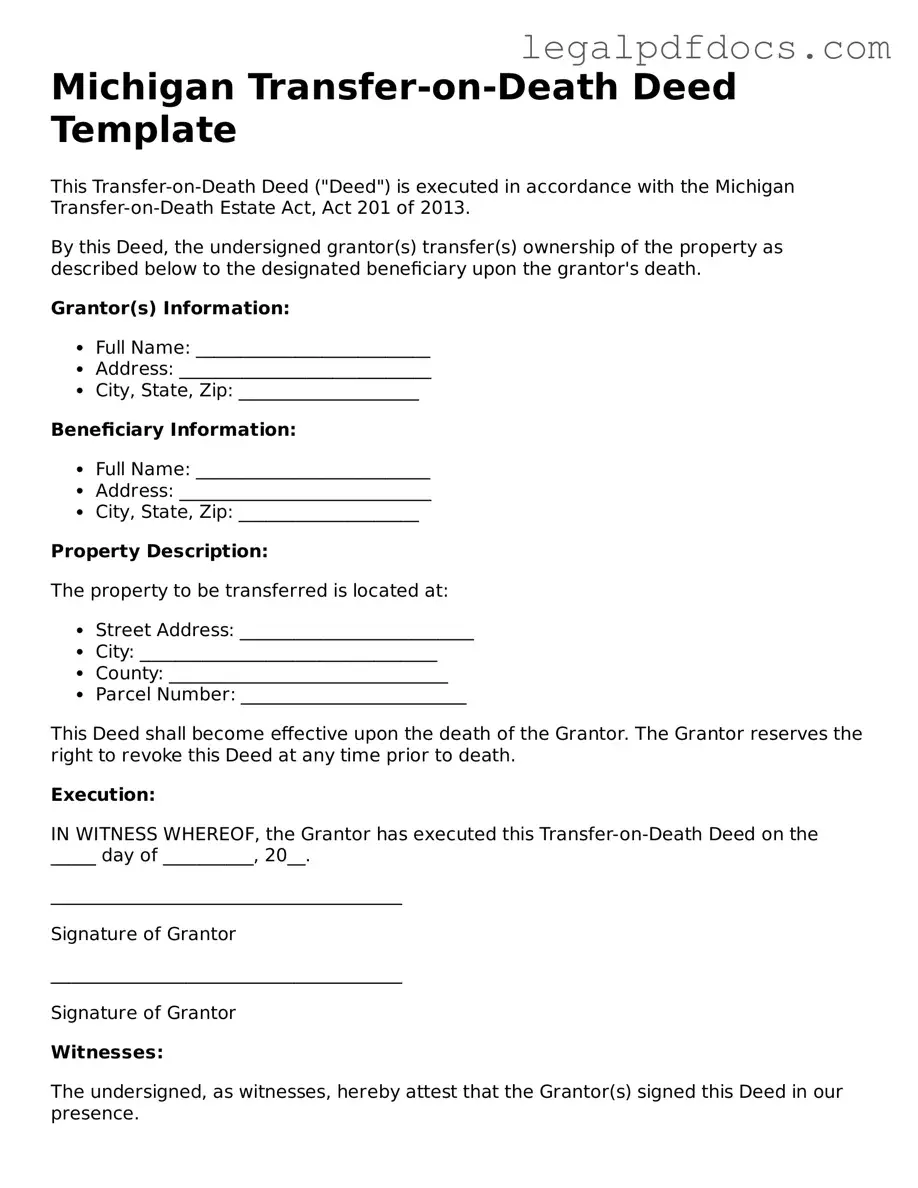

Once you have obtained the Michigan Transfer-on-Death Deed form, it's important to complete it accurately to ensure that your property is transferred according to your wishes. Follow these steps carefully to fill out the form correctly.

- Gather necessary information: Collect details about the property, including the address and legal description. You will also need the names and addresses of the beneficiaries.

- Fill in your name: At the top of the form, write your full name as the owner of the property.

- Provide property details: In the designated section, enter the address of the property you wish to transfer. Make sure to include the county where the property is located.

- Include legal description: Find the legal description of your property. This can typically be obtained from your property deed or local tax records. Write this description in the appropriate space on the form.

- List beneficiaries: Write the names and addresses of the individuals you want to inherit the property. If there are multiple beneficiaries, list them all clearly.

- Sign the form: As the property owner, sign the form in the designated area. Your signature must be witnessed.

- Have witnesses sign: Two witnesses must sign the form in your presence. Ensure that they include their names and addresses as well.

- Notarize the document: Take the completed form to a notary public. The notary will verify your identity and witness your signature.

- File the deed: Submit the notarized form to the appropriate county register of deeds office for recording. There may be a filing fee, so check with the office beforehand.

After completing these steps, keep a copy of the recorded deed for your records. This will serve as proof of the transfer arrangement you have established for your property. It's also wise to inform your beneficiaries about the deed and its implications.

Find Popular Transfer-on-Death Deed Forms for US States

Tod Deed California - This deed is beneficial for those who wish to maintain full control over their property while alive.

Deed on Death - The deed can be beneficial for those who wish to keep their estate private and away from public scrutiny.

Kansas Transfer on Death Form - The Transfer-on-Death Deed becomes effective as soon as it is recorded, ensuring prompt transfer of ownership upon death.

Documents used along the form

When dealing with property transfers in Michigan, the Transfer-on-Death (TOD) Deed is a valuable tool for ensuring that your real estate passes to your chosen beneficiaries without going through probate. However, there are several other forms and documents that often accompany the TOD Deed. Understanding these documents can help streamline the process and ensure that all legal requirements are met.

- Last Will and Testament: This document outlines how you want your assets distributed after your death. While a TOD Deed specifically addresses real estate, a will covers all other property and can provide clarity on your overall estate wishes.

- Affidavit of Heirship: This form may be used to establish the heirs of a deceased person. It can help clarify who is entitled to inherit property when no will exists, especially in cases where a TOD Deed is not in place.

- Beneficiary Designation Form: This document is often used for financial accounts and insurance policies. It allows you to name beneficiaries who will receive these assets upon your death, similar to how a TOD Deed works for real estate.

- Power of Attorney: This legal document grants someone the authority to act on your behalf in financial or legal matters. It can be crucial for managing your affairs if you become incapacitated.

- Property Deed: This is the official document that shows ownership of real estate. If you are transferring property using a TOD Deed, having the original property deed on hand can be essential for reference.

- Transfer Tax Affidavit: This form is often required when transferring property in Michigan. It helps determine any taxes owed on the transfer and is typically submitted along with the deed.

- Notice of Transfer: After executing a TOD Deed, it may be beneficial to file a notice with the local register of deeds. This document informs interested parties about the transfer and can help prevent disputes.

By familiarizing yourself with these additional documents, you can better navigate the complexities of property transfer in Michigan. Each form plays a distinct role in ensuring your estate is managed according to your wishes and that your loved ones are taken care of after your passing.

Misconceptions

Understanding the Michigan Transfer-on-Death Deed can be complex, and several misconceptions often arise. Here are seven common misunderstandings:

- It automatically transfers property upon death. Many people believe that the deed triggers an immediate transfer of property once the owner passes away. In reality, the transfer only occurs after the owner's death and if the deed is properly executed and recorded.

- All types of property can be transferred using this deed. Some individuals think that any property can be transferred with a Transfer-on-Death Deed. However, this option is limited to real property, such as land and buildings, and does not apply to personal property like vehicles or bank accounts.

- It replaces a will. There is a misconception that a Transfer-on-Death Deed can serve as a substitute for a will. In fact, it is important to have both documents, as they serve different purposes in estate planning.

- Beneficiaries can access the property before the owner's death. Some might assume that beneficiaries can use or access the property before the owner passes away. This is not the case; the property remains under the owner's control until their death.

- It is a complicated process to create. Many people think that creating a Transfer-on-Death Deed is overly complicated. While there are specific requirements to meet, the process can be straightforward with the right guidance.

- Once created, it cannot be changed. There is a belief that once a Transfer-on-Death Deed is executed, it is set in stone. However, the owner can revoke or change the deed at any time before their death, as long as the proper procedures are followed.

- It avoids probate completely. Some individuals think that using a Transfer-on-Death Deed will entirely eliminate the probate process. While it can simplify the transfer of property, it does not necessarily avoid probate for other aspects of the estate.

Being aware of these misconceptions can help individuals make informed decisions regarding their estate planning in Michigan.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed (TOD) allows an individual to transfer real property to a beneficiary upon their death without the property going through probate. |

| Governing Law | The Michigan Transfer-on-Death Deed is governed by the Michigan Compiled Laws, specifically MCL 565.25. |

| Eligibility | Any individual who owns real property in Michigan can create a TOD deed, provided they are of sound mind and at least 18 years old. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the grantor, through a recorded revocation document or by creating a new TOD deed. |

| Beneficiary Rights | Beneficiaries do not have any rights to the property until the death of the grantor, which means they cannot sell or mortgage the property while the grantor is alive. |

| Tax Implications | There are no immediate tax implications for the transfer of property through a TOD deed; however, beneficiaries may be subject to estate taxes depending on the overall estate value. |

Key takeaways

Filling out and using the Michigan Transfer-on-Death Deed form can be straightforward if you keep a few key points in mind. Here are some important takeaways:

- The form allows property owners to transfer real estate to beneficiaries upon their death without going through probate.

- Ensure that you clearly identify the property you want to transfer. Include the legal description to avoid any confusion.

- Both the property owner and the beneficiary must be clearly named on the form.

- Sign the deed in front of a notary public to validate it. This step is crucial for the deed to be legally binding.

- Once completed, the deed must be recorded with the county register of deeds where the property is located.

- Keep a copy of the recorded deed for your records. This can help avoid disputes in the future.

- You can revoke or change the deed at any time before your death by filing a new Transfer-on-Death Deed.

- Consulting with a legal expert can help clarify any questions and ensure that the deed meets all legal requirements.