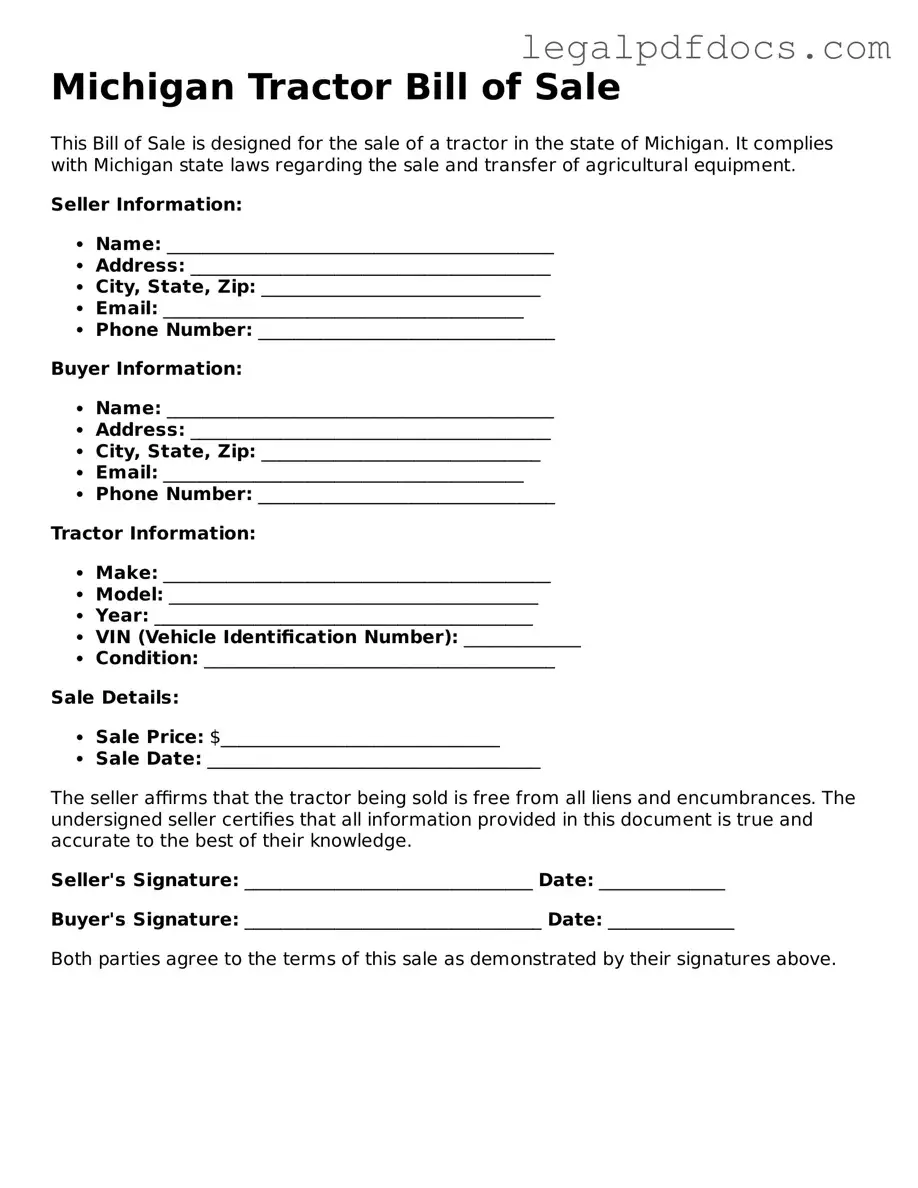

Official Tractor Bill of Sale Form for Michigan

The Michigan Tractor Bill of Sale form serves as a crucial document in the transfer of ownership for tractors within the state. This form captures essential details, including the buyer's and seller's names and addresses, the tractor's make, model, year, and Vehicle Identification Number (VIN). It also specifies the sale price and the date of the transaction. By providing a clear record of the sale, this document helps protect both parties involved in the transaction. Additionally, it may include sections for disclosures related to the tractor's condition, ensuring that buyers are fully informed before completing the purchase. Having a properly filled-out bill of sale is not only a best practice but also a legal requirement in many cases, facilitating a smooth transfer of ownership and helping to prevent potential disputes in the future.

Dos and Don'ts

When filling out the Michigan Tractor Bill of Sale form, it's important to follow certain guidelines to ensure accuracy and legality. Here’s a list of things you should and shouldn’t do:

- Do provide accurate information about the tractor, including make, model, and year.

- Do include the Vehicle Identification Number (VIN) to identify the tractor uniquely.

- Do ensure both the buyer and seller sign the document to validate the transaction.

- Do keep a copy of the completed bill of sale for your records.

- Don't leave any fields blank; fill in all required information completely.

- Don't use whiteout or make alterations on the form; this can lead to issues later.

- Don't forget to include the sale price; this is crucial for tax purposes.

- Don't ignore state-specific requirements; ensure you comply with Michigan laws.

How to Use Michigan Tractor Bill of Sale

Once you have the Michigan Tractor Bill of Sale form in hand, you'll want to ensure that all necessary information is filled out accurately. This form is essential for documenting the sale of a tractor, providing both the buyer and seller with a record of the transaction. Follow the steps below to complete the form correctly.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller. This includes the street address, city, state, and zip code.

- Next, fill in the buyer's full name and address, including the street address, city, state, and zip code.

- In the designated area, write the make, model, year, and Vehicle Identification Number (VIN) of the tractor being sold.

- Indicate the sale price of the tractor in the appropriate section. This should be the total amount agreed upon by both parties.

- Both the seller and buyer should sign and date the form at the bottom. This signifies their agreement to the terms of the sale.

- Finally, make copies of the completed form for both the buyer and seller to keep for their records.

Find Popular Tractor Bill of Sale Forms for US States

Tractor Bill of Sale Form - A legal document transferring ownership of a tractor from seller to buyer.

Tractor Bill of Sale - Acts as evidence in case of future disputes over ownership.

Farm Tractor Bill of Sale - This form plays a critical role in safeguarding against future claims on ownership.

Documents used along the form

When completing a transaction involving a tractor in Michigan, the Tractor Bill of Sale form is essential. However, several other documents can complement this form to ensure a smooth and legally sound transfer of ownership. Here are four important documents to consider:

- Title Transfer Document: This document officially transfers ownership from the seller to the buyer. It must be signed by both parties and submitted to the Michigan Secretary of State to update the vehicle records.

- Odometer Disclosure Statement: Required for vehicles less than 10 years old, this statement verifies the tractor's mileage at the time of sale. It protects both the buyer and seller from potential fraud regarding the vehicle's condition.

- Purchase Agreement: This is a more detailed document outlining the terms of the sale, including the price, payment method, and any warranties or guarantees. It serves as a reference for both parties in case of disputes.

- Affidavit of Ownership: If the seller cannot provide the original title, this affidavit can help establish ownership. It includes a declaration that the seller is the rightful owner and can facilitate the title transfer process.

Having these documents ready can streamline the transaction and protect both parties involved. Always ensure that all paperwork is completed accurately to avoid future complications.

Misconceptions

Understanding the Michigan Tractor Bill of Sale form is essential for both buyers and sellers. However, several misconceptions often arise regarding its purpose and requirements. Below is a list of common misconceptions, along with clarifications to help you navigate this important document.

- It is not necessary to have a bill of sale for a tractor. Many people believe that a bill of sale is optional. In reality, having a bill of sale is crucial for proving ownership and protecting both parties in the transaction.

- The bill of sale must be notarized. While notarization can add an extra layer of security, it is not a requirement for the Michigan Tractor Bill of Sale. A simple signed document is usually sufficient.

- Only the seller needs to sign the bill of sale. Some individuals think that only the seller's signature is required. However, both the buyer and seller should sign the document to ensure mutual agreement.

- All information must be typed. There is a misconception that the bill of sale must be typed. Handwritten forms are acceptable as long as all information is legible and complete.

- The bill of sale is only for new tractors. Many believe this document is only necessary for new purchases. In fact, it is equally important for used tractors to establish ownership and transfer rights.

- There is a specific format that must be followed. Some think there is a strict format for the bill of sale. While it should include essential information, there is flexibility in how it is presented.

- A bill of sale is not needed for gifts. People often assume that if a tractor is given as a gift, a bill of sale is unnecessary. However, documenting the transaction can help avoid future disputes.

- The bill of sale is only for state records. While it can be useful for state records, the primary purpose of the bill of sale is to protect the buyer and seller in case of disputes or issues.

- Once signed, the bill of sale is final and cannot be changed. Some believe that any changes to the bill of sale after signing are invalid. In truth, both parties can agree to amendments as long as they are documented and signed by both parties.

By addressing these misconceptions, individuals can better understand the importance of the Michigan Tractor Bill of Sale form. This knowledge empowers both buyers and sellers to engage in transactions with confidence and clarity.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Tractor Bill of Sale form is used to document the sale of a tractor between a buyer and a seller. |

| Governing Law | This form is governed by Michigan state law, specifically under the Michigan Vehicle Code. |

| Required Information | The form typically requires details such as the buyer's and seller's names, addresses, and contact information. |

| Tractor Details | Information about the tractor, including make, model, year, and Vehicle Identification Number (VIN), must be included. |

| Purchase Price | The sale price of the tractor should be clearly stated in the document. |

| Date of Sale | The date when the transaction occurs is an essential component of the bill of sale. |

| Signatures | Both the buyer and seller must sign the form to validate the transaction. |

| Notarization | While notarization is not always required, it can add an extra layer of authenticity to the document. |

| Record Keeping | Both parties should keep a copy of the completed bill of sale for their records and future reference. |

Key takeaways

When filling out and using the Michigan Tractor Bill of Sale form, keep the following key takeaways in mind:

- Accurate Information: Ensure all details about the tractor, including make, model, year, and Vehicle Identification Number (VIN), are correct.

- Seller and Buyer Details: Include full names and addresses of both the seller and the buyer. This information is crucial for identification and record-keeping.

- Sale Price: Clearly state the agreed sale price. This protects both parties and provides a record for tax purposes.

- Signatures Required: Both the seller and buyer must sign the form. Without signatures, the bill of sale is not valid.

- Keep Copies: Each party should retain a copy of the signed bill of sale for their records. This document serves as proof of the transaction.