Official Quitclaim Deed Form for Michigan

When it comes to transferring property in Michigan, the Quitclaim Deed form serves as a straightforward and efficient tool. This document allows an individual, known as the grantor, to convey their interest in a property to another party, called the grantee, without making any promises about the title’s quality. Unlike other types of deeds, the Quitclaim Deed does not guarantee that the grantor holds clear title to the property; instead, it simply transfers whatever interest the grantor may have. This makes it a popular choice for situations such as transferring property between family members or in divorce settlements. Additionally, the form must be properly executed and recorded to ensure the transfer is legally recognized. Understanding the nuances of the Quitclaim Deed is essential for anyone looking to navigate property transfers in Michigan effectively.

Dos and Don'ts

When filling out the Michigan Quitclaim Deed form, it is important to follow certain guidelines to ensure the document is completed accurately. Below is a list of things you should and shouldn't do.

- Do provide accurate information about the property being transferred.

- Do include the names and addresses of both the grantor and grantee.

- Do ensure that the legal description of the property is correct.

- Do sign the deed in the presence of a notary public.

- Do check for any local requirements that may need to be fulfilled.

- Don't leave any fields blank unless instructed to do so.

- Don't use vague language when describing the property.

- Don't forget to file the completed deed with the appropriate county office.

- Don't attempt to transfer property that you do not legally own.

How to Use Michigan Quitclaim Deed

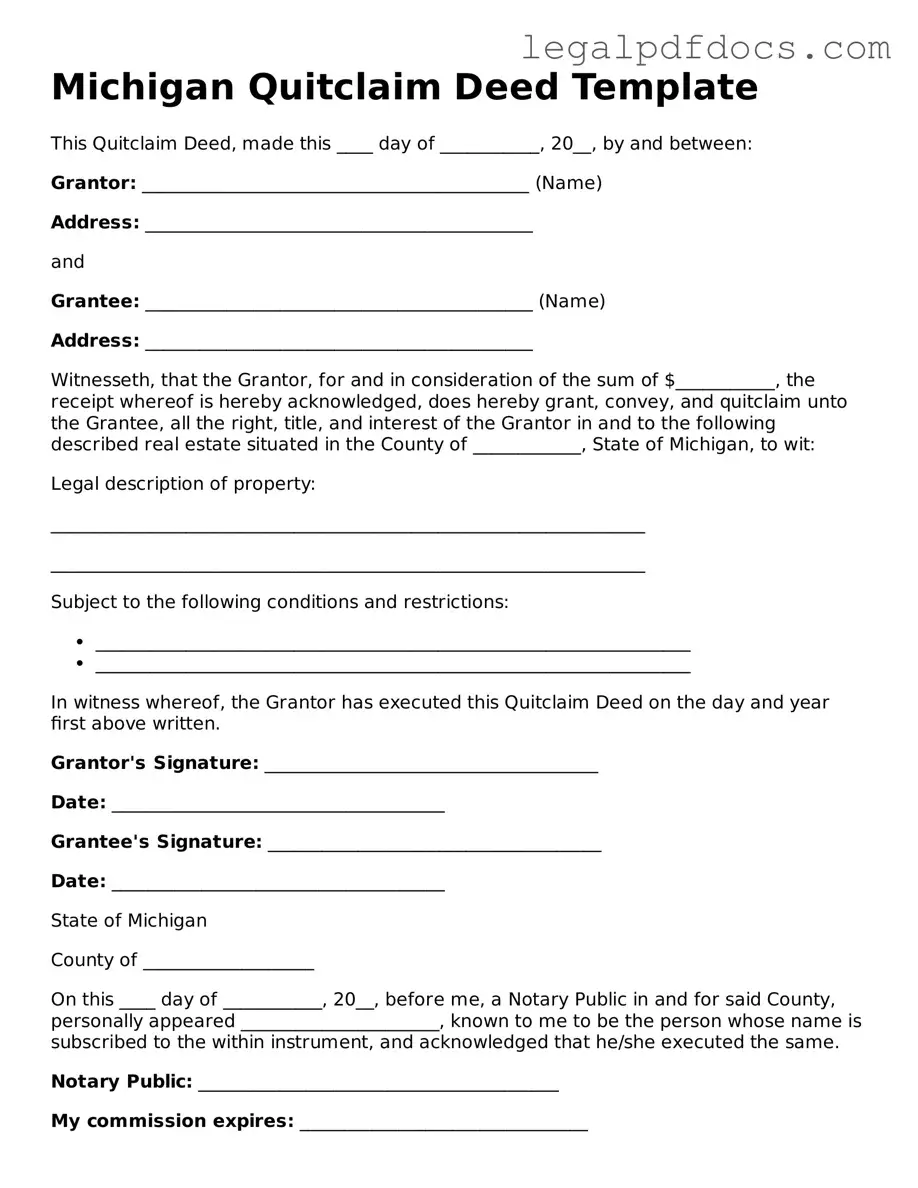

After obtaining the Michigan Quitclaim Deed form, you are ready to fill it out. Make sure you have all the necessary information at hand, including details about the property and the parties involved. Once completed, the form will need to be signed and notarized before being filed with the appropriate county office.

- Begin by entering the name of the grantor (the person transferring the property) at the top of the form.

- Next, provide the name of the grantee (the person receiving the property) below the grantor's name.

- Fill in the property description. This should include the address and legal description of the property. You can find this information on the property deed or tax records.

- Indicate the consideration amount, which is the value exchanged for the property. This can be a nominal amount if the transfer is a gift.

- Include the date of the transaction. This is typically the date you are signing the deed.

- Sign the form as the grantor. If there are multiple grantors, each must sign.

- Have the signature notarized. A notary public will verify your identity and witness the signing of the document.

- Finally, submit the completed deed to the county clerk's office in the county where the property is located for recording.

Find Popular Quitclaim Deed Forms for US States

Wuick Claim Deed - It is usually advised to consult a real estate professional when using this form.

Quit Claim Deed Georgia - A Quitclaim Deed can simplify the transfer of family property upon death.

Quitclaim Deed Form Texas - The recipient of a Quitclaim Deed takes on the property "as is," with all existing rights and responsibilities.

Quitclaim Deed Form Kansas - In a divorce, a quitclaim deed can transfer one spouse’s interest in the marital home to the other.

Documents used along the form

When you're working with a Michigan Quitclaim Deed, there are several other documents that can be important to have on hand. Each of these forms serves a specific purpose and can help ensure that your property transfer goes smoothly. Here’s a brief overview of four common documents that often accompany a Quitclaim Deed.

- Property Transfer Affidavit: This document is used to report the transfer of property to the local tax assessor. It provides details about the property and the parties involved, ensuring that the tax records are updated appropriately.

- Title Insurance Policy: While not mandatory, obtaining title insurance can protect you against potential issues with the property’s title. It offers peace of mind by covering legal costs if any disputes arise regarding ownership.

- Real Estate Purchase Agreement: If the property was purchased, this agreement outlines the terms of the sale, including the price, contingencies, and obligations of both the buyer and seller. It serves as a record of the transaction.

- Affidavit of Identity: This document helps confirm the identity of the parties involved in the transaction. It can be particularly useful in preventing fraud and ensuring that all parties are who they claim to be.

Having these documents ready can help streamline the process and protect your interests. Whether you're transferring ownership or ensuring that all legal bases are covered, these forms play a vital role in real estate transactions in Michigan.

Misconceptions

When dealing with the Michigan Quitclaim Deed form, several misconceptions often arise. Understanding these can help clarify its purpose and use.

- Misconception 1: A Quitclaim Deed transfers ownership completely.

- Misconception 2: Quitclaim Deeds are only for transferring property between family members.

- Misconception 3: A Quitclaim Deed eliminates any liens or debts on the property.

- Misconception 4: A Quitclaim Deed is the same as a Warranty Deed.

While a Quitclaim Deed does transfer any interest the grantor has in the property, it does not guarantee that the grantor actually owns the property. It simply conveys whatever rights the grantor may have.

This is not true. Although Quitclaim Deeds are often used in family transactions, they can be used in any situation where property rights need to be transferred, such as sales or partnerships.

This is a common misunderstanding. A Quitclaim Deed does not remove any existing liens or debts. The new owner may still be responsible for any financial obligations tied to the property.

These two types of deeds are different. A Warranty Deed offers guarantees about the title and protects the buyer from claims against the property. In contrast, a Quitclaim Deed does not provide any such assurances.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties. |

| Governing Law | The Michigan Quitclaim Deed is governed by the Michigan Compiled Laws, specifically under Act 132 of 1970. |

| Parties Involved | The document involves two main parties: the grantor (the person transferring the property) and the grantee (the person receiving the property). |

| No Warranty | Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor has clear title to the property. |

| Usage | Quitclaim Deeds are often used in situations like transferring property between family members or clearing up title issues. |

| Filing Requirements | The completed Quitclaim Deed must be filed with the county register of deeds in Michigan for it to be effective. |

| Consideration | While it’s common to include a nominal consideration (like $1), it is not legally required for the deed to be valid. |

| Signature Requirements | The grantor must sign the Quitclaim Deed in the presence of a notary public to ensure its validity. |

| Impact on Title | Using a Quitclaim Deed can affect the title insurance and future sales of the property, as it does not provide protection against claims. |

Key takeaways

When dealing with property transfers in Michigan, the Quitclaim Deed form is a vital document. Here are some key takeaways to keep in mind when filling it out and using it:

- The Quitclaim Deed is primarily used to transfer ownership of property without any guarantees about the title. This means the seller is not promising that they own the property free and clear.

- It's important to include the legal description of the property. This ensures that the deed accurately identifies the property being transferred.

- Both the grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly identified. Their names should match those on their legal identification.

- In Michigan, the Quitclaim Deed must be signed in front of a notary public. This adds a layer of authenticity to the document.

- After completing the form, it should be filed with the county register of deeds. This step is crucial for the transfer to be legally recognized.

- Filing fees may apply, and these can vary by county. It's wise to check with your local register of deeds for the exact amount.

- Once filed, the Quitclaim Deed becomes part of the public record, making it accessible to anyone who wishes to verify property ownership.

- Consulting with a real estate attorney or a professional can provide additional guidance, especially if there are complexities involved in the property transfer.