Official Promissory Note Form for Michigan

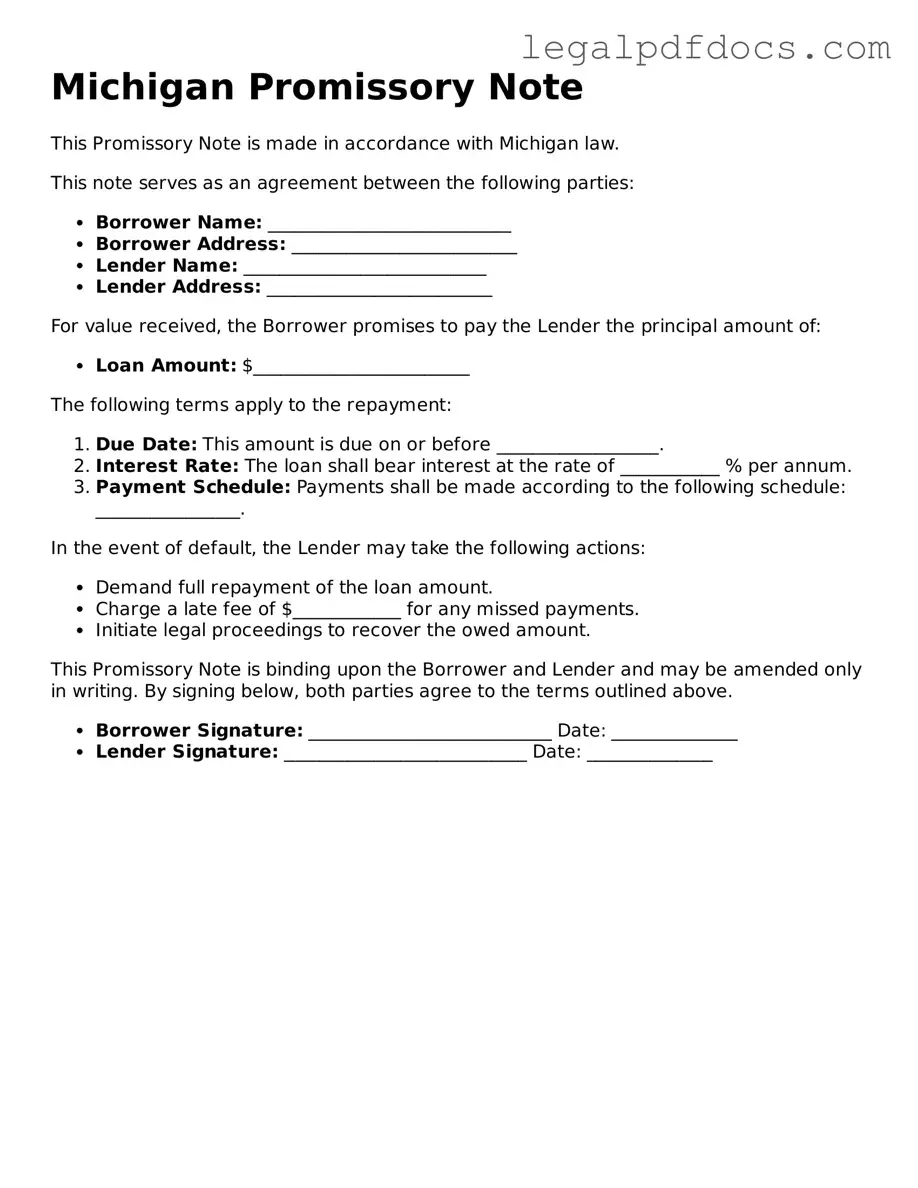

The Michigan Promissory Note form serves as a crucial financial instrument for individuals and businesses alike, facilitating the lending process by clearly outlining the terms of repayment. This form typically includes essential details such as the principal amount borrowed, the interest rate, and the repayment schedule. It establishes the borrower's obligation to repay the loan and the lender's right to receive payment. Additionally, the note may specify any collateral securing the loan, providing an added layer of protection for the lender. By including provisions for default, late payments, and dispute resolution, the Michigan Promissory Note ensures that both parties understand their rights and responsibilities. It’s important for anyone considering a loan to recognize the significance of this document, as it not only formalizes the agreement but also serves as a legal record that can be enforced in court if necessary.

Dos and Don'ts

When filling out the Michigan Promissory Note form, it's essential to be careful and thorough. Here’s a list of things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate information about the borrower and lender.

- Do specify the loan amount clearly.

- Do include the interest rate, if applicable.

- Don't leave any required fields blank.

- Don't use vague language; be specific about terms.

- Don't forget to sign and date the form.

- Don't overlook the importance of keeping a copy for your records.

How to Use Michigan Promissory Note

Once you have the Michigan Promissory Note form in front of you, it is essential to complete it accurately to ensure that all parties understand their obligations. Following the steps below will guide you through the process of filling out the form correctly.

- Begin by entering the date at the top of the form. This should be the date on which the note is being executed.

- Next, write the name and address of the borrower. This identifies who is borrowing the money.

- Provide the name and address of the lender. This identifies the individual or entity lending the money.

- Clearly state the principal amount being borrowed. This is the total amount that the borrower agrees to repay.

- Specify the interest rate. If applicable, indicate whether the interest is fixed or variable.

- Outline the repayment terms. Include the due date and any specific payment schedule, such as monthly or quarterly payments.

- If there are any late fees, detail them in this section. Clearly state how much will be charged if payments are not made on time.

- Include any additional terms or conditions that apply to the loan. This could cover aspects like prepayment penalties or collateral requirements.

- Both the borrower and lender must sign and date the form. This signifies that both parties agree to the terms outlined in the note.

After completing the form, it is advisable for both parties to keep a copy for their records. This ensures that everyone has access to the terms agreed upon and can refer back to them if necessary.

Find Popular Promissory Note Forms for US States

Promissory Note Arizona - In many cases, promissory notes can be transferred to other parties.

Texas Promissory Note Template - The legal name of the borrower and lender should be clearly stated in the Promissory Note to avoid confusion.

Promissory Note Template Georgia - Utilizing templates for Promissory Notes can streamline the process for both parties.

Promissory Note Template Illinois - The note may also outline the conditions for converting the debt to equity.

Documents used along the form

When entering into a loan agreement in Michigan, a Promissory Note is often accompanied by several other documents that help clarify the terms and provide additional legal protections. Understanding these documents is crucial for both lenders and borrowers to ensure that all parties are on the same page regarding their rights and responsibilities.

- Loan Agreement: This document outlines the specific terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide to the loan's conditions.

- Security Agreement: If the loan is secured by collateral, this agreement details the collateral being used and the rights of the lender in the event of default. It protects the lender’s interest in the collateral.

- Disclosure Statement: This document provides important information about the loan, such as the total cost of the loan, the annual percentage rate (APR), and any fees associated with the loan. It ensures transparency for the borrower.

- Personal Guarantee: In cases where a business borrows money, a personal guarantee may be required from the business owner. This document makes the owner personally liable for the loan, providing additional security for the lender.

- Amortization Schedule: This schedule breaks down the repayment plan into individual payments over time. It shows how much of each payment goes toward interest and how much goes toward reducing the principal balance.

- UCC Financing Statement: If the loan is secured by collateral, this document is filed with the state to publicly declare the lender's interest in the collateral. It provides notice to other creditors about the lender's rights.

Each of these documents plays a vital role in the lending process. They help to protect the interests of both parties, establish clear expectations, and ensure that everyone involved understands their obligations. By being familiar with these forms, borrowers and lenders can navigate their agreements more confidently.

Misconceptions

Understanding the Michigan Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are nine common misunderstandings regarding this important legal document.

- All Promissory Notes are the Same: Many people believe that all promissory notes are identical. In reality, the terms and conditions can vary significantly based on the agreement between the parties involved.

- A Promissory Note Must Be Notarized: Some assume that notarization is mandatory for a promissory note to be valid. While notarization can add a layer of authenticity, it is not a legal requirement in Michigan for the note to be enforceable.

- Only Banks Can Issue Promissory Notes: A common myth is that only financial institutions can create promissory notes. In fact, any individual or business can draft a promissory note, provided it meets the necessary legal criteria.

- Promissory Notes are Always Secured: Many people think that promissory notes must be secured by collateral. However, unsecured promissory notes exist and can be just as valid, depending on the agreement.

- Interest Rates Must Be Specified: Some believe that a promissory note must always include an interest rate. While it is common to specify an interest rate, it is not a legal requirement. A note can be interest-free.

- Verbal Agreements are Sufficient: There is a misconception that a verbal agreement can replace a written promissory note. However, having a written document is crucial for clarity and enforceability.

- All Promissory Notes are Enforceable: Not every promissory note is legally enforceable. If the terms are unclear or if the note was signed under duress, it may not hold up in court.

- They are Only Used for Large Loans: Some people think that promissory notes are only necessary for significant loans. In truth, they can be used for any amount, making them versatile tools for personal and business transactions.

- Once Signed, They Cannot Be Changed: A common belief is that a promissory note is final once signed. However, parties can modify the terms if both agree to the changes and document them appropriately.

By clarifying these misconceptions, individuals can better navigate the complexities of promissory notes and ensure their agreements are legally sound.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a future date. |

| Governing Law | The Michigan Promissory Note is governed by the Michigan Uniform Commercial Code (UCC), specifically Article 3. |

| Parties Involved | Typically, there are two parties involved: the borrower (maker) and the lender (payee). |

| Essential Elements | A valid promissory note must include the amount to be paid, the interest rate (if any), and the repayment schedule. |

| Interest Rate | The interest rate can be fixed or variable, but it must be clearly stated in the note. |

| Signatures | The note must be signed by the borrower to be legally binding. |

| Transferability | Promissory notes in Michigan can be transferred to another party, making them negotiable instruments. |

| Default Provisions | It’s important to include default provisions, outlining what happens if the borrower fails to make payments. |

| Legal Enforcement | If the borrower defaults, the lender has the right to take legal action to recover the owed amount. |

| Use Cases | Promissory notes are commonly used in personal loans, business loans, and real estate transactions. |

Key takeaways

Filling out and using the Michigan Promissory Note form can seem daunting, but understanding a few key points can make the process smoother. Here are some essential takeaways:

- Understand the Purpose: A promissory note is a legal document that outlines a borrower's promise to repay a loan under specified terms. It's important to know what this document entails before proceeding.

- Include Clear Terms: Clearly state the loan amount, interest rate, repayment schedule, and any penalties for late payments. Ambiguities can lead to disputes down the line.

- Signatures Matter: Both the borrower and the lender must sign the document. Without signatures, the note may not be enforceable.

- Consider Notarization: Although notarization is not always required, having the document notarized can add an extra layer of authenticity and protection.

- Keep Copies: After the note is signed, both parties should keep copies for their records. This ensures that everyone has access to the agreed-upon terms.

- Consult a Professional: If you have any doubts or specific circumstances, consulting a legal professional can provide clarity and ensure that the document meets all legal requirements.

By keeping these takeaways in mind, you can navigate the process of filling out and using the Michigan Promissory Note form with greater confidence.