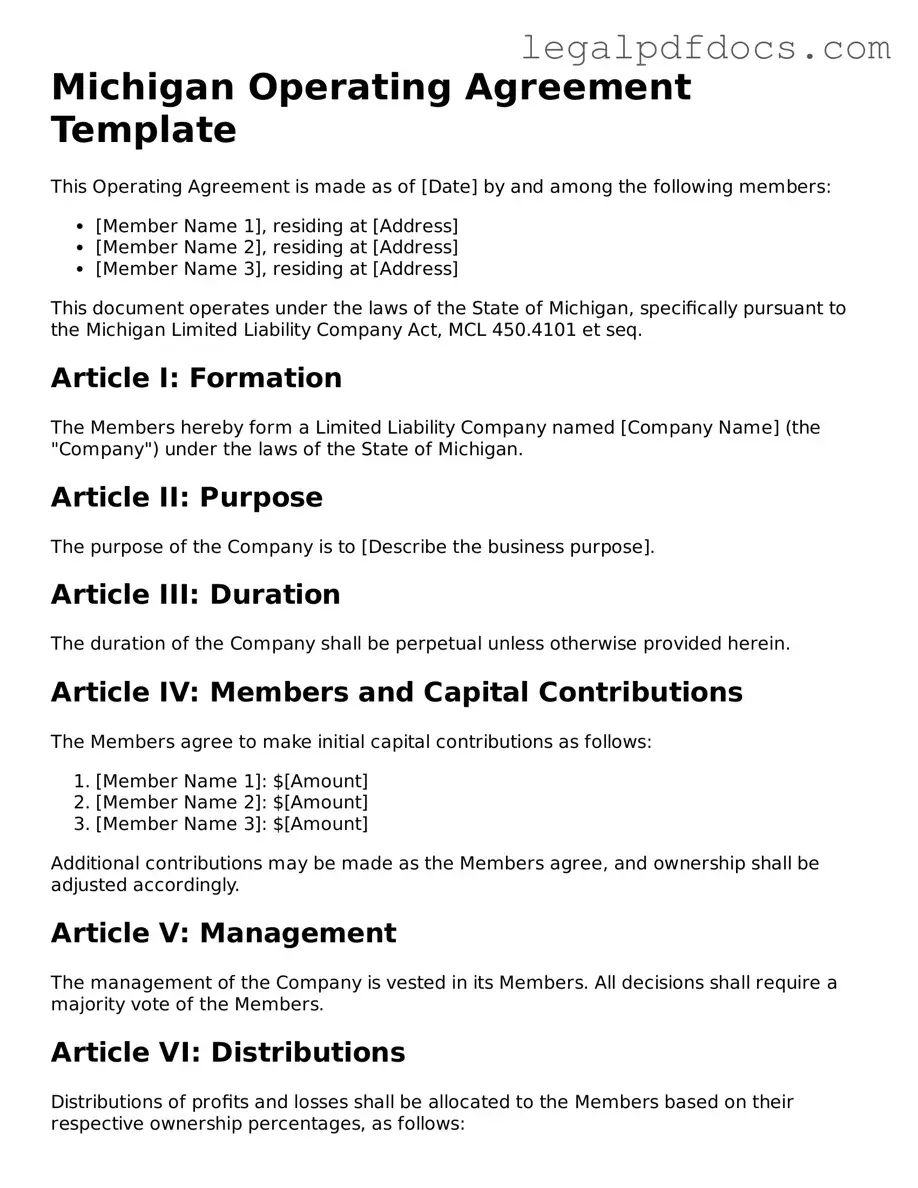

Official Operating Agreement Form for Michigan

The Michigan Operating Agreement form serves as a foundational document for Limited Liability Companies (LLCs) operating within the state. This essential form outlines the management structure, operational guidelines, and member responsibilities, providing clarity and organization for the business. By detailing the rights and duties of each member, the agreement helps prevent misunderstandings and disputes. Additionally, it specifies how profits and losses will be allocated, ensuring that all members are aware of their financial interests. The document may also address issues such as voting procedures, decision-making processes, and procedures for adding or removing members. Overall, the Michigan Operating Agreement is not just a legal formality; it is a vital tool that fosters transparency and cooperation among LLC members, ultimately contributing to the long-term success of the business.

Dos and Don'ts

When filling out the Michigan Operating Agreement form, it's essential to approach the task with care and attention to detail. Here are ten important do's and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate information to avoid future complications.

- Do consult with a legal professional if you have questions.

- Do ensure that all members sign the agreement.

- Do keep a copy of the completed agreement for your records.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any required fields blank.

- Don't use ambiguous language; be clear and specific.

- Don't forget to date the agreement upon completion.

- Don't overlook the importance of reviewing the agreement periodically.

By following these guidelines, you can help ensure that your Michigan Operating Agreement is completed correctly and serves its intended purpose effectively.

How to Use Michigan Operating Agreement

Once you have the Michigan Operating Agreement form in hand, you’ll want to fill it out carefully. This document is essential for outlining how your business will operate. After completing the form, make sure to keep a copy for your records and share it with all members involved.

- Start by entering the name of your LLC at the top of the form.

- Provide the principal address of the LLC. This should be a physical address, not a P.O. Box.

- List the names of all members who will be part of the LLC. Include their addresses and any ownership percentages.

- Outline the management structure. Decide if the LLC will be managed by members or by appointed managers.

- Specify the purpose of the LLC. This can be a brief description of what your business will do.

- Detail how profits and losses will be distributed among members. Be clear about the percentages or amounts.

- Include any rules for meetings and voting. This could cover how often meetings will occur and how decisions will be made.

- Provide information on how new members can join the LLC. This should include any necessary approvals.

- Discuss the process for handling disputes among members. Outline how conflicts will be resolved.

- Finally, have all members sign and date the agreement at the bottom of the form.

Find Popular Operating Agreement Forms for US States

Operating Agreement Llc Arizona Template - The Operating Agreement can set the terms for member compensation and reimbursements.

How to Set Up an Operating Agreement for Llc - The agreement can address management strategies and objectives.

Documents used along the form

When forming a limited liability company (LLC) in Michigan, several documents complement the Michigan Operating Agreement. Each of these documents serves a specific purpose in the establishment and operation of the LLC.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes essential information such as the LLC's name, address, and the names of its members.

- Member Consent Form: This form is used to document the agreement among members regarding the formation and operation of the LLC. It often includes the approval of the Operating Agreement and other initial decisions.

- Initial Resolutions: These are formal documents that outline the initial decisions made by the members, such as the appointment of managers and the opening of a bank account for the LLC.

- Membership Certificates: These certificates represent ownership in the LLC. They are issued to members and can be used for record-keeping and proof of ownership.

- Employer Identification Number (EIN) Application: This application is submitted to the IRS to obtain an EIN, which is necessary for tax purposes and to open a business bank account.

- Bylaws: Although not always required, bylaws can outline the internal rules and procedures for managing the LLC, including meetings and voting rights.

- Annual Reports: LLCs in Michigan must file annual reports to maintain good standing. This document updates the state on the LLC's current status and any changes in membership or management.

These documents collectively support the formation and ongoing management of an LLC in Michigan. Each plays a crucial role in ensuring compliance with state laws and facilitating smooth operations within the company.

Misconceptions

Many people have misconceptions about the Michigan Operating Agreement form. Understanding these misconceptions can help individuals and businesses navigate their legal responsibilities more effectively. Here are nine common misunderstandings:

-

All LLCs are required to have an Operating Agreement.

While it is highly recommended for limited liability companies (LLCs) to have an Operating Agreement, Michigan does not legally require all LLCs to create one. However, having this document can help clarify roles and responsibilities.

-

An Operating Agreement is the same as Articles of Organization.

These two documents serve different purposes. Articles of Organization are filed with the state to officially create the LLC, while the Operating Agreement outlines the internal management structure and operating procedures.

-

Operating Agreements are only necessary for large businesses.

This is false. Even single-member LLCs benefit from an Operating Agreement, as it establishes clear guidelines and protects personal assets.

-

Once created, an Operating Agreement cannot be changed.

This is a misconception. An Operating Agreement can be amended as needed, provided that the members follow the amendment procedures outlined in the document.

-

Operating Agreements need to be filed with the state.

In Michigan, Operating Agreements are internal documents and do not need to be submitted to the state. They should be kept on file for reference.

-

All members must sign the Operating Agreement.

While it is advisable for all members to sign, Michigan law does not mandate signatures for the agreement to be valid. However, having signatures can help avoid disputes.

-

Operating Agreements can only be written by lawyers.

This is not true. While legal assistance can be beneficial, many business owners successfully draft their own Operating Agreements using templates or guides.

-

Operating Agreements are not enforceable in court.

In Michigan, Operating Agreements are legally binding contracts. Courts will enforce them as long as they comply with state laws and are not contrary to public policy.

-

There is a standard template for all Operating Agreements.

Each Operating Agreement should be tailored to the specific needs of the LLC. While templates exist, they should be customized to reflect the unique structure and goals of the business.

PDF Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Michigan Operating Agreement outlines the management structure and operating procedures for a limited liability company (LLC). |

| Governing Law | This agreement is governed by the Michigan Limited Liability Company Act (MCL 450.4101 et seq.). |

| Members | All members of the LLC should be included in the agreement, specifying their rights and responsibilities. |

| Management Structure | The agreement can designate the LLC as member-managed or manager-managed, outlining how decisions are made. |

| Capital Contributions | It should detail the initial capital contributions of each member and any future contribution requirements. |

| Profit Distribution | The agreement must specify how profits and losses will be distributed among the members. |

| Amendments | Procedures for amending the agreement should be clearly stated to allow for future changes. |

| Dispute Resolution | It is advisable to include a section on how disputes among members will be resolved, such as mediation or arbitration. |

| Duration | The agreement should specify the duration of the LLC, whether it is perpetual or for a specified term. |

Key takeaways

When filling out and using the Michigan Operating Agreement form, keep the following key takeaways in mind:

- Ensure that all members of the LLC are included in the agreement to establish clear ownership and management roles.

- Clearly define the purpose of the LLC. This helps in understanding the business objectives and can aid in decision-making.

- Specify the initial capital contributions of each member. This detail is crucial for financial transparency and accountability.

- Outline the distribution of profits and losses among members. This will prevent disputes regarding financial matters later on.

- Include provisions for adding new members or transferring ownership. This flexibility is important for future growth and changes.

- Detail the management structure. Decide whether the LLC will be member-managed or manager-managed, as this affects day-to-day operations.

- Establish procedures for resolving disputes among members. Having a clear process can save time and resources in the event of disagreements.

- Review the agreement regularly. As the business evolves, so should the operating agreement to reflect current practices and laws.

- Consult with a legal professional if needed. While the form is straightforward, legal advice can provide additional clarity and ensure compliance with state laws.