Official Last Will and Testament Form for Michigan

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing, particularly in Michigan, where specific legal requirements must be met. This document serves as a legal declaration of how you want your assets distributed, who will serve as your executor, and who will take care of your minor children, if applicable. The Michigan Last Will and Testament form includes vital sections that allow you to specify beneficiaries, outline your funeral arrangements, and designate guardians for dependents. It is important to note that the will must be signed in the presence of witnesses to be considered valid, and understanding the nuances of this process can help prevent potential disputes among heirs. Additionally, individuals can revoke or amend their wills as life circumstances change, making it a flexible tool for estate planning. By utilizing this form, individuals can take control of their legacy and provide clear guidance to their loved ones during a challenging time.

Dos and Don'ts

When filling out the Michigan Last Will and Testament form, it is essential to approach the process with care and attention to detail. Here are some important dos and don'ts to keep in mind:

- Do ensure that you are of sound mind and at least 18 years old when creating your will.

- Don't use vague language that could lead to confusion about your intentions.

- Do clearly identify your beneficiaries, including full names and relationships.

- Don't forget to include specific bequests for personal items or assets you wish to leave to particular individuals.

- Do sign your will in the presence of at least two witnesses who are not beneficiaries.

- Don't assume that verbal agreements or informal notes will hold up in court.

- Do keep your will in a safe place and inform your executor of its location.

By following these guidelines, you can help ensure that your wishes are clearly expressed and legally upheld.

How to Use Michigan Last Will and Testament

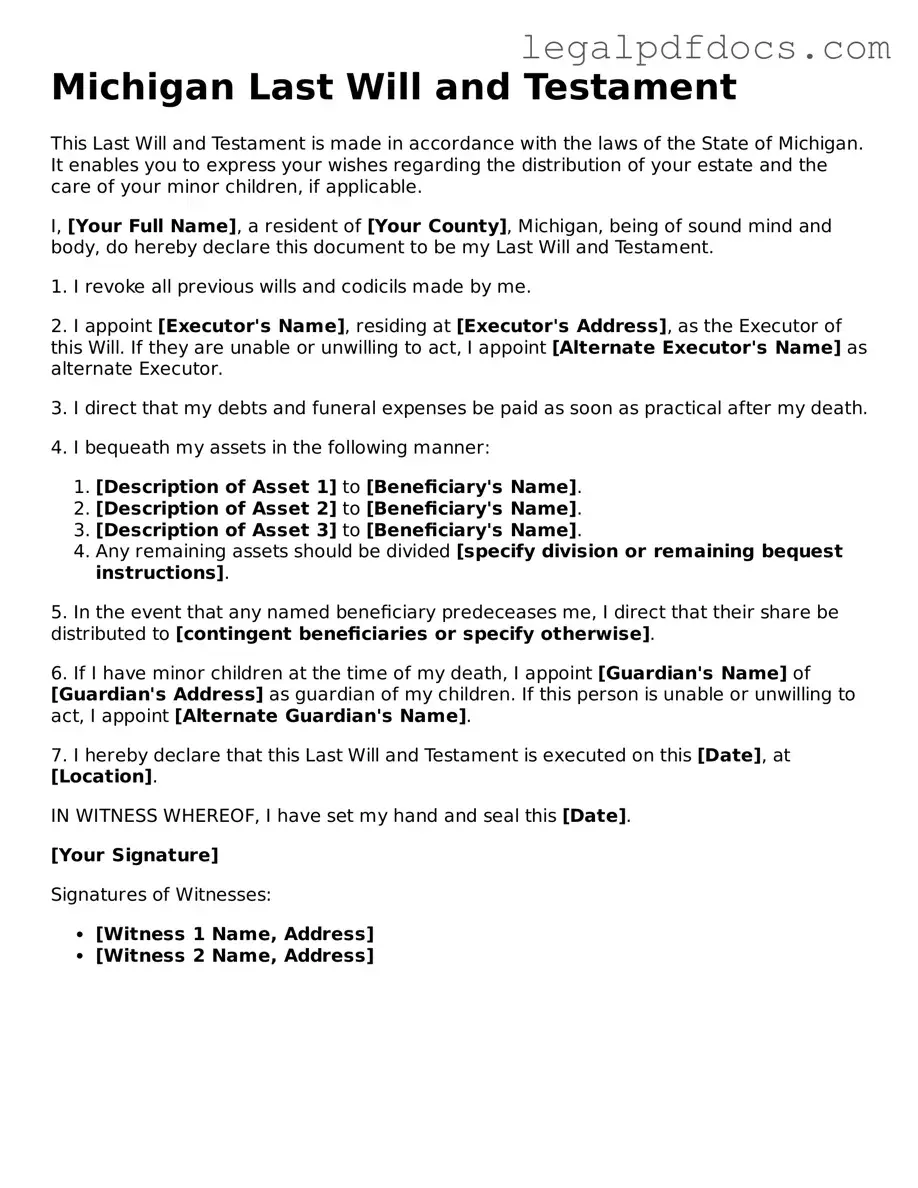

After obtaining the Michigan Last Will and Testament form, it’s important to fill it out carefully. This document will guide your wishes regarding asset distribution and guardianship decisions. Follow these steps to ensure you complete the form correctly.

- Begin by entering your full legal name at the top of the form.

- Provide your current address, including city, state, and zip code.

- State your date of birth clearly.

- Identify your marital status by checking the appropriate box (single, married, divorced, or widowed).

- List any children you have, including their names and birth dates. If you have no children, indicate that as well.

- Designate an executor by naming the person you trust to carry out your wishes. Include their full name and address.

- Specify how you want your assets distributed among your beneficiaries. Be clear about who receives what, and include their names and addresses.

- If you have any specific wishes regarding funeral arrangements, include those details in the appropriate section.

- Review the form for accuracy and completeness before signing.

- Sign the document in the presence of at least two witnesses, who must also sign the form. Ensure they provide their names and addresses as well.

Once the form is completed and signed, store it in a safe place and consider informing your executor and family members where it can be found. This will help ensure your wishes are known and respected.

Find Popular Last Will and Testament Forms for US States

Idaho Last Will and Testament - Establishing a Last Will is an important step in identifying your beneficiaries and ensuring they receive their rightful inheritance.

Last Will and Testament Illinois - Helps in planning for any potential future incapacity.

Kansas Will Template - Can serve as a final message of love, support, and care for your family.

Template for a Will - Allows for specific gifts, such as heirlooms or sentimental items.

Documents used along the form

When preparing a Michigan Last Will and Testament, several other documents may also be necessary to ensure that an individual's wishes are fully honored. Each of these documents serves a specific purpose in the estate planning process. Below is a list of commonly used forms and documents that complement the Last Will and Testament.

- Durable Power of Attorney: This document allows an individual to designate someone to make financial and legal decisions on their behalf if they become incapacitated. It remains effective even if the person becomes unable to manage their affairs.

- Healthcare Power of Attorney: This form grants authority to a designated individual to make medical decisions for someone who is unable to communicate their wishes due to illness or injury. It ensures that medical care aligns with the individual's preferences.

- Living Will: Also known as an advance directive, this document outlines an individual's preferences regarding medical treatment in situations where they are unable to express their wishes. It typically addresses end-of-life care and life-sustaining treatments.

- Revocable Trust: A revocable trust allows individuals to place their assets into a trust during their lifetime. They can manage and modify the trust as needed. Upon death, assets in the trust can be distributed according to the terms specified, often avoiding probate.

- Beneficiary Designations: These forms are used to specify who will receive certain assets, such as life insurance policies and retirement accounts, upon an individual’s death. They take precedence over the will, so it's important to keep them updated.

- Affidavit of Heirship: This document is often used to establish the heirs of a deceased person when there is no will. It provides a sworn statement regarding the identity of heirs and can help facilitate the transfer of property.

Incorporating these documents into estate planning can provide clarity and ensure that personal wishes are respected. Each document plays a vital role in managing assets, making medical decisions, and facilitating the distribution of an estate.

Misconceptions

When it comes to creating a Last Will and Testament in Michigan, there are several misconceptions that can lead to confusion. Understanding the truth behind these myths is essential for ensuring your wishes are honored. Here’s a look at seven common misconceptions:

- Only wealthy individuals need a will. Many people believe that wills are only for the rich. In reality, everyone can benefit from having a will, regardless of their financial situation. A will helps ensure that your wishes are followed regarding your assets and guardianship of minors.

- Verbal wills are legally binding. Some think that simply stating their wishes out loud is enough. However, Michigan law requires a written will to be valid. Without it, your wishes may not be honored.

- All property automatically goes to my spouse. While many assets may transfer to a spouse, this isn’t always the case. Certain assets, like those held in a trust or joint accounts, may not be distributed as expected without a will.

- Once a will is created, it cannot be changed. Many people believe that a will is set in stone. In fact, you can revise or revoke your will at any time, as long as you follow the legal requirements for doing so.

- My family will know my wishes without a will. It’s a common assumption that family members will understand your intentions. However, without a will, there can be disputes and confusion. A written document clarifies your wishes and helps avoid conflicts.

- Wills are only for after I die. Some may think that wills are only relevant posthumously. However, they can also include provisions for your care and decisions if you become incapacitated.

- I can create a will without any help. While it’s possible to draft a will on your own, seeking professional assistance can ensure that it meets all legal requirements and accurately reflects your wishes. An expert can help navigate the complexities of estate planning.

Understanding these misconceptions can empower you to make informed decisions about your estate planning. A well-prepared will can provide peace of mind for you and your loved ones.

PDF Specifications

| Fact Name | Description |

|---|---|

| Legal Age Requirement | In Michigan, you must be at least 18 years old to create a valid Last Will and Testament. |

| Witness Requirement | Your will must be signed by at least two witnesses who are not beneficiaries of the will. |

| Governing Law | The Michigan Last Will and Testament is governed by the Michigan Estates and Protected Individuals Code (EPIC), specifically MCL 700.2501. |

| Revocation | A will can be revoked at any time by creating a new will or by destroying the existing will with the intent to revoke it. |

Key takeaways

Ensure you are at least 18 years old and of sound mind when creating your will.

Clearly identify yourself at the beginning of the document, including your full name and address.

Designate an executor who will be responsible for carrying out your wishes as stated in the will.

List your assets and specify how you want them distributed among your beneficiaries.

Include a clause for guardianship if you have minor children, naming who will care for them.

Sign the document in the presence of at least two witnesses, who should also sign it.

Consider having the will notarized to add an extra layer of authenticity.

Store the will in a safe place and inform your executor and loved ones of its location.