Official Lady Bird Deed Form for Michigan

The Michigan Lady Bird Deed is an important estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. This unique form provides a means to avoid probate, ensuring a smoother transition of property upon the owner's passing. It allows the property owner to maintain the right to live in, sell, or modify the property as they see fit, even after the deed is executed. The Lady Bird Deed also offers protection against creditors, as the property does not become part of the deceased's estate for debt settlement. By utilizing this form, individuals can simplify the transfer process and provide peace of mind to their heirs. Understanding the nuances of the Lady Bird Deed is essential for anyone considering estate planning in Michigan, as it can significantly impact how assets are managed and distributed in the future.

Dos and Don'ts

When filling out the Michigan Lady Bird Deed form, it's essential to follow certain guidelines to ensure the process goes smoothly. Here’s a helpful list of dos and don'ts:

- Do ensure that you clearly understand the purpose of a Lady Bird Deed.

- Do include the full legal names of all parties involved in the deed.

- Do accurately describe the property being transferred.

- Do consult with a legal professional if you have any questions.

- Don't rush through the form; take your time to fill it out carefully.

- Don't forget to sign and date the form in the appropriate places.

- Don't overlook the need for notarization before submitting the form.

Following these guidelines can help ensure that your Lady Bird Deed is completed correctly and meets all legal requirements.

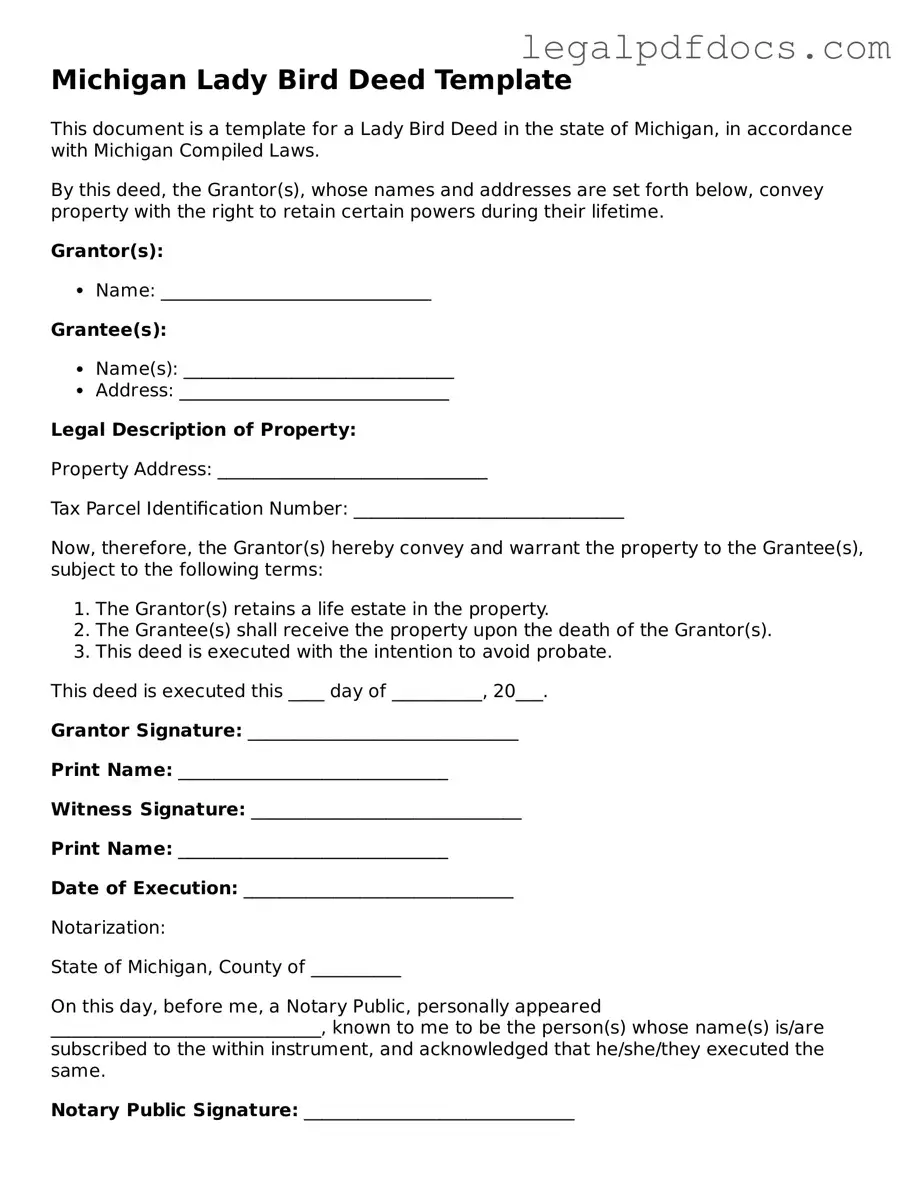

How to Use Michigan Lady Bird Deed

Filling out the Michigan Lady Bird Deed form is an important step in ensuring that property is transferred according to your wishes. After completing the form, it must be signed and recorded with the appropriate county clerk's office to be legally effective.

- Begin by downloading the Michigan Lady Bird Deed form from a reliable source.

- At the top of the form, enter the date on which you are completing the deed.

- In the first section, provide the name of the current property owner(s). Include all names as they appear on the property title.

- Next, enter the address of the property being transferred. Be sure to include the full street address, city, state, and zip code.

- In the section for beneficiaries, list the names of the individuals or entities who will receive the property upon the owner's death. Include their relationship to the owner if applicable.

- Indicate any specific conditions or instructions related to the transfer of the property, if necessary.

- Sign the form in the designated area. This signature should be done in the presence of a notary public.

- Have the form notarized. The notary will verify your identity and witness your signature.

- Make copies of the completed and notarized deed for your records.

- Finally, submit the original deed to the county clerk’s office in the county where the property is located for recording.

Find Popular Lady Bird Deed Forms for US States

How to Get a Lady Bird Deed in Florida - A Lady Bird Deed helps to ensure that loved ones receive property directly and swiftly.

Texas Life Estate Deed Form - The Lady Bird Deed offers peace of mind, knowing that property will be directly conveyed to heirs.

Documents used along the form

The Michigan Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. Several other forms and documents may accompany the Lady Bird Deed to ensure a comprehensive approach to estate planning and property management. Below is a list of commonly used documents.

- Will: A legal document that outlines how a person's assets and property should be distributed upon their death. It can also designate guardians for minor children.

- Durable Power of Attorney: This document allows an individual to appoint someone else to make financial or legal decisions on their behalf if they become incapacitated.

- Advance Healthcare Directive: Also known as a living will, this document specifies an individual’s healthcare preferences in case they cannot communicate their wishes due to illness or incapacity.

- Trust Agreement: A legal arrangement where a trustee holds and manages property for the benefit of another person, often used to avoid probate and maintain privacy.

- Beneficiary Designation Forms: These forms are used to specify who will receive certain assets, such as life insurance policies or retirement accounts, upon the owner's death.

Utilizing these documents alongside the Michigan Lady Bird Deed can help ensure that an individual's wishes are respected and that their estate is managed according to their preferences. It is advisable to consult with a qualified professional to tailor these documents to specific needs.

Misconceptions

The Michigan Lady Bird Deed is a useful tool for property owners, but several misconceptions exist regarding its use and implications. Below are seven common misconceptions:

-

It automatically avoids probate.

While a Lady Bird Deed can help avoid probate, it is not a guarantee. The effectiveness depends on how the deed is structured and whether the property is held in the owner’s name at the time of death.

-

It is only for married couples.

This deed can be utilized by any property owner, regardless of marital status. Single individuals, siblings, or friends can also benefit from this type of deed.

-

It transfers ownership immediately.

The Lady Bird Deed allows the owner to retain control of the property during their lifetime. Ownership does not transfer until the owner passes away.

-

It eliminates all tax implications.

While a Lady Bird Deed can provide tax benefits, it does not completely eliminate tax implications. Property taxes may still apply, and capital gains taxes could arise upon the sale of the property.

-

It is only applicable to residential properties.

This deed can be used for various types of properties, including commercial real estate and vacant land, not just residential properties.

-

It is a complicated legal document.

While the deed must be drafted correctly, it is not overly complex. Many resources are available to assist property owners in understanding and completing the form.

-

It requires a lawyer to create.

Although legal assistance can be beneficial, it is not a requirement. Many individuals successfully complete the Lady Bird Deed on their own using available templates and guides.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Lady Bird Deed allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by Michigan law, specifically under the Michigan Compiled Laws, Section 565.44. |

| Benefits | One key benefit is avoiding probate, which can simplify the transfer process and reduce costs for heirs. |

| Revocability | The Lady Bird Deed can be revoked or modified by the property owner at any time before their death. |

Key takeaways

When filling out and using the Michigan Lady Bird Deed form, keep these key takeaways in mind:

- Understand the Purpose: The Lady Bird Deed allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime.

- Retain Life Estate: The grantor maintains a life estate, meaning they can live on the property and make changes as they see fit.

- Avoid Probate: This deed helps avoid probate, allowing for a smoother transition of property ownership after the grantor's death.

- Fill Out Correctly: Ensure all required fields are filled out accurately to prevent delays or issues with the transfer.

- Beneficiaries: Clearly list all beneficiaries to avoid confusion. It’s important to specify how the property will be divided if there are multiple beneficiaries.

- Consult a Professional: Consider consulting with a real estate attorney or a professional familiar with Michigan property laws to ensure compliance.

- Sign and Notarize: The deed must be signed by the grantor and notarized to be legally binding.

- Record the Deed: After completion, the deed should be recorded with the county register of deeds to make it official and public.

By following these takeaways, you can effectively utilize the Michigan Lady Bird Deed form to manage your property and ensure a smooth transfer to your beneficiaries.