Official Durable Power of Attorney Form for Michigan

The Michigan Durable Power of Attorney form serves as a vital legal tool for individuals seeking to designate someone they trust to make decisions on their behalf, particularly in the event of incapacity. This form empowers a chosen agent to handle financial and legal matters, ensuring that the principal's wishes are respected even when they are unable to communicate them. It is essential to understand that this document remains effective even if the principal becomes incapacitated, distinguishing it from a regular power of attorney. The form allows for flexibility, enabling the principal to specify the extent of authority granted to the agent, which can include managing bank accounts, paying bills, or making investment decisions. Additionally, the Michigan Durable Power of Attorney form must be signed in the presence of a notary public to be legally binding, adding a layer of security and authenticity. By carefully completing this form, individuals can ensure their affairs are managed according to their preferences, providing peace of mind for themselves and their loved ones.

Dos and Don'ts

When filling out the Michigan Durable Power of Attorney form, it's important to approach the process with care. Here’s a list of things you should and shouldn’t do to ensure that your document is valid and effective.

- Do: Clearly identify the person you are appointing as your agent. This individual should be someone you trust completely.

- Do: Specify the powers you are granting. Be as detailed as possible to avoid confusion later.

- Do: Sign the document in the presence of a notary public. This adds an extra layer of validation.

- Do: Keep copies of the signed document in a safe place and provide copies to your agent and any relevant institutions.

- Don’t: Leave any sections blank. Incomplete forms can lead to misunderstandings or legal challenges.

- Don’t: Appoint someone who may have conflicting interests. Your agent should act in your best interest without personal gain.

- Don’t: Forget to review and update the document as needed. Life changes may require adjustments to your power of attorney.

How to Use Michigan Durable Power of Attorney

Filling out the Michigan Durable Power of Attorney form is a straightforward process that allows you to designate someone to make decisions on your behalf. Once the form is completed, you will need to sign it in front of a notary public or two witnesses. This ensures that your document is legally valid and recognized by the state.

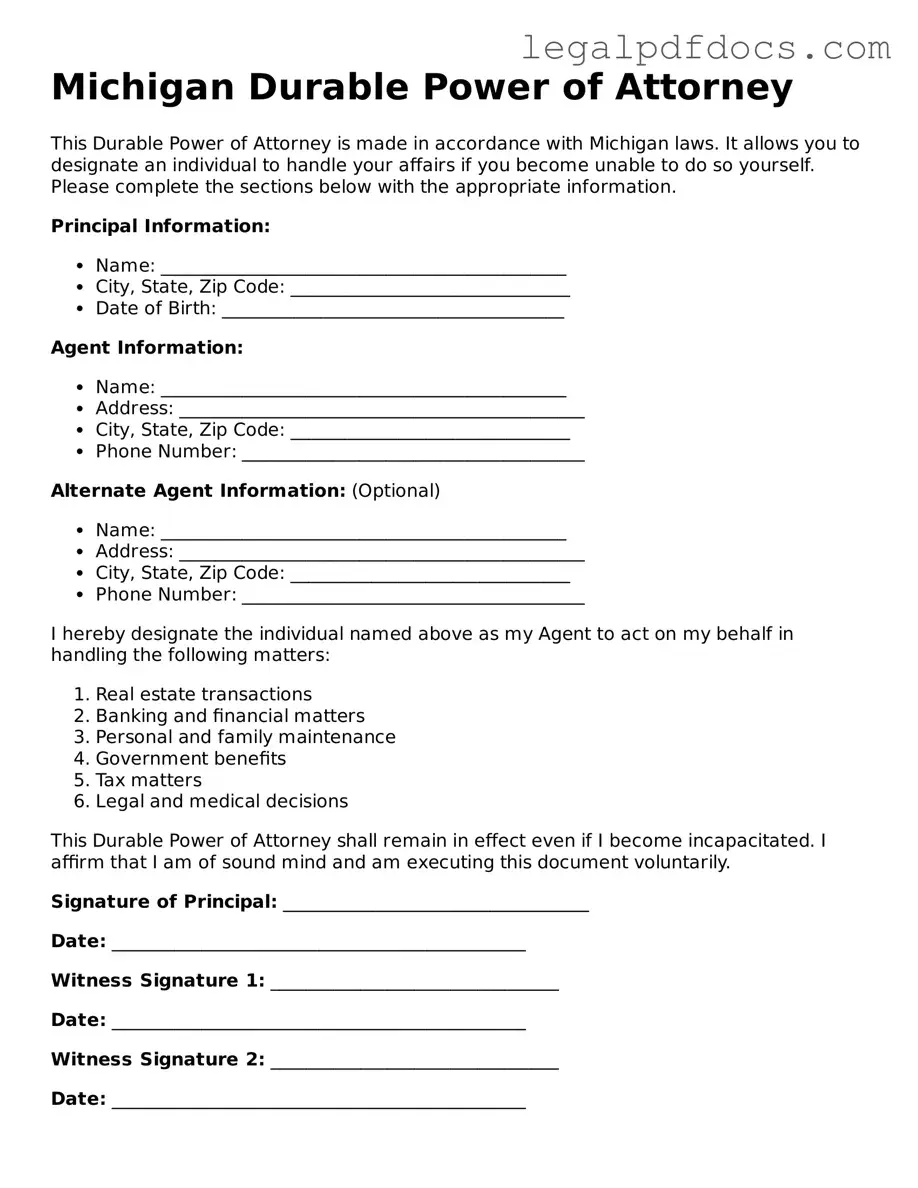

- Obtain the Michigan Durable Power of Attorney form. You can find it online or request a copy from a legal office.

- Read through the entire form carefully to understand the sections that need to be completed.

- In the first section, fill in your full name and address. This identifies you as the principal.

- Next, identify the person you are appointing as your agent. Include their full name and address.

- Decide whether you want to grant your agent specific powers or general authority. Indicate your choice in the designated section.

- Provide any additional instructions or limitations regarding the powers you are granting to your agent, if necessary.

- Sign and date the form in the presence of a notary public or two witnesses. Make sure they also sign the document.

- Keep a copy of the completed form for your records and provide a copy to your agent.

Find Popular Durable Power of Attorney Forms for US States

How to Sign a Power of Attorney - Choosing an agent requires careful thought, as this person will represent you in crucial matters.

What Does a Durable Power of Attorney Allow You to Do - It's a tool for ensuring your health care and financial wishes are respected.

Durable Power of Attorney Forms - The principal can provide specific guidelines on how they want their affairs handled.

Documents used along the form

When preparing a Michigan Durable Power of Attorney, it's essential to consider other documents that may complement it. These forms can help ensure that your wishes are honored and that your affairs are managed effectively. Below is a list of commonly used documents that often accompany the Durable Power of Attorney.

- Financial Power of Attorney: This document allows you to designate someone to manage your financial affairs, similar to a Durable Power of Attorney but typically limited to financial matters.

- Healthcare Power of Attorney: Also known as a medical power of attorney, this form allows you to appoint someone to make healthcare decisions on your behalf if you become unable to do so.

- Living Will: A living will outlines your preferences regarding medical treatment and end-of-life care, guiding your healthcare agent in making decisions that align with your wishes.

- Will: A will is a legal document that specifies how your assets should be distributed after your death. It can also designate guardians for minor children.

- Trust Agreement: A trust can hold assets for the benefit of your beneficiaries, allowing for more control over how and when assets are distributed, often avoiding probate.

- Advance Directive: This document combines a living will and a healthcare power of attorney, providing comprehensive instructions regarding your healthcare preferences.

- Beneficiary Designation Forms: These forms allow you to specify who will receive certain assets, such as life insurance policies or retirement accounts, upon your death.

- Real Estate Transfer on Death Deed: This deed allows you to transfer real estate to a beneficiary upon your death, avoiding the probate process for that property.

- Personal Property Memorandum: This informal document allows you to list personal items and designate who should receive them, providing clarity and reducing potential disputes.

Each of these documents serves a specific purpose and can significantly impact your estate planning. By considering them alongside your Michigan Durable Power of Attorney, you can create a comprehensive plan that reflects your wishes and protects your interests.

Misconceptions

Understanding the Michigan Durable Power of Attorney (DPOA) form is essential for effective estate planning. However, several misconceptions can lead to confusion and mismanagement. Here are nine common misconceptions:

- It only applies to financial matters. Many believe that a DPOA is limited to financial decisions. In reality, it can also encompass health care decisions if specified.

- It is only valid while the principal is alive. This is not entirely accurate. A durable power of attorney remains effective even if the principal becomes incapacitated.

- All powers are automatically granted. Some assume that signing the form gives the agent unlimited authority. However, the principal can specify which powers are granted.

- It is the same as a regular power of attorney. While both documents allow someone to act on another's behalf, a durable power of attorney remains effective under incapacitation, unlike a regular power of attorney.

- It cannot be revoked. This is a misconception. The principal can revoke a DPOA at any time, as long as they are mentally competent.

- Agents must act in the principal's best interest. While this is generally true, the DPOA does not always legally enforce this duty unless explicitly stated in the document.

- It is not necessary to have witnesses or notarization. In Michigan, a DPOA must be signed in front of a notary public or two witnesses to be valid.

- It is only for the elderly. Many think a DPOA is only necessary for older adults. In truth, anyone can benefit from having a DPOA, regardless of age.

- Once created, it never needs to be updated. This is misleading. Changes in circumstances, such as divorce or changes in health, may necessitate updates to the DPOA.

Being aware of these misconceptions can help individuals make informed decisions regarding their legal and financial planning. A well-prepared DPOA can provide peace of mind for both the principal and their loved ones.

PDF Specifications

| Fact Name | Detail |

|---|---|

| Definition | A Michigan Durable Power of Attorney is a legal document that allows an individual to appoint someone else to make financial and legal decisions on their behalf. |

| Durability | This type of power of attorney remains effective even if the principal becomes incapacitated. |

| Governing Law | The Michigan Durable Power of Attorney is governed by the Michigan Compiled Laws, specifically MCL 700.5501 to 700.5516. |

| Principal | The person who creates the Durable Power of Attorney is referred to as the principal. |

| Agent | The individual designated to act on behalf of the principal is known as the agent or attorney-in-fact. |

| Signing Requirements | The document must be signed by the principal in the presence of a notary public or two witnesses to be valid. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time as long as they are competent. |

| Limitations | While the agent has broad powers, the principal can specify limitations or conditions within the document. |

Key takeaways

Filling out and using the Michigan Durable Power of Attorney form is an important step in ensuring your financial and medical decisions are handled according to your wishes. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Durable Power of Attorney allows you to appoint someone to make decisions on your behalf if you become unable to do so.

- Choose Your Agent Wisely: Select a trusted individual who understands your values and can act in your best interest.

- Specify Powers Clearly: Clearly outline the powers you want to grant your agent. This can include financial decisions, healthcare choices, or both.

- Consider Timing: The form can take effect immediately or only when you become incapacitated. Decide which option best suits your needs.

- Sign and Date the Form: Ensure you sign and date the document in the presence of a notary public or witnesses, as required by Michigan law.

- Keep Copies Accessible: Provide copies to your agent, family members, and any institutions that may need it, such as banks or healthcare providers.

- Review Regularly: Periodically review and update the document to reflect any changes in your circumstances or preferences.